Active since 2019 and founded by Director Lynne Connel, Asset Capital Business is an offshore “investment supermarket” that claims to provide services as an online broker, robot-advisor and financial consulting agency. The company is based in Majuro, Marshall Islands and is part of London-based ACB International Ltd.

They provide a regular independent trading service in an extensive range of assets, as well as social or copy trading. While it mentions digital wealth management services on its website, the links do not seem to work, so we can only assume that it is part of the company’s future plans. They also offer training, analytics and personalised financial consulting to help clients better understand financial markets and how to trade them.

To determine whether ACB U.K. can be trusted as a broker and an online consulting agent then read on to see the results of our review.

ACB Review Navigation

What can you trade?

ACB Forex Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £300 | Good | 1:1000 | Mid |

When it comes to forex trading, they offer access to an unusually large group of 656 currency pairs. The maximum volume you can trade is 100 lots, and you can have up to 100 orders outstanding at any one time.

They provide market price execution for all major pairs, and to some minor and exotic pairs.

Regarding leverage, they are an offshore company without any regulatory oversight, so it offers U.K. residents an unusually high maximum leverage ratio of 1,000:1 when trading forex. You can also use as much as 80% of your trading account margin deposit without receiving a margin call.

ACB CFD Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £300 | Good | 1:1000 | Mid |

The company offers an extensive range of 3,800 Contracts for Difference (CFD), including CFDs on over 1,000 U.S., Russian, European and Asian stocks. You can also trade CFDs on 13 indices, four precious metals, three energy commodities, and almost 80 cryptocurrency pairs.

In terms of its client coverage, they aim its CFD business primarily at retail traders. It offers its social trading platform via the COPY TRADE and MT5 networks.

ACB Social Trading Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £300 | Good | 1:1000 | High |

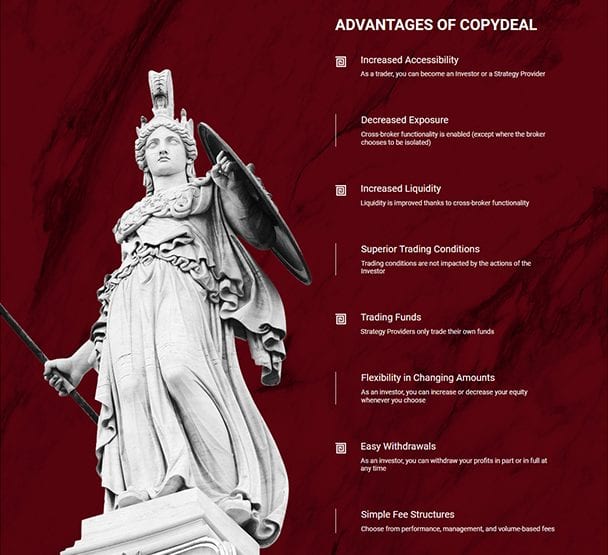

Social trading on the platform is well developed. The company supports both MT5 platform’s Trading Signals service, as well as the COPYDEAL platform designed by Trading Solutions for Brokers (TSB).

You can search for successful traders to follow by reviewing their performance, or you can offer a signal service if you are a good trader yourself.

To use COPYDEAL, you will need to have opened and verified a COPYDEAL account and then connect to your MT5 account. You will then be able to use the social trading features of the platform.

ACB Cryptocurrency Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £300 | Many | 1:20 | Mid |

When it comes to cryptocurrencies, this is where ACB shines. They offer an unusually broad range of 78 cryptocurrency pairs. Around eight of those pairs are cryptocurrency crosses, where one digital coin is quoted against another. The remaining 70 cryptocurrencies are quoted against the U.S. dollar.

Some of the cryptocurrencies available for trading on the platform include Bitcoin (BTC), Bitcoin Cash, Ethereum (ETH), Ethereum Class (ETC), Ripple (XRP), Litecoin (LTC), Monero (XMR), DASH (DAS), EOS, TRON (TRX), NEO and many more.

ACB Robo Advisor Review

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £300 | 200 | 1:1000 | High |

The company claims, in several places on its website, that it offers a robot-advisor or digital wealth management services. However, when writing this review, the links did not provide any further information.

It could be an oversight on the website developer’s part, or perhaps it was indicative of the lack of service currently being offered, despite it being mentioned repeatedly on their website.

ACB Service recently published a news post outlining their stock market ideas and forecasts, claiming that the firm has prepared an investment portfolio that their analysts believe will rise in value. It is available to invest in via their website or by contacting your account manager.

They claim to offer clients who invest in this portfolio a 100% deposit insurance. However, you should be extremely wary of this offer.

What did our traders think after reviewing the key criteria?

ACB Fees

The first thing we have to mention here is the crazy spreads the company has listed on their website, for example, if we take the EUR/USD pair, it shows a 28 pip spread and the EUR/RUB has a spread in the thousands. This is not standard practice with reputable brokers.

These spreads are also subject to variation based on market conditions and so could end up being higher than listed.

To open up an account, you need a minimum deposit of $300. ACB also displays swap prices on its platform. They also charge a flat per trade commission of $10 for non-CFD trades.

There do not seem to be any other account-related fees charged although you may need to pay commissions to any traders you copy if you decide to participate in social trading.

Account Types

The website offers a free demo account you can use to practice or test trading strategies. They only have one real money account type for traders so that you can access all account features even with a small initial deposit.

The minimum trade size on offer is a micro-lot, 0.01. Clients can use up to 1,000:1 leverage with an 80% margin call level, which is very excessive and we would not recommend using anywhere near this amount of leverage regardless of the broker platform you choose.

A final note to add is that you can have up to 100 open orders and trade a maximum size of 100 lots.

Platforms

You can trade CFDs and forex pairs with ACB via the popular MetaTrader 5 (MT5) platform. However, the platform does not presently support MetaTrader 4 (MT4).

The MT5 platform also lets you use third party trading expert advisors (E.A.s) to automate your forex trading, although you will need to keep in mind that MT4 EAs do not work on MT5. MT5 also has a social trading feature called Trading Signals.

The company also uses the COPYDEAL platform, which, as mentioned previously, is developed by TSB.

ACB’s website states that it provides a wealth management investment service, but the associated button and link on its website do not provide any further information.

Mobile trading consists of using the MT5 app that is available for both Android and iOS mobile devices on the Google Play and App Store.

One of the benefits of the mobile MT5 app is that it provides you with push notifications when the market reaches a specific price point.

Usability

The official website has a simple format featuring white, black text on a black or red background. There is a distinct lack of information on the website, which immediately brings into question the brokers reputation. The site’s top menu links to all the essential topics you might wish to research with dropdown menus for each specific section.

To provide you with a sense of its organisation, the primary menu tabs on the site include trading, our Services, platforms, analysis, about us, and FAQs. The footer of each page has further links and legal details.

In our review, we noticed that the links to many parts of the website did not seem to work correctly.

However, the company is relatively new, so we take into consideration that these sections of the site may just be incomplete.

Customer Support

The customer support staff are available on a 24/5 basis during the trading week via phone and email, although they do not offer the webchat function that many traders prefer. The phone number and email address of the support team can be found at the bottom of the website.

Payment Methods

The website states that the company allows clients to deposit money into live accounts using a variety of payment channels. However, those who prefer to use e-wallets will be disappointed at the total lack of any options provided.

Although ACB does not support e-wallet deposits, it does offer the following alternative account deposit options:

- Credit and debit cards: You can make deposits via either Visa or MasterCard. However, there is a limit of $5,000 on a single transfer of funds made this way

- Bank wire transfer: A maximum of $5,000 can be transferred this way at any one time

- Cryptocurrencies: You can make fast and secure deposits in the Tether cryptocurrency that is tied to the value of the U.S. dollar

Best Offers

Although it may have special offers from time to time, the company currently doesn’t provide any financial incentive to sign up for its live account. There are also no added services provided if a client makes a significant account deposit.

While ACB notably lacks training programs or educational material for its clients, the website does have an analysis tab with some daily market update videos and reviews. They also provide links to an economic calendar.

The company’s FAQ section could be improved upon since it left many typical questions unanswered, and lacked detail in the questions it did answer.

They also have several active social media accounts you can check out. Its Facebook Page had recent posts that also appear on its website, although it only has a modest following of around 600 accounts. Their Twitter account has similar content, although it suspiciously does not have any followers or follow anyone. Their YouTube channel has lots of market update videos posted but only 166 subscribers to date.

Regulation and Deposit Protection

As it is an offshore company based in the Marshall Islands, it lacks oversight by an official regulatory body. Although at least one online review says it is regulated by the U.K.’s Financial Conduct Authority (FCA), they were not found in a search among authorised firms on the FCA’s official website. By offering financial services in the U.K. without being registered with FCA, they are breaching regulations.

Therefore it is most likely not following the E.U.’s Markets in Financial Instruments Directive II, which states that clients funds should be segregated from its own, it should provide negative balance protection, and apply any of the restrictions on leverage that need to be imposed in the U.K. or E.U.

These are very significant warning signs.

The company also does not mention having a third-party custodial arrangement set up for its touted wealth management plans, which seems rather suspect if ACB is indeed offering such products. Furthermore, U.K. traders do not have the usual benefit of being protected against default by this broker under the Financial Services Compensation Scheme (FSCS).

Regarding personal data protection, they have a detailed data policy. Still, due to its complicated legal language, it is not straightforward or comforting to a person who strongly prefers their data to remain private.

Regardless of whether they are acting in good faith or not, its lack of regulation and flouting of FCA rules should suggest that you move your money elsewhere or avoid them entirely.

Awards

As a newcomer to the online broking scene in 2019, it may not be surprising that the company has not gotten any awards.