Bitcoin Cash – Introduction

Bitcoin Cash was created in August 2017 following a hard fork on Bitcoin. There was a lot of controversy regarding the fork. The main reason for the split was that a large part of the community was not happy about the segregated witness feature that was placed into the original Bitcoin code in mid- 2017. As a result, Bitcoin Cash (BCH) was developed and became the first Bitcoin network hard fork. This hard fork took place in August 2017 and since then, Bitcoin Cash has grown to be the 5th largest cryptocurrency in terms of market capitalization. In May of 2017, Bitcoin transactions were taking four days to be processed in some cases.

There were also significant fees associated with expediting these transactions. This of course went against the inherent principles that Bitcoin was built upon – namely being a payment method which was ultra-quick and very cheap when compared to the traditional payment systems. The average transaction fee went as high as the $28 mark, sometimes hitting highs of $55. The main issue with the Bitcoin network was and is the scalability. The blockchain block size for Bitcoin had originally been set at 1MB, which offered some benefits, but it also meant that as the network became more popular, there would be rising unconfirmed transactions and fees.

The 1MB block size helped prevent Denial of Service (DoS) attacks, which overloaded the network when an illicit party intentionally spamming the network with micro transactions. It helped to limit the size of the blockchain, making everything more manageable. However, there were still rising tensions which made the community divide.

The two opposing teams were Bitcoin traditionalists who believed that Bitcoin was straying away from what was originally envisioned, which is a transfer of exchange which was seamless, cost effective and trustworthy. The other group were the miner and security proponents who wanted the current level of fees and mining procedures to remain the the same and ensure that the high decentralisation level was maintained.

Until the start of 2017, Bitcoin enthusiasts kept aligned under a core set of shared rules. However, once the scalability issues became clearer, it was obvious to a lot of people that the 1MB block size was not going to be able to keep up with transaction volume into the future, especially as the popularity of Bitcoin transactions was growing massively. The solution the traditionalists provided was to increase the size of blocks up to 8MB. The community could not come to agreement on this issue, which is how Bitcoin Cash emerged. This hard fork took place on the 1st of August 2017. It saw current Bitcoin holders awarded Bitcoin Cash tokens at 1:1. On this launch date, Bitcoin was priced at $2,718.26, with Bitcoin Cash launching around the $380.01 mark.

Bitcoin Cash – Essence and History

- Bitcoin Cash is a peer-to-peer structured payment system, originating from a Bitcoin network hard fork.

- While there are certain similarities between the two networks, there are some integral differences between the two currencies.

- Bitcoin Cash aims to fulfil the original promise from the creators of Bitcoin, acting as a peer-to-peer form of electronic cash and was tasked with unrestricted growth, worldwide adoption, innovation that did not need permission and development in a decentralised manner.

- The creators of Bitcoin Cash also aimed to stick to the on-chain scaling roadmap that was laid out in the original Satoshi Nakamoto’s roadmap. This is why the blockchain was increased to 8MB, so it would be able to handle mass adoption.

- Bitcoin Cash is a good option as a digital currency because people across the world can send payments online without having to deal with an intermediary that is heavily centralised, often intrusive and inefficient.

- While there is a certain level of privacy related to the traditional payment models, Bitcoin Cash takes access to information risks out of the equation.

- Using public keys and the public distributed ledger, any user is able to see what a given key is sending to another without knowing any other information that is linked to the transaction.

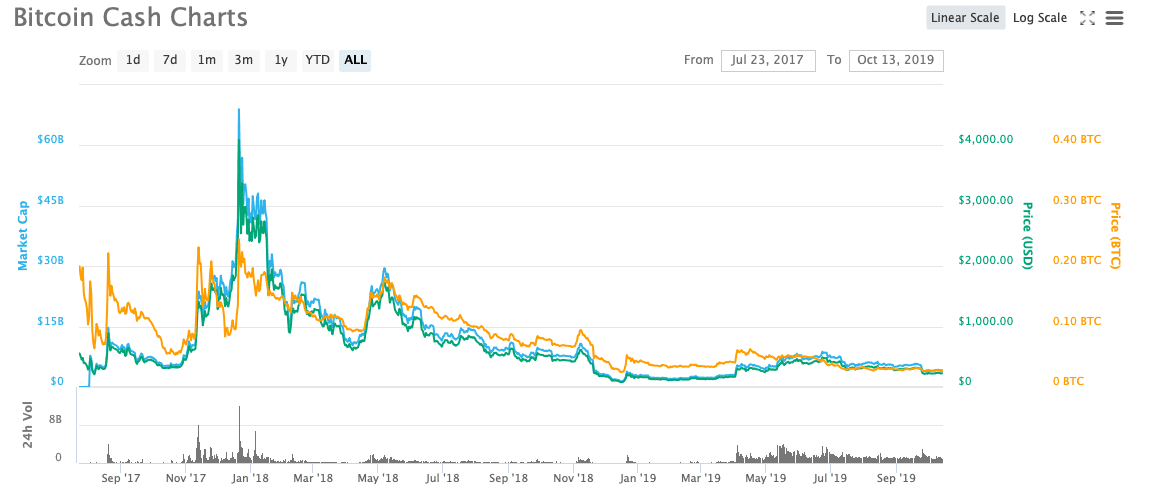

Since the hard fork in August, 2017, Bitcoin Cash has taken off big time, especially judging by the market cap. More and more businesses and major exchanges support the currency. While most wallet providers and crypto brokers were worried about the performance of Bitcoin Cash following the high tension during the fork process, Bitcoin Cash has managed to stabilize its position. Bitcoin Cash was listed on Coinbase at the start of 2018, which also gave a major value boost to the currency. Bitcoin Cash is also profitable to mine, although mining has become very volatile. Towards the end of 2017, there was a new algorithm introduced which allowed the mining community to stabilize the volatility and difficulty of mining. This led to a further influx of miners and therefore led to a better hash rate. There was also another hard fork on the 15th of May. This Bitcoin Cash hard fork saw the block size increase by a multiple of four, up to 32MB from 8MB. The aim was to solidify the position of Bitcoin Cash as being a superb option for peer-to-peer exchange.

Bitcoin Cash and Bitcoin – Major Differences

While Bitcoin was the original cryptocurrency, there are many people who were not happy with how it developed over time due to a number of key issues. They decided to focus their effort on Bitcoin cash or other digital currencies instead.

- With the faster transaction times and cost-effective fees, you could say that the current version of Bitcoin Cash is very similar to what Bitcoin was before scalability issues first became apparent.

- Both currencies are trying to connect people into a global economy and disrupt the hold the traditional financial institutions and banks have on the monetary payment system across the world.

- They have similar messages, but it’s the process by which they hope to achieve these goals where they differ.

- Bitcoin Cash has much lower transaction fees than those of Bitcoin, with this being one of the core causes of the original hard fork.

- Bitcoin fees have decreased in recent times, but Bitcoin Cash is still a lot cheaper to use.

Bitcoin Cash – Criticism

The main criticism that Bitcoin Cash receives is that it has a higher level of centralization than Bitcoin. While the greater block size was made with intentions to increase the memory, there is more computing power required to do this, which means more expensive rigs for mining are needed. Therefore, the mining pool who is working on encryption, storage and transactions on the network is lower. Therefore, there is a certain level of power that this minority has when compared to the massive pool of miners seen with Bitcoin. There have been a few other incidents of note which have shaken some of the confidence in Bitcoin Cash. It was in November 2017 that some believed that there was a potential pump and dump when the price suddenly spiked to the $2,500 mark before sharply falling down to the $1,000 mark, all in the period of 48 hours.

Another criticism was related to the issue that emerged after trading of Bitcoin Cash was temporarily suspended on Coinbase after it was revealed that the authorities believe some Coinbase employees utilised insider information about the coin being listed and subsequently made profitable trades.

Growing Popularity – The Reasons

Having said all of this, the popularity of Bitcoin Cash has been steadily growing over time. Increased trading activity in South Korea is one of the reasons for this growth. The recent hard fork has also provided investors with a lot of confidence in the future potential of this network, despite the overall cryptocurrency market being in the doldrums. With concerns about Bitcoin’s scalability issues continue, more and more people may decide to jump over the fence and take their business to Bitcoin Cash. The Bitcoin Cash developers are passionate about their offering and they are hard at work to help it gain mainstream adoption. The main criticism Bitcoin Cash receives is that it has a higher level of centralization than Bitcoin. Trying to predict the future price of investment is going to be fraught with danger. This is especially the case when you are dealing with a market as volatile as that of the cryptocurrency sector.

Conclusion

Bitcoin Cash has seen a lot of ups and downs in its short history since August, 2017. As can be seen from the price chart above, the price really spiked the “crypto summer” of December, 2017 and then as volatility and uncertainty emerged, the price levelled off. However, the major drive of Bitcoin Cash’ popularity is that it has faster transaction time and lower fees.

PEOPLE WHO READ THIS ALSO VIEWED: