There are estimated to be over 18,000 cryptocurrencies in existence, so the AskTraders analysts have provided this shortlist of the altcoins, which are the best Bitcoin alternatives.

- What are the top five altcoins?

- Why buy Ethereum?

- Why buy Ripple?

- Why buy Polkadot?

- Why buy Cardano?

- Why buy an altcoin index?

- Where can I buy altcoins?

- Final thoughts

WHAT ARE ALTCOINS?

Put simply, altcoins are a cryptocurrency that are alternatives to Bitcoin. They operate using the same blockchain technology as Bitcoin and also aim to be useful as a store of wealth and a means of exchange. There are reported to be 18,000+ altcoins and each one has a chance to be a currency of the future.

The buzzwords swirling around the crypto space include ‘open-source’, ‘decentralised’, ‘blockchain’, ‘protocols’, ‘tokens’ and ‘e-wallet’. It’s a very technical space. Altcoins have sprung up based on their potential to do what Bitcoin does but use improved technology to do it better.

In realistic terms, it is unlikely that there will be more than one winner of the crypto-race. Bitcoin is currently in pole position, but the market capitalisation data of the top cryptos suggests there is a chance for altcoins to catch up. From a trading perspective, rumours such as those cause dramatic price moves.

WHAT ARE THE TOP FIVE ALTCOINS?

One important note is that the top five altcoins by market capitalisation might not necessarily suit your style of trading and risk appetite. As with equities, if you’re looking to run short-term, speculative, strategies, then you might want to trade markets in smaller coins, which are extremely volatile. If you’re looking for a buy-and-hold style position, then the below five instruments could be for you.

Trading altcoins can be a bumpy ride, but the following best Bitcoin alternatives all have the potential to become the global currency of the future.

WHY BUY ETHEREUM (ETH)?

Ethereum and its native coin, Ether, have for many years been seen as the best altcoin to buy. Often referred to as ‘Bitcoin’s silver’ it has a long-standing reputation for matching Bitcoin price moves and Ethereum’s market cap of $139bn is some way above that of the third ranked crypto Tether ($66bn),

From a technical perspective, Ethereum can be claimed to be more ‘useful’ than Bitcoin. Transactions are cheaper and faster than they are with Bitcoin and the Ethereum platform also has the advantage of being more accommodating of other altcoins, NFTs, and tokens. It’s built to be used, and many are doing so which is why it is the current leading bitcoin alternative.

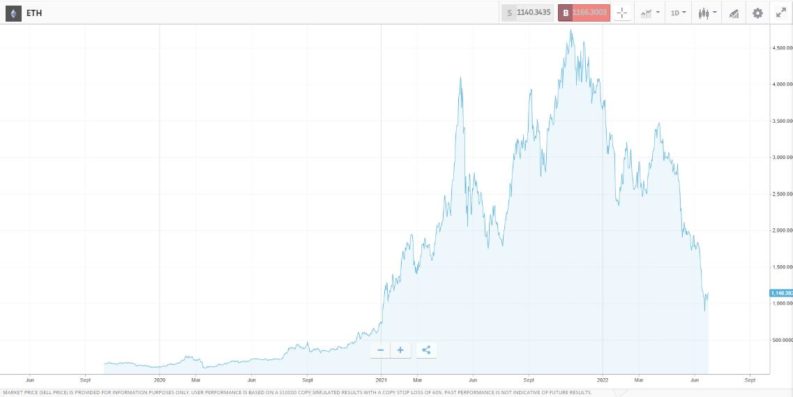

Ether Price Chart – 2019 – 2022

Source: eToro

The advantages that Ether has over Bitcoin as an effective means of exchange resulted in it outperforming its bigger rival between January 2020 and June 2022. During that period, the price of Bitcoin increased by 307% but Ether recorded an eye-watering 1,241% gain in value.

Bitcoin, however, continues to be held in higher regard as a store of value. This and technical glitches around roll-outs of ETH system upgrades have seen the price of Ethereum recently underperform that of Bitcoin. During the pullback, which impacted the entire crypto sector in 2022, Bitcoin lost 35.8% in value between January and June, whilst the price of ETH fell by 50.72%.

WHY BUY RIPPLE (XRP)?

Founded in 2011, Ripple is a blockchain system that is already bridging the gap between crypto and mainstream finance. Transaction volumes are market-leading, and the cost of processing a payment on Ripple is so low that it’s almost not worth noting.

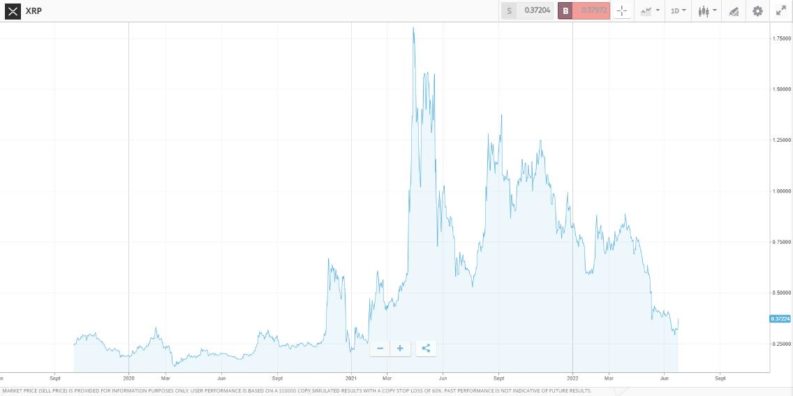

Ripple Price Chart – 2019 – 2022

Source: eToro

The RippleNet payment framework is global and involves traditional crypto traders but also mainstream financial institutions. Its use as a means of exchange is where Ripple’s strength lies but could also be its weakness.

Cryptocurrencies and their open-source software and decentralised processes grew out of discontent with the financial system after the 2008 crash. Cryptos were supposed to liberate individuals from the established big institutions, but Ripple looks very much like a very good payments system with some neat add-on features making it an interesting bitcoin alternative.

At the same time, Ripple’s interaction with mainstream financial systems has brought it to the attention of regulators. The platform has found itself embroiled in a court case with the SEC, which accuses the platform of blurring the lines between regulated and unregulated investments.

That legal dispute continues to be a major drag on XRP price performance, but it’s widely thought that if the court finds in Ripple’s favour, then that would trigger a price surge. The coin currently ranks 6th in the table of cryptos by market cap. Given its potential to bring the best parts of blockchain into mainstream processes, its market cap of $16bn could be preparing for lift-off.

WHY BUY POLKADOT (DOT)?

Polkadot was founded in 2017 by Ethereum co-founder Gavin Wood. Despite its late entry into the sector, it’s market cap has grown to $7bn, making it the number 11 ranking crypto by size. With so many bitcoin alternatives / altcoins in the market, its ability to thrive might at first be surprising, but Polkadot’s competitive edge is that it offers a way to help different blockchains interact.

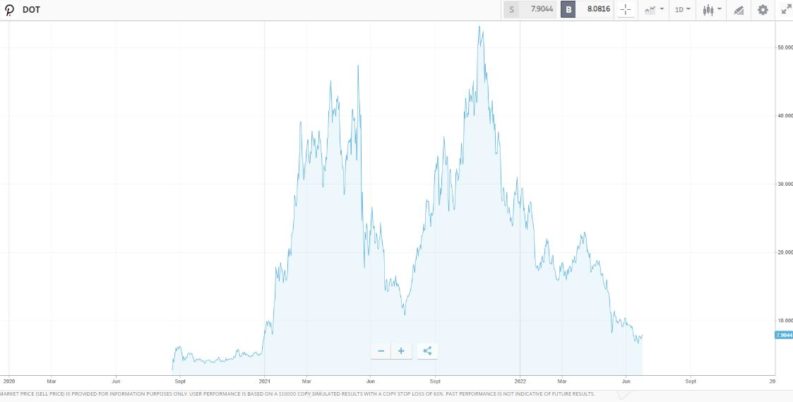

Polkadot Price Chart – 2020 – 2022

Source: eToro

Polkadot facilitates messaging and transactions between different crypto platforms without the need of a third party. It also uses cutting-edge Proof of Stake (PoS) protocols rather than the Proof of Work (PoW) approach adopted by Bitcoin. That enables faster and more efficient processing and the potential for staking. Investors who hold DOT positions as a medium or long-term investment and decide to stake their position currently receive an annual return in the region of 10%.

WHY BUY CARDANO (ADA)?

Launched in 2015, Cardano ranks as number eight crypto by market cap. Like Polkadot, it uses Proof of Stake protocols and has leveraged the improved functionality of those protocols to offer its users a range of neat features.

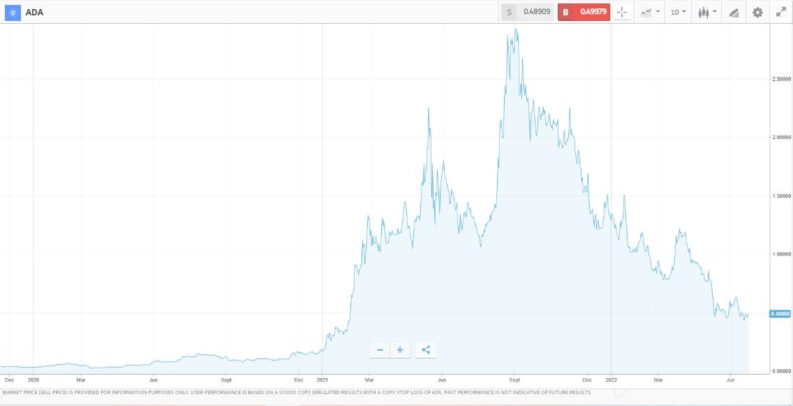

Cardano Price Chart – 2019 – 2022

Source: eToro

The headline selling point for Cardano is that it can process 257 transactions per second. That figure is impressive enough compared to Bitcoin’s seven transactions per second, but further ground-breaking upgrades are on the way. Cardano is currently putting through a system upgrade, which could result in it being able to process 1,000 per second by the end of 2022. Its ambitious layer 2 solution Hydra, which is also in the pipeline, could allow Cardano to process as many as a million transactions per second.

Cardano also prides itself as an environmentally friendly alternative to bitcoin using less than 0.01% of the energy consumed by bitcoin. These environmental credentials, coupled with the scalability of their platform is why ADA is a potential alternative to BTC.

WHY BUY AN ALTCOIN INDEX?

The fifth ‘altcoin’ to make it onto our list is actually a blend of altcoins. Some brokers provide an index of altcoins so that traders can get exposure to several at once. This minimises losses in cash terms if you back the wrong one, and reduces the time taken to build a diversified portfolio by buying one position at a time.

Etoro’s Scalable-Crypto index invests in the cutting-edge coins that solve a range of problems facing first-generation names such as Bitcoin. It takes positions in cryptos which aim to increase transaction speed (faster finality) and transaction throughput (high transactions per second) without sacrificing decentralisation or security.

The portfolio aggregates a select group of crypto assets that are implementing scaling techniques and solutions and is rebalanced yearly or at eToro’s discretion, pending market conditions.

Selecting your preferred altcoin can be tricky, but there is an abundance of free research available online. Some brokers and exchanges offer in-house analysis or software tools and trade entry point indicators to support their clients’ trading activity.

WHERE CAN I BUY ALTCOINS?

There are several ways of buying altcoins. If you have a friend or acquaintance, you can organise a face-to-face transaction. Alternatively, you can trade altcoins from anywhere in the world and tap into the global liquidity offered by crypto exchanges and brokers.

Buying altcoins using a crypto exchange

Cryptocurrencies are unregulated and while some of the specialist ‘crypto-only' exchanges are in the process of building up their accreditation with regulatory authorities, that is still a work in progress.

Adopting a ‘buyer beware’ approach and applying some common sense does work for many. There are now a number of reputable exchanges in the market. The good news for altcoin buyers is that each one has a reputation to protect.

The exchanges simply put buyers and sellers in touch with each other. They also help the parties process the transaction, so that scammers don’t leave one of those involved empty-handed. These exchanges include:

- Cryptology – Ideal for beginners. High quality with easy-to-access customer support, and not trading revenue options include referral programs. A solid cost-effective exchange.

- Bitstamp – An established player with a reputation for driving down costs.

- Binance – The largest global crypto exchange. Ideal for intermediate-level crypto traders.

- Coinmama – Beginners will be drawn to the intuitive functionality of the trading platform and 24/7 (email) customer support. The top altcoins are covered but you need to be careful with the T&Cs as fees can soon rack up.

- Changelly – A user-friendly platform supporting more than 140 altcoin markets. Low transactional costs, but wire transfer fees are higher than average for certain payment methods.

Buying altcoins using a multi-asset broker

Big-name online brokers that also offer trading in assets such as stocks, forex, and commodities have responded to consumer demand and added crypto trading to their platforms. While crypto markets themselves are unregulated, multi-asset brokers tend to be regulated because they offer trading in some markets, such as equities, where being licensed is required. That means they know their way around client safety rules and regulations and have been set up in a way to comply with compliance protocols of highly-regarded regulators.

Buying crypto using an online broker, rather than an exchange also removes the need to set up a specialist wallet. You can trade stocks, oil, gold, currencies and crypto from the same account. Another big plus-point for multi-asset platforms is they usually offer a free demo account. Trading altcoins using virtual funds is a good way to get a better understanding of what can be a high-risk environment. You can also double-check if the site functionality suits you.

The three regulators listed below are considered to be Tier-1 regulators. While they don’t regulate crypto markets or trading activity, a broker who has a rubber-stamp from one of these authorities is a safer bet than one that doesn’t.

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

FINAL THOUGHTS

The altcoin space is certainly a very exciting one presenting traders with multiple bitcoin alternatives. There are risks involved, but there is also the opportunity to get in early on the next big thing.

Picking the right coin is part of the process, but trading using a reputable exchange of broker is also fundamental to making a profit.