The unprecedented events of 2021 have catapulted them to centre stage. It’s not just all about COVID, there are also some long-term structural reasons to buy into the sector. The Singapore population is ageing, with the average age of citizens creeping up and lifespans extending. There are also lifestyle illnesses to factor in. These underlying trends, added to COVID concerns, make healthcare stocks in Singapore a hot ticket right now.

There are 18 healthcare providers and two healthcare REITs listed by SGX and they have a combined market capitalisation of S$25bn. Being listed on SGX makes them easy to trade and we’ll outline the steps to follow to do that and how to locate and get the most out of a regulated broker.

Signing up for an account and starting trading is relatively easy to do, and if you make the right choice, you can invest in a well-run business that has the potential to make you gains over the short and long term.

Best Healthcare Stocks in Singapore

- Medtecs International Corporation Limited

- IHH Healthcare Berhad

- First Real Estate Investment Trust (REIT)

- Thomson Medical Group Limited

- Haw Par Corporation Limited

1. Medtecs International

Medtecs International found itself a must-have stock in 2021 thanks to its position as a global leader in the manufacture and supply of Personal Protective Equipment (PPE). The firm has been operating in the sector for more than 30 years and is a ‘trusted national strategic stockpiling partner’.

On 13th March 2020, before the extent of the COVID pandemic had been acknowledged, the Medtecs share price was S$0.08. The unprecedented demand for PPE took the share prices as high as S$1.85 by 21st August. That 23-fold increase in value reflected panic buying of PPE and Medtec stock, and the share price then fell back to consolidate at the S$0.95–S$1.15 price level.

Source: IG

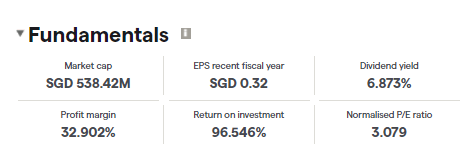

Medtecs’ customer base is global, which means that the discovery of any new variants anywhere in the world is likely to require Medtec to ship some of its ready-to-hand inventory. The firm’s profit margins are a very healthy 32.9%, and although it’s not necessarily seen as a dividend stock, the current calculated yield is a jaw-dropping 6.87%. The fact the firm has a market capitalisation of S$538m makes it clear to see why many investors are finding room for the stock in their portfolio.

- 2021 – Reported dividend amount per share: 5.68%

- 2020 – Reported dividend amount per share: 1.15%

- 2007 – Reported dividend amount per share: 0.14%

Source: Dividends

2. IHH Healthcare Berhad

IHH is one of the largest healthcare firms in the world by market capitalisation and is listed on the Singapore Stock Exchange. It offers one-stop-shop premium healthcare in Singapore, Malaysia, Turkey and India, with plans to build its presence in Greater China and Europe.

The firm’s business model covers a range of healthcare sectors. It is strong in primary, secondary and tertiary care and has also tapped into growth markets such as travel medicine, medical education and molecular diagnostics.

Being well-positioned in the healthcare sector has brought IHH to the attention of buy-out specialists Mitsui, which in May, was reported by Bloomberg to be considering buying up IHH stock to take it private. There’s no confirmation that a deal will be tabled, but if private equity firms are hovering over a stock, it’s usually a sign that it’s undervalued.

- 2021 – Reported dividend amount per share: 0.73%

- 2020 – Reported dividend amount per share: 0.73%

- 2019 – Reported dividend amount per share: 0.55%

- 2018 – Reported dividend amount per share: 0.55%

- 2017 – Reported dividend amount per share: 0.55%

Source: Dividends

3. First Real Estate Investment Trust (REIT)

There are several ways to gain exposure to the sector and one of the most talked-about Singapore healthcare stocks is First REIT. The Real Estate Investment Trust invests in medical facilities and healthcare-related property with the aim of generating capital growth and dividend income to investors.

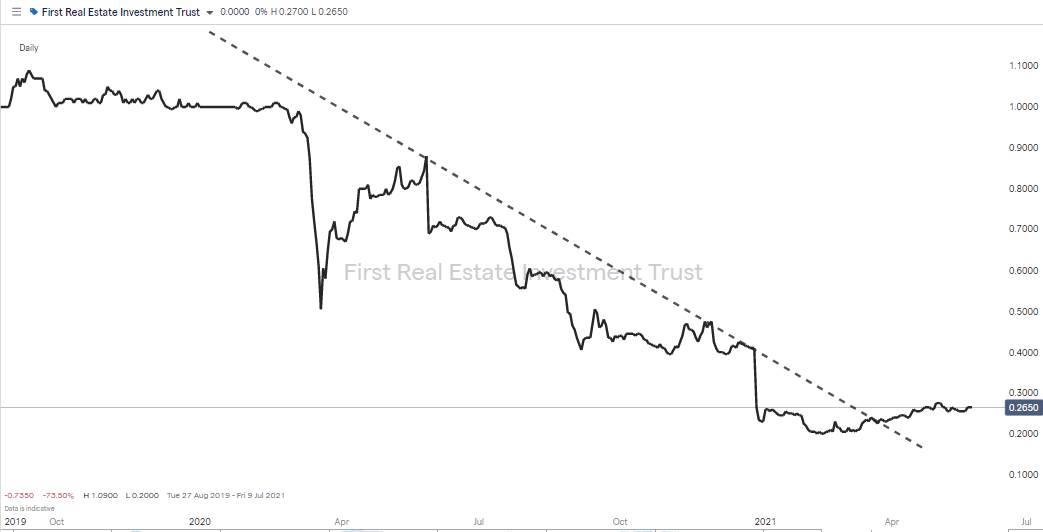

First, REIT’s share price has recently shown signs of bottoming out and breaking its downward trend. However, the low share price offers a chance to buy in at levels that make the dividend yield look particularly attractive, particularly when compared to bank savings rates.

- 2021 – Reported dividend amount per share: 5.52%

- 2020 – Reported dividend amount per share: 20.22%

- 2019 – Reported dividend amount per share: 31.85%

- 2018 – Reported dividend amount per share: 31.85%

- 2017 – Reported dividend amount per share: 31.67%

Source: Dividends

In May 2021, First REIT announced a corporate restructuring program, which will allow the firm to recapitalise its balance sheet and place it in a good position to generate sustainable future growth.

Victor Tan, CEO of First REIT, said of the restructuring:

“The proposed restructuring with LPKR and MPU is expected to set a clean path ahead for First REIT to establish sustainable long-term returns with improved upside sharing for unitholders.”

Source: Dividends.sg

4. Thomson Medical Group Limited

Thomson Medical Group is a large-cap but niche operator. The firm operates a 190-bed private hospital that specialises in gynaecology and invitro-fertilisation.

Controlling shareholder Peter Lim Eng Hock has intimate knowledge about the firm’s growth prospects. In Q1 2021, he upped his stake by another 31.5m shares, which equates to S$2.3m worth of stock. Thomson only pays a small dividend – the real returns are in capital growth as reflected in the share price. The large surge in the Thomson stock price from 0.486 to 0.1179 in early 2021 was followed by a pull-back, which many will be seeing as a chance to buy the dips.

- 2019 – Reported dividend amount per share: 0.25%

Source: Dividends

5. Haw Par Corporation Limited

The Haw Par share price is already on the move. In the six months that followed November 2020, the stock increased in value by more than 44% and as long as it trades above the supporting trend-line, there will be many looking to join the ride.

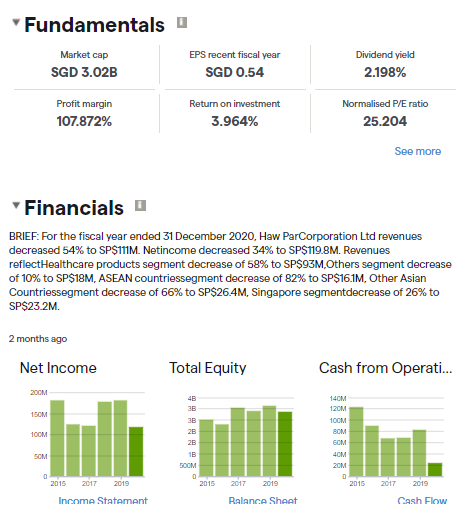

The firm has strong fundamentals. The market cap of S$3.2bn and dividend yield over 2% means it attracts attention from investors looking to combine the security of Singapore blue-chip stocks with a reasonable dividend yield. It also owns and operates global household brands such as Tiger Balm.

Source: IG

- 2021 – Reported dividend amount per share: 1.10%

- 2020 – Reported dividend amount per share: 2.21%

- 2019 – Reported dividend amount per share: 8.46%

- 2018 – Reported dividend amount per share: 1.84%

- 2017 – Reported dividend amount per share: 1.47%

Source: Dividends

How to Buy Stocks in Singapore

Buying healthcare stocks in Singapore is incredibly easy to do, but there are some guidelines to follow to ensure you choose the right broker. The process of signing up for an account and booking your first healthcare trade can be done completely online and takes moments to do. The below step-by-step guide will walk you through the process.

1. Choose a Broker

There are hundreds of online brokers to choose from and the first and most important filter you need to apply is to ensure your broker is properly regulated. To trade the Singapore markets, you’ll need to send hard earned cash to your broking account. One of the best ways to check if your broker is legitimate is to verify if it is authorised by a financial regulator, one of the below is recommended.

- The Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

These financial authorities have the aim of ensuring markets and market participants operate effectively and fairly. They also have a strong bias to protecting smaller retail investors.

Any broker looking to obtain a license from a regulator needs to jump through a lot of hoops. During the application process, they’ll need to demonstrate they have sufficient funds to operate, appropriately trained and non-blacklisted staff in management positions, and a clear business plan.

If their application is approved, they’ll then commit to keeping up to date with regulatory protocols and reporting the state of their position to the authority and independent auditors. When you factor in that regulated brokerage firms also have to have sufficient funds in place to be viable, it’s clear to see that applying to be licensed is not a step that any firm would take lightly.

Regulated firms are in it for the long haul and can have track records stretching back decades. Choosing one that you can trust will offer some security and is the best way to avoid sleepless nights.

Another aspect to consider when choosing a good broker is the functionality of trading platforms. This research note discusses a short list of regulated brokers and their pros and cons. Some specialise in low-cost trading, while others provide value-added services such as education and research materials.

It’s also worth checking that your preferred broker covers the market you want to trade. If you’re looking to trade small-cap Singapore healthcare stocks, you might find those markets aren’t covered by all the brokers.

One of the best ways to establish what works for you is taking a few moments to sign up for a demo account. These simulation accounts usually require little more than an email to set up and provide a very realistic trading package. It’s just that the funds in the account are virtual, so you can practise risk-free.

Demo accounts are a great way to carry out hands-on learning and also offer you the chance to try out different brokers. They are free to set up, so trying a few is to be recommended. That way you can work out which broker is the best fit for you.

Best Brokers to buy Healthcare Stocks in Singapore:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some healthcare stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

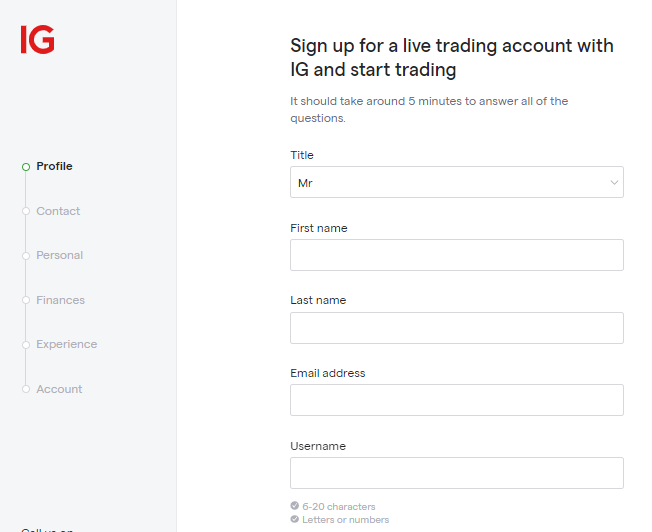

2. Open and Fund an Account

Signing up for an account is done online and can be carried out using a desktop or handheld device. The process involves submitting some personal details to ensure that you and only you have access to the account. You might also be asked a series of questions on your investment aims and trading experience. There aren’t any right or wrong answers to these questions, they are just so the broker can build a profile of you and set appropriate customer care levels on your account.

Paying money into your new account is very much like any other online transfer or purchase. Most brokers offer a range of payment providers to facilitate the transaction in a best fit for each user. Different payment options come with different time scales, so it’s worth checking the T&Cs to ensure you find the one which suits you. It’s also worth double-checking if there are any commissions on deposits as there’s no need to give money away on admin fees.

Once funds hit your account, they can only be returned to the account that made the deposit. This is to crack down on money laundering and means that brokers simply can’t forward funds on to another account. It’s a neat additional safety check and all additional layers of protection are to be welcomed.

Two of the fastest and most popular payment methods are debit or credit card and once the funds hit your account, you’re ready to trade.

3. Open an Order Ticket and Set Your Position Size

You may choose to use technical analysis, fundamental analysis or a combination of both to identify your target Singapore healthcare stock. Your broker should be able to help you with that. The platforms are user-friendly, but if you scratch the surface, you’ll find they contain a range of powerful software tools. To find the market you want to trade simply use the search function or if your broker supports it, filter by country and sector.

Trading in its purest form involves simply inputting the amount you want to buy and clicking or tapping the ‘buy’ or ‘sell’ buttons. There are some neat additional features on offer, which are designed to help you with risk management.

4. Set Your Stops & Limits

Stop Loss instructions and Take Profit orders are automated risk-management instructions built into the system. These mean you can sell some or all of your position without having to watch the markets 24/7. In the case of stop-losses, the system will close out some of your position if price goes against you. No one likes taking a financial hit, but stop-losses can stop you from blowing up your account if one position goes bad.

Take profits work in the opposite direction. These orders automatically lock in profits by selling some of your position if price goes your way.

These two tools are often recommended for beginners. Stop-losses cut back on risk and take-profits crystalise gains, but there is an alternative view. Buy-and-hold investors and those taking a medium- to long-term approach to healthcare investments might take the view that they are willing to ride out short-term market noise. A temporary slump in a share price could lead to you being kicked out of a position that could ultimately come good.

There are other ways to mitigate risk. These involve diversifying your portfolio across a range of names. That way, each position size is a smaller percentage of the total, so one bad apple won’t wipe you out.

Another top tip shared by experienced traders is to work into a position. The temptation is to buy immediately, but if you think there is a chance that price might dip before heading upwards, you can take advantage of Limit Orders. These are binding, automated instructions to buy at a certain price level. There’s no guarantee you’ll get ‘filled’ at that lower level, but if you do ,then your entrance point will be optimised.

5. Make Your Purchase

The final part of the process is double-checking the trade details then clicking or tapping ‘Buy’ Whether you are using a PC, tablet or phone, that will be the moment when cash in your brokerage account will be converted into a Singapore healthcare stock position.

To follow its performance and keep track of the trading P&L (profit and loss), just head to the portfolio section of the platform. This is where the value of your position will be reported according to the live market price feed. It is also where you can adjust stop-loss and take profit levels, and when the time is right, sell out of your position.

One important piece of advice shared by experienced traders is to check your trade details as soon as you’ve executed your trade. Broker platforms are state of the art pieces of technology, but human error can come into play. If you’ve bought the wrong stock or too much or too little of it, then fixing that problem before price moves too far can help protect your bottom line.