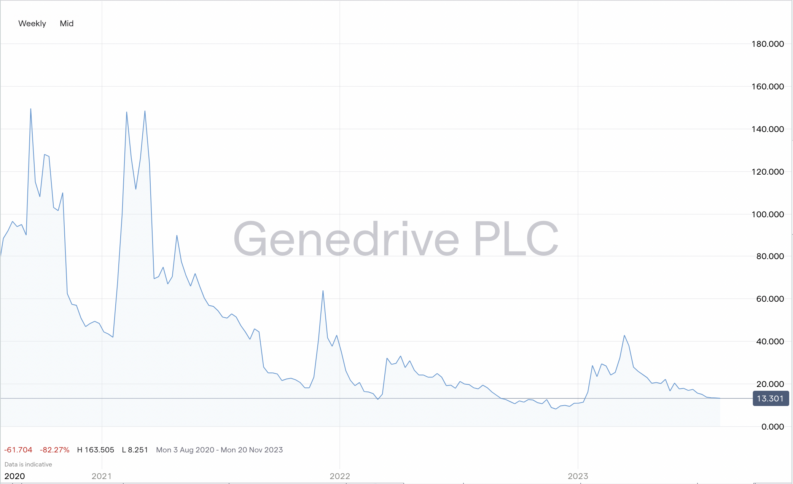

If you bought into Genedrive at any time in the last couple of years, the lack of sustained momentum to the upside may seem worrying. The small-cap UK-based diagnostics group has, since 2020, experienced rapid rallies, followed by sustained downside.

YOUR CAPITAL IS AT RISK

Since the highs of May 2020, the Genedrive share price has slumped, which, while bad news for those left nursing losses, could be good news for those considering stepping in at these levels to open a new position.

Make no mistakes, the firm is still a high-risk proposition. However, if some of the elements of the business plan that caused such excitement previously do come back into play, there might once more be eye-watering share price gains in the pipeline.

There’s something for everyone. Short-term traders can find joy in using technical analysis to buy or sell Genedrive shares. Those with a longer-term view can use fundamental analysis to answer a different question: is Genedrive a good stock to buy and hold? This review will look at the prospects for both types of investors and come up with a Genedrive stock forecast.

Table of contents

Who are Genedrive?

Genedrive’s core operations involve developing rapid and low-cost molecular diagnostics platforms. These are used to identify and treat a selection of infectious diseases. It also has other divisions that involve human genotyping, animal health and pathogen identification. The firm uses cutting-edge technology and, true to its academic roots, is still based at the University of Manchester.

The 2016 name change from Epistem Plc to Genedrive Plc represented a shift in approach as the firm looked to exploit the commercial applications of its range of new products.

When COVID-19 hit in early 2020, the firm was quickly identified as being in a position to meet the dramatic upward shift in demand for the kinds of products needed to manage the global pandemic. The firm’s Genedrive® 96 COV19-ID Kit offered the hope of ground-breaking technology being used to offer easy-to-use, reliable, and rapid testing for COVID-19.

Red tape got in the way of Genedrive’s meteoric share price rise, and the stock has failed to breach its 2020 highs since.

Where Will Genedrive’s Stock Price Be at the End of 2023?

The Genedrive Stock forecast is heavily influenced by the hit-or-miss nature of its products making it to market.

The share price rise and fall reflect the fact that such products are required to undergo formal clinical qualification and regulatory filing, and the rate at which these are completed can be hard to predict.

The balance sheet is not great reading. It is yet to turn a profit and revenues are minimal at best. It is burning through its cash pile, although it recently said it “has sufficient cash in the business for its current plans and forecasts.” In addition, it noted that it will see an “acceleration of revenues through 2023 and going forwards.”

One positive to note is that GDR shares recently jumped after the UK's National Institute for Health and Care Excellence (NICE) endorsed in draft guidelines the use of the company’s CYP2C19 gene test in patients before administering clopidogrel, a medication used to prevent strokes.

Despite the company’s confidence, if it keeps haemorrhaging cash, then shareholder interests could wane further.

Genedrive Long-Term Forecast

It is clear that Genedrive is very much a ‘buyer beware’ situation, but given the recent pullback following the NICE announcement, it’s a proposition that will be tempting a lot of investors.

Digging down into the company’s most recent report and outlook, the company, as mentioned, said while revenue was minimal in H1, it is expected to accelerate in 2023, while the NICE recommendation is expected to facilitate the rollout of our AIHL product in both the UK and international markets.

“We are seeing the commercial traction resulting from our focus on pharmacogenetic testing and investment in the development of new products and are optimistic about our ability to succeed in the future, by creating value for our shareholders and by improving people's lives,” said GDR.

Furthermore, in March 2023, GDR confirmed a financing facility of up to £5m, which “will help finance the Company's future growth.”

While there are obviously concerns about Genedrive and its shares, the company remains confident, and there are some encouraging signs. Whether that is enough to sustain it, in the long run is another question. Nevertheless, investors interested in buying GDR shares should be cautious and understand the risks of the business they are buying into.

Is Genedrive a Good Buy?

There are a particularly large number of ‘unknowns’ in play, and investors who don’t happen to be world-leading students of many different areas of medical diagnostics are largely reliant on others being willing to interpret the medical data into more manageable terms.

A decision to buy Genedrive is a long way from making that call because you visited a high-street shop and decided that it being packed full of new customers was an adequate buy signal.

Other risks include the size of the firm. Genedrive may have had a share price in the region of nearly £3 during the endemic surge, but it is, in essence, a small-cap penny stock, and those have particular characteristics that investors need to be aware of.

Of course, if the company is able to manage its cash runway and deliver on its revenue promise, the gains could be considerable, but there are also significant risks that investors should be aware of.

The Best Brokers to Trade Genedrive Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some Genedrive stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.