The Singapore stock exchange has been one of the big stories of 2021. After a few years of underperformance, it’s become a target for hordes of domestic and international investors looking for the next big thing. The old adage in investing is to join the party late and leave it early. In the case of Singapore stocks, the music has started but nobody’s thinking of going home yet. Finding the optimal time to buy stocks is the first part of the process, the second is making sure you do so safely. This easy-to-follow, step-by-step guide will draw on the knowledge of experienced traders, show how to choose a good broker and explain the mechanics of putting on a trade to explain how to buy stocks in Singapore.

SPDR Straits Times Index ETF – 2010–2021

Why Buy Stocks in Singapore?

Establishing why now might be a good time to buy stocks in Singapore doesn’t need much gazing into a crystal ball. Instead, it’s a case of listening to the arguments put forward by those who have already started buying.

Singapore – A ‘Good’ Pandemic

From a global perspective, the Singapore economy managed the COVID-19 pandemic relatively well, with the country’s preparedness and testing regimes being taken as examples of best practise. This not only reduced the impact of the pandemic at the time but means Singapore-based companies are in a great position to capitalise on being the first out of lockdown. Make no mistake, being first out of the blocks creates the opportunity to snatch market share from lumbering rivals and that would translate into long-term growth.

Momentum is Already Building in the Singapore Stock Market

The prospect of Singapore companies being able to upgrade their future earnings has resulted in stock prices surging. As of 30th April 2021, the flagship Singapore stock index, the Straits Times Index, was up 12.55% on a year-to-date basis. Over the same time period, the Japan Nikkei 225 was up only 6.66% and the Hang Seng index up 4.79%. Rival companies based in countries such as Japan will, of course, ultimately receive some benefit from coming out of lock-down, but until they do, it’s Singapore firms leading the charge. 2020 was a bad enough year for some sectors and companies. To finally come out of deep freeze and find market share snapped up by rivals, could be an existential shock for some firms that are already fighting for survival.

Which Stocks to Buy?

Lift the lid on the Singapore stock exchange and you find a dazzling array of different stocks. There is something for everyone, with the market offering reliable blue-chips, property stocks, dividend stocks for yield investors, and also the laggards – those stocks still seen as undervalued. There are small-cap property companies focussing on high-end residential and commercial real estate, semi-conductor tech firms and some of the biggest investment banks in the region.

Nothing can be guaranteed, but evaluating the risk-return factors involved means now looks like a great time to invest in stocks in Singapore.

How to Buy Stocks in Singapore

The recent buzz of excitement around the Singapore equity markets has brought it to the attention of experienced and novice traders. A question often asked by the latter group is ‘how to start investing in stocks in Singapore’ and it’s a good one to ask. Market risk, the likelihood of your Singapore stock purchase tanking is unavoidable, but choosing a trusted and safe broker is something that can be managed. There are some easy-to-follow guidelines that can help navigate a course to finding the best-fit broker in the market and then putting on a trade.

1. Choose a Broker

Choosing a safe broker is more important than getting your stock pick right. The unfortunate fact is that if you sign up with a scammer then you could lose all your money regardless of what happens in the market.

Fortunately, financial authorities such as the Monetary Authority of Singapore make it their duty to regulate the financial markets and have tasked themselves with looking after the little guys. The licenses of approval that regulators offer can only be attained by the broker completing a range of costly and time-intensive tasks. These include submitting business plans that outline why their business is viable and demonstrating that staff have appropriate skills and experience to operate effectively. They have to undergo independent audits, have sufficient capital on account to weather financial ups and downs, provide ongoing compliance reports and keep up to date with new rules and regulations.

It’s not a step that any firm would take lightly, so if the brokers on your short-list are regulated by one of the below Tier-1 authorities it’s a sign that they are a legit operation.

- The Monetary Authority of Singapore (MAS)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The US Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

Buying stocks can also be a medium- to long-term proposition, so you want a broker that also has a good track record. A firm that has recently been set up may well in many ways be an ideal broker, but if you want to avoid worrying about them, choosing one with a minimum track record of five years could offer some comfort.

A little research can help you find the best broker for you. Time spent on choosing a good broker is time well spent, but if you want to fast-track the process, this shortlist of regulated brokers offering services in Singapore is a good place to start.

Also, consider the functionality of trading platforms, there are subtle differences from broker to broker. It’s also worth noting that some brokers offer more markets than others. Most will provide markets in the big names, but if you’re looking to trade some smaller stocks, double-checking which broker offers them can save you having to switch brokers at a later date.

One way to run all those checks and at the same time practise trading using virtual funds is to set up a demo account. These take seconds to sign up for and typically only require you to submit an email address. The platform you will practise on is exactly the same as the one that you’ll carry out live trading on. It’s just that if you make any newbie errors, they won’t impact your real cash pile.

Best Brokers to buy Stocks in Singapore:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to add some stocks to your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

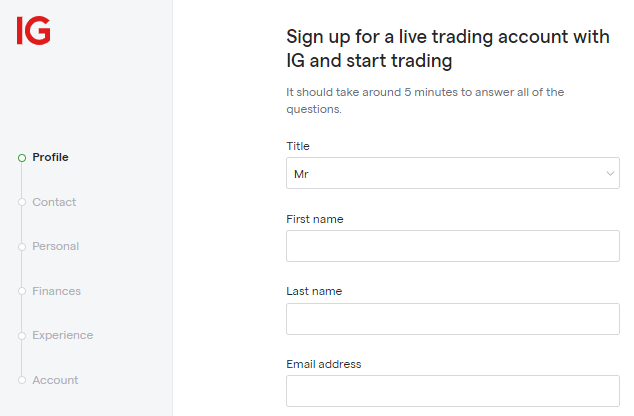

2. Open and Fund an Account

If you’ve already signed up for a demo account, you’re halfway to setting up a full account, which will support live trading. Alternatively, you can start the process by following the ‘Open an Account’ links found on a broker’s home page.

Onboarding is done online and regulated brokers follow a market-standard template. The first involves submitting personal details, then there may be a series of questions relating to trading experience and investment aims. These are all part of the broker building a profile for you. The final stage involves verifying your ID and then your account is set up. The whole process can be done using a desktop device or a mobile handset and takes minutes to complete.

It’s good to adopt a questioning approach through each stage of the process. You are, after all, sending hard-earned cash to a new account.

One factor that offers some comfort is that regulated brokers have to comply with anti-money laundering (AML) laws. These are intended to prevent criminals from moving money through accounts and out to someone else and stipulate that any funds paid into a brokerage account can only be returned to the account from which they originally came. This cuts back the risk of someone accessing your account and forwarding your funds to a scam account, a regulated broker just won’t allow that to happen.

In addition, you will be the only person with knowledge of the account user ID and password.

The process of sending funds to your new brokerage account is similar to any other online transaction. It’s possible to send funds using a variety of payment providers and it’s worth checking the T&Cs to find one which doesn’t incur administrative charges – there’s no point giving away money unnecessarily. Two of the fastest and most popular payment methods are debit or credit card as these are associated with near-instant transfer times and once the funds hit your account, you’re ready to trade.

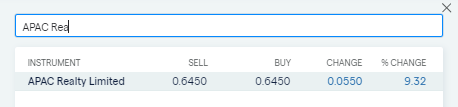

3. Open an Order Ticket and Set Your Position Size

Whether you use one of the short-lists of stock picks or your own technical analysis and fundamental analysis to identify your target stock, the process of buying it is the same. Find your stock by running a search for its name on the platform or find a group of stocks by filtering the market by country and sector.

Source: IG

Trading ultimately comes down to bringing up the trading dashboard, inputting the amount you want to purchase and clicking ‘buy’. It can be as simple as that, but there are some additional risk-management features worth considering using.

4. Set Your Stops & Limits

‘Stop loss’ instructions and ‘take profit’ orders are orders built into the system to trade on your behalf if price reaches a certain point. Stop losses will automatically sell some or all of your position if price reaches a certain level. You decide what that level is and submit the instruction into the system. The intention being that if your investment does turn out to be a poor choice, you’ll cut your losses rather than risk wiping out your whole account.

Take profit orders work in the same way, but close out your position if price moves in your favour. They lock in profits by selling some or part of your position, and again, you decide the details.

These two tools are often recommended for beginners and trying them out in a demo account is recommended, but it’s also worth factoring in your investment aims. There is an alternative view that buy-and-hold investors might not want to use stop-losses or take profit orders. The argument goes that a short-term price slump is a distinct possibility, but if you remain confident about your strategy, then you might want to ride out the dip. Stop losses would lead to you getting kicked out of a position before it has time to come good.

In a similar way, ‘take profits’ can bank cash, which is always a good thing, but letting the position run might be preferable. Such decisions are best taken on a case-by-case basis and having a clear strategy involving entry and exit price targets is always advisable.

Final order types to be aware of are ‘limit orders’. These allow you to state the price at which you want to book your first trade. They involve applying a degree of patience rather than rushing in and buying at current market levels. If a stock is trading at $2.10 but you think it will clip the $2.05 price level before heading upwards, you can build that instruction into your broker platform. There’s no guarantee you’ll be filled at $2.05, but if you are you’ll have achieved a more elegant entrance into the market.

5. Make Your Purchase

Buying stocks is very straight-forward. The functionality of the sites is designed to make things easy and this is borne out by the influx of beginners setting up accounts and trading their own accounts. The process may be similar to other online purchases, but as you might be putting considerable amounts of cash at stake, there are some final checks to make after you’ve clicked or tapped ‘buy’.

Trade execution involves converting cash in your brokerage account into stocks and the stock will then be valued according to moves in market price. So immediately after trading, it’s important to check the ‘portfolio’ section of the platform. If you’ve made an error – for example, bought the wrong stock or added a zero, such errors are best rectified before price moves too far. Even experienced traders make these checks as human error applies to everyone.

Summary

The portfolio section of the site is also where you’ll be able to monitor the performance of your stock position. You’ll be able to watch the P&L (profit and loss) on the position fluctuate and at your discretion sell some of it or even add to it by buying more. If your purchase is a long-term investment then you might want to take advantage of price alerts which are where the broker will send you messages about price moves, so that you can carry on focussing on your day job but at the same time hope to gain from your investment.