Companies with an ethical approach to how they do business are becoming increasingly popular with investors. First of all, they have a feel-good factor that is increasingly important to many. Another by-product of that surge in demand is that the prices of the best ethical stocks are skyrocketing.

YOUR CAPITAL IS AT RISK

There has been a seismic change in terms of the weight given to ethical concerns when selecting stocks. It’s not just retail investors who are being selective. Huge institutional investment firms are also considering ESG and CSR factors, and the trend looks set to continue.

As trading with the trend is the number one rule of successful investing, we’ve identified the most ethical stocks in the market. The stocks listed below tick the box in terms of business practices and investment returns. In this article, we’ll look at the following:

Table of contents

- What Is Ethical Investing?

- The Five Most Ethical Stocks To Buy Now

- Microsoft Corp (NYSE:MSFT)

- Good Energy Group PLC (LON:GOOD)

- Aflac Inc (NYSE:AFLAC)

- Enphase Energy Inc (NASDAQ:ENPH)

- Halma PLC (LSE:HLMA)

- Why Invest in Ethical Stocks Right Now?

- Ethical Investing – How to Avoid Firms That Engage in ‘Greenwashing’

- Final Thoughts

What Is Ethical Investing?

Ethical investing is being more widely discussed, but the truth is that it is a trend that has been steadily building for decades. The resulting upward momentum in ethical stock prices has been long lasting and consistent, which is what makes the sector so appealing. There’s little sign of the trend reversing anytime soon.

Picking the most ethical stocks is made more difficult by the fact that there are various criteria used to rate firms. All of them are informative. However, investors looking to buy ethical stocks need to start out by evaluating what they really want to achieve.

Corporate social responsibility (CSR) criteria can be used to gauge the extent to which a company’s business model helps it be socially accountable to itself, its stakeholders and the public.

Environmental, social, and corporate governance (ESG) protocols are a set of standards that measure a company’s impact on the environment and society. This factors in externalities, which are costs such as pollution that are incurred by communities rather than the company creating them.

ESG and CSR reports are created by firms themselves and independent third parties, so it’s possible to see that getting an accurate picture of a firm’s operations can be harder than it should be. Then, there are the issues of ‘greenwashing’ and ‘sportswashing’, where corporations artificially improve their reputations by associating themselves with a high-profile and worthy cause.

Considering all of the above factors, and using technical and fundamental analysis, we’ll establish which are the most ethical stocks to buy now.

The Five Most Ethical Stocks To Buy Now

Individual preference plays a big part in determining what element of ethics each investor might consider. Some may want to buy cruelty-free stocks, while others may be interested in clean energy stocks.

We consider later in this article how trusting your gut feeling about a firm is an important part of the process. However, the five best ethical stocks listed below perform well in terms of current ESG and CSR criteria, and also offer an insight into how diverse the sector is.

Each one has compelling reasons – including those highlighted above – for you to buy them now:

Microsoft Corp (NYSE:MSFT)

Microsoft might at first glance appear an unusual choice when considering business ethics, but applying ESG and CSR criteria to its operations confirms how highly the firm ranks. It might not necessarily be setting out to change the world, but in many ways, it is a model firm.

One major initiative launched by Microsoft is to be carbon negative by 2030. On top of that, by 2050, the company is aiming to have removed the carbon that it has created since it was founded in 1975. This pioneering approach can be expected to have knock-on effects as it significantly raises the bar for all big corporations.

YOUR CAPITAL IS AT RISK

Microsoft’s move towards being more ethical is helped by the fact that it is so profitable. However, the decision to invest profits in an overhaul of its operations deserves credit. This doesn’t make it a bad stock pick from a financial point of view. The firm is getting the balance right and has a P/E ratio of 26.40, generates a dividend yield of 1.11%, and comes with the security offered by a $1.83tn market capitalisation.

Good Energy Group PLC (LON:GOOD)

It has been possible to buy shares in green energy company Ecotricity since 2015. Listed on the London Stock Exchange as the Good Energy Group PLC (LON:GOOD), the firm has ethical credentials that are hard to beat.

It was founded in 1996 with one wind turbine operating from one trailer in the English countryside. Today, the world’s first green electricity company has thousands of those turbines in operation. It is even responsible for an electric car-charging superhighway that runs the length of the country.

From a performance return perspective, GOOD stock was impacted by the market-wide sell-off in 2022. However, being in the utilities sector, it will be to some extent insulated from the worst of any fallout caused by a global recession.

YOUR CAPITAL IS AT RISK

Good Energy Group is an out-and-out game-changer. Its operations are at the heart of the shift towards cleaner energy, and this makes it one of the most ethical stocks to buy. Despite the small size of the firm (market cap £32.03m), it has a dividend yield of 1.34% and looks a good long-term prospect, with an ethical twist.

Aflac Inc (NYSE:AFLAC)

US-based insurance company Aflac was recently named one of Ethisphere’s most ethical companies. The award largely stems from Aflac’s approach to staff conditions. It invests heavily in ensuring that work conditions meet a range of in-house criteria, which cover inclusion and diversity.

Two notable features of Aflac make it an ideal stock pick for ethical investors. The first is that the company’s approach is hardcoded. It has been recognised in Ethisphere’s list of the World’s Most Ethical Companies for 16 years running.

The second point of interest is that Aflac stands out from its peer group in terms of ethical credentials. It is the only Fortune 500 insurer to have consistently been ranked as one of the world’s most ethical. This helps with brand recognition, and client retention. It also puts it right on trend.

YOUR CAPITAL IS AT RISK

As the Aflac website states: “It costs money to properly train employees, to accommodate clients’ needs and to put clients first.” However, this investment is paying off, for all involved, including shareholders.

Between March 2020 and November 2022, AFLAC stock increased in value by 183.07%, but investors looking for ethically orientated opportunities haven’t missed the boat. The AFLAC P/E ratio is still a modest 9.19, and the dividend yield of 2.33% makes Aflac stock one likely to generate income returns as well as capital growth.

Enphase Energy Inc (NASDAQ:ENPH)

The solar energy sector is an obvious choice for ethical investors, but if you want your investment to have the most impact, then Enphase Energy is the name to consider.

The California-based firm builds integrated solar panels, batteries and micro-inverters that target the commercial rather than the retail market. While retail green energy production is important, Enphase’s operations convert large commercial and industrial buildings to cleaner energy – those large-scale developments being just what is needed in the race to meet carbon emission targets.

YOUR CAPITAL IS AT RISK

The Enphase stock price chart illustrates how there is no longer a trade-off between investing with a conscience and portfolio returns. Those looking to enter into positions in ENPH might do well to demonstrate some patience and wait for the price to pull back to the supporting trendline. The upward trend is confirmed, but the current P/E ratio of 156.29 could be improved upon by getting into positions at a lower level.

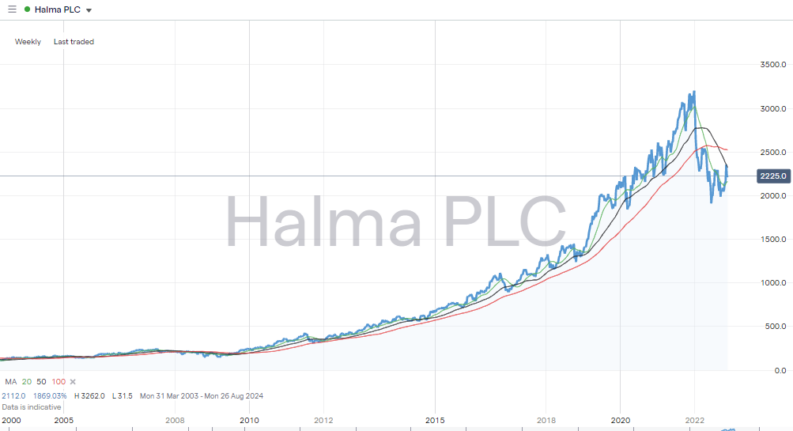

Halma PLC (LSE:HLMA)

Halma’s diverse business operations are focused on developing a safer, cleaner and healthier society. Its innovative technological products and unique corporate structure make it a top pick for ethical investors.

The company divides its operations into three divisions: Healthcare, Safety, and Environmental & Analysis. These provide products and services ranging from analysing and optimising vehicle flow to monitoring and protecting the environment.

YOUR CAPITAL IS AT RISK

The progressive approach taken by Halma has been matched by share price performance. The long-term price chart shows that in the five-year period between January 2017 and January 2022, HLMA stock increased in value by 257%. The recent softness in the stock price represents a chance to apply a pullback strategy and buy an ethical stock that’s set to offer long-term financial rewards.

Why Invest in Ethical Stocks Right Now?

If you’re in any way unsure of the scale of the shift towards ethical investing, a report by Bloomberg has outlined the extent of the move. According to a report by Bloomberg Intelligence: “Global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management.”

This estimate could be considered conservative as it factors in the ESG sector growing by 15% each year, which is half the average rate of the last five years.

One other point of interest unearthed in that report is that the US looks set to be an ethical investment growth market, with Asian investors closely following that move. The move is taking place on a global scale, but some regions may fast-track their progress.

“While Europe accounts for half of global ESG assets, the U.S. has the strongest expansion this year and may dominate the category starting in 2022. The next wave of growth could come from Asia — particularly Japan.”

Source: Bloomberg

Ethical Investing – How to Avoid Firms That Engage in ‘Greenwashing’

The proliferation of different ranking systems, and third-party tables that rank ethical credentials of different firms, can sometimes confuse rather than clarify the situation.

There is also a sense that unscrupulous corporations with large budgets can invest in schemes that mislead investors. Given the extra public scrutiny of the sector, it is certainly possible for firms to create an impression of being ethically orientated, without necessarily being so.

As a result, regulators are beginning to step in. The FCA, for example, has recently announced plans to introduce consumer-friendly labels on ethical funds. Its statement highlights concerns about the extent of greenwashing in the markets. The question remains whether the introduction of another ranking system will make it easier for mindful investors.

One inside tip on how to filter out the ‘noise’ is offered by Tariq Fancy, who once held the title of Head of Sustainable Investment at BlackRock. He was speaking with the BBC when he explained that after spending much of his career trying to run comparisons on different firms around the globe, he started basing decisions on a simple proposition.

“Having spent years digging through ESG data and trying to understand and disaggregate it, I would actually say that sometimes the level of work going into it is almost counterproductive. It tries to put precision onto things which are quite hard to measure.”

He continued:

“The simplest thing is to run a test that if this company doubles in size, is it good or bad for the world? Well, if it’s an electric vehicle maker, it’s probably good for the world… and if ExxonMobil doubles in size, it’s probably not good for the world.”

Source: ForexTraders.com

Final Thoughts

Making money never goes out of fashion, but ethical investing has demonstrated that returns don’t need to come at any cost.

It’s true that adopting ethical work practices means that firms incur extra costs. However, investment in doing things the right way can pay off in the long term, and that outlook ties in with buy-and-hold investors who are willing to wait for their investment to come good.

The call for firms to carry out business with a social conscience is building momentum. Whether you are fully on board with the ethos or more interested in spotting trends, ethical investment is something well worth considering, for financial as well as moral reasons.

If you’re new to investing, then the mechanics of the process of putting on a trade are explained in this easy-to-follow guide. This list of trusted brokers includes the names of firms that are well-regulated and offer investors a safe way to enter into the market.