PayPal (NASDAQ: PYPL) is the world’s largest digital platform providing money transfer services, but is this stock on the rise, and what opportunities lie ahead for investors?

YOUR CAPITAL IS AT RISK

PayPal has carved itself a niche that positions it next to Visa (NYSE: V) and Mastercard (NYSE: MA), the two behemoths of the industry, but it has unique features that give it an edge over both those incumbent operators and new entrants.

The potential for PayPal investors is that the stock could return to the highs of July 2021 when it traded at $309 per share. In 2022, it traded as low as $61.6, a 77% price crash in 18 months. So, what’s going on with PayPal, and is the current dip an opportunity to buy?

Answering that question is best done by considering personal investment aims. Short-term investors could well be drawn by the high volatility of the stock. Buy-and-hold investors with one-year and five-year time horizons will be factoring in how markets overshoot and that the 2022 sell-off in tech stocks could have taken PayPal to levels where it can be considered ‘cheap.’The analysis below uses fundamental and technical metrics to outline a PayPal stock forecast for every type of investor. Whatever your investment aims, these are the price drivers to look for.

Table of contents

Who Is PayPal?

Launched in 1998 during a boom period for internet stocks, PayPal Holdings Inc is listed on the New York Stock Exchange with the ticker PYPL. Previously founded as Confinity, it was the brainchild of leading tech pioneers Peter Thiel and Max Levchin. They identified a gap in the market relating to the amount of information and time required to complete online financial transactions. After merging with X.com in 2000, Confinity became PayPal and focused on being a digital payment platform for use over the Internet.

The PayPal payment processing system offered a way to buy goods or services or transfer funds using a personalised and secure online wallet. The added convenience of one-click payments appealed to both individuals and businesses and resulted in the firm expanding to have a worldwide client base of 223m users.

Having initially formed close links with major online retailers such as eBay (Nasdaq: EBAY), PayPal has become an international payments operator, is accepted in more than 200 countries, and supports 25 currencies.

PayPal became popular because it provides a safer, easier way to pay and get paid online. The service is flexible, allows users to share less personal financial information, and unsurprisingly saw PayPal expand its market share. Investors who bought PayPal stock for $33.50 in 2016 had made a +850% return within five years, but the threat to PayPal came not from it being a bad idea but from competitors entering the market. Within two years of recording an all-time high in July 2021, the PYPL share price lost more than 75% of its value.

YOUR CAPITAL IS AT RISK

Where Will PayPal Stock Be in Three Months?

As PayPal is a growth stock and a tech stock, a lot of the fluctuations in the price of the PYPL shares are driven by broader investment themes as much as they are company-specific factors. Following the market-wide sell-off in tech stocks in 2022, PayPal is not alone in seeing its shares trading at levels not seen for several years. Until 2022, the last time that PayPal stock had traded below $70 was in 2017 – which raises the question, is now the time to buy PayPal?

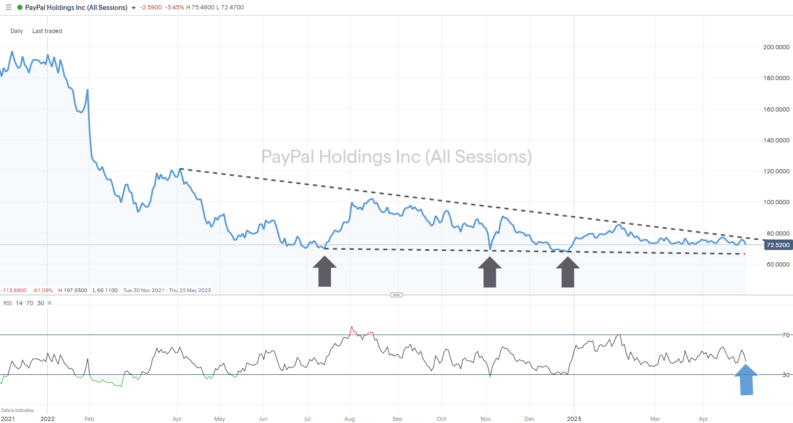

Some investors will conclude that the dramatic price crash from its highs is showing signs of bottoming out. The descending-wedge pattern dating from April 2022 has guided price in a broadly sideways pattern, with the upper and lower trendlines guiding the PYPL share price into the funnel at the end of the wedge.

– Daily Price Chart – 2020-2023

The price appears to be waiting for a catalyst before deciding whether to break to the upside or downside. Given that the lows of July, November, and December 2022 were all between $67 and $69, this price level can be seen as a critical support level, which points to the next break being upward.

One potential trigger for increased interest in the tech sector could be any hint from the US Federal Reserve that US interest rates could be about to stabilise or fall. That would bring about a paradigm shift in the financial markets that will likely be followed by a surge in tech stock prices.

The RSI on the Daily Price Chart as of May 2023 was in the region of 43.2. That points to the stock being more ‘oversold’ than ‘overbought’ on that timeframe, leaving room for any potential rally to gain momentum before the RSI reaches 70, indicating the market is oversold.

Previous tests of the $100 per share price level between August and September 2022 failed to lead to further price rises. The resistance from the ‘round number’ price bar can be expected to come into play if there is another rally. However, anyone buying at current price levels and selling at $100 would post a return of approximately +37%.

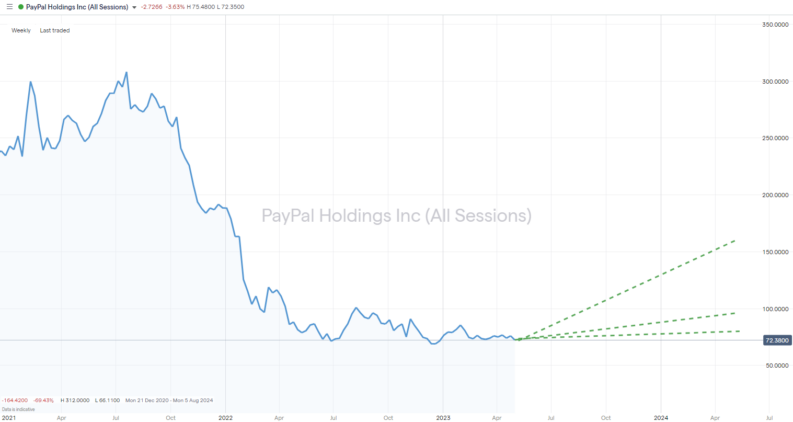

Where Will PayPal’s Stock Price Be in One Year?

In a 12-month timeframe, the decisions taken by the PayPal management team can be expected to influence the company’s share price significantly. Short-term fundamentals appear to be improving, and 37 industry analysts offering a 12-month price forecast for PayPal are largely bullish on the stock.

The median price target of their predictions is that in 12 months, PayPal stock will be trading near the $95 mark. The most aggressive analyst estimate forecast envisages the stock trading at $160 per share, and the lowest prediction is $75.00.

Renewed optimism for PayPal stock is driven by a range of initiatives coming down the pipeline. The Buy Now Pay Later (BNPL) feature, introduced by the company in 2020, allows PayPal clients to make purchases using debt, ties in well with the current cost-of-living crisis and meets challengers such as Klarna head-on. In an earnings update in August 2022, the firm stated that growth in BNPL was 226% on a year-on-year basis. Since the launch of BNPL, PayPal has offered nearly 200m loans to almost 30m customers and made the program available to almost 300,000 merchants worldwide.

E-commerce sales are also increasing, with the change in shopping habits brought about by COVID-19 lockdowns looking to be firmly embedded. Retail e-commerce sales in the US in 2022 hit new all-time highs of $856bn and are forecast to extend to $1,011bn in 2023 and $1,169 in 2024. The growth in the size of the total market presents an opportunity for PayPal even if it doesn’t outperform its rivals, with the $1tn total marking a 9% increase from the same time 12 months previous.

YOUR CAPITAL IS AT RISK

Where Will PayPal’s Stock Price Be in Five Years?

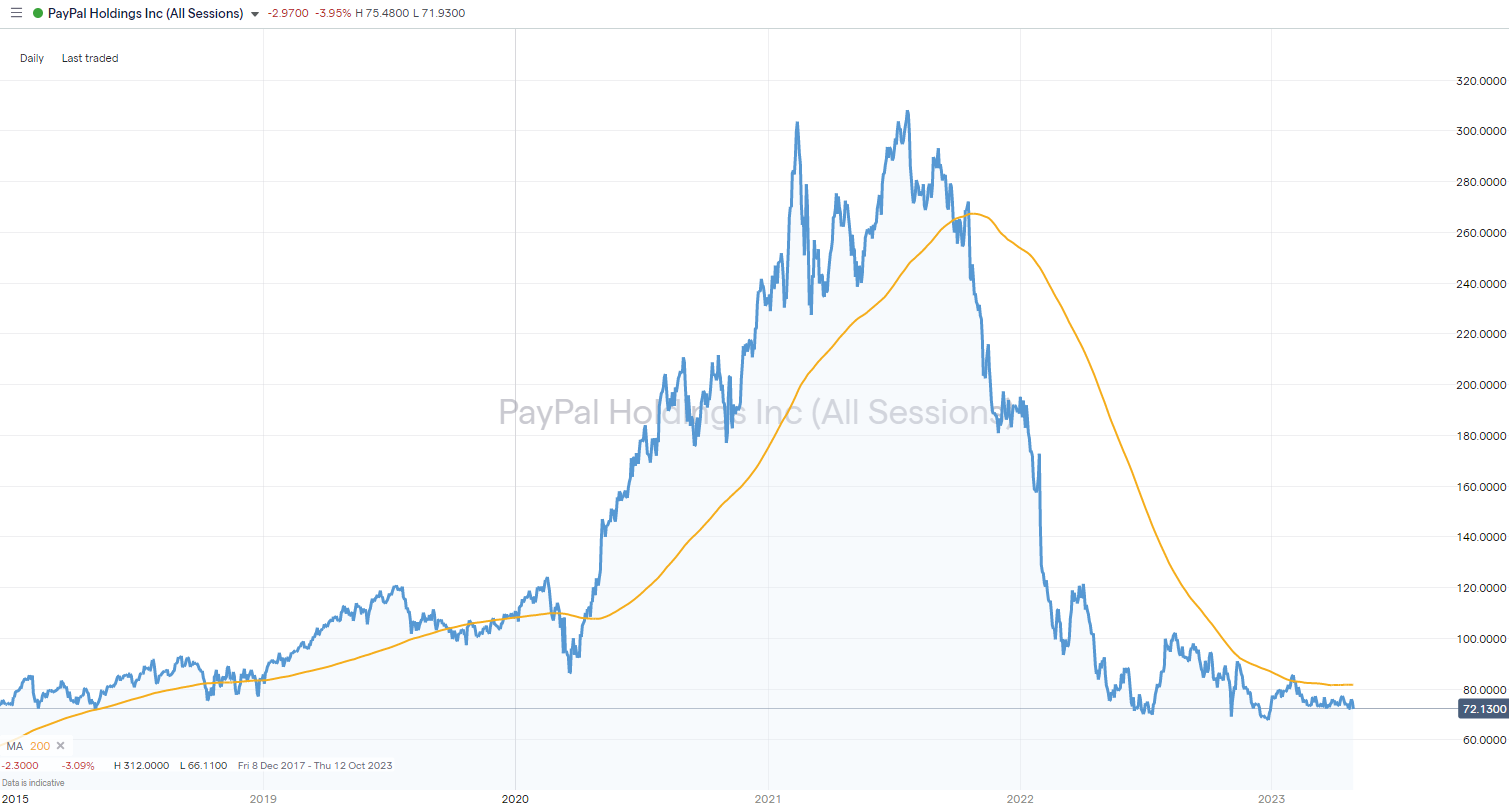

When preparing a PayPal stock forecast for 2028, it is best to start with a chart that goes back at least four to five years. That allows analysis of one of the key metrics of the stock markets, the 200 SMA on the Daily Price Chart.

With the 200 Daily SMA in the region of $81.70, any short-term price rally to $160 or above would result in a divergence between price and the SMA. With classical technical analysis dictating that this situation often results in price reverting to mean, it could be a long haul for PayPal investors.

That doesn’t necessarily mean PayPal stock won’t increase in value, but that the opportunity cost of tying up capital in a position for five years needs to be factored in.

PayPal’s current P/E ratio of 34.52 suggests that the stock is far from cheap compared to the average P/E ratio for the broader NASDAQ 100 index of 23.38. However, a relatively high P/E ratio is par for the course for PayPal, which has, at times, not let the fact that it is ‘expensive’ on traditional metrics get in the way of a surge in the stock price. Over the past seven years, the P/E ratio of PYPL has ranged between 32.89 and 79.92, which means the current P/E reading is at the lower end of the long-term range.

The proposition that PayPal is expensive but still worth buying is backed up by the firm’s shift in strategy and growth prospects. The number of Active Customer Accounts is expected to reach 496 million by 2025; however, PayPal is focusing less on gaining new customers and more on making more out of the ones it has.

Strong overall growth, combined with targeting clients who are middle and high-earners, also appears to be paying off. Total Payment Volume grew by 9% between 2021 and 2022 and totalled $1.36Trn, and few are forecasting that the firm won’t be able to sustain its momentum.

Is PayPal a Good Buy?

Is PayPal a good stock to buy? Well, for long-term investors, the answer is probably yes. The firm has come a long way from being the convenient payment partner of eBay, and the strategic change in direction it has taken proves its ability to move with the times.

It has stuck with the ethos of being an insurgent challenger to establishment operators but, at the same time, has developed a secure global client base. That mixture of dynamism and security bodes well for buy-and-hold investors in PayPal stock.

The threat of cryptocurrencies becoming more mainstream and competing for market share hasn’t completely disappeared, but much of the euphoria surrounding that sector has died down. Of the establishment operators, PayPal looks best positioned to meet such challenges. If the firm remains vibrant and offers innovative payment solutions, it will remain a good ‘buy’.

Recent declines in stock prices can be attributed to natural economic cycles, so for those with a longer-term outlook, PayPal is at a price level that represents a good buying opportunity.

YOUR CAPITAL IS AT RISK

Final Thoughts

PayPal could well experience a short-term price spike. If the forecast for the macroeconomic environment improves, then a shift in broader investor sentiment from bearish to bullish would favour the stock due to its high beta.

Medium-term PYPL stock price growth could be held back by the stock starting from a low base level. However, if conditions are favourable, the long-term prospects for the stock bring into play the all-time high of £304 per share recorded in July 2021.

As investing in PayPal could be a long-term project, some thought needs to be given to broker selection. Priority number one is that the firm you choose is trustworthy, and this list of regulated brokers includes firms that are well-regarded and offer the tools and services to help your trading of PayPal get off to the best possible start.