For many, all tips such as those from Buffett are useful as the bond market can sometimes appear harder to understand when compared to other asset groups. Terms such as ‘gilts’, ‘bonds’, ‘treasuries’ and ‘junk’ are often used by those on the inside. Below we break down the different terms used to make it easier to incorporate bonds into a successful portfolio.

What Is a Bond?

The first step towards getting the most out of any financial instrument is building an understanding of the nature of the market and the key terms used.

The essence of bond investing is that it represents a relatively secure investment. It typically offers lower risk-reward than equities, but better returns than holding cash in a bank savings account.

When you buy a bond, you are essentially lending money to another party. The terms of that loan agreement are outlined when the bond is issued and will include details of a regular payment called a ‘coupon’ that is paid to the bondholder. The loan agreement, the bond’s lifespan, will be set at a fixed period of time also known as the ‘term’ of the bond.

At the end of the bond’s life, at the ‘maturity date’, the loan agreement ends, and the bond holder will have their initial investment returned to them when the bonds ‘redeem’. For bondholders, the net gain over the term of the deal is represented by the total amount of coupons they receive. The maximum potential return is known at the time that the trade is entered into, which explains why the process is often associated with the phrase ‘fixed income’.

Different variables influence the size of the coupon that will be paid. These are largely based on counterparty risk, the chance of the bond issuer defaulting on the agreement and not being able to return funds to bondholders at the maturity date or make interim coupon payments. Other factors that influence demand for bond products include interest rates and inflation levels.

Stable governments and highly rated corporations tend to be seen as more secure counterparties so can offer relatively lower coupon terms and still manage to find enough buyers of their bonds. At the other end of the spectrum are corporations and other agencies, which are seen as riskier and so have to offer bond investors a greater return to generate interest in their product.

The ‘primary market’ in a bond is the day that a batch of bonds is issued and first sold to investors. As bond issuances can run into billions of dollars in value, this process is typically overseen by investment bankers. For a fee, they liaise between the bond issuer and high-profile investors such as pension funds to ensure that the new float is a success. Bonds bought after issue date are bought in the ‘secondary market’, which is facilitated by brokers that offer live market prices in the instruments.

Gilts, Bonds, Treasuries, Bunds, AAA-Rated and Junk

As of 2021, the global bond market was estimated to be $119tn in size. Given the enormous scale of investor interest, specialist agencies have evolved that offer ‘credit ratings’ of organisations that issue bonds. This helps bond traders assess the risk-return on potential deals, and as credit ratings are periodically updated, it also helps bondholders consider if they should continue to hold a position or sell out of it as circumstances change.

Fixed-income investors have also developed a range of terms to describe the different bonds in the market, which enables them to quickly establish the type of product they are discussing and thinking of trading. These terms include gilts, bonds, treasuries, bunds and junk. They’re all ‘bonds’, but they have different profiles and offer investors different degrees of risk-return.

‘Gilts’ is the name given to bonds issued by the UK government, the term being a legacy of the certificates historically being issued with gilded edges. ‘Treasuries’ is the term used to denote a bond that has been issued by the US government and is sometimes abbreviated to ‘T-bills’. The German government issues bonds that are known as ‘bunds’ and ‘bobls’, and corporations also find benefit from engaging in the bond market and issue ‘corporate bonds’.

The sliding scale of risk-return is denoted by credit ratings. The issuer that is deemed most secure by credit rating agency Standard & Poor’s will receive a rating of AAA, and those with a rating as BBB or below are considered ‘junk’ bonds. Bonds issued by parties that have a credit rating of BB+ and below are termed ‘non-investment grade’ or ‘high yield’.

Governments tend to have higher credit ratings, but there are some anomalies thrown up by the fact that the credit agencies measure hard facts relating to the financial health of a bond issuer, not their reputation. As a result, and potentially surprising to some, two US corporations, Microsoft (MSFT) and Johnson & Johnson (JNJ), currently have an AAA rating, which is higher than the AA+ rating attributed to the US government.

What Is a Bond Yield?

One term that crops up frequently in the bond world is ‘yield’. In a simple example, a bond is issued by corporation XYZ and has a maturity date in 12 months’ time. On the day it is issued, it is priced at $100, and as it pays a coupon of $10 over the course of the year, it offers a 10% yield.

If after the bond has been issued, there is a negative news update about XYZ, demand for the bond will drop, because the default risk has increased. For the sake of simplicity, let’s assume that this all happens on the day that the bond is issued and first traded. Anyone who takes the view that the news report is not as significant as others believe could step in to buy the bond at $95. The coupon remains the same at $10, but the yield, the percentage return on the investment, is now 10.52% [10 / 95 * 100 = 10.52%].

As the price of a bond goes up, the yield falls, and vice versa. In an alternative scenario, if market sentiment turns bearish due to geopolitical risk dominating the news wires, and investors then rush to buy fixed-income assets, this will drive up the price of bonds, and the capital return, the yield, will fall. The safety of bonds is seen as more important than a return on capital during times of market upheaval.

One of the key price drivers of yields is interest rates. When interest rates rise, bond prices fall, and vice versa. We previously used an example of company XYZ issuing a one-year bond that had a coupon payment that represented a 10% yield. Those terms would have been carefully thought out by the corporation – it wants to secure enough funding by selling all its bonds, but doesn’t want to pay more than is necessary.

The challenge for XYZ is that if interest rates rise, then alternative investment opportunities, such as money market funds, and even cash bank accounts will be more attractive to people who would otherwise invest in their bonds. If XYZ wants to issue more bonds, it would have to offer a higher coupon. The knock-on effect for the bonds that were originally issued is that they are now less attractive than both money market products and the new tranche of bonds that XYZ is bringing to the market. Holders of the already issued bonds of company XYZ are now incentivised to sell out of their positions and the price of those bonds will drop.

Ways to Invest in Bonds

As previously mentioned, market guru Warren Buffett has gone on record to suggest that investors should consider reserving about 10% of their portfolio for fixed-income products. Going into further detail, he suggested that the target market should be short-dated government bonds, which includes US T-bills and UK gilts.

His product selection captures the security offered by strong counterparties and also that short-dated bonds offer greater flexibility than long-dated ones. With short-dated bonds, you won’t be stuck in a position for an extended period of time if there is a change to the broader economy. If, for example, interest rate levels change, the impact on the prices of longer-dated bonds will be greater because there are more coupons left to process before the bond matures.

Different government schemes have been set up to allow investors to invest directly in government bonds. In the US, the online T-bill buying service is called Treasury Direct, and UK gilts can be bought directly from HM Debt Management Office. There can be tax advantages from buying directly from a government agency, but the disadvantage is that the product range is limited.

A convenient and cost-effective route into the bond market is offered by online brokers. This list of trusted multi-asset brokers includes the names of well-regarded firms that offer their clients’ accounts from which they can take positions in bonds, stocks, forex, commodities and options. Being able to hold all your investment positions in one place makes the whole process less labour intensive and also makes it easier to reallocate capital between different asset groups.

Which Bonds Should You Invest In?

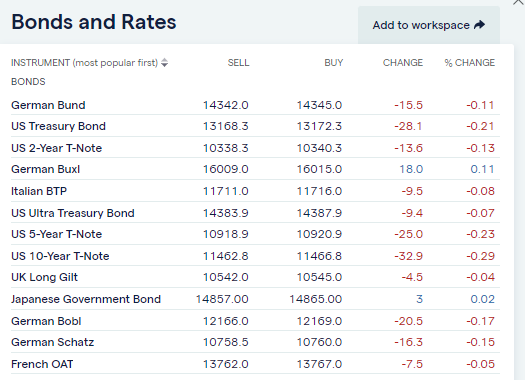

Government bonds can be bought using online brokers as well as the dedicated government sites. The selection at broker IG extends to French, Italian and Japanese bonds.

Government Bond Market Monitor at IG

Source: IG

Most brokers offer an even greater selection of both government and corporate bonds in ETF (exchange-traded fund) format. ETFs are a cost-effective and user-friendly way for investors to gain exposure to a basket of similar assets with just one trade.

The Betashares Australian Government Bond ETF (AGVT), for example, invests primarily in a portfolio of relatively long-dated Australian government bonds. Eligible bonds must be AUD-denominated fixed-rate bonds and have a term to maturity of between seven and 12 years. The fund spreads risk by investing in a range of different bonds but keeps its geographical focus, and the annual management fee is a modest 0.22%.

iShares J.P. Morgan Emerging Bond UCITS ETF (KIID) – Daily Price Chart 2022

Source: IG

The iShares J.P. Morgan Emerging Bond UCITS ETF (KIID) aims to generate returns by focusing on lower-grade bonds. It invests in USD-denominated bonds issued by emerging market governments and investment-grade entities. While the bonds in this ETF might be at the riskier end of the spectrum, the structure makes it ideal for UK bond investors. The company is registered in Ireland, where is it regulated by the Central Bank of Ireland and listed on the London Stock Exchange under ticker KIID.

Betashares Australian Government Bond ETF (AGVT)) – Daily Price Chart 2022

Source: IG

If you’ve traded stocks, forex, commodities or even crypto before, then you can take comfort from the process relating to buying bonds being the same as for those assets. The functionality of online broker platforms makes it easy to locate your target market, and buying a bond position is as easy as clicking a mouse or tapping a screen.

Most brokers allow clients with existing accounts to start buying bonds and holding them in the same place as their other investments. The profit and loss on the trade will be shown in the portfolio section of the online account, and positions can be added to, or reduced, whenever the market is open.

Final Thoughts

Despite the attractive features of fixed-income products, few retail investors who are building a diversified portfolio are likely to start off allocating capital to bond investments. The recommendation by experienced investors to consider them is completely valid, but the returns on equities can be greater, and more eye-catching, particularly in the short term.

The fact that bond prices don’t swing around as dramatically is at the same time part of their appeal. Developing an understanding of how the bond markets work is also relatively easy to do. Investors can in a short period of time build the skills that enable them to move on from asking ‘What is a gilt?’ to investing in a bond ETF. The basics of how to trade are the same – it’s just that bonds offer a different kind of return.

Whether you are an experienced trader or beginner, the subject of ‘counterparty risk’ extends past establishing if a bond issuer is reliable. It is also important to ensure that the broker you choose to hold your positions is credible and secure. This list of regulated brokers includes names of firms that as part of their regulatory reporting have to demonstrate to Tier-1 authorities that they have enough capital to maintain their business. This is an ideal starting position if you’re looking to include long-term bond returns as part of your portfolio.