CAN YOU USE METATRADER 4 WITH 24OPTION?

MetaTrader 4 is the most widely used platform by CFD traders due to its excellent user-interface, cutting edge tools and the choice to execute manual, automated and copy trading strategies. The platform supports multiple order types, browsers, operating systems and is accessible on all computers and mobile devices. If you are signing up for a live account with 24option, you would be happy to know that the broker offers the globally-renowned MetaTrader 4 in addition to its proprietary offering. But, before we go into the features of the broker’s MT4 platform, let’s quickly take a look at the account opening procedure at 24option.

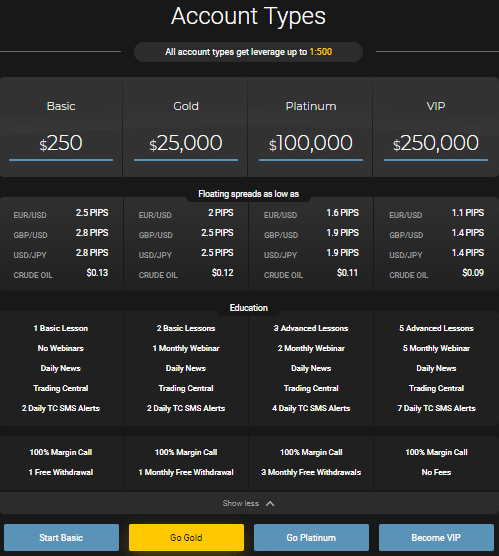

An overview of the account types and the benefits

As mentioned earlier, 24option provides retail traders with the choice of four account types; Basic, Gold, Platinum and VIP. While the trading conditions comprise of floating spreads for all the accounts, you can set up the Basic Account with a minimum deposit of $250. On the contrary, the initial account opening charges are $250,000 for a VIP Account.

The account opening steps at 24option are simple and straightforward. To begin the Live Account opening process, select the account type and click the corresponding button at the bottom of the ‘account types’ tab. As part of the account opening guide, we decided to set up the ‘Go Gold’ Account. Here we go

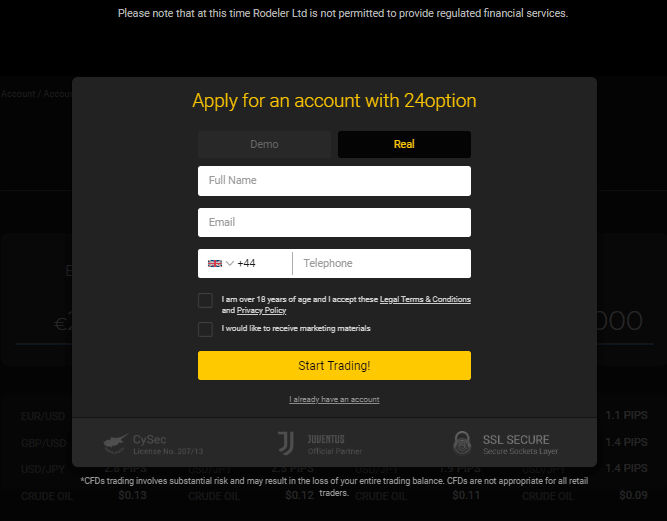

Step-1

Click on ‘Go Gold.’ An email verification pop-up opens up. Choose ‘Real’ for a Live Account, fill out some basic details, check the two boxes and hit the ‘Start Trading’ button.

At this point, we’d also like to warn you that 24option is discontinuing its CIF status and would no longer come under the tier-I regulations of the CySEC.

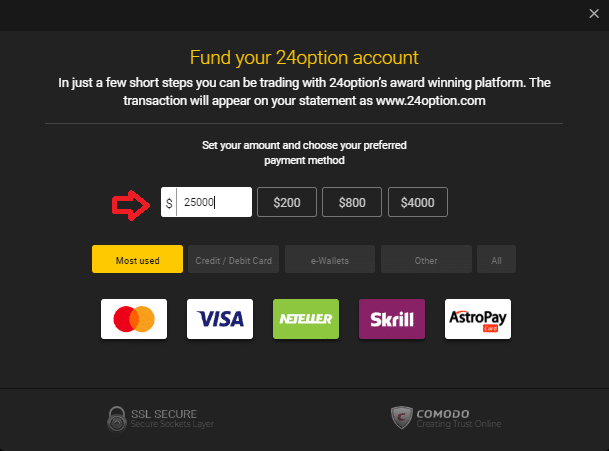

Step-2

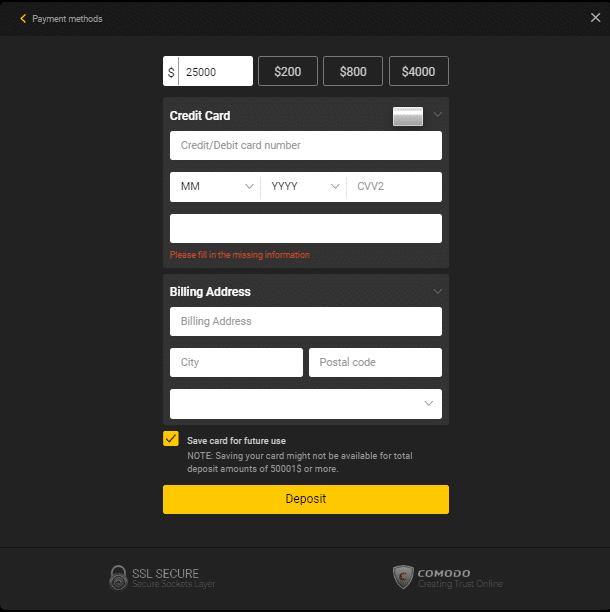

Enter the amount you wish to deposit, choose your funding method, fill in all the info and click ‘Deposit.’

Step-3

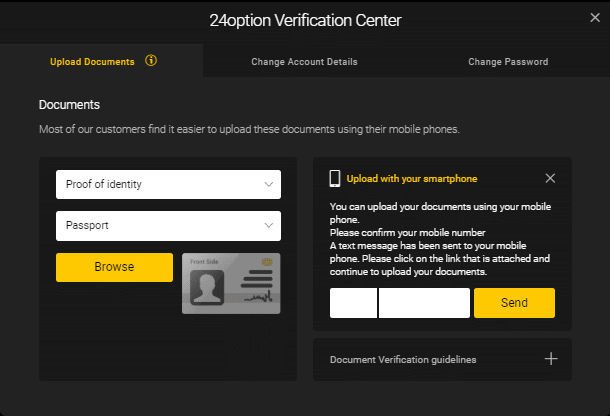

However, if you wish to deposit funds after completing the rest of the account opening procedure, go to ‘My Profile,’ upload the id and proof of address documents, update the account details/password if necessary.

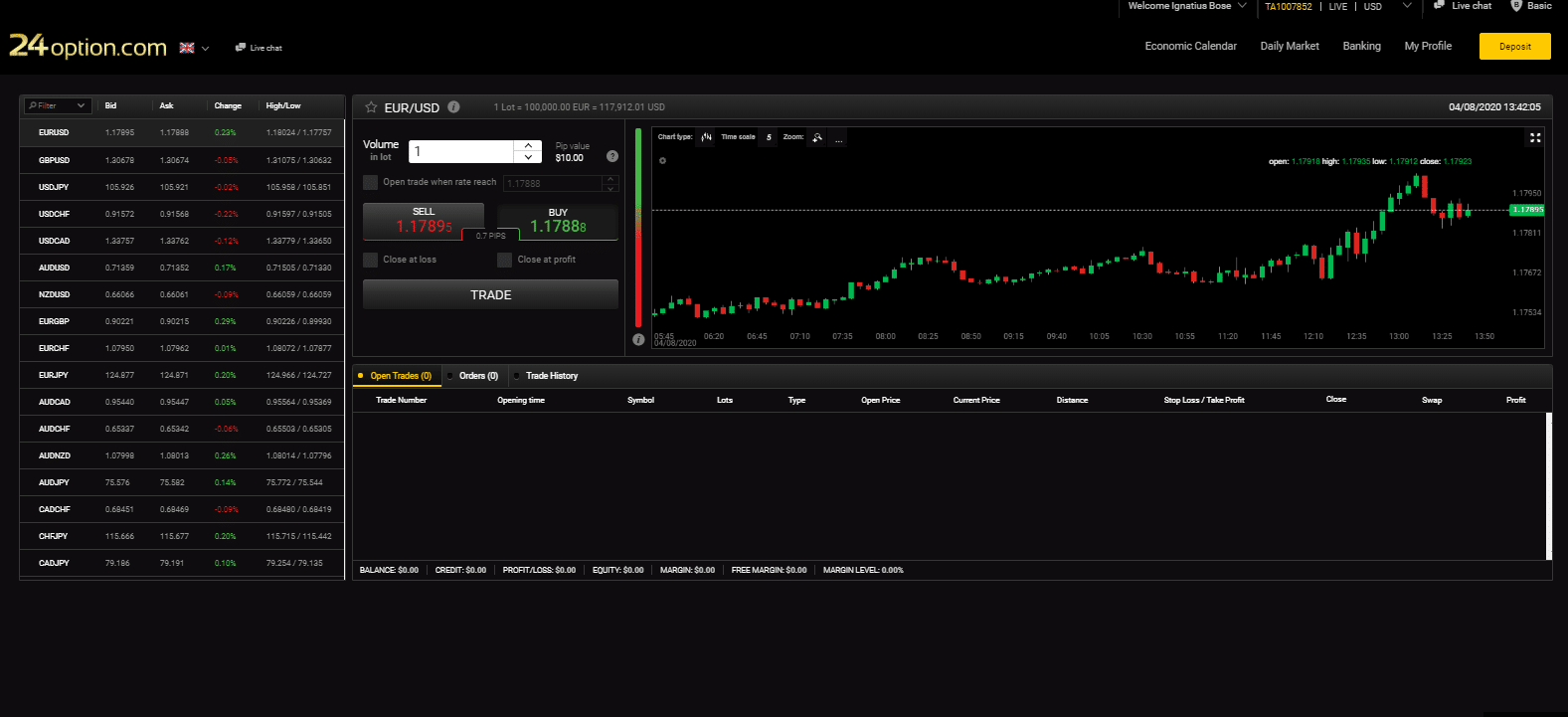

You can also monitor the Live 24option web trading application from the Client Area.

Unlike some CFD brokers, 24option does not link the account opening process to the Live MetaTrader 4. Instead, you have to download the demo/live platform directly from the website.

In the case of the Live MT4, you would receive the login details only after making the first deposit. But, if you’d prefer to test the demo platform before committing funds with the broker, request for a demo id from the live chat support executive and use the password created at the time of opening the Live Account.

THE METATRADER 4

The MT4 is a multi-asset platform to trade forex and CFDs in commodities, stocks, indices, cryptos, bonds, ETFs and derivatives. The platform is a favourite among online CFD brokers due to its excellent user interface, a wide selection of trading applications and the option to integrate it with other systems, applications. Although it is difficult to put a percentage to the number of users, according to estimates, MT4 accounts for more than 50% of the global CFD trading volumes outside Japan. The popularity stems from the full range of analytical functions, the option to carry out manual, algo & copy trading, besides secure encrypted data exchange between the client terminals and the broker’s servers.

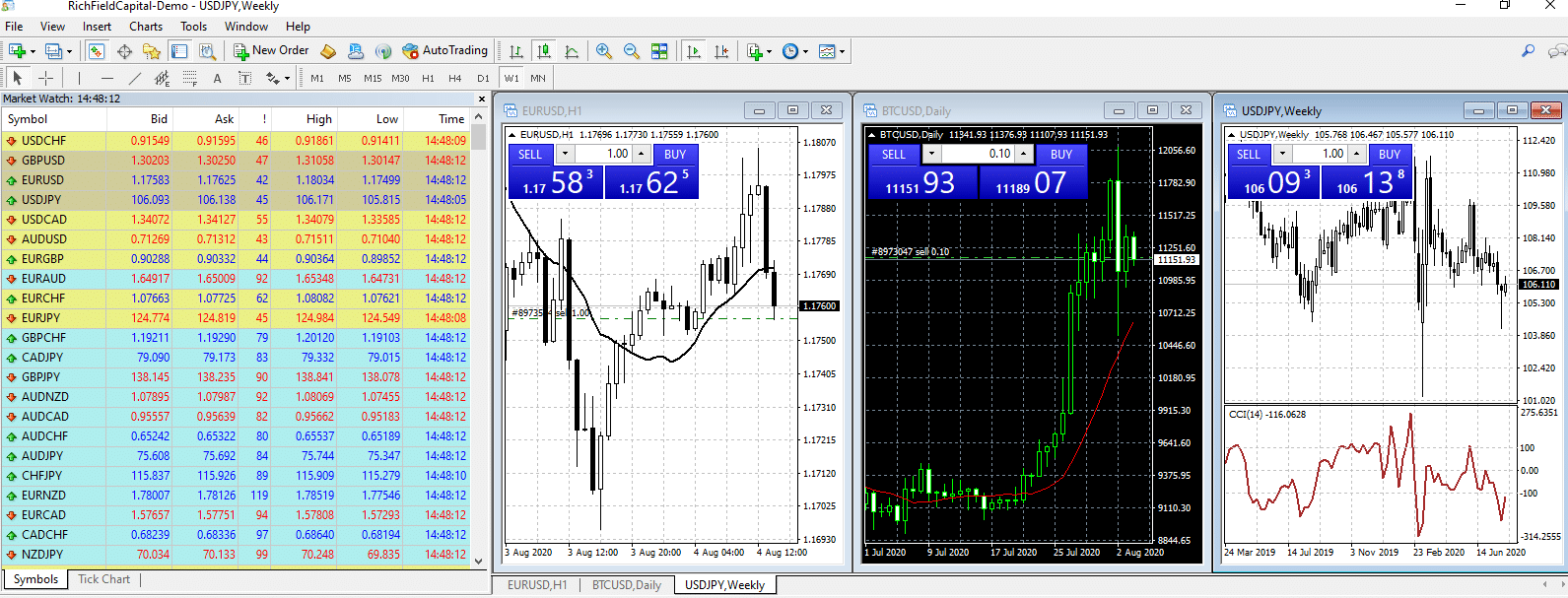

FEATURES OF THE 24OPTION MT4

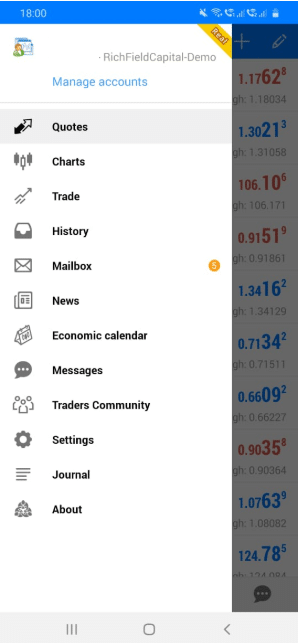

The MT4 offering from 24option includes most of the basic features and a few advanced. Here is a quick view of the characteristics of the desktop and Android applications.

- The platform is compatible with Windows, Linux, and macOS.

- It supports all browsers plus Android and iOS mobile devices.

- Manual and algorithmic trading.

- The MT4 has flexible order types that include instant, market and pending orders.

- Monitor interactive charts in 9-time frames with 30 technical indicators and 23 analytical objects.

- The platform features alerts and push notifications for mobile apps.

- Download, rent or purchase thousands of technical indicators, trading signals from the Codebase.

- Gain first-hand experience of the MQL4 IDE development environment.

- Connect with the MQL5 community of traders and exchange views, ideas.

Besides the basic MT4 features, 24option also provides clients with the plugins to access Trading Central. Here are some of the features

- Patented pattern recognition

- Daily market analysis

- WebTV

- Newsletters

SUMMARY OF THE 24OPTION MT4 PLATFORM

The 24option MT4 platform is a mixed offering. While the CFD broker has not included some of the basic requirements like live news, all the other in-built features of the MetaTrader remain intact. While the addition of Trading Central is a bonus, the other drawback is that the broker does not allow the copy trading. So, if you are a beginner looking to copy strategies of professionals and profitable traders, you are likely to be disappointed.

PEOPLE WHO READ THIS ALSO VIEWED: