You've made some successful trades on eToro, and now you want to withdraw those hard-earned gains into your bank account.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

In this guide, we're going to show you the easiest ways to withdraw money from eToro and answer some frequently asked questions about the eToro withdraw process.

Table of contents

Before We Get Started, Take A Look At Our Other EToro Guides:

- Check our eToro review

- Read our eToro demo account guide

- Find out more about eToro's minimum deposit

How to withdraw money from eToro?

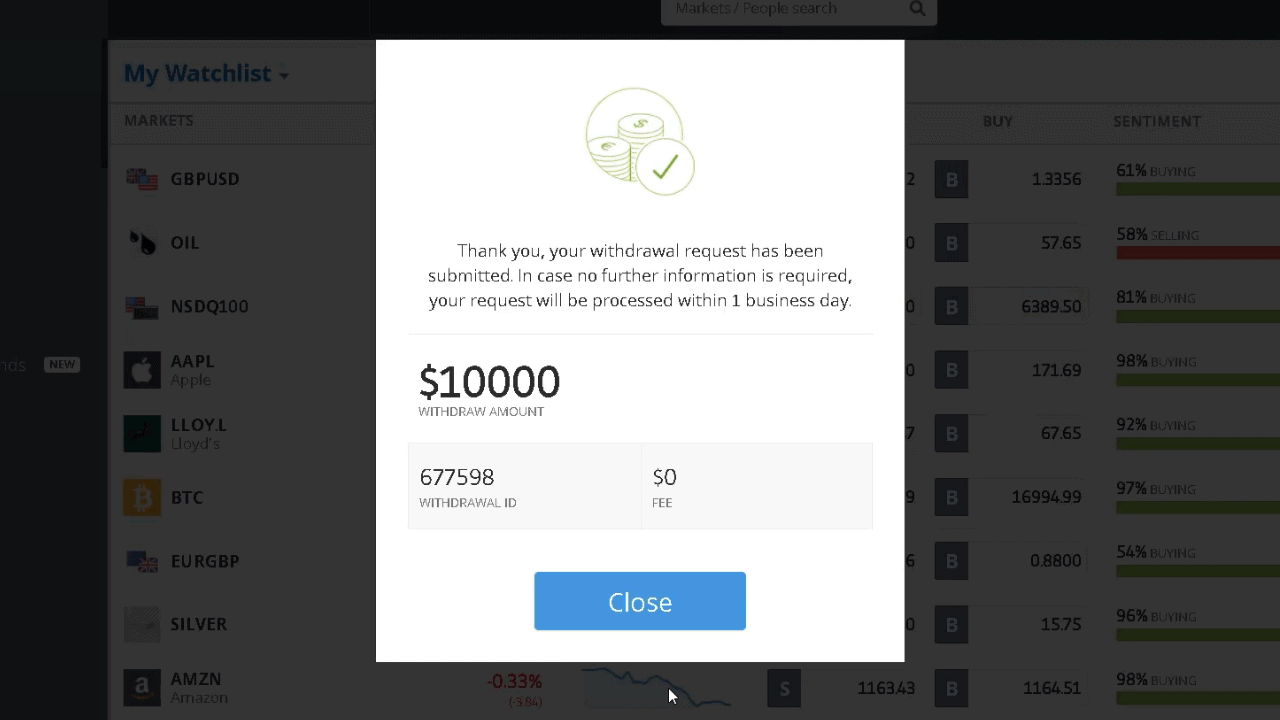

In order to withdraw funds from eToro, you'll need to put in a withdrawal request. You can do this by following the five simple steps below:

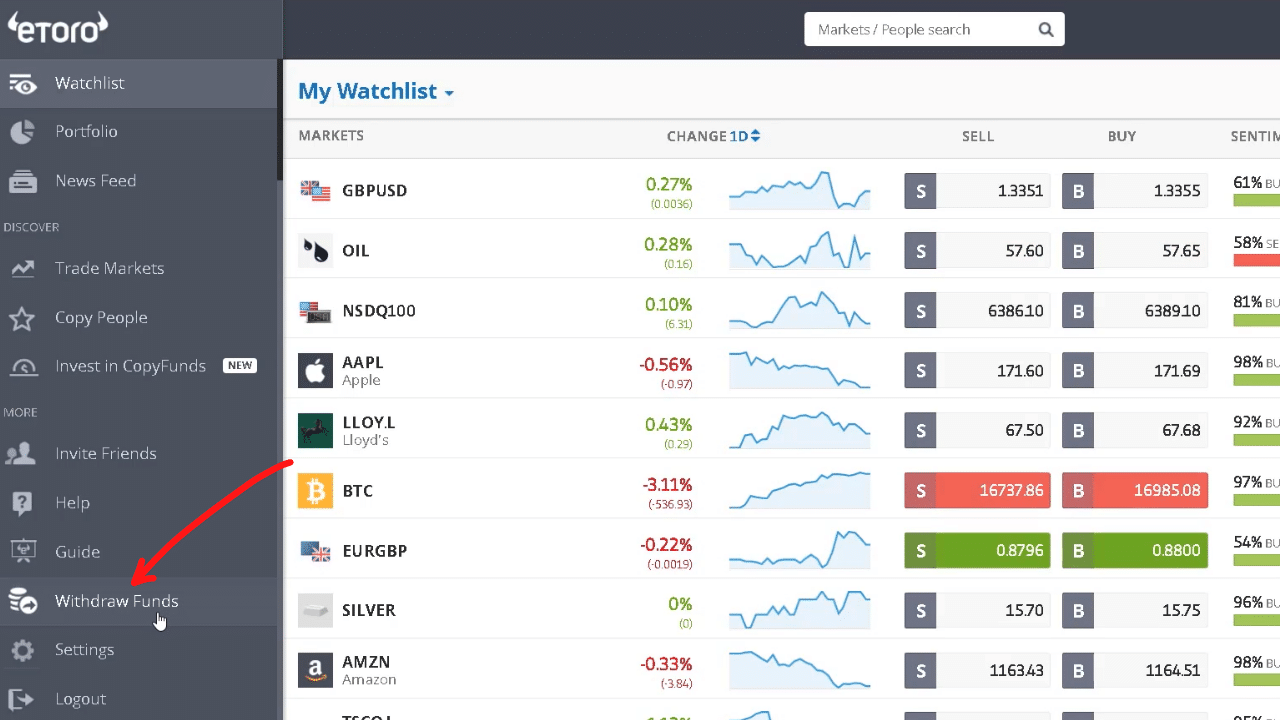

1. In your eToro account, click on Withdraw Funds located on the side menu

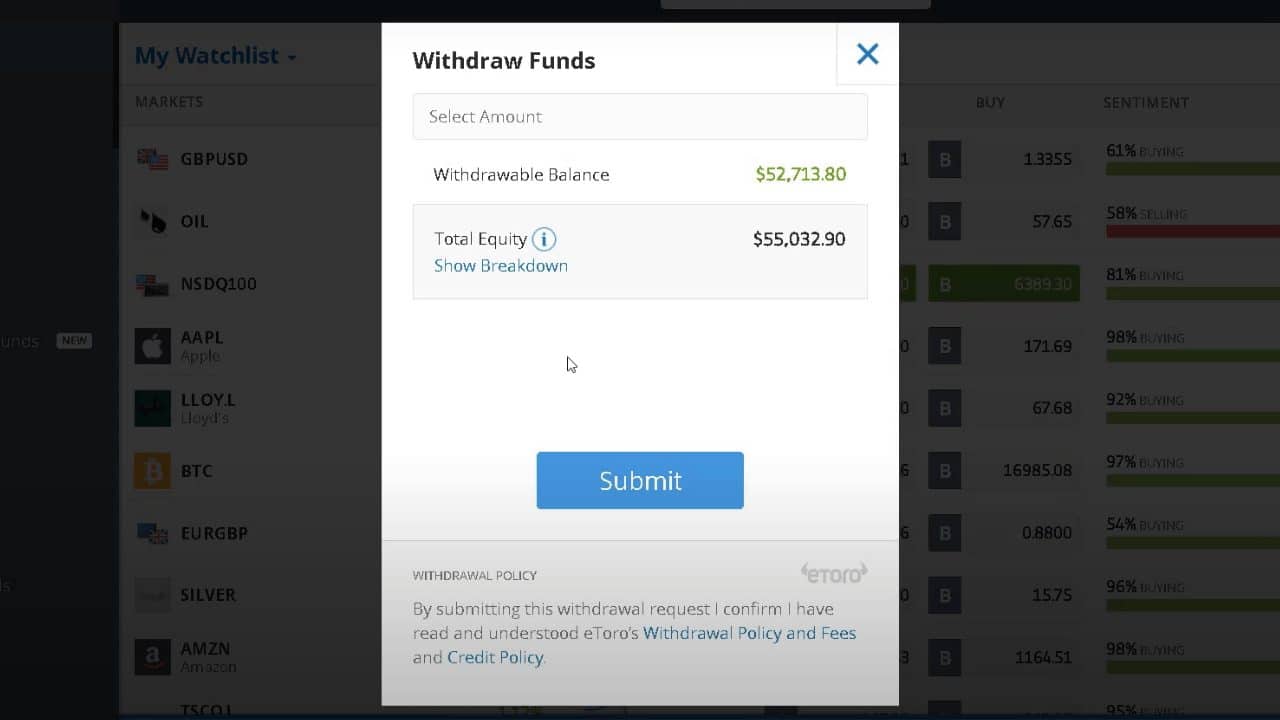

2. A pop-up window will appear showing your total and withdrawable funds balance

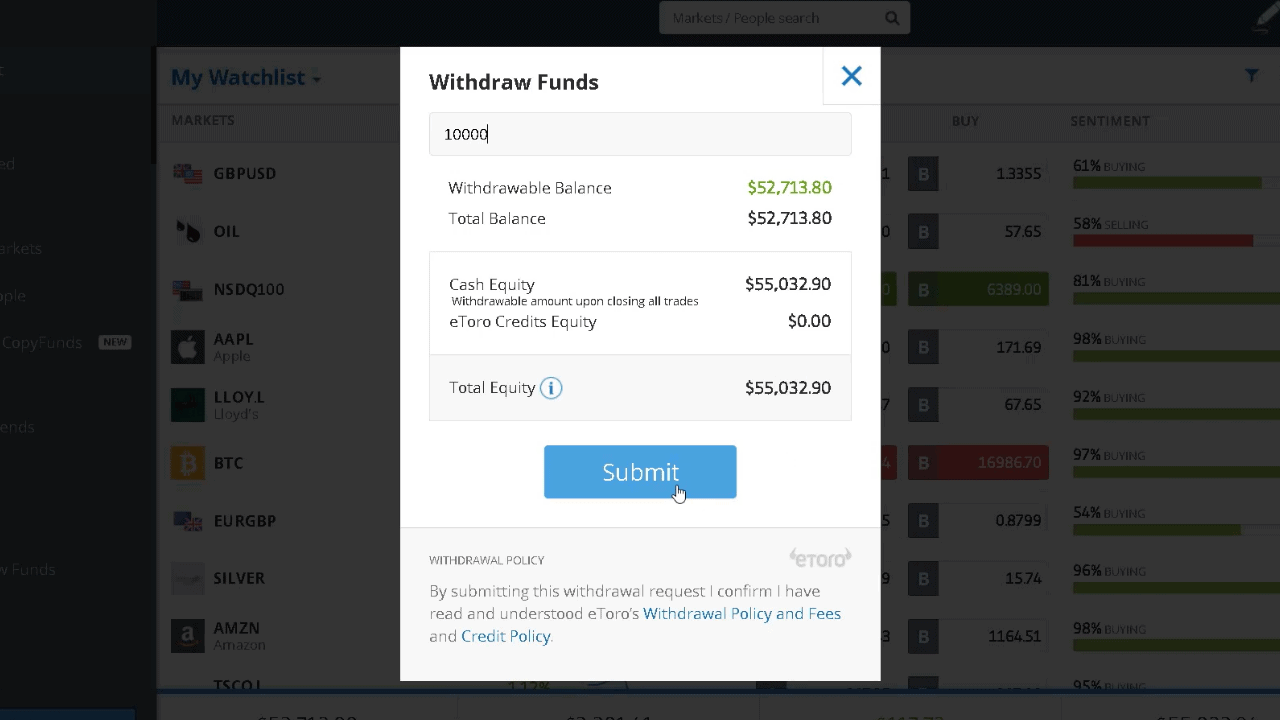

3. Input your desired withdrawal amount (note the $5 withdrawal fee) & click ‘submit'

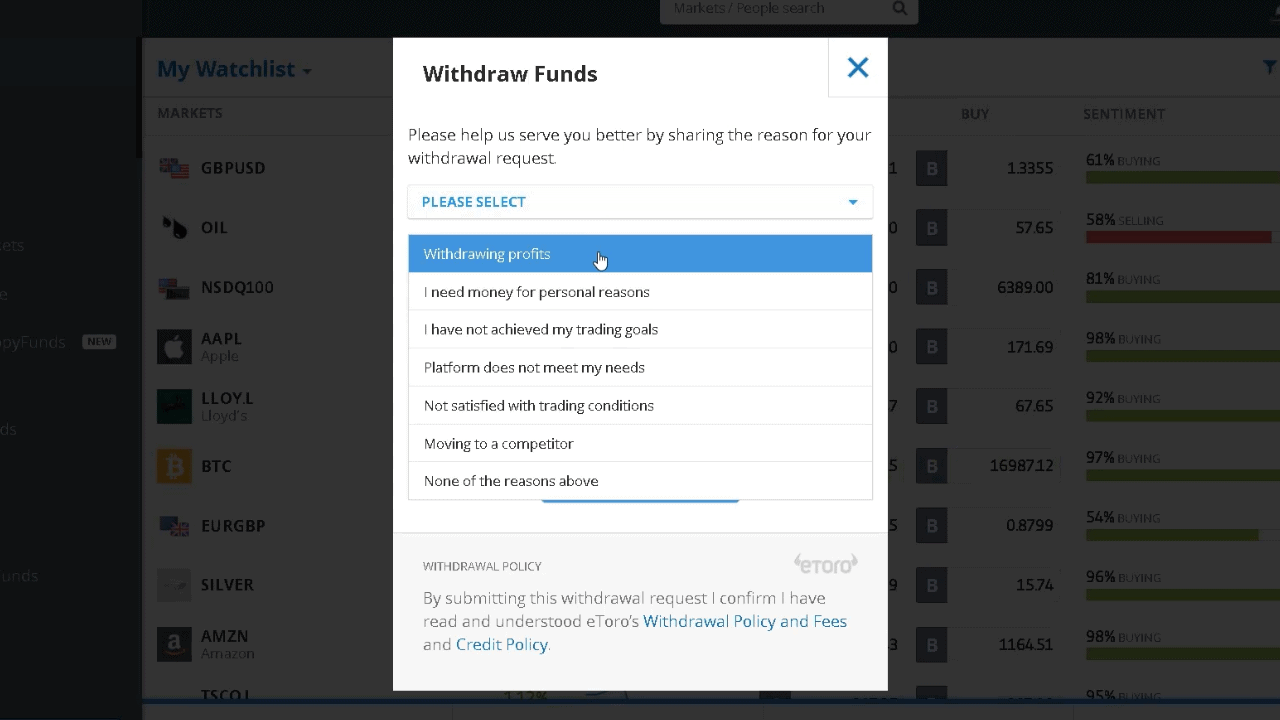

4. Specify a withdrawal reason and click ‘continue'

5. Choose your withdrawal method and click ‘submit' and you're done!

You can withdraw money from your eToro account at any time up to the value of the balance of your account, minus the amount of margin used. You don't need to hold any money in your account, so it's possible to withdraw the full balance if you need to.

The important thing to remember is that any withdrawn funds will be sent directly to the account that you used to make the deposit. For example, if you made a deposit with a credit card then the money will be sent to your card.

Note that certain withdrawal methods take priority. If you are withdrawing your money onto a credit card, this will happen first, then PayPal and finally bank transfers. If your details have changed since you deposited the funds, then you will be asked by eToro to provide an alternative withdrawal method.

How long does it take to withdraw money from eToro?

It can take up to 1 business day for eToro to process your withdrawal request – assuming that all the details on your account are correct. Once the withdrawal is processed, the estimated time to receive payment depends entirely on your payment provider.

eToro Withdrawal Time

The typical timeframe for each payment method is:

| Payment provider | Timeframe |

| Credit/Debit card | 3-8 working days |

| PayPal | 1-2 business days |

| China Union Pay | 1-2 working days |

| Neteller | 1-2 working days |

| Skrill Limited UK | 1-2 working days |

| WebMoney | 1-2 working days |

| Bank Transfer/Wire Transfer | 3-8 working days |

When it comes to bank transfers, if a large amount is being withdrawn then we suggest contacting your bank in advance. Large withdrawals may be put on security hold, causing further delays.

How much does eToro charge to withdraw?

- eToro charges a flat fee of $5 on all withdrawals

- The minimum withdrawal amount is $30

If you're withdrawing funds in a different currency than USD, then you'll also be charged a conversion fee. This conversion fee will vary depending on your chosen currency.

You may also be charged a transfer fee by your own bank, credit card provider or PayPal once the transaction has taken place. You can keep up-to-date with the status of your withdrawal in the Portfolio tab. It's important to note that eToro fees are subject to change at any time, depending on market conditions.

| eToro Withdrawal Fee | $5 |

| eToro Minimum Withdrawal Amount | $30 |

Need a New Broker?

Pepperstone: #1 Forex Broker

Take A LookIG: Tax Free Trading

Take A LookIf you're looking to deposit your profits with a new broker then these are the ones we recommend. At AskTraders we compare broker across several categories to help you choose the right broker for you.

eToro Withdrawal Checklist

Before you proceed on withdrawing funds from your eToro account, below are the checklist or requirements that you need to be aware of.

- Your account needs to be verified and in good standing with eToro

- The withdrawal fee for all withdrawals from eToro is $5.

- You will be notified via email once your withdrawal request is processed by eToro.

- You are able to cancel your withdrawal request while it is “Under Review” via your Portfolio by clicking on the blue History icon and then clicking the “Reverse” button on the request you wish to cancel.

- Funds deposited via online banking cannot be withdrawn until 7 days after the deposit was made.

Also, your account must have withdrawable funds available to proceed with withdrawals.

How to Cancel a Withdrawal Request on eToro

If you've changed your mind, don't worry. As long as your withdrawal status is Under Review, you can cancel your request by using the following steps:

- Log into your trading account and click on the tab that says Withdraw Funds

- This will open up a pop-up message. Use the Click Here link to view your withdrawal history

- Click the Reverse button on the withdrawal you want to cancel

- Confirm the cancellation

Your funds and any fees applied to the withdrawal will be immediately returned to your account. If the transaction is showing up as In Process, then it won't be possible to cancel the withdrawal. If this happens, you'll need to contact eToro directly for help.

Withdrawal issues and delays in payment

If the funds haven't appeared in your account, it's important to take into consideration processing and payment times. Depending on your chosen payment method, it can take up to 8 working days to process. Also, don't forget that it will also take eToro up to 1 business day to process your withdrawal request.

If you're still concerned, you can easily check the status of your withdrawal via your account:

- Click on the Portfolio tab

- Then click on the History tab

- Check to see which payment method your funds were sent

Alternatively, you can also check the email confirmation you would have received from eToro in relation to your withdrawal request. Public holidays can also cause a delay in payment, so check your calendar to make sure that your withdrawal request doesn't fall on or between one of these dates.

Further Reading

- Learn how good is eToro mobile app

- eToro dividends explained

- Learn about tax on your eToro profits in UK

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.