Forex Trading – What Is It?

First of all, forex trading, what exactly is it?

Simply put, foreign exchange (Forex) trading is the buying and selling of currency pairs. As the name would suggest, a currency pair is two currencies measured by an exchange rate. This is the rate where you can exchange one currency for another currency.

Exchange rates constantly fluctuate, actively changing hands 24-hours a day, 6-days a week. There is ample liquidity to trade the forex market as it is the largest of the global capital markets with a daily transaction volume of up to 5-trillion dollars a day.

There are several nuances and lingo that is used when describing forex trading. This includes:

- Major currency pairs

- Base and a counter currency

- Bid offer spread/Liquidity/ and Orders

- Spot and forward trading

- Leverage

- The Players

- Fundamental and Technical Analysis

- Charting

The Major Currency Pairs

The most liquid currency pairs are the major currency pairs. To be considered a major currency pair, one of the two currencies needs to be the US dollar. Major currencies, including the dollar, are:

- Euro

- Japanese Yen

- British Pound

- Swiss Franc

- Australian Dollar

- Canadian Dollar

- New Zealand Dollar

| US Dollars (USD) | |

| Euro (EUR) | EUR/USD |

| Japanese Yen (JPY) | USD/JPY |

| British Pound (GBP) | GBP/USD |

| Swiss Franc (CHF) | USD/CHF |

| Australian Dollar (AUD) | AUD/USD |

| Canadian Dollar (CAD) | USD/CAD |

| New Zealand Dollar (NZD) | NZD/USD |

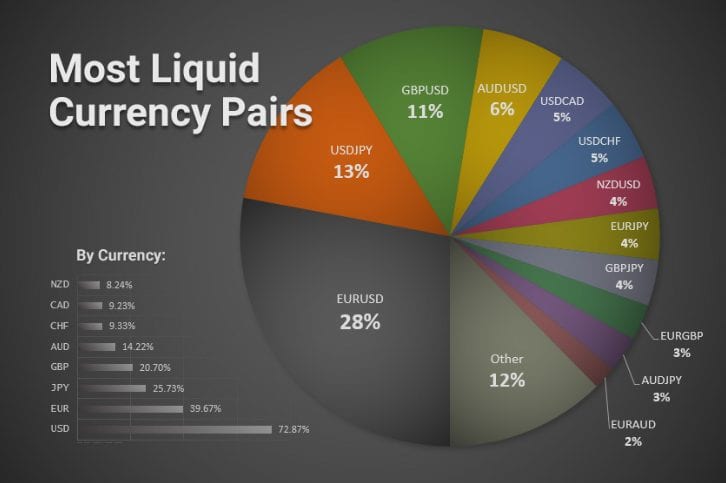

Nearly 73% of the currency trades transacted include the US dollar. The most liquid currency pair is the Euro versus the US dollar – EUR/USD. This describes how many dollars are needed to purchase 1-euro.

Approximately 28% of the total volume of forex trading is transacted as the EUR/USD.

Several other currency pairs have robust liquidity. Currency pairs that do not have the dollar as either the base currency or the counter currency are referred to as cross currency pairs.

Crosses such as the EUR/JPY and GBP/JPY, along with EUR/GBP, have ample volume. Currency pairs that do not include one of the major currencies are either minor currency pairs or emerging currency pairs.

Check out the best currency pairs to trade in Forex!

Based and Counter Currency

A currency pair is made up of two currencies, the base, and the counter currency. The quoting of each currency pair determines which is the base and the counter currency.

The base currency is the first currency you see in the quoted-pair. For example, in the EUR/USD, the Euro is the base currency. The second currency in the pair is referred to as the counter currency.

Simply put, the exchange rate tells you how much of the counter currency is needed to purchase 1-unit of the base currency. For example, if you see a quote for the USD/JPY at 107.96, you would know that you need 107.96 yen to purchase 1 USD dollar.

The Bid/Offer Spread and Liquidity

Trading activity in the forex market occurs around the clock, providing opportunities to enter and exit trades at any time. Your ability to buy and sell these currency pairs at any time is what makes this market so attractive to many investors.

Most forex brokers do not charge a commission when you enter and exit a trade. Instead, brokers provide you with a price where they are willing to purchase a currency pair and where they will sell a currency pair. This difference is referred to as the bid-offer spread.

- Bid – where a broker is willing to purchase a currency pair.

- Offer – where a broker is willing to sell a currency pair.

| Bid | Offer | Spread | |

| EUR/USD | 1.1101 | 1.1104 | 0.027% |

| USD/JPY | 107.96 | 107.99 | 0.028% |

| GBP/USD | 1.2271 | 1.2274 | 0.024% |

You can purchase the EUR/USD at the offer price of 1.1104 or place a lower bid and wait to see if you get filled at your expense. If you buy at the market, you will likely get filled at the offer price. This is called a “market order.” If you place your bid below the offer price, this is referred to as a “limit order.”

You can sell the USD/JPY at the bid price of 107.96. If you sell at the market, you will likely get filled at this level. Alternatively, you can place an offer to sell above this level. This would be considered a limit order.

The spread describes the difference between the bid and offer. When spreads begin to widen, it tells you that the market is becoming less liquid.

Spot and Forward Markets

There are two distinct time horizons used in forex trading, which include spot and forward trades.

The exchange rate of a currency pair for immediate delivery is called the spot price. The settlement of a spot transaction is 2-business days. Any transaction that has settlement beyond 2-business days is referred to as a forward price.

Most of the trading you will be transacting will not require that you take delivery of a currency. Your broker will handle any operational aspects of the currency process for you. You need to know if you trade through a retail forex broker, the exchange that you will trade is spot exchange rates. If you hold your currency pair for more than 2-business days, your broker will need to roll your trade into the forward market.

The forward market has slightly different prices than the spot market as it incorporates the interest charges for holding the currency pair beyond 2-business days.

Futures exchanges also accommodate currency transactions as they allow traders to buy and sell currency futures contracts. These are forward contracts that have a settlement at a set period in the future. The interest charges are already incorporated into the futures prices.

Leverage

One of the benefits of trading the currency markets, whether you are trading in the spot, forward, or futures markets, is leverage. Leverage allows you to enhance your returns by increasing the size of the position with borrowed capital.

Your broker provides leverage through a margin account. When you apply for a margin account, your broker will often ask questions about your knowledge and experience to determine how much leverage to provide when you trade.

Leverage ratios can range from 2 to 1 through 400 to 1. This means that some brokers will allow you to increase your trades’ value by up to 400-times; this is known as High Leverage Trading.

Leverage can enhance the size of the positions you will be able to transact. For example, when using a market account, you might only be required to post $100 to take a USD/JPY position with a value of $10,000 using 100 to 1 leverage.

The returns you can generate when using leverage are significant. If you only post $100 and use 100-1 leverage, a 1% gain on $10,000 ($100) provides you with a 100% return on the capital you posted for the trade ($100/$100).

Leverage cuts both ways. If you lose 1%, you could wipe out the capital you posted for the trade. Your broker will consistently monitor your account and request more capital if you fall below key equity levels in your account.

If you do open a margin account, make sure you read the agreement carefully. Most margin accounts allow your broker to liquidate your positions if you fall below crucial equity levels.

The Players in Forex Trading

The forex markets provide an arena where traders can speculate, but it also allows a corporation to hedge their liabilities.

For example, if a US corporation makes money in Euros in France, they eventually need to exchange the Euro for US dollars. They will need to use the currency markets to sell Euros and buy US dollars.

Additionally, central banks are consistently buying and selling currencies for regulatory operations and monitoring the value of the currency they regulate. Commercial and investment banks are consistently trading forex in the market to buy and sell for clients as well as their obligations.

The most liquid forex trading is between commercial and investment banks. This is referred to as the interbank market. Hedge funds and pension funds are also very active in taking speculative positions and provide liquidity. Lastly, there is a very active retail market.

In addition to the spot and forward and futures markets, traders can also take currency positions by using contracts for differences (CFDs), exchange-traded funds (ETFs) as well as exchange-traded notes (ETNs).

Fundamental and Technical Analysis in Forex

There are several ways traders attempt to determine the future movements of a currency pair. To evaluate currency pairs, traders often use different types of analysis.

Fundamental analysis is the evaluation of macro events. This could include economic activity, as well as monetary policy, which focuses on interest rates.

Another type of analysis is called technical analysis. This focuses on historical prices. Technical analysis is a broad category. Some patterns and studies can be used to help you determine the future movements of a currency pair. One of the best ways to use technical analysis is through a price chart.

Price Charts

A price chart will help you determine where a currency has been and where it might be going.

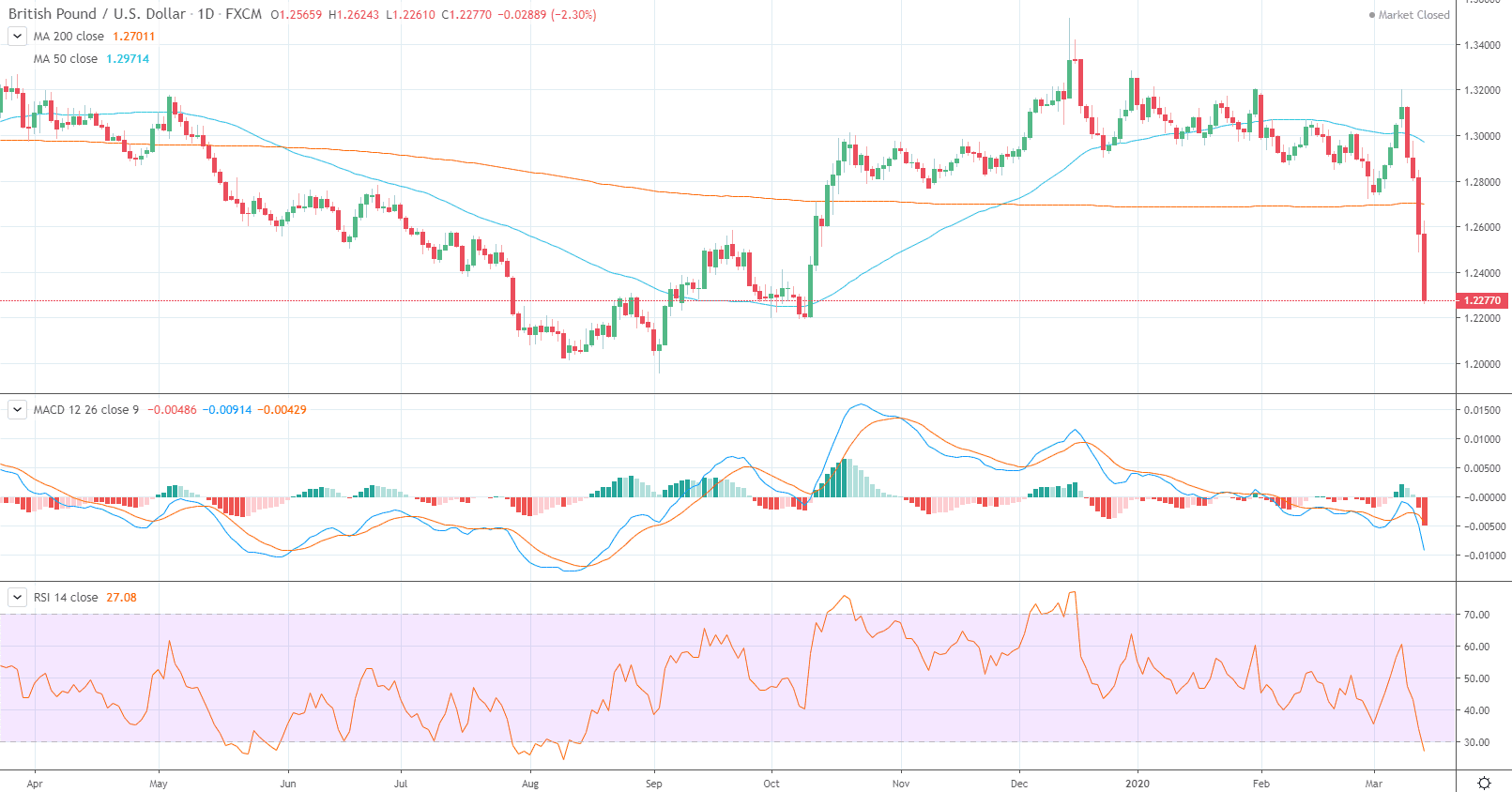

A currency pair chart can be a line chart or a bar chart, or even a candlestick chart. You can place moving averages on the chart to find support and resistance levels as well as trends. Or add studies, like the MACD to determine momentum or the RSI, to determine if an exchange rate is overbought or oversold.

The picture helps many traders visualize the future direction of a currency pair.

Key Takeaways

You should take away that the currency markets are the most liquid of the capital markets and provide traders, corporate treasurers, hedge funds, and bankers with tools to generate returns.

There are hundreds of currency pairs, but the major currency pairs provide the best liquidity around the clock. When you trade currency pairs, you will likely have access to leverage through a margin account.

While leverage can significantly enhance your returns, it can also increase your risk.

Lastly, one of the best ways to evaluate a currency pair is through a chart. This will allow you to see past price action and will enable you to analyze each currency pair using technical analysis.