IQ Option is a leading online trading platform that allows traders to trade CFDs of a wide variety of financial instruments including stocks, forex, commodities, ETFs and cryptocurrency.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Before we get going, have a look at our other IQ Option guides:

In this guide, we’ll be taking a look at the fees you may (or may not) be aware of and how to avoid getting stung by unexpected charges.

Table of contents

Deposit Fees

There are no fees on deposits at IQ Option (*currency conversion fee might apply). The minimum deposit amount is 50€, which is well below the amount required by other comparable trading platforms.

Transaction & Commission Fees

IQ option charges little to no commission fees. A fee of 2.9% will be charged if you open a ‘long' cryptocurrency position. For example, if you invest $10 to buy the equivalent in Bitcoin, you will be charged $0.29 for opening the position (or 2.9% of $10).

Overnight Fees

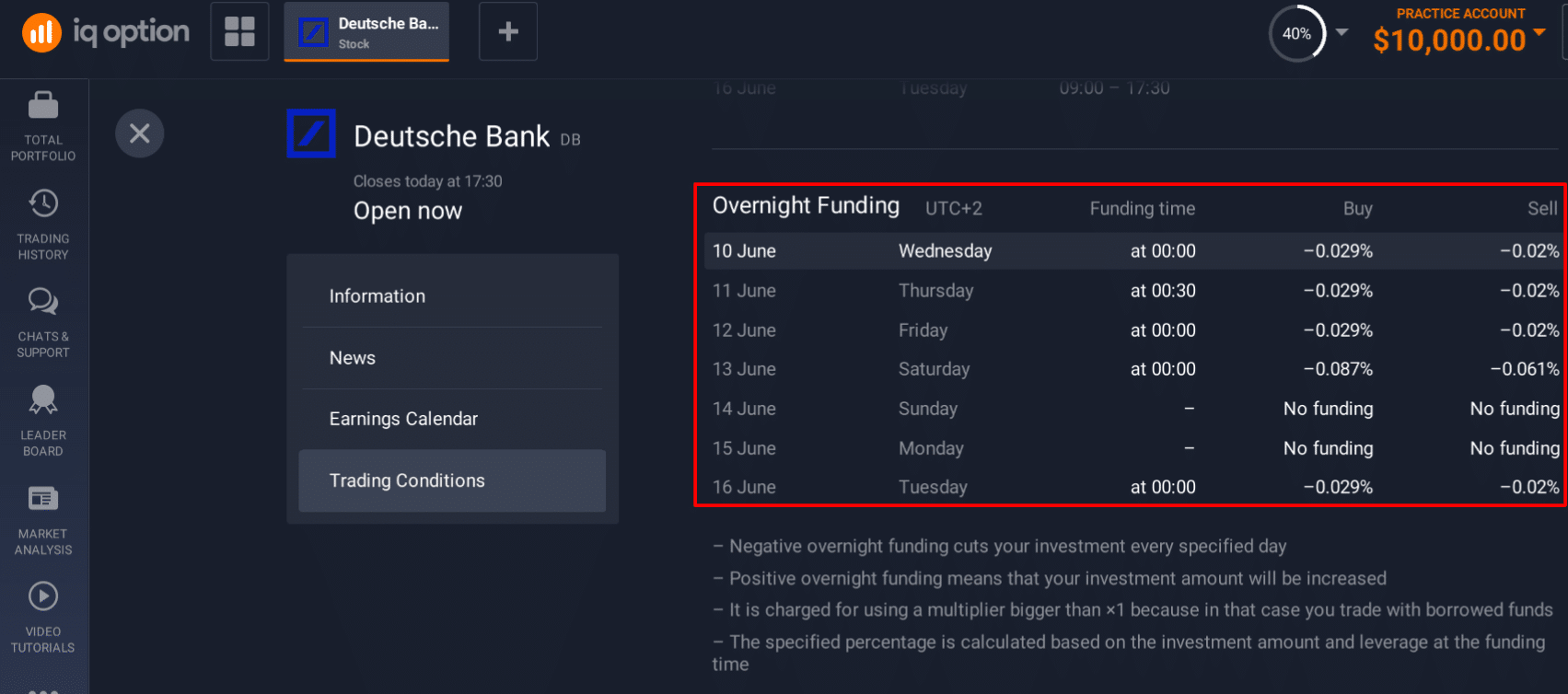

Also known as a ‘Swap Fee’ or ‘Overnight Funding’, this will be charged on CFD positions left open overnight. This fee is set at 0.01% – 0.5% of the face value of the position and affects CFDs on forex, ETFs, cryptocurrencies and commodities. Brokers such as IQ Option will charge an overnight fee to cover the cost of the leverage a trader uses overnight.

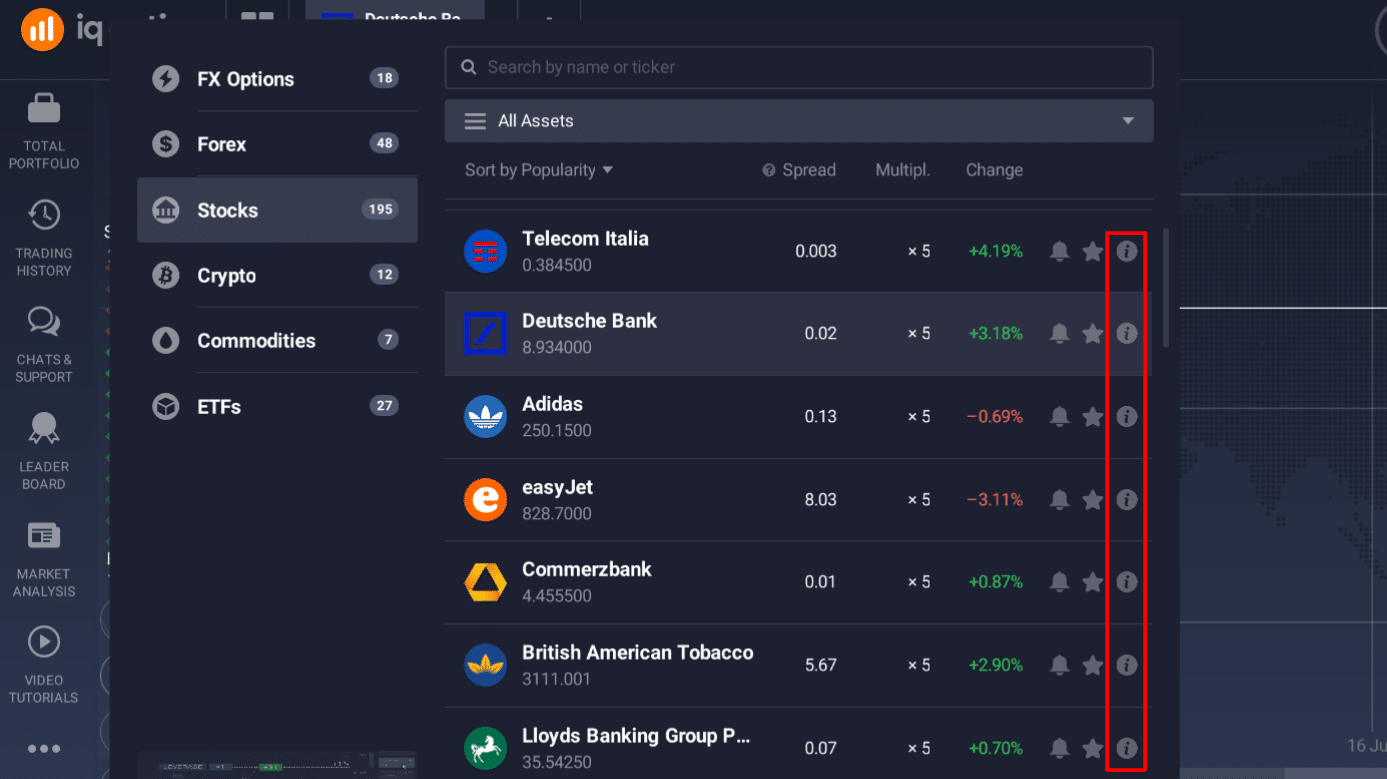

You can easily check swap rates for different assets via your account:

Click the ‘information' button next to an asset

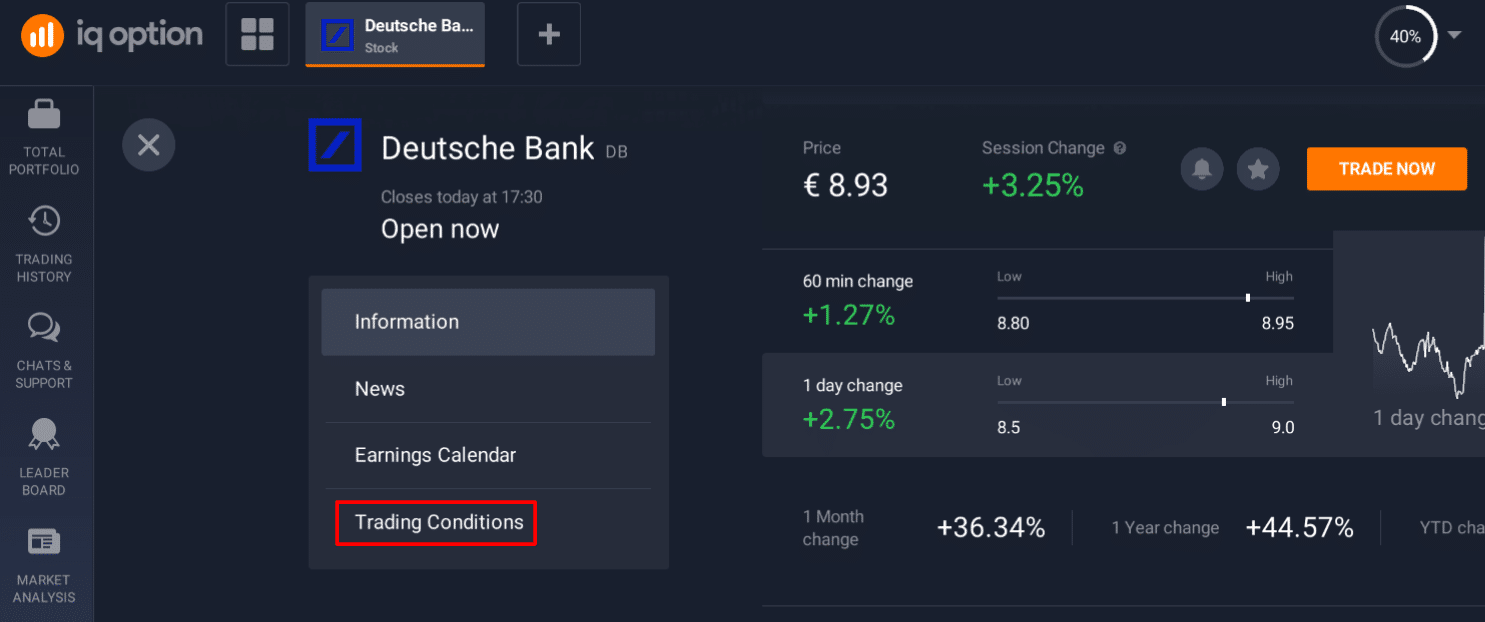

Click ‘Trading Conditions'

Scroll down to ‘Overnight Funding' (or Overnight Fees)

Low Cost IQ Option Alternatives

eToro: Market-leading platform

Take A LookPepperstone: FCA and ASIC regulated

Take A LookAdmirals (Admiral Markets): Impressive range of assets

Take A LookPlus500 | CFD provider: 82% of retail investor accounts lose money when trading CFDs with this provider

Take A LookIf you are looking for a reliable broker with low fees and fair conditions then this is who we recommend. All have been reviewed by our team and have been found to offer a low cost way to trade.

Withdrawal Fees

Withdrawals via bank transfer will cost $31 for every transaction. However, there are no withdrawal fees if you use a Payment Service Provider (PSP) to withdraw funds. These include:

- PayPal

- Skrill

- Neteller

- EcommPay

- WebMoney

- SOFORT

- WorldPay

- PPRO

Withdrawals under €2 (or equivalent in another currency) can't be processed, so you'll need to contact Customer Support for assistance if you want to withdraw less than €2.

Trading fees

IQ Option does not charge any fees on trading activity. You’re free to profit off your open and closing trade positions without paying any trading or commission fees. Many brokers will take a slice of the profits generated from the ‘spread’, i.e. the price difference between where traders buy or sell an asset. However, IQ Option does not do this and instead generates its revenue by alternative means.

Inactivity Fee

There is a ‘Dormant Account Fee with this broker. While some brokers only require that you log in to your account to keep it active, IQ Option charges a fee if an account is inactive for 90 days. If no trades are opened, pending, or executed inside 90 days, your account will be charged the €10 fee. The same amount will also be charged monthly afterwards if your account remains dormant.

Verification Fee

While you won't be charged for opening an account with IQ Option or making a deposit, it's important that you submit your identification verification documents as soon as possible after you've opened your account. If you don't submit them within 15 days after making your first deposit, all your funds (minus profits) will be returned to your account. If your balance is above €5 then you don't need to worry, but if it's below €5 then you'll be charged a fee of up to €5.

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

People who read this also viewed:

- Here are our latest trending stories

- Learn IQ Option trading strategies

- How to use IQ Option MT4