IQ Option is one of the leading trading platforms across the world with its great features for traders.

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage. 83 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This article will look at IQ Option minimum deposit, how to make your deposit, how to get your account set up, and what the best options and choices are for you. With IQ Option, you can trade in Forex alongside stocks and crypto, as well as ETFs.

Table of contents

IQ Option Minimum Deposit

The minimum deposit amount is €20 across all payment methods including Visa/Mastercard, Skrill, PayPal, Neteller, Sofort and via Bank Transfer. You can look at IQ Option's “Deposit and Withdrawal” menu for more information on the deposit payment.

Some websites indicate that you would be expected to place a minimum deposit of up to $250 with some brokerage services, which is a stark comparison when these figures are put next to each other.

In comparison, some citations state offerings of five-figure sums, all the way up to $25,000 for just one broker comparison.

How to Deposit in IQ Option by Bank Card

Here's how to make a deposit in IQ Option:

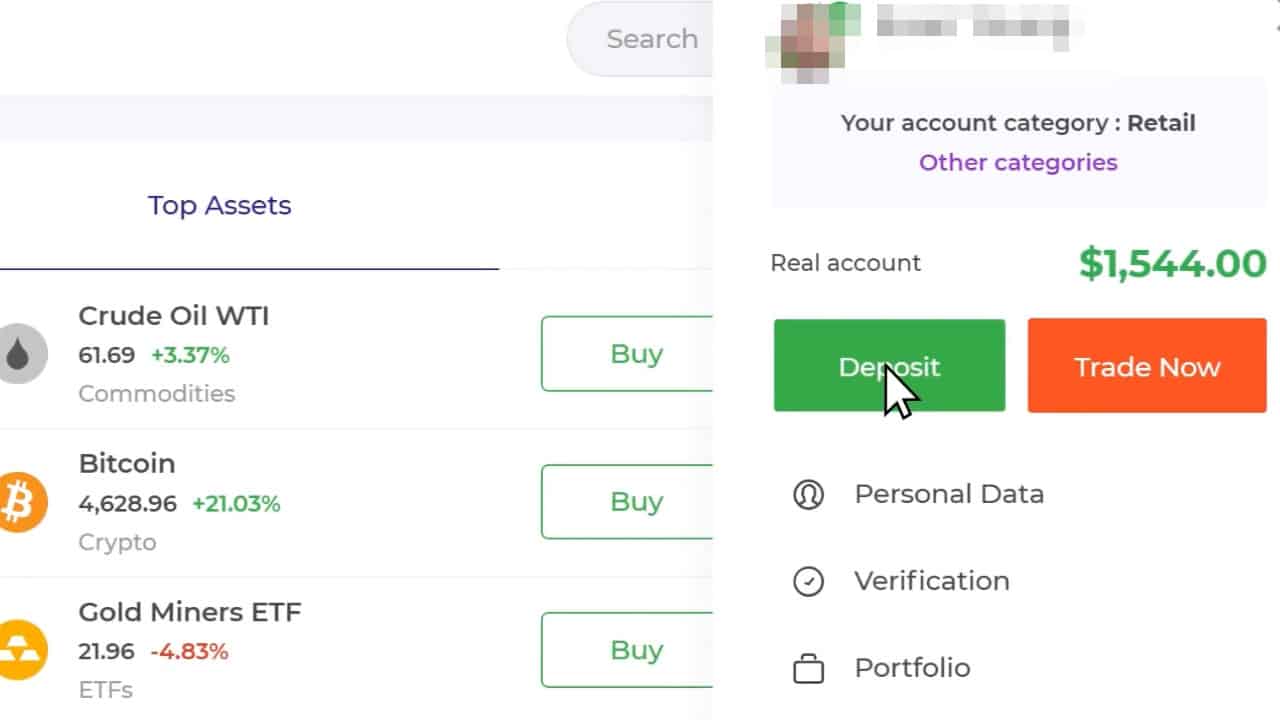

- Click ‘Deposit' in the upper-right corner of the main website page and trading platform

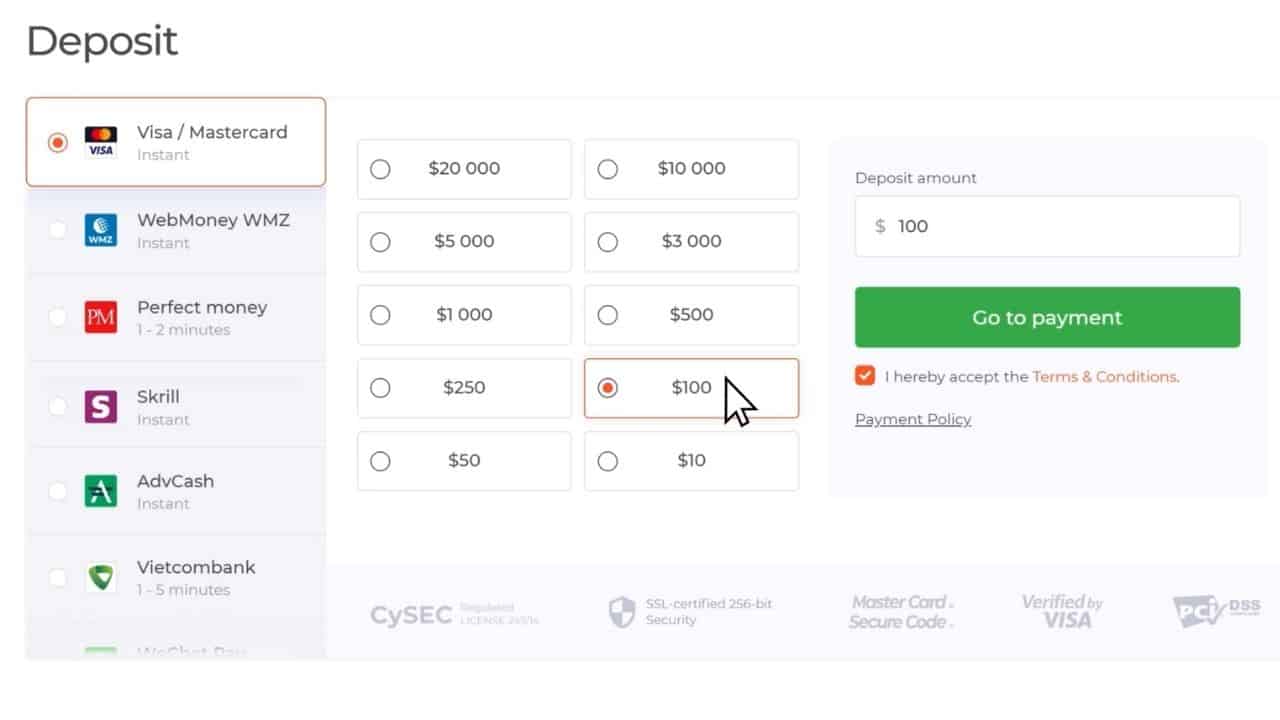

- Select the Visa/Mastercard payment method

- Enter your deposit amount manually or select one from the list

- Click ‘Go to Payment'

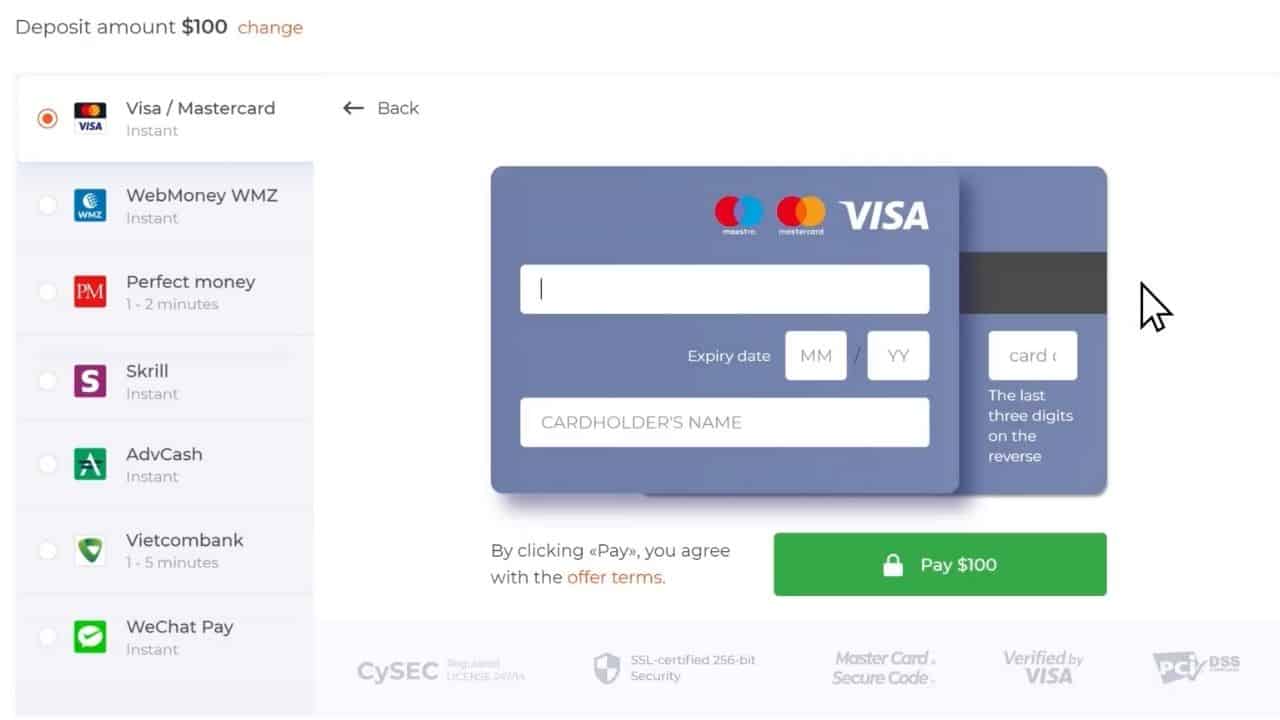

- Input your card details

- Complete the transaction by clicking the ‘Pay' button

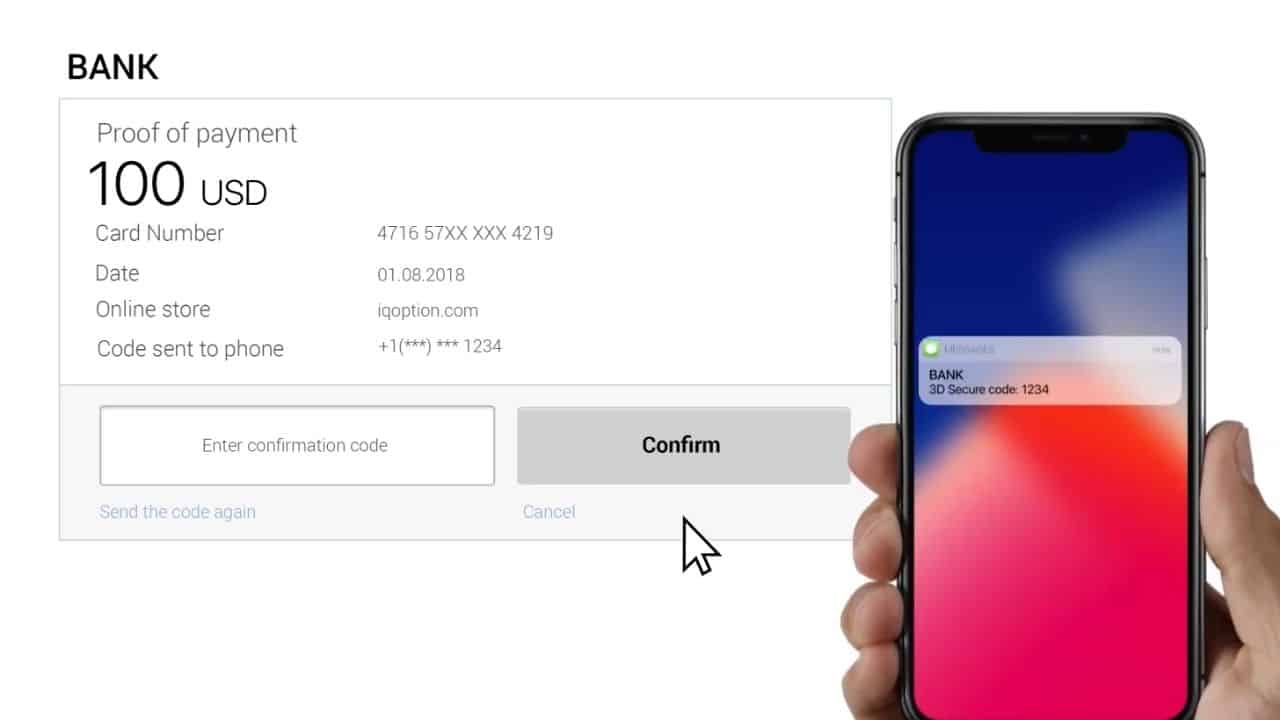

- Enter the 3D Security Code to confirm the security of the deposit

- A confirmation window will appear and your funds will be credited instantly

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage. 83 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Get Started with a Demo Account

If you want to test the waters before investing, it is possible to get used to the platform first. By opening a trading demo account, you can use their practice platform before you get serious.

IQ Option demo account is a great way to test certain strategies, and it significantly helps if you come across trading instruments you have not yet used before. If, for example, you were not aware that IQ Option offers more than are interested in checking out if Forex trading could suit you, you can do all of this without investing any money at all.

- Test out what minimum deposit suits you.

- Find your trusted strategies.

- Check out different markets.

Using the trading demo account allows you to get familiar with the platform, see what works and figure out, among other things, what your IQ Option minimum deposit should be.

If you decide you don't want to risk too much to start with, you can find out at IQ Option how to deposit with a smaller fund to reduce any potential apprehension you may initially have.

Of course, it also means that if you make a mistake the first time, it won't cost you anything with your first investment.

Conclusion

Choosing the right broker is essential for every trader that wants to start investing. As one of the fastest growing online trading brands globally, IQ Option is indeed among the best trading platforms for beginners. They have extensive trading instruments that range from CFDs on stocks and ETFs, and Forex trading for you to work with.

CFDs are complex instruments and entail a high risk of losing money rapidly due to leverage. 83 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

People who read this also viewed:

- Find more about IQ Option Fees

- Trade stocks with the top-rated eToro

- Learn IQ Option trading strategies