Day-trading comes with a short-term focus, as against traditional investing. Trading can be broken up into days, hours, minutes, and seconds. The small edges, even when timing an entry, can make all the difference.

Whether you are day trading or swing trading, defining the right time to enter and exit the market can be the difference between profit and loss.

Is there any best time to buy stocks? Or even the best day of the week to sell them? Can there even be a best month or day when to buy stocks? Let’s study how time trading decisions can yield instant profits and lasting returns.

Best Time, Day, and Month For Stocks & Shares – In Brief

- Trade during the opening and closing hours for the highest volumes and volatility

- The Monday effect and the January effect offer key insights for seasonal traders

- Holding shares for the right time is as important as buying or selling stocks

- September is often the best month to buy shares, given the October boom

- ‘Santa Rally' is now entrenched in the minds of markets, with December the beneficiary

Table of contents

- Best Time, Day, and Month For Stocks & Shares – In Brief

- Right Time of the Day For Buying and Selling Stocks

- Middle of the Day: Calm Before the Storm

- The Trading Week

- Right Time of the Year and the Month to Buy Stocks

- Right Day of the Month To Invest

- Buying & Selling Stocks At the Right Time: Working Out the Safety Margins

Right Time of the Day For Buying and Selling Stocks

Market volumes plus prices go to the extremes, first thing in the morning.

- Opening hours are a window when market factors of all fresh releases since previous closing time contribute to volatility.

- The closing hour is also a volatile period as traders re-adjust their positions.

- Skilled traders can recognise certain patterns and make quick profits during these periods.

- Less skilled traders could suffer immeasurably. For beginning traders, trading when volatility is high or at the start of the opening hour should be avoided.

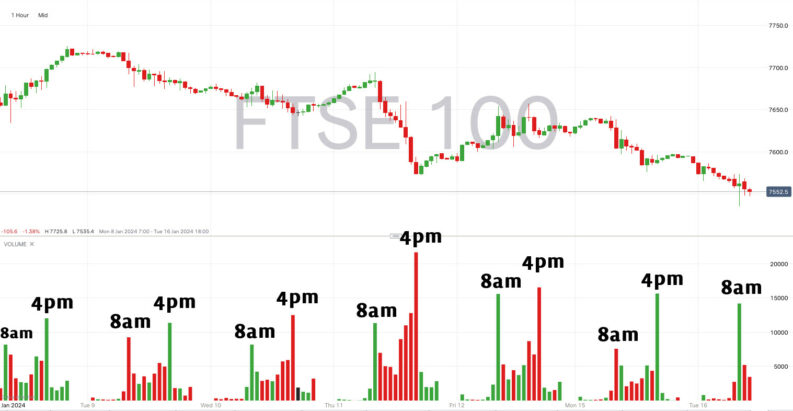

For experienced traders, the first quarter of an hour post the opening bell is the best time to trade. It is the period when the most profitable trades of a day on initial trends, are up for grabs. The time to day trade is during the first hour of trading. As you can see in the hourly chart above, FTSE 100 volume tends to spike at 8 am, when the market opens, and at 4 pm, ahead of the close.

This is because the biggest trades take place in the least period of time. In other words, there is more volatility and liquidity. However, professional day-traders often will stop at that time, when volume, as well as volatility, hit a low. Once this takes place, trades are executed over a longer period of time with smaller moves and lower volume.

Learning when to trade also depends on the assets and exchange timings. Another factor needs to be taken into account is the spread between bid and ask that is high in the first minute after the market opens.

Middle of the Day: Calm Before the Storm

For those looking for the calmest trading period the middle of the day is usually it. This is because people wait for future news to be released at that time of the day. News reports have already been factored into share prices. So, many are waiting to see how the news for the rest of the day impacts where the stock-market is headed. Prices are generally stable during this time.

Because the action is slow, returns may be easier to predict making it a right time for beginners to place winning trades. It’s literally the calm before the storm, as within the last hour of trading, volume and volatility rise. Most intra-day stock-market patterns reveal the closing hour is much like the opening. It’s replete with big moves, full-sharp reversals plus last-minute changes, especially during the closing seconds of trading. For the last hour of trading, day traders often try to close-out positions or join in a late intra-day rally hoping the momentum carries forward to the next day.

The Trading Week

Defining the best time of the week to buy and sell shares will depend on various factors. However, it’s important to remember that just because a certain day of the week may have been profitable in the past, it is no guarantee that buying or selling stocks on that day in the future will provide a return.

The best time to buy shares within a week on consensus is Monday. The Monday Effect is the theory that generally, the market will continue its trend from the previous session. Some people believe Monday is the best time of the week to buy or sell stocks as a result.

How true that is (as with many things in the markets) is debatable, as many go along with the theory that markets will move lower on Monday as traders digest the upcoming data and adjust their positions for the week. There is also more time for news reports, sometimes negative to be released over the weekend. Now, this may be a good thing for traders holding a position for the week, as it may provide an opportunity to enter at a good price. The key is to build up a solid amount of data to ascertain if it is statistically viable.

While Monday can be considered to be a good day to be clear about when to buy stocks, Friday can be the ideal day to sell these before the weekend break and to not leave positions open. So while the start of the trading week can be the ideal for purchasing shares, selling them results in profits only at the close of the position.

Another day of the week that is considered a good day to buy and sell stocks is Friday, as market participants adjust their positions at the end of the week. While the theory may work, traders and investors should always evaluate the larger market context and the stock(s) they are trading. For example, if you went short a stock on a Friday, and after the close, a Fed speaker said they believe a rate cut is incoming, stocks may jump at the open on Monday, pushing your position into the negative. Leaving positions open over the weekend leaves you more open to uncertain movements in either direction.

Right Time of the Year and the Month to Buy Stocks

Market cycles and seasonality centres around anticipating how markets will behave at a specific time during the year. Market timing centres around understanding short-term pricing patterns and trying to zero in on market highs and lows depends on timing. For example, if traders know December or January are stronger trading months, they can buy shares in November and lock in the position for the ensuing months.

A real world example of this is what is called the “Santa Rally.” This refers to the historical tendency for stock markets to rise leading up to Christmas and into the last few days of the year.

Another example of seasonality is the notion that September is traditionally the month of downward movements in equities, while in October, it is assumed that the average returns are positive. This isn’t always the case, however, as there were record drops in October during the American Depression and the 1987 crash.

Historically, strong returns are common at the year’s turn and during summer months.

Yet another deciding factor to be considered is the January Effect. At the start of the year, traders return to markets with determination, pushing prices up. This is more so for small-cap and value stocks, as per the experts. For seasonal traders, the close of December is also an excellent point in time to purchase value stocks or small caps shares poised for rising in the coming month. Many investors also sell stocks towards the end of the year, especially those declining in value for claiming capital losses on tax returns filed. The last trading day each year can, therefore, offer excellent bargains. As a caveat, the January effect does not appear constantly through time, with years in which January would show a negative return.

YOUR CAPITAL IS AT RISK

Right Day of the Month To Invest

While no one particular day of the month is ideal for stock purchase and sales, shares tend to increase in value at the turn of a month. This is associated with periodic new cash flows directed towards MFs at the start of the month. Fund managers also try to make balance sheets match at the close of the quarter, by purchasing stocks performing well in that quarter. So stock prices tend to fall during the middle periods of a month. Traders can benefit from buying shares at the midpoint of the month, within a fortnight. The best time to sell these shares would be 1 – 5 days from the time of the month’s turn.

While market cycles are seasonality and important, it is vital to remember that these are general assumptions and not absolutes. As a result, if you want to profit from these trends, you will need to do your research to ascertain how best to execute a position during these periods.

Buying & Selling Stocks At the Right Time: Working Out the Safety Margins

An alternative strategy is to buy the stocks of significantly higher quality than stocks in broader indices one is seeking to beat. Paying a rational price is the only focus, once the watchlist is replete with quality stocks. This is when the safety margin is important. It represents the difference between intrinsic company value and share price. The bigger the discount, the greater the bargain. Checking if there is a right safety margin is crucial for placing winning trades. Some experts look for 10% for industrial businesses and 20% for the resources. Others like Warren Buffet state that a wonderful company at a fair price is worthier than a fair company at a wonderful price while buying stocks.

Many deals exist in the market today where the sentiment has shifted or the trend has changed. That can be temporary rather than fundamental. It therefore depends on your timeline and whether you are trading or investing.

Downturns and momentum shifts can provide opportunities. The 2008 – 2009 period offered great opportunities for getting stocks at beaten down prices. The same can be said for early in 2020 as Covid restrictions hit. Many good companies were significantly undervalued. That is the best time to buy stocks, when the gap between true value and price is there to be had.

While buying or selling a share, establishing a range of value is important. Without a price target range, investors can be facing issues regarding when to buy a stock. One of the best ways to evaluate the extent of under or overvaluation is to estimate the future prospects of the company. For instance, discounted cash flow analysis is a key valuation technique to use. Other techniques and metrics include comparing price-to-earnings multiples of stocks with competitors and price to sales or price to cash flow to see which ones are a bargain.

Once the research regarding timing a trade in or out is complete, remember that waiting is sometimes the best policy. It can take time for stocks to trade up to the true value. You need to ensure that the time to act is rightly judged. If you are investing, and confident on your value mark, you may need to hold for 3-5 years, especially if there’s a chance they can yield good returns. Buying stocks you know about is important. The time at which you buy or sell a stock is another important factor for trading success.

YOUR CAPITAL IS AT RISK