Any beginner's guide to trading acknowledges that the functionality of the online sites is now so intuitive that those new to trading could do worse than test-run a virtual account at a reputable broker. It takes a couple of moments to set up a Demo account to trade virtual funds and to realise an immediate feeling of how easy it can be to trade. Read on for this guide on how to start trading online.

Hands-on learning of this kind is best done with virtual funds only. It does give a direct insight into the financial markets, and it shows that there are plenty of good quality trading platforms for beginners.

You can register with an online broker, access a state-of-the-art trading platform and be trading the markets within minutes. Any natural reaction to approach the situation with a degree of caution should be embraced and the virtual or Demo accounts are an excellent place to start. These typically require only an email address to set up. One other check to make is that you, and you alone have the log-in details. That will mean you have control over the funds in the account when you come to trade with real money.

You can also take comfort from the fact that the Real and Virtual accounts look and feel the same. They allow you to practise trading and to learn the basic principles before having a seamless transition to Live trading. Traders who are already active with real funds often continue to use their Virtual account as a risk-free environment in which to test new trading ideas.

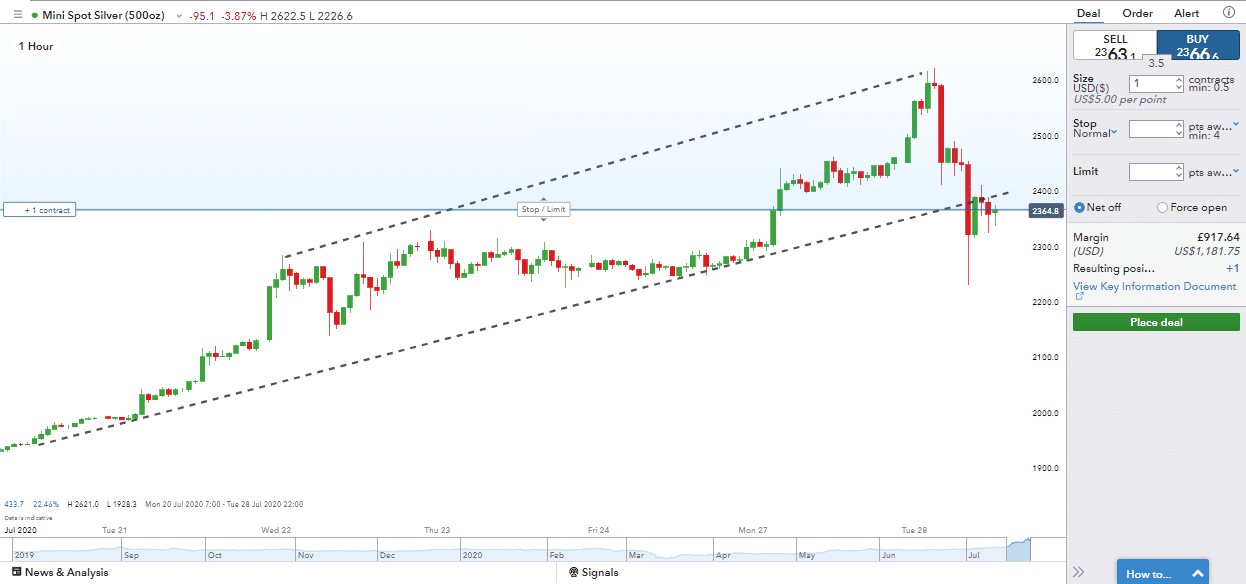

Online market trading simply involves using some of your deposited funds to take a position in a financial asset. In the below example taken from IG, the trade about to be executed is a buy of one lot of silver.

Source: IG

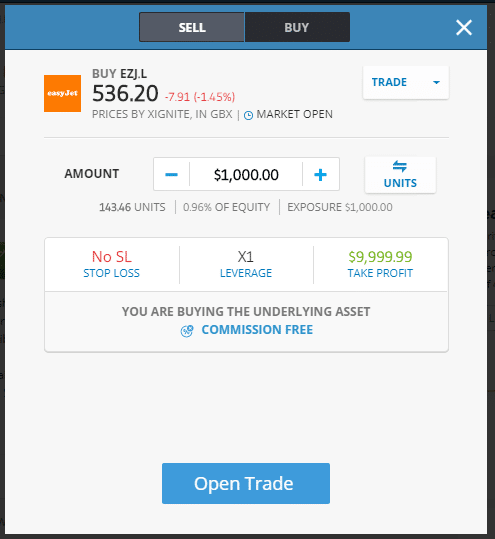

The trade interface at eToro looks a little bit different but has the same data fields. ‘Buy’ or ‘Sell’, ‘What to trade’. In this example, clicking on ‘Open Trade' will result in us buying $1,000 of easyJet airlines.

Source: eToro

The Risk Management features of both brokers include ‘stop-losses' and ‘take profit' instructions. These allow you to build instructions into the system so that your position is closed out automatically if price reaches a certain level. That can offer you protection from sudden market moves and allows you to get on with your day job rather than worrying about positions. Another common approach to risk management is to start trading in a small way.

These non-leveraged trades won't incur any daily financing charges. We haven't borrowed any money from the broker to buy them, so we can enjoy zero daily fees as we run a buy-and-hold style strategy.

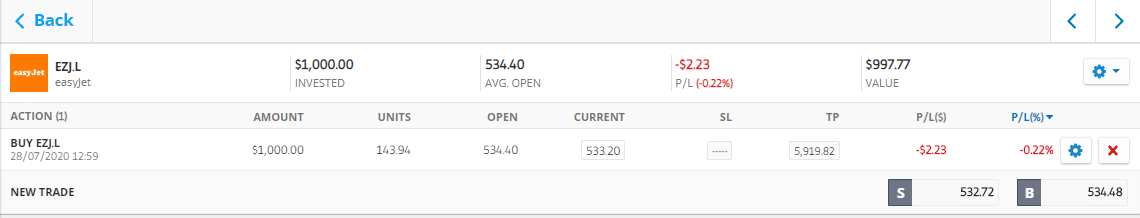

The portfolio reports are readily accessible using desktop or handheld devices. Soon after ‘putting our trade on', the position at eToro is reporting the below P&L.

Source: eToro

Research and ideas

After following the logical path to put on a trade, the next step for many is to get a better understanding of the markets and how to make money by trading them. Fortunately, support materials are abundant and freely available online. Some might reach for a copy of Share Trading for Dummies; others might prefer the online tutorials and webinars which are available in live/interactive and ‘listen again' formats. Regulated brokers are an excellent place to start when looking for research and education resources. The brokers, Pepperstone and IG, both have a range of nice-to-have services, which can be accessed free of charge.

Getting the basics right

You may have already noticed that the internet is overflowing with people and organisations willing to share the ‘secrets to successful trading' or offering courses entitled ‘Trading for Beginners'. Weighing up the benefit of each of any trading guide requires you to keep your eyes wide open. Some of it is better than others, but when you set out to learn to trade online, the real ‘secret' is choosing a regulated broker, after all, the security of your funds is of paramount importance.

The reputable brokers realise this, and they invest time and money to ensure they are compliant with the rules and regulations of tier-one brokers. As the big businesses operate globally, some operate under a licence from several authorities. Where you live will ultimately determine which regulator's umbrella you fall under, but three names to look out for are:

The Financial Conduct Authority, better known as the FCA, is a financial regulatory body in the United Kingdom that operates independently of the UK Government.

The Australian Securities and Investments Commission, better known as ASIC, is an independent Australian government body that acts as Australia's corporate regulator.

The Cyprus Securities and Exchange Commission, better known as CySEC.

The nature of the protection provided by each of these regulators varies slightly. However, they will typically offer protection measures such as ‘segregation of client funds', which means if they go into administration, your funds are protected.

If you keep your log-in details safe, then you'll benefit from levels of online security close to those of online banking. One other note in terms of client security is that regulated brokers are by law required to return funds to the account from which they came. This regulation was brought in to prohibit money-laundering, but it acts as another security measure for clients at regulated brokers.

Next steps

Trading online for beginners is something where it is relatively easy to master the basics. Still, a large part of your personal development and your progress towards being consistently profitable will require some self-analysis.

It's essential to be realistic about how much time you can commit. There are plenty of ways of adopting a hands-off approach to trading while still getting exposure to the markets. The Copy Trader function at eToro is just one way of letting others do most of the heavy lifting in terms of research and analysis. However, you might prefer and enjoy the process of identifying, researching and implementing your strategies. Making money out of trading is like any business, so it's vital to make sure your approach is viable.

It might sound a bit strange, but you may also find you prefer trading some markets to others. That is entirely understandable as the different instruments have distinct characteristics. For example, the cryptocurrency markets are notoriously volatile. If you find that equity markets suit you, that could lead you to use a broker that is good at supporting trading shares for beginners. A list of the top five can be found here: ‘Which stock trading site is best for beginners?’

During your virtual trading, you may have realised that your style of trading is suited to the forex markets, and you might be asking yourself ‘Can you get rich by trading forex?’ The principles of buy and sell are the same for the different asset groups, but there are features of each market that might appeal to you.

As well as what to trade, there is the question of how to trade. Online market trading functionality is moving on at an incredible pace. The offer of online trading for beginners has massively reduced the costs of trading. Now a lot of progress is being made in terms of functionality. If you're wondering how to start trading online, one question to ask is whether you intend to use a desktop or handheld device. The time and money invested by brokers in making the trading experience as good as it can help new traders to set up and start trading while on the go. If that does apply to you, then you'll find that some brokers have a superior offering and articles such as this might help you find a good fit: best stock trading app for beginners.

One common question raised is ‘which form of trading is best for beginners?' Part of the answer to that question includes matter of fact statements such as ‘always choose a regulated broker’. Other aspects of it require more self-reflection and personal growth. There are many valuable lessons to be learnt from trading and many revolve around what works for you. The trick is to make sure you minimise the financial costs of learning those lessons, so you are still in a position to profit from trading in the future.

PEOPLE WHO READ THIS ALSO VIEWED: