Unfortunately, becoming an effective day trader doesn't happen overnight – it requires a lot of patience, education, and discipline. Around 90% of traders lose money, and 80% quit within the first two years.

YOUR CAPITAL IS AT RISK

In this day trading for beginners guide, we'll show you how to become one of those successful remaining 10% of traders. You'll also:

- Learn more about the entire process of day trading

- Find out more about what you need to get started

- Read the best tips on day trading

- Learn best day trading strategies

What Is Day Trading?

Day trading refers to the process of buying and selling securities in a single trading day. Day trading can be performed in any market, but it’s most common in the foreign exchange (Forex) and stock markets.

Successful day traders are usually very knowledgeable and, above all, well-financed. Intraday trading is typically focused on developing short-term strategies to make a profit on small price changes in liquid assets.

This type of trader is very perceptive when it comes to events or news that move the market in the short run. Scheduled news releases on economic statistics, interest rates, GDPs and so on have the ability to move the market. Day traders try and anticipate the market direction, hoping to capitalise on that anticipation.

Before You Get Started

Before you dip your toes in trading waters, it's important to fully immerse yourself in the world of trading and soak up as much information as you can.

Unfortunately, there is no fast-track to success.

Here are some things every trader should bear in mind before they get started:

Discover Your Trading Personality

Like a farmer nurturing his fields, do you value patience and sowing the seeds of long-term success, or do you see opportunity where others see risk?

Your strategy of choice will be a direct reflection of your trading personality. As the old saying goes, “If you don't know who you are, [the stock market] is an expensive place to find out.”

Find your feet and develop your own unique flair.

Useful Pages:

Compare Stock Brokers | Compare Forex Brokers | Compare CFD Brokers

Develop a Strategy

Day traders always tend to gain an upper hand over the rest of the market through their trading strategies.

Some of the well-known strategies in day trading are swing trading, arbitrage, and trading news. Traders tweak these strategies until they start bringing constant profits and limit losses.

Most of the time, new day traders try to benefit from proven strategies, rather than develop their own strategies. After learning a specific strategy in detail, you can tweak it until it suits your needs.

Whatever the strategy, it’s important to have a setup and methodology that you’re comfortable with when you enter the market. This approach will allow you to develop your expertise more efficiently, as opposed to attempting to benefit from a number of different setups at once.

Our advice? Don't spread yourself too thinly. Instead, focus on what suits your trading style as there is no one-size-fits-all strategy.

Keep Up-To-Date

Access to quality news sources is extremely important as news releases can be a great opportunity to make a profit. For example, every trading room has access to the Dow Jones Newswire, CNBC news releases, applications that search news providers for significant releases, and more.

Keeping your finger on the pulse of the market is the key to staying ahead of the curve.

Learn Technical Analysis

A firm understanding of technical analysis will make you a much more effective trader. Once you understand it, you'll be able to spot trends in the market and identify profitable trading opportunities.

Jumping head-first into day trading without first understanding technical analysis is a recipe for disaster.

Analytical software is extremely helpful when it comes to day trading and many brokers have this built into their platforms. If your preferred broker doesn't offer any technical analysis tools, then the ever-popular MetaTrader4 (or MT4) has hundreds of standard and custom tools to choose from.

Why is analytical software so important?

Take automatic pattern recognition for example, which helps you find technical indicators including flags and channels, Elliot Wave patterns and other indicators. Backtesting is a common analytics software feature that lets traders see how a particular trading strategy performed in the past.

More: Technical Indicators & Overlays For Beginners

What Are The Risks Involved?

Risk-management is perhaps the most critical skills to learn when it comes to day trading. There are two types of risks you need to know about: trade risk and daily risk.

Trade Risk

Trade risk represents how much money you’re willing to risk on every trade. Traders usually risk no more than 1% on each move. To do this, you need to choose an entry point and place a stop-loss order, which will exit the trade automatically if you start losing too much money.

Keep in mind that trade risk is related to the size of your position in the respective market. While taking into account your position size, entry point and specific stop-loss, you should never risk more than 1% on each trade.

Daily Risk

While trade risk refers to a single trade, daily risk refers to a single trading day. That’s why you should know how to set a proper daily loss limit. A common decision among traders is setting a 3% daily risk limit.

The logic behind this is that you’d need to lose three trades or more to hit the 3% limit, assuming you’re risking 1% on each trade. This shouldn’t happen very often if you have a well-developed trading strategy. It is generally advised to stop trading when you reach the daily cap.

What Can I Trade?

Whether you’re new to day trading or an expert, this profession requires consistency. A good way to stay consistent is to try and trade during the same hours every day.

Some traders like to trade only a few hours a day, while others trade during the entire session – from 9:30 a.m. to 4 p.m. EST in the United States. You can trade whenever it suits you, however, different hours are important in different markets.

Let’s now take a look at the best asset classes and time to trade each one of them:

1. Shares

If you’re focused on stock trading, then aim for the first 1-2 hours after the start of the trading session and the last hour before the end. The first two hours after the open is the most volatile period as it includes the largest price movements as well as the most profit potential. The last hour of the trading session can also bring some large price movements – from 3 p.m to 4.pm.

More: best shares for beginners

2. Indices

Trading indices involves investing in stock indexes e.g. S&P 500, FTSE 100, the Dow Jones, DAX30, Nikkei 225, and more. Since those indexes follow the largest companies in the world, the indices market is especially volatile around political events, major news releases, and other factors that influence companies in a specific sector.

3. Forex

The forex market is the largest financial market in the world as it operates 24 hours a day, five days during the week. The most commonly traded currency pair in Forex are EUR/USD and USD/JPY.

The largest trading volumes in Forex usually happen between 1 a.m. and noon EST, while the period between 7 a.m. and 10 a.m. EST usually involves the biggest price movements as this is when both the London and New York markets are open.

4. Cryptocurrencies

Day trading digital currencies is becoming more and more popular. Cryptos fits day trading because of the high volatility and trading volumes involved. Some of the most popular cryptocurrencies in day trading are Bitcoin, Ethereum, Litecoin, Ripple, and more.

Before you start day trading cryptocurrencies, get a basic understanding of blockchain as this will help you respond better to crypto news releases, and anticipate future price moves.

Tips To Become A Successful Day Trader

Here are useful tips to bear in mind when day trading:

- Develop a solid trading strategy that outlines the trade, entry and exit points as well as a decent risk-management plan;

- Approach day trading as if it were your private business as it requires a lot of time, effort, patience and discipline;

- Protect your funds by learning which trade is worth the risk and which isn’t;

- Always use stop-loss orders. This will make sure each of your trades has an exit in case things go south;

- Always set trade and daily risk limits;

- Sometimes the best thing you can do is quit trading for the day, especially if you incur losses and get emotional.

Day Trading Strategies

When it comes to strategies, there are some that appear in every trader's toolkit. Here are six of our favourite day trading strategies to get you started:

1. Scalping

Scalping is a trading strategy focused on the smallest market movements. This trading strategy is based on the idea of opening a large number focused on small profits. Profits will eventually increase as the market exposure is low given that a trader is spending a few minutes in each trade. Scalpers are looking to win no more than 7 or 8 pips per trade and usually risk up to 5 pips.

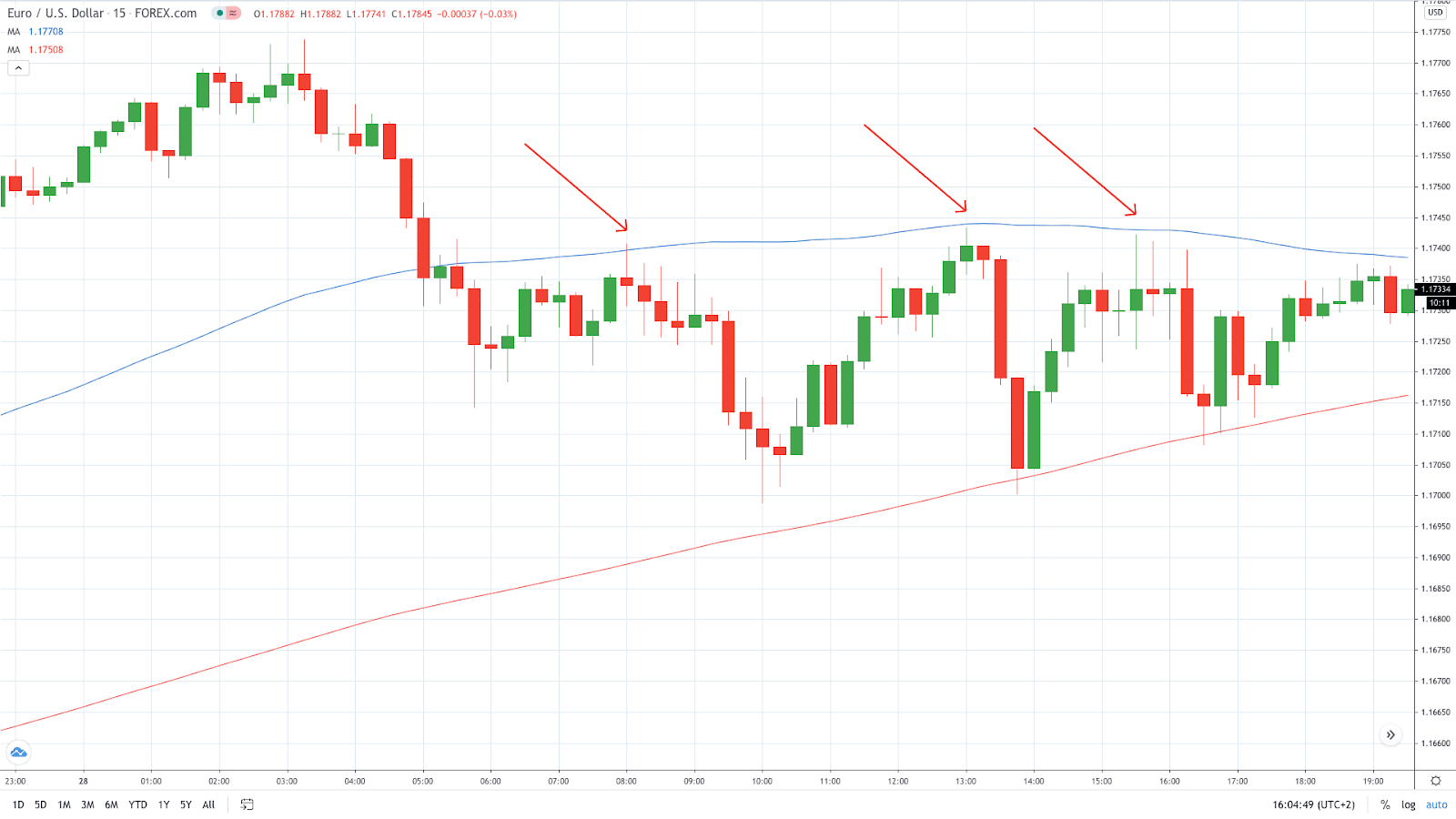

Scalping is conducted on lower time frames e.g. 1-min to 15-min periods. Here, we see the EUR/USD 15-min chart where a trader is looking to sell any attempt to break the 100-MMA. This way, a trader closed three successful trades by spending no more than 15 minutes in each of these trades.

2. Breakout Trading

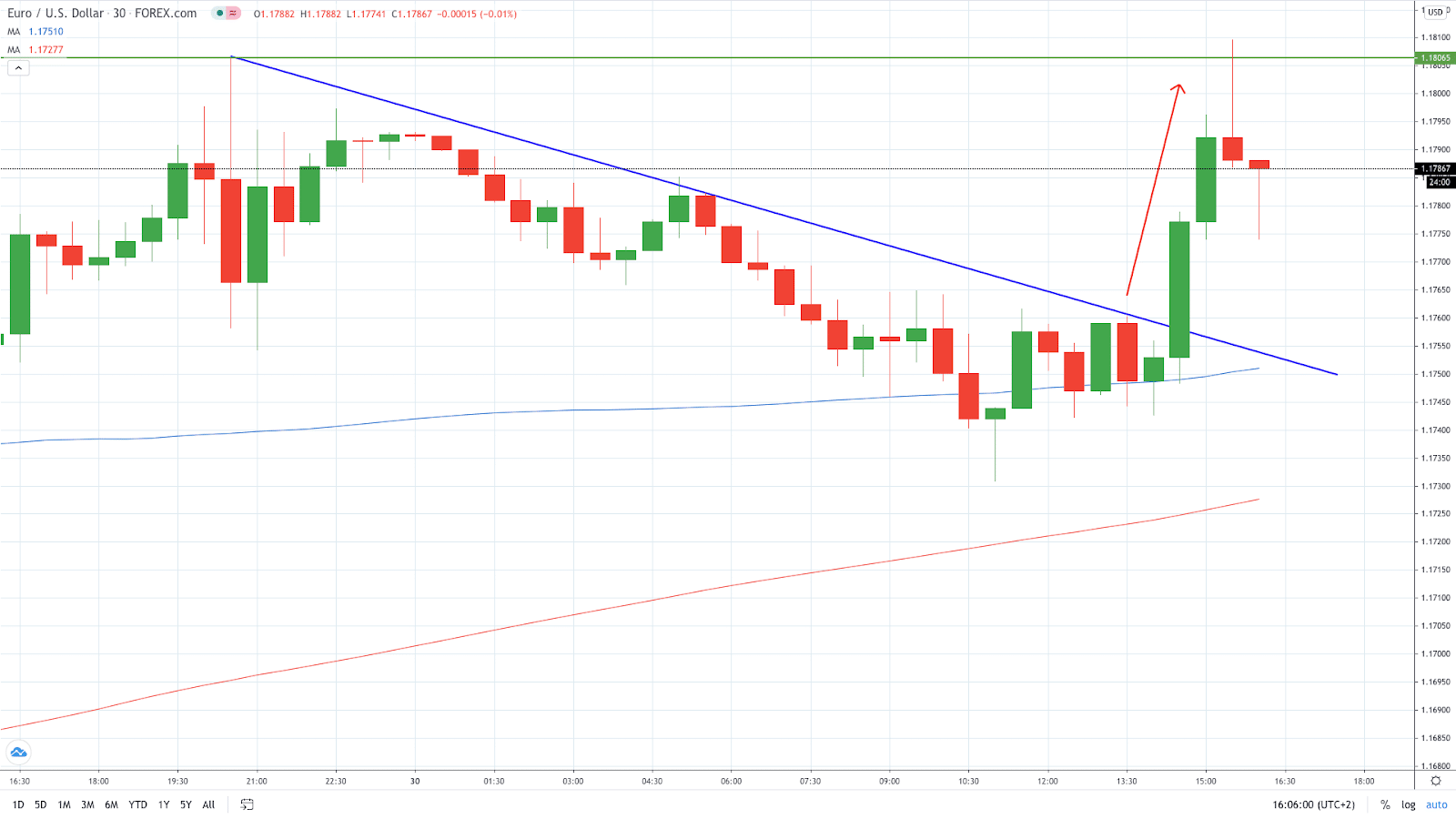

Breakout trading is the opposite of range trading. A breakout takes place when the asset’s price moves above resistance or below support with increased volume. As a result, the market starts trending in an uptrend or downtrend, offering traders attractive setups.

In the EUR/USD 30-min chart above, the price action is trading lower as the descending trend line caps the buyers’ attempts to move higher. However, a break takes place to end the downtrend and start an uptrend. Traders should place buy stops above the trend line to capitalize on the impending move higher.

3. Swing Trading

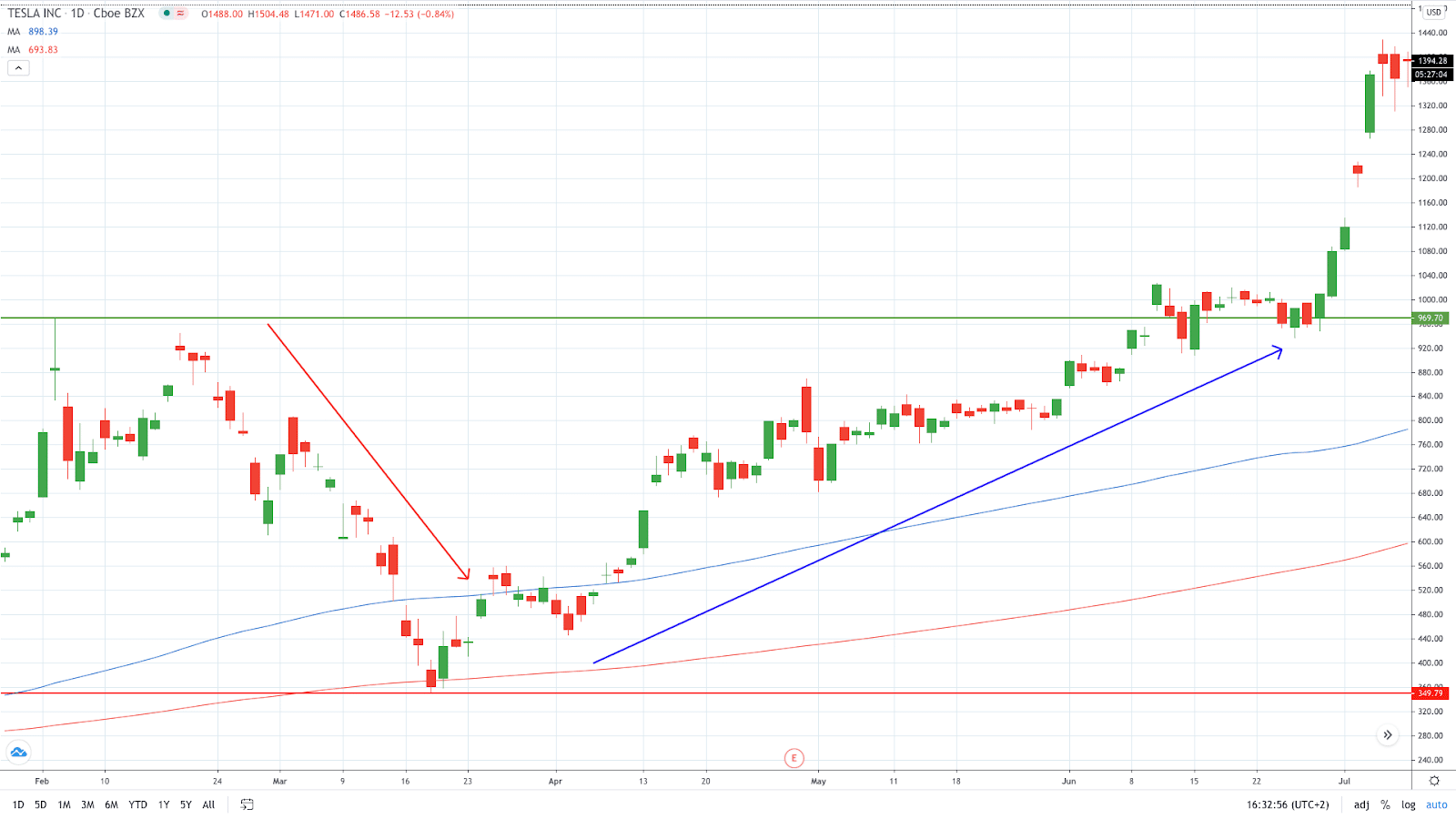

Swing trading is one of the most popular trading strategies. As the market moves between support and resistance lines, swing traders aim to profit from market swings. Swing traders sit in the middle of the continuum between day traders and position traders. They tend to stay in a position at least a day, although typically for around two or three weeks.

Here, we see Tesla share price moving lower before bouncing off the support to explode higher. Swing traders will look to capitalize on a downtrend, before buying at support to ride the trend reversal to a point where the market signals it may reverse again.

4. Momentum Trading

Momentum trading is a trading strategy that aims to capitalize on current market trends. This type of trader is not so much interested in long-term market developments. Instead, momentum traders are buying a security that is in an uptrend and selling assets while in a downtrend.

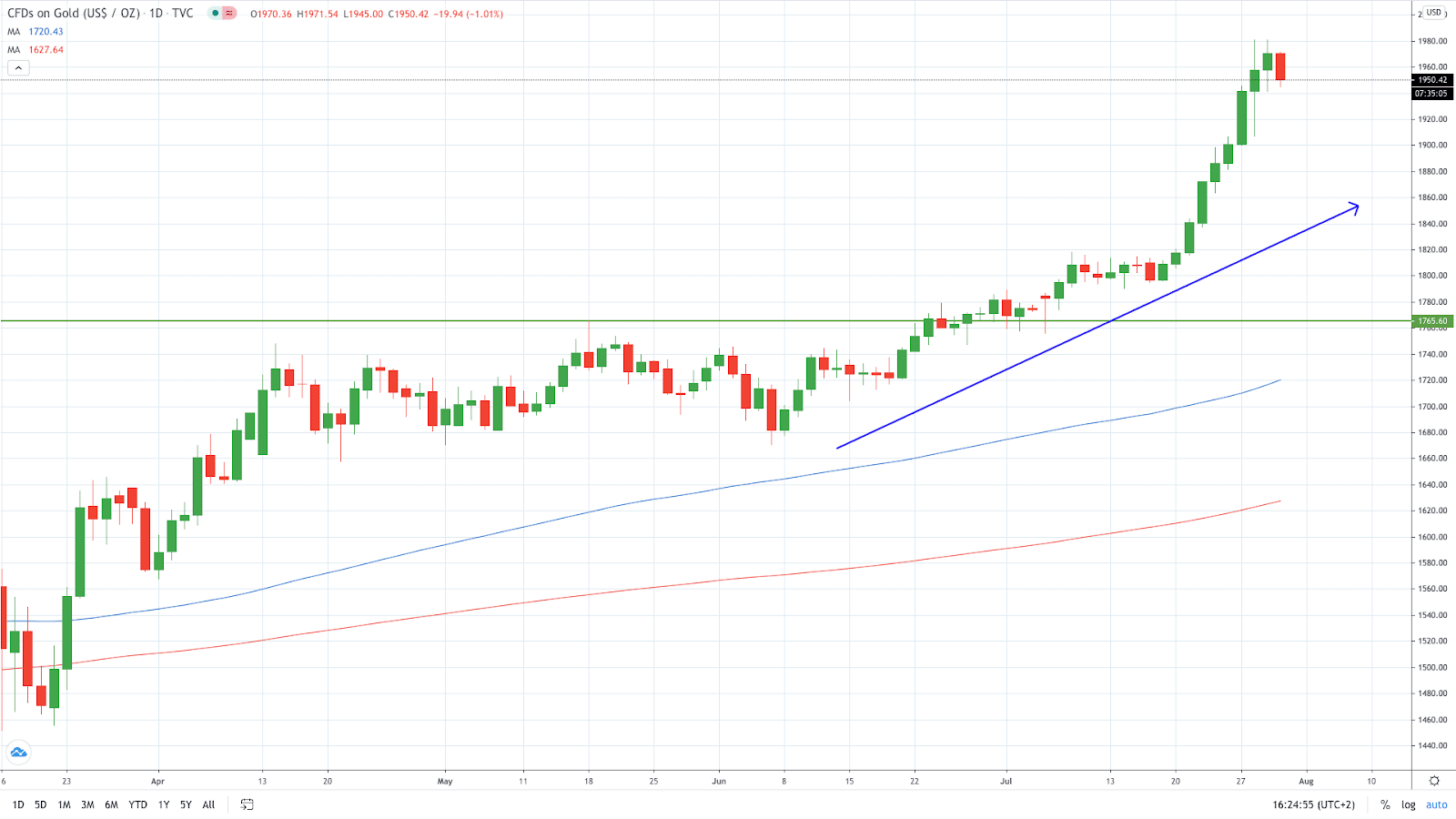

In this particular case, we see Gold prices trading in a sustainable uptrend. Once the horizontal resistance (the green line) is broken, momentum traders will look to “ride the trend” until the point of a reversal occurs. They will place their stop loss and take profit orders in accordance with their risk sentiment and trading style.

5. Reversal Trading

Reversals refer to changes in the trend direction. The dominant market side is no longer able to push the price movements in the desired direction. As a result, the opposite market side is now using this weakness to prompt a change in the trend direction. Hence, reversal trading is focused on capitalising on these changes in the trend direction.

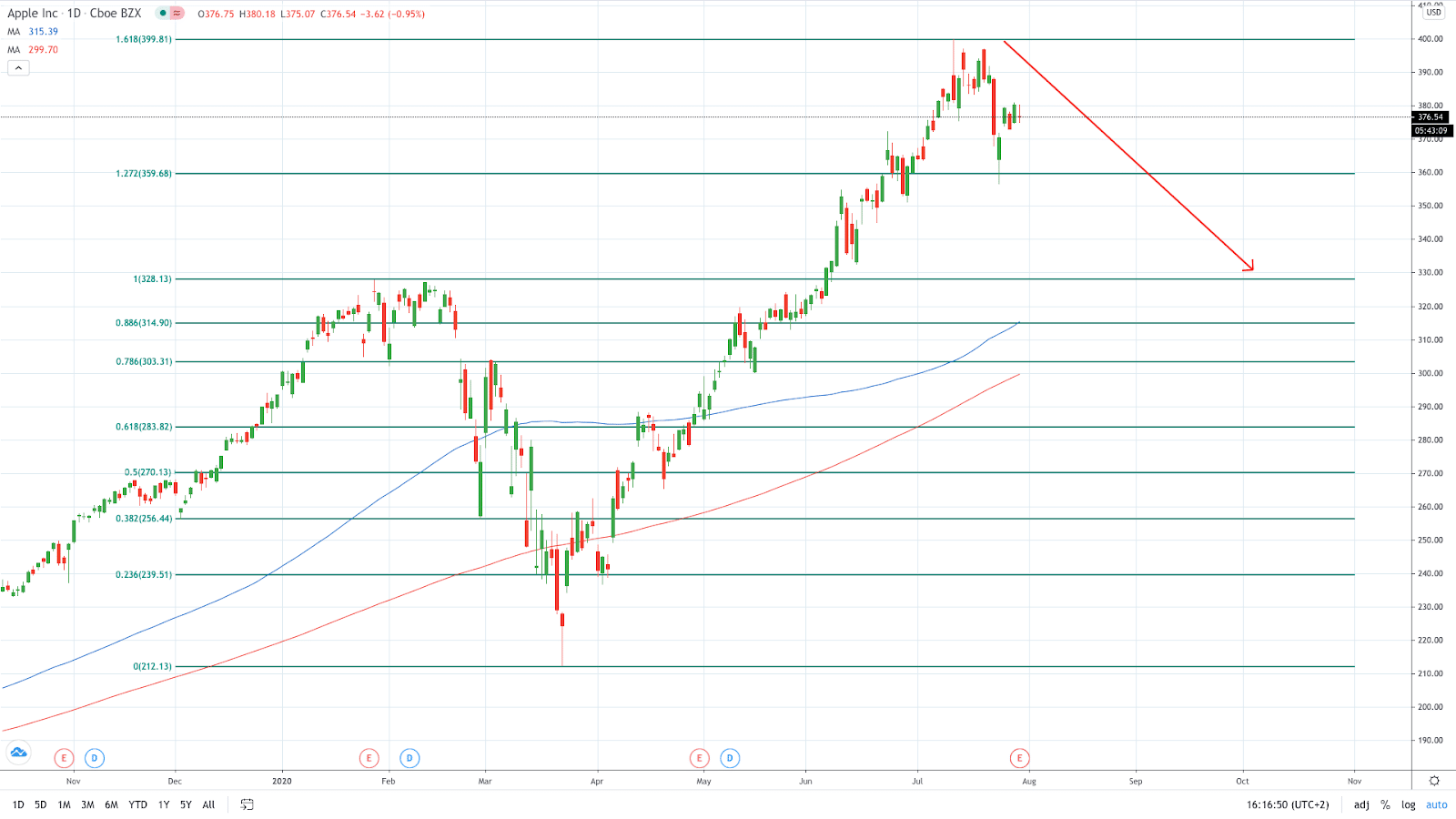

Apple stock price is trading higher in an aggressive uptrend. Reversal traders are focused on Fibonacci extension lines to find a next resistance line. The 161.8% Fibonacci extension is major resistance, hence traders are looking to capitalize on a potential change in the trend direction.

Hence, they are looking to sell Apple stock at this resistance, placing a stop-loss order above the resistance line. Take-profit should be located around 127.2% Fibonacci, former resistance, and now support.

6. Position Trading

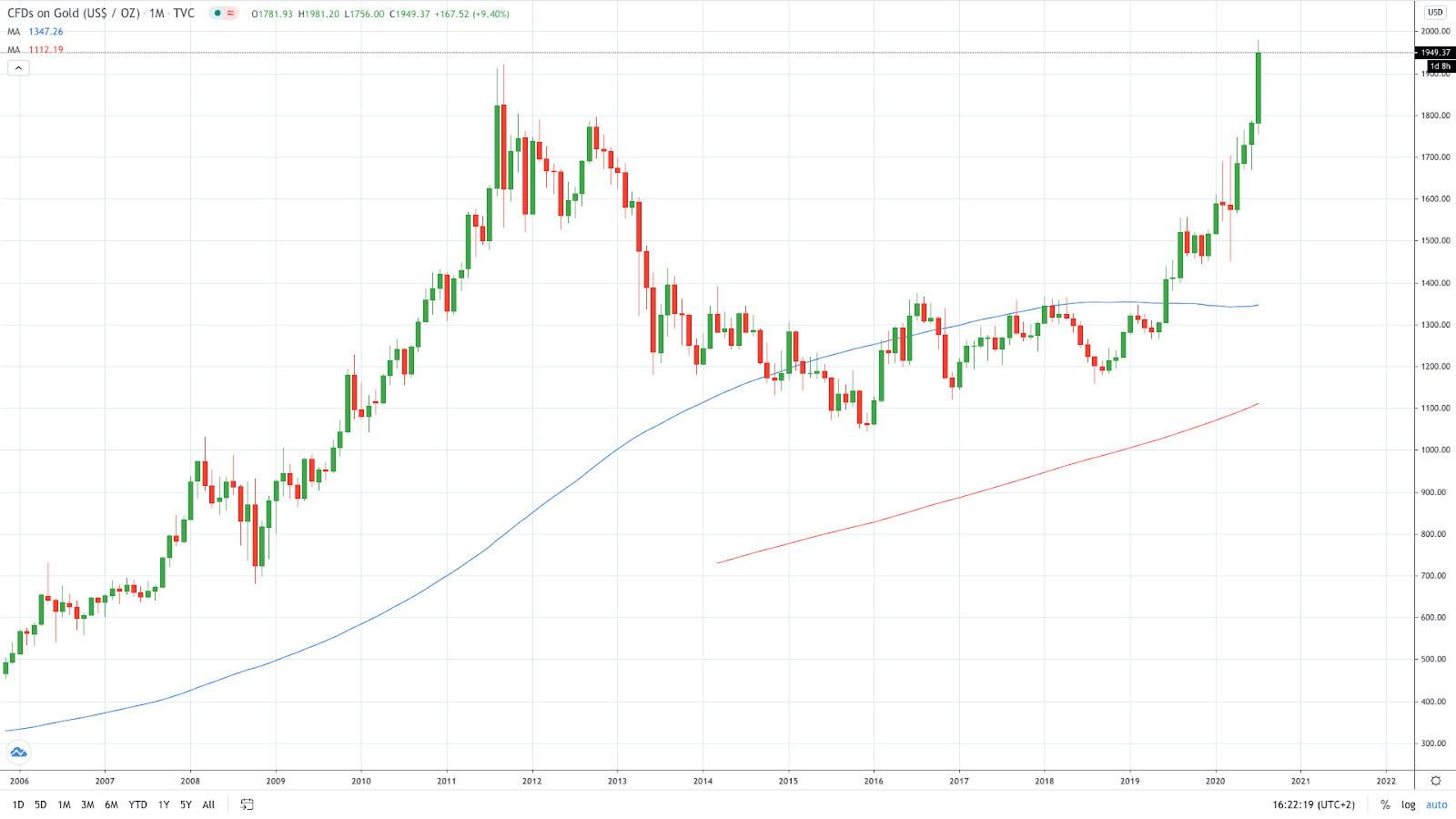

Position trading is a specific trading strategy where an individual or institution is looking to profit from longer market cycles. As such, position trading is closely associated with institutional investors who are looking to achieve long term success. This trading strategy is completely opposite to scalping or day trading.

Position traders usually design their trading ideas based on macroeconomic factors and geopolitical developments. For instance, position investors may have decided to invest in gold this year due to a worsening global outlook amid the COVID-19 outbreak.

More: What Are Chart Patterns? (Explained)

How to Start Day Trading (Step-By-Step)

Now that you know what day trading is and have spent some time developing a strategy and learning technical analysis, it's time to start trading.

You can start day trading in as little as five easy steps:

1. Decide What to Trade

Find a market that you think will suit your needs and start learning how to make money in that market. Once you get comfortable in one market, it’s easier to adapt to another one. Some of the most popular choices are the Forex market, stocks, indices, cryptos, precious metals, commodities, and more.

2. Develop a Trading Strategy

With day trading, finding one successful strategy is enough. Once you tweak it according to your preferences and it starts bringing profits, you can implement it over and over again. Whatever the strategy, it should provide you with a method for entry/exit points and stop-loss, and of course, it needs to generate profits.

3. Find a Broker

Once you decide what you want to trade and develop a trading plan, you need to shop around and find the right broker. Different brokers specialize in different areas, therefore you should look for a broker who’s great in the area you want to specialize in. Like a good glove, your broker should fit your trading needs perfectly.

4. Practice on a Demo Account

Practising on a demo account is highly recommended, especially for novice traders. Even expert traders use demo accounts when they want to try out new strategies as it’s a great way to learn from your mistakes without actually risking real money and trading in real-time. However, keep in mind a demo account can’t accurately mimic the actual market as it doesn’t involve as much emotional turmoil traders put up with when trading with real capital

5. Make Your First Live Trade

Once you get comfortable and you think you’re ready, go on and place your first live trade. Always remember what you’ve been practising on a demo account and try to implement your trading strategy precisely. Doing that will help you minimize negative emotions that might hud your trading.

Summary

- Day trading involves buying or selling financial market assets in a single day;

- Day traders are likely to open/close positions multiple times within a single trading session if high-probability market opportunities present themselves;

- This type of traders typically use a variety of technical analysis tools e.g. moving averages, pivot points, oscillators, Fibonacci, etc;

- Some of the most popular strategies employed by successful day traders include: scalping, swing, breakout, momentum reversal and position trading;

- Day traders should set maximum risk tolerance parameters at no greater than 2% of the total account size

PEOPLE WHO READ THIS ALSO VIEWED:

- Learn the basics of trading Bitcoin

- Trade stocks with top-rated Pepperstone

- Explore and learn Bollinger bands strategy