Finding the right trading strategy that suits your style can be tough, but using an EMA crossover strategy can be extremely effective in helping you to become a profitable technical analysis based trader.

YOUR CAPITAL IS AT RISK

In this article, we will talk about EMA trading and go through:

Table of contents

What Is the EMA?

The exponential moving average is a moving average that places an emphasis on recent prices. This is accomplished by weighting the moving average so it responds more quickly to newer information. The formula that is used to calculate an EMA involves using a multiplier to alter the simple moving average. Indicators and platforms will calculate the EMA for you.

The EMA can also be referred to as the Weighted Moving Average.

How To Trade The EMA Crossover Strategy

So, let’s get into the strategy.

What you will need:

- 30-minute chart

- 50 period EMA

- 20 period EMA

Remember, the variations and number of periods can be adjusted based on your preference and trading style. Day traders may wish to use shorter timeframes, whereas swing traders may wish to use a longer-term chart. However, the periods are chosen based on best practices and to give you a guide on entries and exits.

First, before looking for trading opportunities, you will need to define the direction the market is trending in. You can do this by either using the 50 EMA as your basis or another indicator, such as the Parabolic SAR, to help you.

The EMA crossover strategy is geared toward finding the middle of the trend. Since it uses backward-looking data, you will receive a signal only after something has already happened.

YOUR CAPITAL IS AT RISK

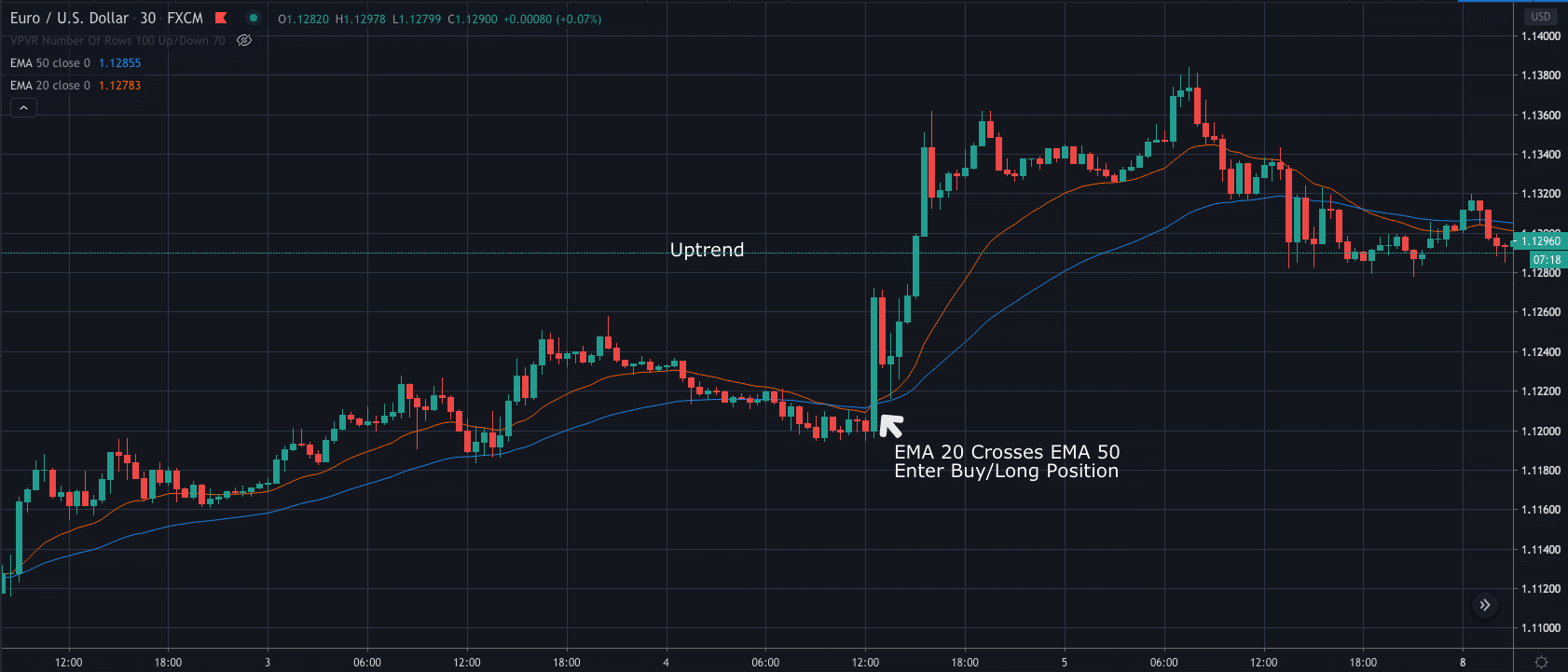

How To Enter a Buy Position

To enter a position, you will need:

- To define the direction of the trend

- Wait for the 20 EMA to cross above the 50 EMA

So, once you have confirmed the trend, you will need to watch and wait for the 20EMA to close above the 50 EMA, and then you can enter a buy position.

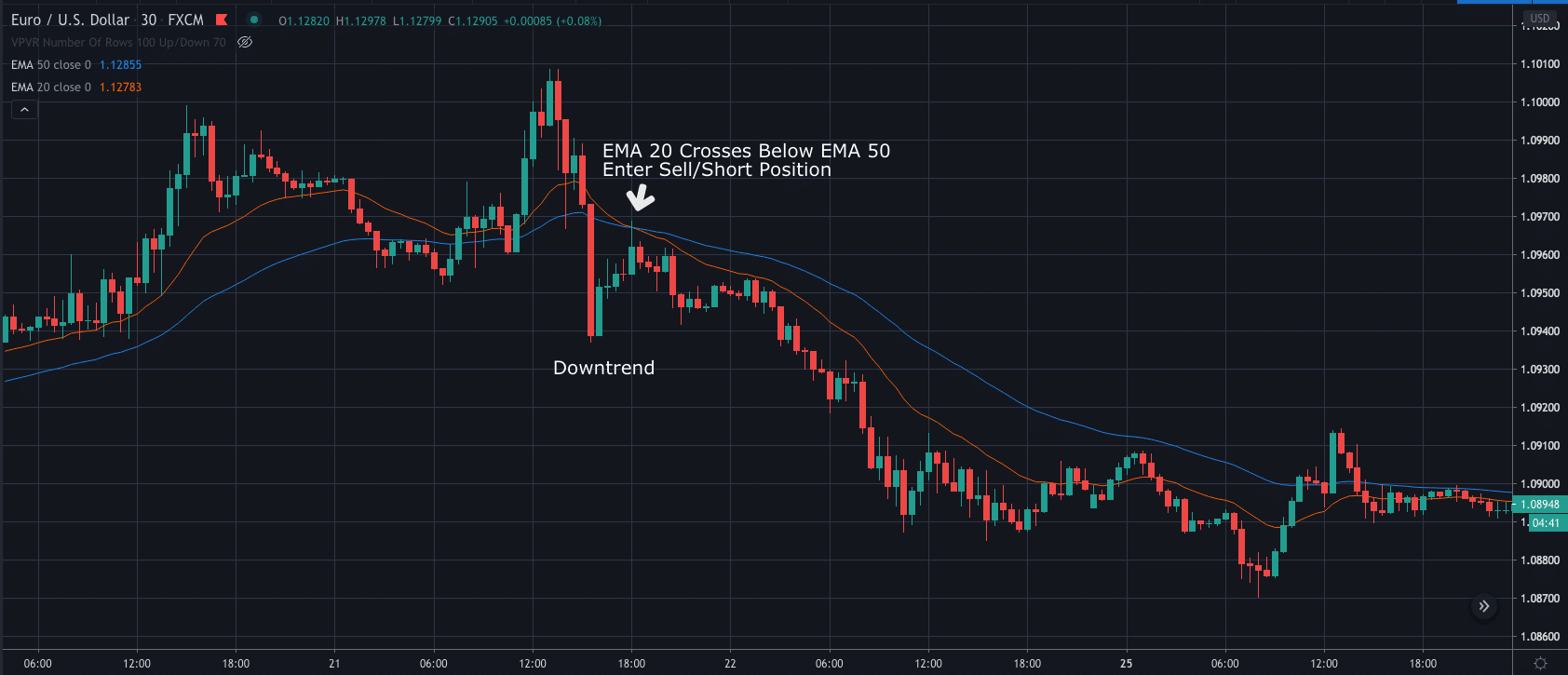

How To Enter a Sell Position

I’m sure you have worked out that sell signals occur when the exact opposite happens, but just for clarity, to enter a sell position, you will need:

- To define the direction of the trend

- Wait for the 20 EMA to cross below the 50 EMA

YOUR CAPITAL IS AT RISK

Right, now you’ve mastered that part, let’s move onto a vital part of trading strategies, risk management, or in this case, where to place stop-loss and take-profit levels.

Stop-Loss and Take-Profit Placement

Where to Place Your Stop-Loss

Now, a key part of trading and having a solid strategy is understanding risk management and where to place stop-loss levels.

With the EMA crossover strategy, it is best to place your stop-loss above or below the most recent swing in price (I have outlined a potential stop-loss level in the picture below).

It's important to understand that the EMA does not work all the time. Asset prices trend only 30% of the time. Your risk management will play an important function in the success of an EMA crossover trading strategy.

Where To Place Your Take-Profit

When it comes to choosing your take-profit level, it is important to take into consideration the risk-reward ratio you want to implement.

So, it is vital that you only enter positions based on a positive risk-reward ratio.

There are two suggestions for placing your take-profit levels using the EMA crossover strategy.

Firstly, placing a profit target at the next key level. Targeting key price levels is a popular way of placing take-profits

Secondly, you could use a trailing stop.

Now, I know you probably think that doesn’t sound right, but if you consider the saying “the trend is your friend,” then we have to believe that each entry has the potential for large rewards. So, by placing a trailing stop, you can track the trend until it eventually turns against you.

YOUR CAPITAL IS AT RISK

Advantages and Disadvantages

There are always advantages and disadvantages to trading strategies. The advantages and disadvantages of the EMA crossover strategy are:

| Advantages | Disadvantages |

|---|---|

| Trading Opportunities: The reactive nature of the EMA crossover strategy means there will be a good amount of signals when day trading | Consolidating Markets: The strategy does not operate well in consolidating or sideways markets due to its reactive nature |

| Reaction Time: It can provide a quick reaction to a change in the direction of the market | Fakeouts: Given the reactionary nature of the strategy, it is prone to fakeouts |

| Potential for Significant Returns: If implemented with a trailing stop, profitable trades can provide great returns |

Which Is Better SMA or EMA?

Comparing the simple moving average (SMA) and the exponential moving average (EMA) is a difficult task, as there are positive and negative aspects to both.

Of course, they are both lagging indicators, but the EMA gives a stronger weighting to more recent data, meaning that newer data has a stronger impact on the moving average, and the EMA reacts faster.

The SMA calculates the average price over a specified period, which can be adjusted to suit your needs, with each data point given equal weighting.

The benefit of using an EMA compared to a simple moving average is that you are likely to receive a signal that is more in tune with current price action.

However, using an SMA over the EMA will mean that you reduce the number of fakeouts.

Therefore, deciding which is better is highly dependent on your trading style and strategy.