Growth investing is a financial market strategy to build capital wealth by focusing on assets capable of achieving above-average expansion in the future. This market approach centers on the performance of growth stocks, which are typically categorized as small-cap companies with above-average earnings projections (relative to the industry sector as well as the broader market).

Understanding Growth Investment

Typically, a growth investors will seek out investment opportunities in markets or industries which are ready to show rapid expansion. Oftentimes, new services, products, or technologies are being adeptly developed. These growth investments aim to capitalize on emerging earnings profitability and generate capital appreciation in the process. In simple terms, “capital appreciation” refers to the gains an investor will receive after the stock rises in value and the equity position is sold.

As opposed to investments in dividend stocks (which generate peripheral returns), growth investment strategies require capital gains in order to achieve profitability. For the most part, companies in the growth-stock category won’t offer dividends to shareholders because this money needs to be used to reinvest back into the core businesses. This is the fastest way for earnings growth to occur in any company’s earliest stages.

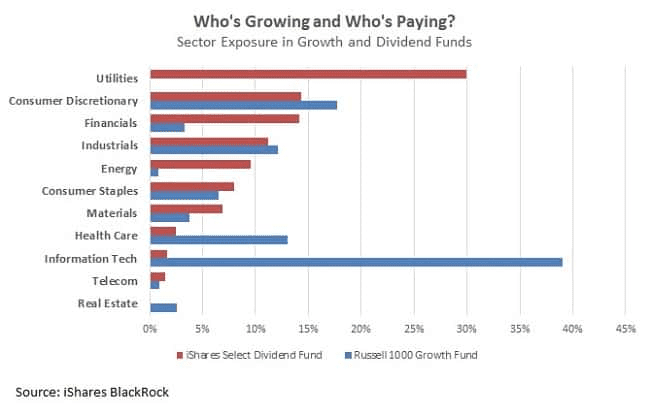

Growth companies tend to be young businesses of smaller size (with stocks that have only recently been made available for trade on public exchanges). However, these can also be stocks with the most upside potential (for capital appreciation) in all of the financial markets. The chart below offers a comparison of industry categories and their relative growth/dividend rates. Consider the strong growth trends seen in the information technology, consumer discretionary, and healthcare industries:

With these trends in mind, the central idea of growth investing is that a new company will be able to expand and prosper in ways that are simply not possible for large, mature companies. This enhanced potential for growth in revenue and earnings eventually translates positively and produces stock price rallies in the future. Investors are always interested in maximizing the potential for capital gains, so strategies involving growth investing might sometimes be referred to as “capital appreciation” or “capital growth” strategies.

Assessing Potential For Stock Growth

When assessing a company’s potential for stock growth, an investor might first look at the market or industry that is most directly relevant to its performance. Does the potential for growth in the consumer market even exist? Does the company have a product or service that is truly unique and likely to gain traction within a large population demographic? Of course, there’s no guaranteed formula that can be used to evaluate a company’s true potential for growth. All possible calculations require a certain degree of interpretation, but assessments based on objective factors and subjective judgment can often yield favorable results.

Growth investors can use specific criteria as a framework when conducting stock analysis. However, any metric-based fundamental analysis method needs to be viewed in conjunction with company-specific factors in mind. Investors must have a broad understanding of the situation vis-a-vis historical financial performance within the context of the past (and future) industry outlook. When selecting companies to use as an investment vehicle for growth investors to achieve capital appreciation, consider these five financial metrics:

Historical strength in earnings growth: Growth stock candidates should be able to display a track record of earnings gains for at least five years. However, minimum growth in earnings per share (EPS) will always be dependent upon the size of the business. For example, amongst stocks trading a market cap over $4 billion, an investor might seek out companies showing annualized EPS growth that’s not less than 5%. However, these criteria would change if the market cap is reduced. For example, with a market cap that trades between $500 million and $4 billion, an annualized EPS growth rate of 7% might be a requirement. For smaller companies (i.e. market cap less than $500 million) the requirement might growth to as much as 12%. Essentially, the point to remember is that companies showing evidence of strong earnings growth in the past have a better chance of continuing the positive trend moving forward.

Forward earnings growth projections: Companies will publicly announce earnings statements as a way of guiding profitability expectations for a certain period of time. These are usually for the coming quarter and the following year. These statements are released on specific dates that are scheduled during the corporate earnings season. However, market expectations are generally influenced by equities analyst estimates (which precede the actual releases by weeks or months). Growth investors pay special attention to these estimates as they can help determine a subset of all companies likely to show growth rates that are above-average (relative to the rest of the industry).

Sustainable profit margins: Pretax sales profit margin for any company is calculated using a deduction of all sales expenses (other than taxes) and then dividing that figure by the total sales figure. For growth investors, this is a critical metric because some companies might have incredible sales figures but lack strong earnings gains. In this scenario, it could be said that management has failed to control costs while building revenues. This is a red flag for any growth investor. Instead, growth investors seek to find companies likely to exceed their five-year pretax profit margin average (and the five-year average of the broader industry competition). When this is found, growth investors are more likely to start buying the stock.

Stable equity returns: Return on Equity (ROE) is a measurement of a company’s profitability which reveals the amount of profit that can be generated using the capital invested by shareholders. ROE is calculated using the shareholder equity figure, which is then divided by net income: ROE = Net Income / Shareholder Equity. As a general rule, growth investors will compare the current ROE of a company and then place that performance within the context of the five-year ROE averages for the broader industry. Stable increases in a company’s ROE figure implies management has done an effective job of producing returns using shareholder capital. Overall, this metric helps growth investors define the operating efficiency of a company.

Bullish stock performances: Most of the time, it’s unrealistic to expect the value of a stock to double within any five-year period. When this does occur, growth investors might view its performance with a certain degree of skepticism (and might not even consider it a true growth stock). As always context is important. If a growth stock rose in value at a rate of only 10%, it’s value would effectively double in just seven years. While skyrocketing prices might be a source of concern for many growth investors, it should also be understood that many of the stocks in the rapidly expanding industries (shown in the second chart) can rally by a substantial amount in a relatively small period of time.

Value Investing vs. Growth Investing

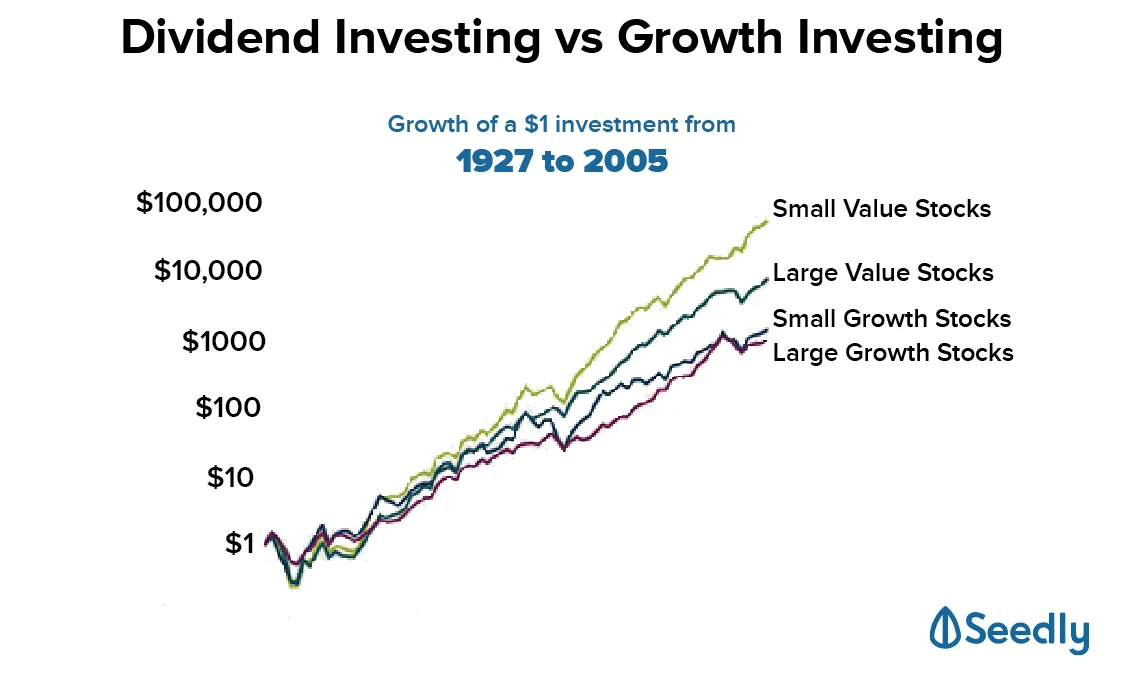

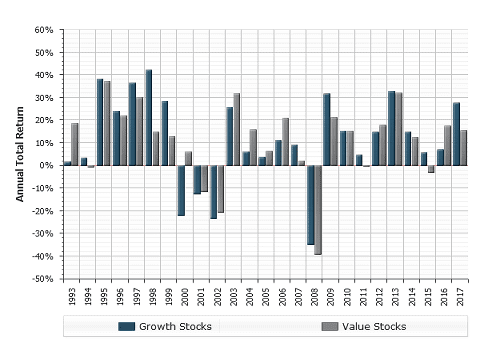

From each of these characteristics, we can see that growth investors aim to build wealth through short- and long-term capital appreciation. When compared to value investing, the returns present in growth investing strategies have presented some impressive returns over the last 25 years:

During strong market periods (i.e. the 1990s) growth investing strategies outperformed value investing strategies by a healthy margin. This trend reversed during the tech bubble market crash of 1999-2001, which is not surprising given the large number of technology stocks that fall into the growth stock category. However, during the larger market crash of 2008-2009, value investing stocks were actually hit much harder (with losses that outpaced growth stocks by a wide margin).

Some market analysts consider value investing and growth investing as diametrically opposed strategies. Value investors tend to focus on stocks that are currently trading below book value or at a discount relative to the intrinsic value of the company. On the other hand, growth investors tend to ignore stocks with lower (or sub-standard) financial metrics. While growth stocks investors aim to conduct a broad analysis of the fundamental worth of a company, these investors often have no problem buying into a stock position that a value investor might consider to be overvalued.

The central difference is that value investors seek stocks trading at levels that are below intrinsic value, which is why many in the market will often refer to the strategy as “bargain hunting.” In contrast, growth investors are more focused on the forward outlook and future earnings potential of a company (rather than current share prices). This means growth investors might consider buying stocks that are actually above current intrinsic valuations (based on the assumption that the company’s intrinsic value is still in its earliest phases and likely to grow far beyond current valuations).

SUMMARY

- Growth investing is a financial market strategy to build capital wealth by focusing on assets capable of achieving above-average expansion in the future.

- The ability to successfully buy into a young company in its earliest stages of growth is a skill that can generate impressive returns if the business is able to deliver on its expectations.

- Growth investors often consider five important factors in the fundamental analysis of stocks: share price performance, return on equity, historical earnings growth, and profit margins.

- Growth investors aim to build wealth through short- and long-term capital appreciation.

- Growth investors might consider buying stocks that are actually above current intrinsic valuations based on the assumption that the company’s intrinsic value is still in its earliest phases and likely to grow far beyond current valuations.