-

Posts

0 -

Joined

-

Last visited

Never

Content Type

Profiles

Forums

Blogs

Articles

Posts posted by Hassan Maishera

-

-

ADT's stock price has been on a downward trend over the past month. It certainly wasn't helped by its recent quarterly earnings report, which some analysts were not much impressed about. he security company posted revenue in line with estimates at $1.2 billion. ADT's 2019 revenue guidance was also very tight: between $4.9 and $5.1 billion, compared to the $4.9 billion surveyed by Refinitiv.

-

The shares of Casey’s General Stores is well on its way to recovery. The slight drop in stock value is due to the mixed earnings report the company presented a few hours ago. A look at the price chart shows that CASY has had a mixed year and it would most likely stay that way for a while.

-

Probably not. The strong rally yesterday was due to the company releasing a better-than-expected second quarter earnings report.

Stitch Fix posted earnings per share of 12 cents on revenues of $370 million. Wall Street expected earnings of 5 cents on revenues of $365 million. Stitch Fix’s active clients increased 18 percent to 2.96 million and beat the estimated 2.95 million. However, the company could see its stock price rise significantly higher this year if it continues on this path.

-

Wall Street analysts are becoming pretty confident that the price of Apple's stock, AAPL will bounce back after it slumped earlier this year. Recently, analysts at Bank of America upgraded their position on the stock to a Buy, up from their previous position of Neutral. This shows that they are very confident in its resurgence. A look at AAPL's chart over the past one month will show you exactly why they think so. TF International Securities analyst Ming-Chi Kuo, known for following AAPL's progress pretty much has the same opinion.

-

Nvidia's acquisition of Mellanox Technologies is a big deal for the company since it will boost its business of making chips for data centers. At the moment, a third of Nvidia's revenue comes from manufacturing chips for data centers and purchasing Mellanox would help them boost that while also reducing their reliance on the video game industry, for which it is popular with. By beating Intel to acquire Mellanox, is a sign that the company could contribute very much to Nvidia's growth.

-

The cut in oil supply alongside a drop in U.S. rig activity has pushed the price of Brent crude oil from $59 to $65 over the past two months. The Saudi oil minister Khalid al-Falih recently stated that n end to OPEC-led supply cuts was unlikely before June, and in that case, the price could push towards $70 before the end of second quarter. As long as OPEC does not change its policy soon, the oil price could rise higher soon.

-

Yes, the shares of Boeing will dip lower over the coming hours/days. Following the crash of a 737 Max plane, China asked domestic airlines to temporarily ground those jets by 6 p.m. local time, and Ethiopian Airlines said it would ground them until further notice. The stock is lost 19 percent in Germany and it is currently down by 8.76 at the pre-market trading in the US. It could also drop further in the U.S. as concerns are increasing over the jet.

-

Yes, it could. The company's profit took a big hit, dropping by 39.6% to $24.8 million during the last quarter, compared with $41.1 million during the same period a year earlier. Its revenue fell 2.9% to $220.9 million during the quarter, compared with $227.5 million last year. The management told its investors that the loss was due to injustice and that might not go down well with the investors, so the stock could suffer further over the coming days.

-

The value of Costco's stock surged this high due to the company revealed its quarterly profit which was above the expectations of Wall Street analysts. The company did record profit in the grocery space despite huge competition from Amazon, Kroger, Wallmart, and others. Investors were clearly excited about the profits recorded considering the fact that Costco had to slash grocery prices in order to compete with the market leaders.

-

Absolutely. Despite the slow start to the year, Tesla is expected to bounce back and record reasonable sales in Europe and China. Obviously, the slow start to 2019 has affected TSLA price but with high demand from Europe and China and a steady production of the Model 3 and other cars, the stock could bounce back in the second quarter of the year. At the moment, the Tesla team is being praised by some analysts who believe they have done a great job so far this year

-

Yes, the company's shares could suffer further losses. The CEO of the hospitality company revealed that they suffered a massive data breach involving up to 383 million guests in its Starwood hotels reservation system. That is a big deal and it could lead to them losing customers over the coming months. It could also dampen investor confidence in their security. So at the moment, MARS could plunge even lower

-

Analysts at JPMorgan Chase seem to think so. The stock has recently been upgraded to "overweight" from "neutral as they believe the company will achieve its revenue and earnings goals following its recent Analyst Day. The stock has been performing well over the past few days and the recent upgrade by JPMorgan saw it surge by 2% today. so from all indications, the company will be able to achieve its set revenue target for this year.

-

The shares of AEO is down by 3% today despite the company reporting that it earned 43 cents per share in the previous quarter. Traders and analysts were disappointed due to the less-than-expected revenue presented by the company. The financial forecast for the current quarter is also weak, with the company focuses on spending more on marketing and opening new stores. The stock is expected to bounce back though, as investor confidence is still high at the moment.

-

It is highly unlikely that the shares of Kroger will bounce back soon. The recent dip occurred after the company's annual forecast fell below analysts' estimation. The company is expected to spend heavily on new in-store technology and delivery services to better compete with Walmart and Amazon. This means that for the meantime, it will record some losses and would take a while before its stock bounces back.Online sales are rising, surging by 58 percent this year and if Kroger continues to record such healthy figures, then they would provide tough competition to Amazon and co.

-

It has the potential to. The recent cut in production by OPEC has led to an increase in crude oil prices. At the moment, the WTI is closing in on its 2019 high of $57.26 and if it could sustain its recent momentum, then it could set a new high for this year.

-

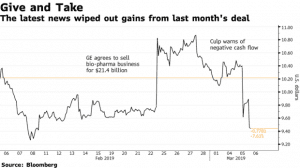

The financial woes plaguing General Electrics Company will not end soon as the company had previously stated that it will post negative cash flow this year. GE is expected to undergo a very large restructuring this year and this move will definitely gulp a huge sum of money. There is no easy way out for GE at the moment and if things continue in the current trend, the company might go into recession. Nonetheless, there are expectations by Wall Street analysts that GE could turn things around in three years time or so.

-

The shares of Bristol-Myers Squibb plunged after the company urged its shareholders to support its planned $74 billion takeover of Celgene Corp. The drug manufacturer believes the takeover is the best course of action but the company shareholders are rejecting the proposals. Some shareholders publicly opposed the deal and that does not do anything good for Bristol Myers. The low correlation between the management and shareholders doesn't inspire investor confidence and the stock could plunge further very soon.

-

At the moment, they are not. A House of Representatives Judiciary subcommittee is set to look into the potential effects of the merger on workers, consumers and the internet at large. The merger proposal has been a topic of discussion for long but it is yet to come to fruition. T-mobile's TMUS and Sprint's stock could potentially be affected if the committee hearing supports the merger. It might also be a good thing as the merged company would provide tougher competition for Verizon and AT&T, the leading telecommunication companies in the State.

-

At the moment, they are not. A House of Representatives Judiciary subcommittee is set to look into the potential effects of the merger on workers, consumers and the internet at large. The merger proposal has been a topic of discussion for long but it is yet to come to fruition. T-mobile's TMUS and Sprint's stock could potentially be affected if the committee hearing supports the merger. It might also be a good thing as the merged company would provide tougher competition for Verizon and AT&T, the leading telecommunication companies in the State.

-

The slash in iPhone price might not affect the price of Apple's stock (AAP). This is the second time Chinese retailers are cutting the price of iPhones in the country and from the earlier move, iPhone sales increased, AAPL started the year in a slightly bearish condition but has recovered over the past few weeks. If anything, the price cut could lead to more purchase of iPhones in China.

Why did Coupa Software's shares plunge despite positive quarterly earnings report?

in Stocks

Posted

Sure, the stock performed better than expected. The technology company reported earnings per share of 5 cents, compared to the 0 cents forecast by analysts. Revenue was $74.9 million, topping estimates of $67.7 million. Investors and analysts were however disappointed the company traded light on 2020 profit guidance. For next year, the Coupa a forecast adjusted profit of 7 cents per share on revenue of $326 million vs. analyst estimates of 21 cents and $315 million.