Exchange-Traded Funds (ETFs) have user-friendly functionality, something that has resulted in them becoming an increasingly popular way of getting exposure to the financial markets. They're ideal for beginners but are often included in the portfolios of more experienced traders.

YOUR CAPITAL IS AT RISK

The total size of the ETF market has grown from $204bn in 2003 to $10tn in 2021. That is due to them being an easy to use and cost-effective way of smoothing out returns and diversifying risk. ETFs are structured similarly to traditional mutual funds but are far easier to manage and can be traded instantly rather than at month-end.

Why Are ETFs So Popular?

Those ETFs that aren't actively managed come with attractively low administration fees and can cover commodities, stocks, and bonds. A position in 10s of green energy stocks or dividend stocks can be bought with the click of just one button, making it easy to manage risk and reward while trading a whole sector.

High dividend stocks form a crucial part of most well thought out investment portfolios. Think of big blue-chip names like Unilever and Johnson & Johnson. Thanks to their established market positions and widely recognised brands, they offer relative stability. Growth potential might be limited, but the income stream means they make solid returns and consistently return a large share of profits to shareholders.

It is, of course, possible to research high dividend stocks and build up positions in them, but that can be costly if you're paying individual dealing commissions, and it also takes time. The attractive proposition offered by ETF managers is they'll do the hard work for you. The responsibility to work through data reports and identify high dividend stocks will be theirs. Even if you have only $100, they'll manage the process of buying small positions in each of the stocks in their basket. You just have to take a few minutes to set up an account with a trusted online broker, navigate to the market, enter the quantity you want to buy, and click ‘place order'.

Choosing the best ETF with dividends can be tricky as many different ETF managers offer similar products. In this article, we'll share the benefits of research by experienced traders and look at the following topics:

- Best Dividend Paying UK ETFs

- Best ETFs for Income Investing

- ETFs With the Best Global Dividends

- What You Need to Know About Dividend Weighted ETFs

- How Much Does ETF Investing Cost?

- How to Choose the Best ETFs With Dividends

- Advantages of Dividend ETFs

- Final Thoughts

TRADE DIVIDEND ETFS WITH IG

Look no further than IG if you're looking for a top-rated ETF broker. The firm was established in 1974 and is today one of the most popular and trusted online brokers. It providea access to a wide range of markets, including over 2,000 exchange-traded funds. You can get started with a minimum deposit as low as £250 or practice for free using IG’s demo account.

BEST DIVIDEND PAYING UK ETFs

We've compiled a list of the best UK ETFs with dividends for you below. Each of these best UK ETFs for income investing has its own take on how to optimise returns for investors.

- iShares MSCI United Kingdom ETF (EWU)

- First Trust United Kingdom AlphaDEX Fund (FKU)

- iShares MSCI United Kingdom Small-Cap ETF (EWUS)

- Franklin FTSE UK ETF(FLGB)

- Alerian MLP ETF (AMLP) – Best High Yield ETF UK for Investing in the Energy Sector

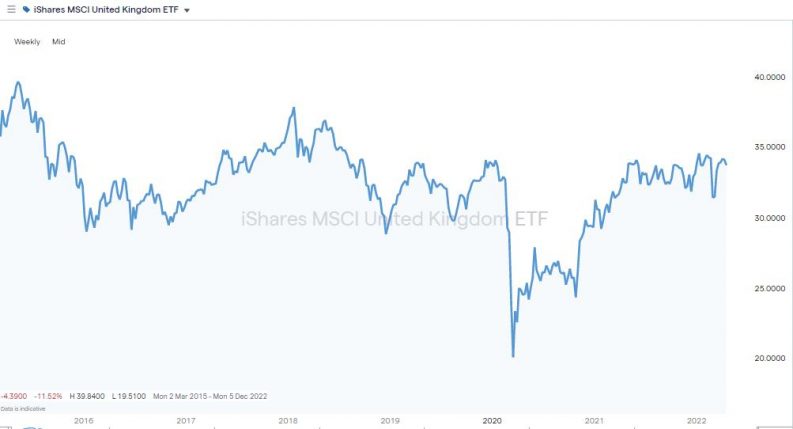

iShares MSCI United Kingdom ETF (EWU)

Over the last five years, the iShares MSCI United Kingdom ETF (EWU) has posted a healthy 26.29% cumulative return. That certainly beats returns from a bank deposit account over the same time. While past performance is no guarantee of future returns, there is a feeling of consistency about EWU – the cumulative 10 year return being 45.94%.

The ETF seeks to track the investment results of an index composed of UK equities, so it invests in mid and large-sized companies in the United Kingdom. Consumer staples, financials, and energy are the fund's major sector allocations, accounting for over half of the fund's assets. Those sectors are known for being high yield stocks, and accordingly, the 12-month trailing dividend yield as of 31st March 2022 was 4.30%. The fund's expense ratio is 0.50%.

iShares MSCI United Kingdom ETF (EWU) – Weekly Price Chart – March 2015 – April 2022

Source: IG

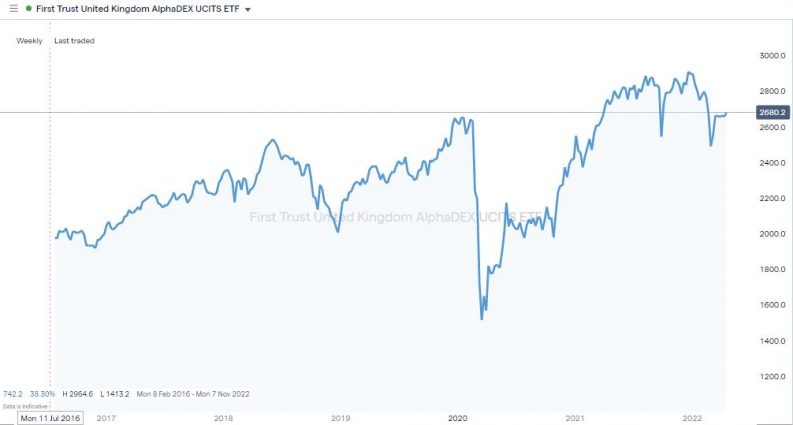

First Trust United Kingdom AlphaDEX Fund (FKU)

The First Trust United Kingdom AlphaDEX Fund (FKU) also offers exposure to the UK economy but adopts a more selective approach. First Trust fund managers grade stocks in terms of dividend yield and growth to create a list of 75 selected stocks. These are then subdivided once more, and the ones First Trust thinks are the best prospects receive greater weighting.

The fund's expense ratio is slightly higher at 0.80%, but this is offset by the ETF offering capital growth and dividend returns.

First Trust United Kingdom AlphaDEX Fund (FKU) – Weekly Price Chart – August 2016 – April 2022

Source: IG

iShares MSCI United Kingdom Small-Cap ETF (EWUS)

The iShares MSCI United Kingdom Small-Cap ETF (EWUS) fund has a 5-year cumulative performance return of 24.02% as of 31st March 2022. The capital return on the fund has been minimal, so generating that +20% return has required dividends to be reinvested rather than withdrawn.

The fund targets small-cap UK stocks, and as those markets can involve higher transaction costs, the expense ratio of EWUS UK is 0.59%

iShares MSCI United Kingdom Small-Cap ETF (EWUS) – Weekly Price Chart – March 2015 – April 2022

Source: IG

Franklin FTSE UK ETF(FLGB)

Buying into FLGB is deciding to take positions in UK mid and large-cap stocks. The ETF is capital weighted, meaning larger stocks make up a more significant percentage of the ETF.

Franklin's take on a UK ETF was launched in 2017, and its USP is the refreshingly low expense ratio of just 0.09%. While the number of shares FLGB invests in is typically larger than the number held by EWU, the headline performance of FLGB has lagged that of its iShares rival.

As of 31st March 2022, the three-year cumulative return of FLGB was 13.85%

Alerian MLP ETF (AMLP) — Best High Yield ETF in the UK for investing in the Energy sector

The Alerian MLP ETF may be worth considering if you're seeking the top dividend ETF that invests in a specific sector. This leading UK dividend ETF monitors the performance of a benchmark index made up of companies in the energy industry.

The energy sector is an increasingly hot market, and buying into AMLP is based on where the ETF might go rather than how it has performed in the past. During boom years, the best energy stocks can generate impressive dividend yields, and the current annual dividend income generated by AMLP is 7.99%.

As of 31st March 2022, the AMLP 5-year return was 16.19%. The extra work involved in selecting the best energy stocks means that the expense ratio of this ETF is 0.87%.

BEST ETFs FOR INCOME INVESTING

ETFs can cover a broad sector, such as European large-cap firms or bespoke sectors such as renewable energy firms. Each fund can set its parameters regarding market exposure, stock selection and weighting. One group of ETFs has emerged, which strives to generate the largest potential income stream. The top three ETFs with massive dividends for income investors are listed below.

- VictoryShares US Large Cap High Div Volatility Wtd ETF

- WisdomTree US High Dividend ETF (DHS)

- Invesco KBW High Dividend Yield Financial ETF (KBWD)

1. VictoryShares US Large Cap High Div Volatility Wtd ETF

As of 31st March 2022, the VictoryShares US Large Cap High Div Volatility Wtd ETF recorded a 30-Day SEC Yield of 2.93%. That followed on from the same statistic for February 2021 of 2.92%. The consistency of income payments is one attractive feature of this ETF – the other is the low net expense ratio was 0.35%.

2. WisdomTree US High Dividend ETF (DHS)

Wisdom Tree's US High Dividend ETF targets income returns and invests in US stocks. With the focus on income generation, the fund adopts a passive investment strategy which means it can keep the expense ratio as low as 0.38%

As of 31st March 2022, the fund held positions in 315 different US stocks and recorded an impressive year-to-date return of 6.92%.

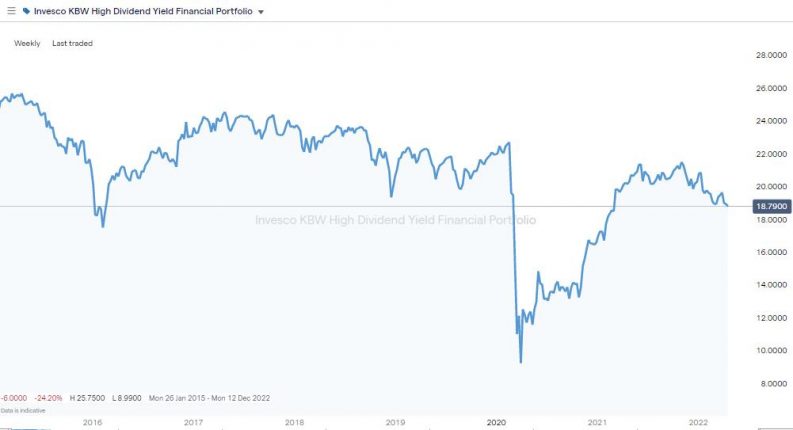

3. Invesco KBW High Dividend Yield Financial ETF (KBWD)

The KBWD fund from Invesco targets high yield stocks in the NASDAQ index and sets out to invest 90% of its capital in US firms. As of 31st March 2022, the ETF had an impressive SEC 30-day yield of 9.68%, but the trade-off is that the expense ratio comes in at a relatively high 2.59%. The fund has a current dividend yield of 8.67% compared to the yield of 9.7%, with a significantly higher expense ratio of 2.59%.

Invesco KBW High Dividend Yield Financial ETF (KBWD) – Weekly Price Chart – March 2015 – April 2022

Source: IG

THE BEST GLOBAL DIVIDEND ETFS

The best global dividend ETFs by a one-year fund return as of March 31, 2022, are stated below:

- VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF

- FlexShares Developed Markets High Dividend Climate ESG UCITS ETF

- Franklin LibertyQ Global Dividend UCITS ETF

WHAT YOU NEED TO KNOW ABOUT DIVIDEND WEIGHTED ETFS

As with any investment, there are some features of the ETF market investors would do well to consider.

Growth Stocks vs Dividend Stocks

Not all dividend-paying companies are an equally lucrative proposition because of differences in cash flows and approaches. While mature firms with large cash flows may offer a stable, conservative approach to dividend pay-outs, growth-oriented firms are another story. The management teams of growth stocks might choose to reinvest profits in aggressive expansion plans rather than return some to investors. That can still result in capital returns, but the change would represent a shift in strategy and mean the position is not what ETF investors bought into in the first place.

Shock Events

It's also important to factor in that shock events can result in once confirmed ‘bankers' reining in their dividends. During the darkest moments of the COVID pandemic, energy giant Royal Dutch Shell announced it would be withholding its dividend for the first time in its history. The firm has since returned to business as usual, but even subtle changes can lead to your investment shifting off track.

Number of Holdings

Well-diversified dividend ETFs provide protection by reducing the stock-specific risk that would arise from investing in one or a small number of stocks. An equally weighted portfolio of around nine stocks could deliver a considerable loss if one to three of them suffers a price decline. In contrast, well-diversified dividend-oriented equity ETFs that have holdings close to 30 stocks will better navigate declines driven by a small number of stocks because winners will offset the losers.

Accidental Concentration

If you're new to ETF investing, you might choose to start your portfolio off with a fund that offers wide-ranging global exposure. If you take a position in Xtrackers EURO STOXX Select Dividend 30 UCTIS-ETF, you'll gain exposure to the largest European firms known for paying healthy dividends.

If the next decision is to buy Vanguard's VMID, your portfolio will include a different kind of stock as that ETF focuses on UK mid-cap stocks, which will be too small to be part of the Xtrackers ETF.

If, on the other hand, you bought SPDR S&P UK Dividend Aristocrats UCITS ETF (UKDV), you might unintentionally take on too much exposure in UK large caps. As of 22nd April 2022, UK pharma giant GlaxoSmithKline is one of the top five holdings of the Aristocrats ETF, and pharma stocks make up +5% of the Xtrackers Euro Stoxx Div 30 ETF. This accidental concentration of position size can lead to investors unintentionally being overweight in a stock, country, or sector in which they don't want to be overweight.

Passive or Active

The greater the degree of intervention by a fund manager, the higher the fees. A manager that, for example, filters what it thinks are the 70 best stocks in an index that contains 500 names will expect to be recompensed for the work it carries out on research and analysis. Passive and tracker style funds tend to have lower fees.

Do Your Research

ETFs are a super convenient way to trade the markets. That, of course, doesn't absolve investors of all responsibility. Fortunately, the ETF managers provide neat summaries of their different funds and show in a transparent format what the ETF's aims are and the costs they charge.

Global, Country or Sector?

One tip shared by many ETF managers is for those looking to generate evened out long-term returns to choose ETFs made up of a diverse range of instruments. Investing in a UK-based ETF creates exposure to the health of one country's economy. Consider how the surprise result of the Brexit referendum created long-term uncertainty for the country's corporations. Green energy stocks are similarly exposed to the risk of government subsidies being scaled back.

HOW MUCH DOES ETF INVESTING COST?

The cost of an ETF needs to be considered. Executing your ETF trade and opening the position may be subjected to brokerage charges. These vary depending on which broker you use, and whilst they are often no more than $20, over-trading can eat into returns.

The ongoing running costs of ETFs are described as the expense ratio. The typical ETF has an expense ratio of 0.44 %, which indicates that for every $1,000 invested, the fund will cost you $4.40 in yearly fees.

HOW TO CHOOSE THE BEST ETFS WITH DIVIDENDS?

There are thousands of ETFs available in the market and one broker, IG, holds more than 2,000 on its online platform. While choice is always a good thing, it does raise the question of how to find the perfect ETF for your investment needs. We have listed a few of the standard parameters that investors are advised to consider but choosing the best ETFs with dividends ultimately comes down to personal choice. The aim is to find the ETF that matches your investment aims and risk appetite.

1. Level of Assets

An ETF should have a minimum level of assets, a common threshold being at least $10 million. Funds with assets below this threshold are likely to have limited investor interest.

2. Trading Activity

Trading volume in the most popular ETFs runs into millions of units per day. However, some ETFs hardly trade at all. Trading volume is an excellent liquidity indicator, regardless of the asset class. It is often the case that smaller, illiquid ETFs are associated with higher transaction costs, wider bid-offer spreads, and an increased risk of getting stuck in a position.

3. Underlying Index or Assets

From the perspective of diversification, it may be preferable to invest in an ETF based on a broad, widely followed index rather than an obscure one with a narrow industry or geographic focus.

ADVANTAGES OF DIVIDEND ETFs

There are indeed many advantages of ETFs to be compared to traditional investments. Let us look at the benefit of investing in ETFs with dividends.

1. Flexibility

Trading ETFs provides investors with flexibility. Trading in and out of positions can be done instantly rather than waiting for a month-end dealing day, as with traditional mutual funds. There are also plenty of good brokers who offer a cost-effective route into the sector.

Investing in ETFs has the same feel as investing in common stocks. Risk management features can include limit orders, stop-limit orders, stop loss, and take profit instructions. ETFs can be bought outright using cash or traded using leverage.

2. Portfolio Diversification and Risk Management

Whatever strategy you are running, you are just one click of a button away from gaining access to a ready-made basket of assets. An ETF can provide exposure to a collection of equities, styles and market segments. It can also track a wider range of stocks and, in some cases, attempt to mimic the returns of a single country or a group of nations.

In certain situations, an investor may have a significant risk in a particular sector but cannot diversify that risk because of restrictions or taxes. In that case, the individual can short an industry-sector ETF or buy an ETF that shorts an industry for them.

3. Lower Costs

The expense ratios of ETFs compared to actively managed funds are lower. Mutual funds tend to be actively managed. The costs include, but are not limited to, portfolio management fees, custody costs, administrative expenses, marketing expenses, and distribution.

FINAL THOUGHTS

High dividend stocks might not be the most glamorous area of the financial markets, but they can be the way to unlock long-term returns. Using ETFs to trade the sector allows investors to take a cost-effective shortcut to include one of the investment industry's core asset groups in their portfolio.

Whether you are a complete novice or an experienced trader, navigate to this list of trusted ETF brokers where your route into the ETF sector will benefit from top-tier support.