IG証券で口座から出金をするには

出金は5つのステップで簡単に行えます。

1. ホームページよりログインしMyIGへログインし取引画面を開きます。

2. 実際の資金でトレードを行う「ライブ口座」をクリックします。

3. 左側のエリアから、「ご出金」を選択します。

4. 出金したい金額を数字で入力し、「出金依頼送信」をクリックします。

この操作の後、出金依頼を行った口座の証拠金残高から即座に依頼額が差し引かれます。あとはご自身の銀行口座に出金が到着するのを待つのみとなります。

また、IG証券では電話による出金も受け付けています。担当者と確実にコミュニケーションを取り出金を行いたい場合、以下に連絡することで出金が対応されます。

フリーダイヤル:0120-257-734

電話受付時間

月~金 8:00~21:00 祝日 8:00~20:00

出金依頼した資金が銀行口座に振り込まれるまでの時間

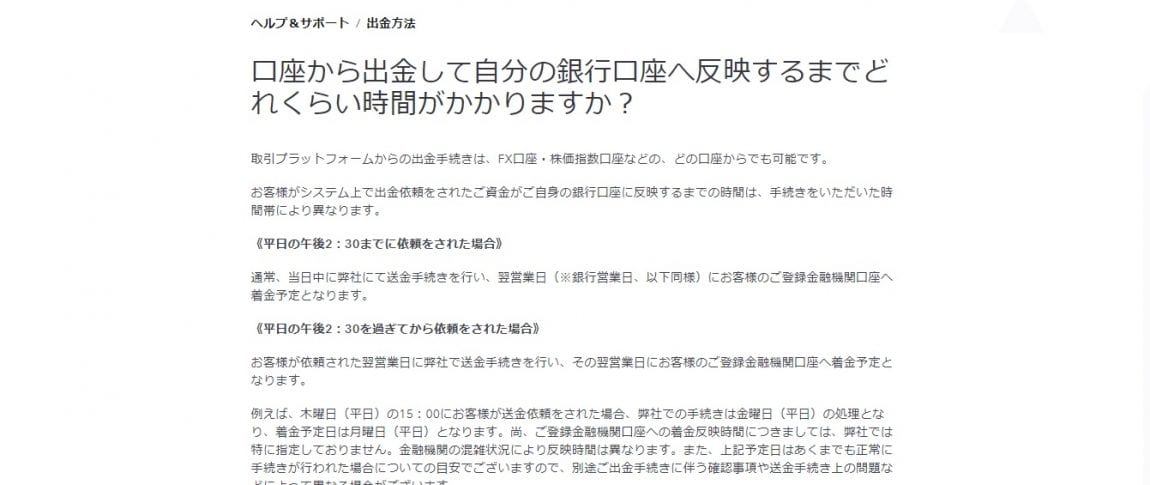

この画像ではIG証券で出金する際、ご自身の口座に振り込まれるまでの日数が明記されています。基本的に午後2時30分までの出金依頼については、翌営業日に登録金融機関に送金されます。つまり午後2時半以降の依頼は翌日に確認が繰り越されそのさらに翌日に振り込まれることとなり、出金に要する時間は最大で2営業日となっています。祝日や週末をはさむ場合は銀行の営業カレンダーに基づき振り込み日が決まります。ヘルプページに下記画像の通り説明がありますので、必要に応じ確認してください。

IG証券最小入金金額についてのページでも説明していますが、IG証券では日本の名のある信託銀行に顧客資産が保管され、また取引口座も日本の大手銀行ばかりなので素早い出金が実現しています。外資系ではあるものの、日本国内でのスムーズな運営に必要な条件をすべて抑えているので、出金に時間がかかるといった不満は聞かれません。

ここまでをまとめると次のようになります。

- 出金はオンラインまたは電話で対応可能

- 午後2時30分までの出金依頼は翌営業日、午後2時半以降だと翌々営業日の振り込み

- 迅速でハードルのない出金手続きと対応

IG証券出金手数料について

出金にかかる時間については、外資系ブローカーでありながら一切のハンデを追っていないことがお分かりになったかと思います。以降の項目では出金にまつわる注意事項を説明しますので十分確認するようにしてください。

まず、出金手数料ですがオンライントレードでは出金手数料が完全無料の証券会社は非常に少ないため、ある程度計画的に行う必要があります。IG証券では、出金手数料が無料となる最低金額は5,000円に設定されており、5,000円未満の出金には一律330円の手数料が発生します。5,000円以下の出金を頻繁に行うことは稀ですが、手数料については事前に把握しておいてください。また、米ドル口座からの出金には必ず手数料が発生するため、米ドル口座をお使いの方は注意が必要です。

出金に際しもう一つ注意しておきたいことは、保有ポジションの有無です。未決済ポジションがあるまま出金を行うと、証拠金残高に影響し強制ロスカットがかかるタイミングがよりシビアになります。レバレッジをかけたトレードの場合、証拠金残高にレバレッジをかけた数値に基づいて強制ロスカットの値が決まりますので初心者のうちはこの点に注意してください。場合によってはIG証券側から出金をキャンセルされることもあります。特に初心者のうちは、保有ポジションの有無には注意して出金を行ってください。

注意点をまとめます。

- 5,000円未満の出金には手数料発生

- 米ドル口座には毎回手数料発生

- 保有ポジションは決済してからの出金が望ましい

出金のキャンセルについて

IG証券では、出金手続きを行った後のキャンセルは受け付けられません。オンライントレードでは出金のキャンセルが可能なケースは少数派と言えます。内容を確認してから出金を行うようにしましょう。

出金で問題がある場合

本サイトでIG証券を推奨する理由の一つに、出金手続きの明快さがあげられます。IG証券では出金にまつわるトラブルがあった、審査が通らなかった、などの報告はインターネット上でも見つけることができないくらいとなっています。一部海外の無登録業者では出金を意図的に遅らせたり拒否したりといったことがありますが、IG証券は日本国内の証券会社として法人登記しており、日本の規制機関から正規に監督を受けています。これにより、日本国内では通用しない商慣習や理不尽な出金遅延がまかり通るということはありません。

前述のポジションを持った状態での出金依頼など、トレーダー側に問題がない場合はほぼすべて出金が処理されている実績があるようです。

何らかの問題があり出金依頼操作がうまくいかない場合、もちろんサポートに連絡することができます。

メール

フリーダイヤル

0120-257-734

現状チャットでのサポートはありませんが、IG証券の電話サポートは特に定評があり親切に対応してもらえるとの評判が高いのも本サイトでIG証券を推奨する理由の一つです。さらに、万が一証券会社自体やその信託銀行に問題があったとしても、日本で法人登記を済ませ17年以上の運営実績をもつIG証券であれば、日本の国内法に基づきトレーダーの資産が保護されるということにもなります。逆に、あなたが極端に狭いスプレッドや魅力的なスワップなどを理由に海外の証券業者の利用を検討する時、このような出金手続きの明快さや資金の保護の有無については十分な注意を払う必要があります。

IG証券 出金要件のまとめ

ここまで見てきたとおり、出金に際してはいくつかの特徴があります。

- インターネットからでも、電話からでも出金依頼が可能

- 振り込みは最大で翌々営業日

- 5,000円未満には手数料がかかるが最低額は設定なし

- 出金拒否、審査が通らなかったという実例はインターネット上で見当たらない

- ポジションを決済してからの出金が望ましい

これに加え、初回の出金時にのみ振込先登録が必要です。証券会社では多くの場合、資金洗浄や不正利用を防ぐ目的で本人名義の口座にのみ出金が可能となっており、他人名義の口座は利用できません。必ずご自身の銀行口座を登録するようにしてください。

出金時の依頼をはじめ、口座開設時の書類アップロードから入金の操作まで、IG証券のサイトでの情報提供時はSSL通信で暗号化されるため、他者による情報の読み取りは不可能になっています。URLの表示されるアドレスバーの左に鍵マークがついているのが分かるはずです。情報は安全に保護されているので安心して利用できます。

IG証券出金手続きのまとめ

以上、IG証券の出金手続きについて見てきました。あなたがもつIG証券での出金手続きに関する疑問は解決できたと思います。IG証券での出金は非常にシンプルかつスピーディであると言えるでしょう。5,000円以上の出金依頼には手数料無料という設定も無駄なコストを省く一つのポイントとなっています。

意図が理解しにくい出金拒否や審査なども本サイトで報告されておらず、出金にまつわるストレスはほぼないと言えます。

最後に

オンライントレードを扱う証券会社はすべてのユーザーにパーフェクトなソリューションを提供するわけではありません。どこの証券会社も強みと特徴をより進化させ独自性を打ち出す努力を続けています。そんななかIG証券ではプラットフォームのまとまり具合、幅広い通貨でのトレード、国際的な金融商品ラインナップ、トレーダーのリスクを最小限に抑える驚異的ともいえるノックダウンオプションに加え明快な出金手続きを備えていることが本サイトで推奨する理由です。

上記IG証券の強み、また特に初心者であれば注意したい点についてはIG証券デモ口座開設方法の解説ページで詳しく説明していますので合わせてお読みください。