Take 2 minutes to sign up with a broker

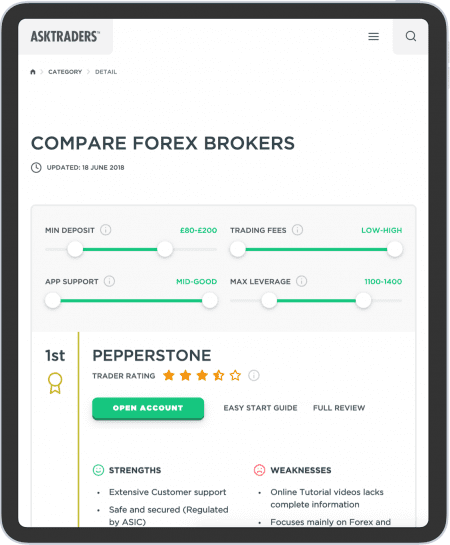

Compare brokers rated and reviewed by traders

Save hours of research with our broker comparison and reviews. Our market professionals review all the key features for you.

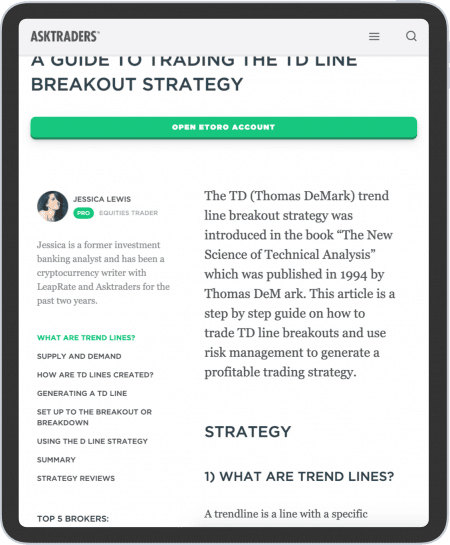

Learn trading strategies, risk management and more

Whatever your level of experience our education section is the ideal place to improve your trading knowledge and skills.

Meet the Asktraders team of industry experts

Meet our team of highly experienced market professionals. We only featured seasoned professionals so we can bring you the best content.

Trade using expert market analysis and ideas

Get new trade ideas and analysis throughout the day. Our team of traders are constantly scanning the markets for the best opportunities.