When considering investment options for your Individual Savings Account (ISA), one of the most important decisions you’ll face is choosing between active and passive investing strategies. Both approaches offer distinct advantages and drawbacks, making it essential to understand their differences before making your investment decisions. This comprehensive guide will help you navigate the world of active vs passive ISA investing and determine which approach aligns best with your financial goals and risk tolerance.

The choice between active and passive investing within your ISA can significantly impact your long-term financial outcomes. Active investing relies on professional fund managers who actively research, select, and trade investments with the goal of outperforming market benchmarks. Passive investing, on the other hand, seeks to match market performance by tracking specific indices such as the FTSE 100 or S&P 500. Both strategies have gained popularity among UK investors, with passive investing UK trends showing significant growth in recent years.

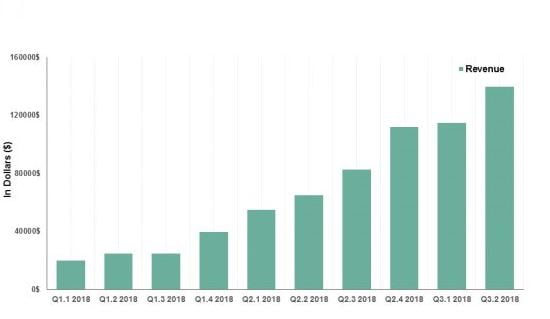

According to the Investment Association’s latest report, index trackers accounted for over a third of total UK assets in 2020, representing a substantial increase from just a fifth in 2010. This shift reflects growing investor awareness of the benefits that passive strategies can offer, particularly in terms of cost efficiency and consistent market exposure.

What Is Active?

Active investing represents a hands-on approach to investment management where professional fund managers make strategic decisions about which assets to buy, sell, and hold within a portfolio. Fund managers are the cornerstone of active investing, employing their expertise and market knowledge to oversee investment funds and make tactical decisions aimed at generating superior returns.

The active investment process involves comprehensive research and analysis of individual companies, including evaluation of new products in development, assessment of how businesses align with current economic trends, and scrutiny of senior management teams. For example, a fund manager might identify a pharmaceutical company developing a breakthrough drug that could become a market leader, prompting them to purchase shares before the anticipated price increase occurs.

Active fund managers also monitor broader economic factors that could influence investment performance, such as political changes, international conflicts, and regulatory developments. This comprehensive approach allows them to make rapid adjustments to portfolio holdings, potentially selling underperforming assets to minimize losses or capitalizing on emerging opportunities.

The flexibility inherent in active management enables fund managers to adjust portfolio composition based on market conditions and investment opportunities. They have the freedom to choose specific investments and determine the weighting of each holding within the fund. This adaptability can be particularly valuable during market volatility, allowing managers to shift assets from riskier investments like equities to more conservative options such as bonds or cash holdings.

Active investing strategies often focus on specific market segments or investment themes, such as technology, healthcare, or emerging markets. This specialization allows fund managers to develop deep expertise in particular sectors and potentially identify opportunities that broader market indices might not capture effectively.

What Is Passive?

Passive investing takes a fundamentally different approach, seeking to match rather than beat market performance by tracking specific market indices. This strategy involves creating funds that hold a diversified basket of investments mirroring the composition of chosen benchmarks, such as the FTSE All-Share, S&P 500, or other equity, commodity, or fixed income indices.

Passive funds operate in two primary forms: index funds and exchange-traded funds (ETFs). While index funds are priced once daily after market close, ETFs can be traded throughout market hours like individual stocks. For long-term ISA investors, this distinction typically has minimal practical impact on investment outcomes.

The passive investment approach relies on algorithms rather than human decision-making to maintain portfolio composition. These systems automatically adjust the weighting of holdings to ensure the fund continues tracking its target index over time. When the index rises or falls, the passive fund’s value moves in tandem, providing investors with market-matching returns.

Modern passive investing has evolved beyond simple index tracking to include more sophisticated strategies. These might involve following weighted indices designed to emphasize specific themes such as dividend income, value investing, or environmental, social, and governance (ESG) criteria. However, the core principle remains consistent: passive funds aim to deliver returns that closely match their chosen benchmark rather than attempting to outperform it.

Passive investing within ISAs has gained significant traction among UK investors seeking broad market exposure without the complexity of active fund selection. Index trackers provide a straightforward way to participate in market growth while maintaining diversification across hundreds or thousands of individual securities.

The algorithmic nature of passive fund management means these investments are not reliant on the skills, experience, or decision-making abilities of individual fund managers. This removes the human element that can sometimes lead to poor investment choices or inconsistent performance in actively managed funds.

Pros & Cons

Understanding the advantages and disadvantages of each investment approach is crucial for making informed decisions about your ISA strategy. Both active and passive investing offer distinct benefits while presenting certain limitations that investors should carefully consider.

Active Investing Advantages

The primary appeal of active investing lies in its potential to generate returns that exceed market performance. Skilled fund managers may identify undervalued opportunities or avoid overpriced assets, potentially delivering superior results compared to passive index tracking. This outperformance potential makes active investing attractive to investors seeking to maximize their ISA growth.

Active fund managers possess the flexibility to make rapid portfolio adjustments in response to changing market conditions. During market downturns, they can reduce exposure to vulnerable sectors or companies, potentially limiting losses. Conversely, they can increase holdings in promising areas when opportunities arise, capitalizing on market inefficiencies.

The human expertise involved in active management allows for nuanced analysis that automated systems cannot replicate. Fund managers can assess qualitative factors such as management team quality, competitive positioning, and business model sustainability. This deeper analysis can be particularly valuable when investing in smaller companies, emerging markets, or specialized sectors where information asymmetries create opportunities for skilled professionals.

Active managers can also implement ESG considerations more effectively, researching individual companies’ environmental and social practices while engaging with management teams to encourage positive changes. This approach appeals to investors who want their ISA holdings to align with their values.

Active Investing Disadvantages

The expertise and research involved in active management comes at a significant cost. Actively managed funds typically charge higher fees than their passive counterparts, which can erode investment returns over time. These higher costs create a performance hurdle that active managers must overcome to deliver net benefits to investors.

Active investing introduces manager risk, where fund performance depends heavily on the skills and decisions of individual portfolio managers. Poor investment choices can harm returns, and performance may suffer if a successful manager leaves the fund. This reliance on human judgment can lead to inconsistent results and emotional decision-making during volatile market periods.

Research consistently shows that the majority of actively managed funds fail to outperform their benchmark indices over extended periods. This underperformance, combined with higher fees, can result in disappointing long-term outcomes for investors who expected superior returns from active management.

For individual investors attempting active strategies without professional management, the approach becomes extremely time-consuming and challenging. Successful active investing requires constant market monitoring, extensive research, and the emotional discipline to make rational decisions during market stress.

Passive Investing Advantages

The most significant advantage of passive investing is its cost efficiency. Since passive funds require minimal management and trade infrequently, they typically charge substantially lower fees than actively managed alternatives. These cost savings compound over time, allowing investors to retain more of their investment gains.

Passive investing offers predictable performance that closely matches market returns. While this approach will never beat the market, it also avoids the risk of significant underperformance that can occur with poorly managed active funds. This consistency appeals to investors seeking steady, long-term growth without the uncertainty of manager selection.

The simplicity of passive investing makes it particularly suitable for beginning investors or those who prefer a hands-off approach. Index funds provide instant diversification across hundreds or thousands of securities, reducing the risk associated with individual company performance while requiring minimal ongoing attention from investors.

Passive funds eliminate manager risk entirely, as their performance depends solely on the underlying index rather than human decision-making. This removes concerns about manager changes, style drift, or poor investment choices that can affect actively managed funds.

Passive Investing Disadvantages

The primary limitation of passive investing is its inability to outperform market indices. By design, passive funds will always lag slightly behind their benchmarks due to fees and tracking errors, meaning investors cannot achieve above-market returns through this approach alone.

Passive funds lack the flexibility to respond to changing market conditions or avoid overvalued sectors. During market downturns, passive investors must accept full exposure to declining markets without the possibility of defensive positioning. This can result in significant short-term losses during volatile periods.

Most indices weight holdings by market capitalization, which can create concentration risk in the largest companies and most popular sectors. This weighting methodology may lead to overexposure to potentially overvalued areas of the market while underweighting smaller, potentially undervalued opportunities.

Passive investing provides limited ability to incorporate specific investment themes or values-based criteria beyond what is available through specialized indices. Investors seeking targeted exposure to particular sectors, regions, or ESG criteria may find passive options more restrictive than active alternatives.

Costs

The cost differential between active and passive investing represents one of the most significant factors influencing long-term investment outcomes. Understanding fee structures and their impact on returns is essential for making informed decisions about your ISA investment strategy.

Active Investment Costs

Actively managed funds typically charge annual management fees ranging from 0.75% to 2.5% or more, depending on the fund type and investment strategy. These higher fees reflect the costs associated with employing professional fund managers, research teams, and trading activities required for active portfolio management.

Beyond annual management fees, active funds may impose additional charges such as performance fees, which are levied when funds exceed specific return thresholds. Some active funds also charge initial fees or exit penalties, further increasing the total cost of investment. These various fee structures can significantly impact net returns, particularly over extended investment periods.

The higher turnover associated with active management generates additional transaction costs as fund managers buy and sell securities more frequently than passive alternatives. While these costs are typically absorbed within the fund rather than charged separately, they nonetheless reduce overall returns available to investors.

Research and administrative expenses for active funds are substantially higher than passive alternatives, as they require extensive market analysis, company research, and ongoing portfolio monitoring. These operational costs are ultimately passed on to investors through higher management fees.

Passive Investment Costs

Passive funds typically charge annual management fees ranging from 0.05% to 0.5%, representing a significant cost advantage over actively managed alternatives. The largest and most established index funds often charge fees at the lower end of this range, making them extremely cost-effective investment options.

The automated nature of passive fund management eliminates many of the expenses associated with active strategies. There are no expensive fund managers to compensate, minimal research costs, and reduced trading activities that keep operational expenses low.

ETFs, a popular form of passive investing, often provide even lower cost options than traditional index funds. Competition among ETF providers has driven fees down considerably, with some broad market index ETFs charging annual fees below 0.1%.

The low turnover characteristic of passive funds results in minimal transaction costs, as holdings are only adjusted when index compositions change or to accommodate investor flows. This reduced trading activity helps preserve returns that might otherwise be eroded by frequent buying and selling.

Cost Impact on Long-Term Returns

The compounding effect of fees over time can dramatically impact investment outcomes. A 1% annual fee difference between active and passive funds can result in tens of thousands of pounds in additional costs over a 20-30 year investment horizon, assuming typical ISA contribution levels.

For example, an investor contributing £20,000 annually to an ISA over 25 years might pay £150,000 more in fees by choosing an active fund charging 1.5% annually versus a passive fund charging 0.5%, assuming identical gross returns. This cost differential represents a substantial portion of potential investment gains.

The fee advantage of passive investing becomes more pronounced during periods of lower market returns, when high fees consume a larger percentage of available gains. During challenging market conditions, the cost efficiency of passive funds can help preserve more capital for future growth.

However, investors should consider that successful active management may justify higher fees if it consistently delivers superior after-fee returns. The challenge lies in identifying such managers prospectively, as past performance does not guarantee future results.

When selecting investments for your ISA, carefully review all fee disclosures and consider the long-term impact of costs on your investment objectives. Platform fees, fund charges, and transaction costs should all be factored into your decision-making process to ensure you maximize the tax-efficient benefits of your ISA allowance.

The choice between active vs passive ISA investing ultimately depends on your individual circumstances, risk tolerance, and investment goals. Many investors find success combining both approaches, using low-cost passive funds for core market exposure while selectively incorporating active strategies for specialized opportunities or specific investment themes. Whatever approach you choose, understanding the costs involved and their long-term impact will help you make more informed decisions about your Stocks & Shares ISAs investment strategy.