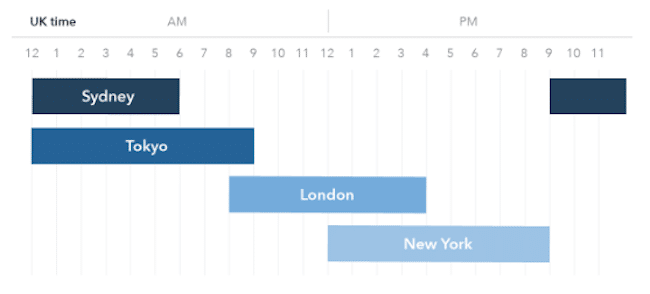

It's the case that unlike stock markets, forex markets trade on a 24/5 basis. The around the clock aspect gives a feeling that the markets are constantly on the move. While this is the case, there are peaks and troughs in activity based on global time zones. Improving your understanding of how price is influenced by the forex market hours is a crucial factor in making a profit from trading.

Forex trading hours

The forex trading week starts on Monday at 8:00am local time in New Zealand. The Kiwi (NZD/USD) is an important currency pair in that it is a good barometer of market appetite for risk. Buying NZD/USD is seen as ‘risk-on' and selling it as ‘risk-off'. From a global perspective, ‘Kiwi' isn't the most heavily traded currency and is more important in terms of answering the question of what time does the forex market open?

New York

The New York forex market accounts for 17% of global currency trading. The US forex trading patterns reflect a greater dispersal of market participants. There are also significant financial centres open in other areas of North America, such as Toronto and Chicago. The West Coast (three time zones behind New York) hosts a selection of some of the biggest and most influential investment firms in the world.

There is a sense that market activity tails off after lunchtime in New York. In contrast, London, for example, starts and finishes with increased trading volumes. Read below for further insight into the London market.

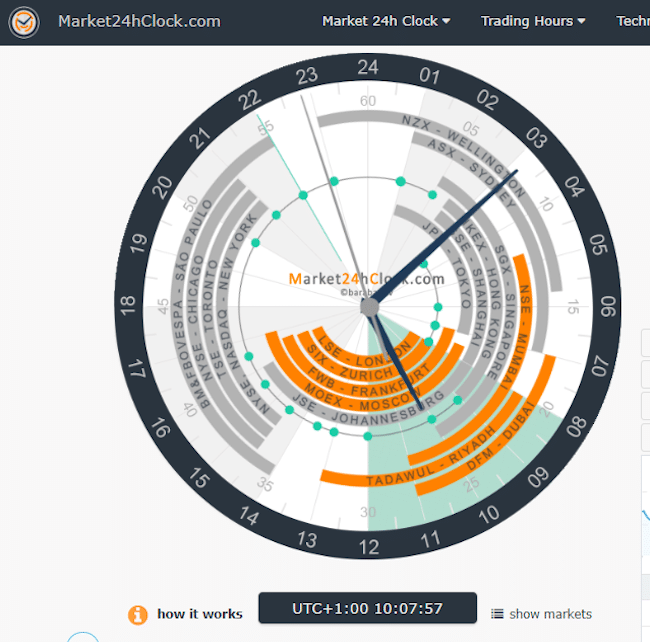

Source Market 24h clock

Tokyo

The Asian or Tokyo market has specific characteristics, which might (or might not) make them attractive for you to trade.

If you're looking to get ahead of the pack, then those using online brokers such as IG or eToro can put on positions at 11:00pm London time on Sunday evening. As you might expect, trading during the Asian forex time zone sees more substantial moves in Asia Pacific currency pairs like AUD/USD and NZD/USD.

Strategies that involve the Japanese yen will require you to become familiar with the Tokyo forex trading hours. Japan is the third-largest forex trading centre in the world and the yen is the third most traded currency. It accounts for 16.8% of all forex transactions.

The Asian markets are seen as being more influenced by economic fundamentals than speculatory trading. The main market participants during the Tokyo session are commercial companies (importers and exporters) and central banks. That might favour those using trading strategies based on fundamentals rather than technical analysis, which are held for a more extended period.

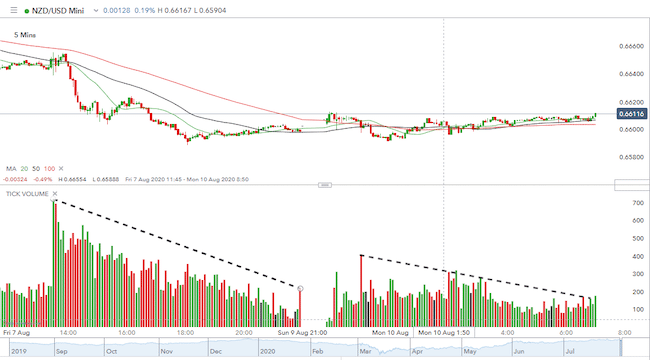

Forex trading volumes illustrate that fact during a typical trading session. The below chart shows the US close, a break for the weekend and then the Asian markets opening. Even the Asia-specific NZDUSD pair sees lower trading volumes in the Asian time zones than in the US ones. Another note is that the peak volume in both sessions was the opening hour — a theme that carries across most markets around the world and not only in forex.

Source: IG

The Asian forex opening times can be both a blessing and a curse for investors in those regions. The relatively limited amount of outright speculation in the forex markets in those time zones comes from the importance of the markets that open after them. Putting on a position in the Tokyo market relies on market sentiment and the conditions prevailing when the European markets and the US markets open.

The US economy is still the most important economy in the world and the dollar is the world's most influential currency. So, if US investors and traders call for a change in direction, that will lead the rest of the world's markets. By the time Asian exchanges re-open, investors in that region can find their portfolios have suffered from the market slipping away from them.

If you're looking to trade non-Asian currency pairs such as EUR/USD, trading volumes can be thin and price action limited, at least until the European markets begin to open.

At IG, the weekday forex market is open from 9:00pm on a Sunday until 10:00pm on a Friday (UK time).

Sydney

The Sydney currency markets open at 7:00am local time. The Australian economy is larger than New Zealand's, meaning there are more import-export businesses trading currencies as part of their fundamental business activities. The bigger the economy, the bigger the forex market. That point is reconfirmed when the Tokyo forex market opens up, at 9:00am local time, or three time zones after the Sydney market.

These sessions overlap. The trading week has the Wellington, Sydney, and Tokyo forex sessions in full flow. The groundswell of activity picks up as Singapore and Hong Kong come online as forex traders in different parts of the world comply with the schedule of forex market opening times.

London

The forex market hours in Europe are the busiest session of the global trading day. Forex opening times in Europe and the UK are synchronised. The London market opening time is 8:00am local time and in Frankfurt, Paris and Rome it's 9:00am, which, combined with the one-hour time difference, means European markets start the trading day with a bang. The forex trading times also overlap with the tail end of the Asian session and later in the day with the opening of the US session. The New York forex trading times are 8:00am to 5:00pm local time.

Mainly due to its geographical positioning, London is the forex capital of the world with thousands of traders making transactions every single minute it is open. About 43% of all forex transactions happen in London. Due to the large number of transactions that take place, the London trading session is often the most volatile. A lot of trends begin during the London session, particularly throughout the first hour of trading, and they typically continue until the beginning of the New York session.

A mid-session London lull allows local traders to take a break, digest the activity from the morning and prepare for the afternoon when the US markets open. Give or take a bit of profit-taking near the close of the European session, a lot of the trends that originate during the London session carry on through that of New York.

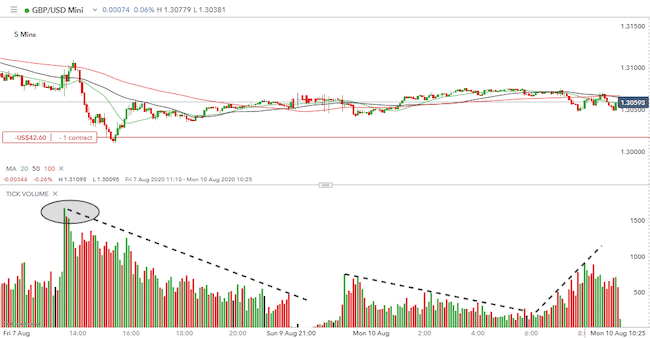

Source: IG

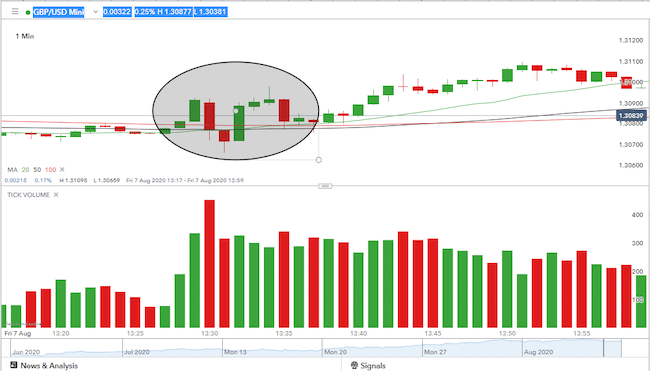

The chart below shows the volumes of trades in GBPUSD peaking at the open of the US markets. The crossover of London and New York trading hours results in bulls and bears in both taking their own decisions. The ellipse shows the importance of news. That spike in volumes was at 1:30pm London time and one hour before the New York forex market opened. The jump in volume traded was caused, in this case, by the US Non-Farm payroll figures. The ‘jobs numbers' are released on the first Friday of every month and are one of the most important data releases in the economic and forex calendars.

Source: IG

With so many unplanned news statements influencing the market, there is a lot to be said for keeping on top of the scheduled announcements.

Forex trading sessions overlaps

Source: IG

Daylight savings time

Keeping track of the forex market hours can improve your trading performance. Seasonal changes, such as those associated with daylight savings schemes, can cause markets to run out of sync or at least at different times. As the forex markets run 24/5, this might not result in you being stuck in a position, but it could mean you will miss the opportune time to enter or exit a trade. A lot of big investors look to put on a trade that will run through the course of the week. Trading the five business days and taking your book to ‘flat positions' is the preferred strategy of many. That is why Monday and Friday can see increased trading volumes.

Public holidays play a smaller role than they do for the equity markets. The only two days that the entire forex markets are closed are Christmas Day and New Year's Day. There will be some days when forex markets are open but are very quiet because one of the major financial centres is closed for a national holiday.

Seasonality is also a factor. Spring and autumn tend to be the busier times in the market. The summer months, in particular, can see prices drift as forex markets trade sideways.

What are the best hours for forex trading?

The beginning of each trading session is when big institutions such as investment banks, hedge funds and pension funds are most active. That then attracts speculators looking to find a trading strategy to match the market mood. Don't forget that base-level activity also takes place. The businesses and firms that need to engage in currency trades for commercial rather than trading reasons also congregate around the busiest time in the markets.

Catalysts for price moves are often released before or during the morning trading session of each market. Economic data such as the GDP figures for the UK are, for example, released at 8:30am (local time). The US authorities tend to release the data between 6:30am–8:30am local time — and it's not only the Non-Farm payroll announcements that can generate significant volatility. Every forex trader needs to know when they are published and must be ready for the market's reaction. Least of all because whip-sawing price action can trigger stop losses and trip you out of otherwise profitable positions.

Source: IG

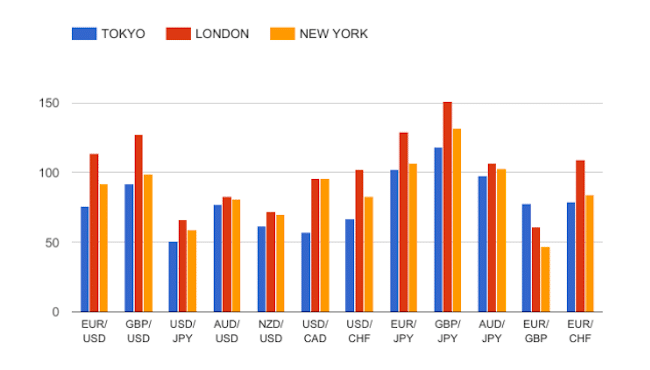

An increase in trade volumes is seen as a confirmatory indicator for technical strategies. For example, a break out from a sideways trading range that is also supported by increased trade volumes suggests the stand-off between buyers and sellers has been conclusively resolved.

The chart below from babypips.com shows the average price volatility (pip movement) for currency pairs across the three principal trading zones. The statistics back up the view that it is the London forex market where most price movement takes place.

The increased market liquidity also helps in terms of trading costs. As the market flow picks up, bid-offer spreads tend to get tighter, reducing the cost of getting into a position.

The bottom line

Do remember that forex moves are ultimately based on economic fundamentals. The more economic growth a country produces, the more positive the economy is regarded by international investors. As a result, investment capital tends to flow to the countries that are believed to have excellent growth prospects. That leads to a strengthening of the exchange of a country that is doing well.

Trading the short-term moves associated with long-term realignments can be profitable. To be successful, you'll need to carry out a realistic analysis of your resources. It should be regularly reviewed and will go some way in helping you decide in which market to trade your strategies.

Some people trade only one currency pair, that degree of focus allows for some specialist knowledge to be gained. Others trade infrequently and put on positions with longer holding periods. Whatever approach you take, keep in mind the characteristics of the different markets and the typical windows of opportunity. Information is not only power but can also help your trading bottom line.

PEOPLE WHO READ THIS ALSO VIEWED:

- Learn Forex trading

- Multiple time frame analysis (MTFA) as a Forex trading strategy