A complete revolution in the finance industry has resulted in millions of more people being able to access and trade the markets. Stocks, forex, crypto, commodities, and more can all be traded via user-friendly trading apps, and the process of setting up an account can also be done from handheld devices. The opportunities are almost limitless, and delving into the markets is as easy as swiping over to an app and tapping a screen.

Being able to trade on the go doesn’t mean that you have to sacrifice client protection or customer service. The regulatory protections that apply to an account are effective whether you trade from a phone or a desktop device. It’s even possible to try trading using a demo account that can be accessed using an app. These take less than one minute to set up and allow newbies to practice trading using virtual funds. For those who have been looking to try trading, the time to try it is now.

#1IG

What We Liked:

What We Liked:

- Great all-round service

- Market-leading, app-based trading platforms with choice of in-house or third-party dashboards

- High-quality research and analysis materials

- More than 17,000 markets to trade, including India stocks and indices

- Asset groups ranging from forex options to US bonds and everything else in between

- Free mobile demo account

- Customer support is available seven days a week

- IGTV offers video-based market news service

- Set up your app to send you price alerts

- Winner of the 2020 ADVFN International Finance Awards ‘Best Finance App’ award

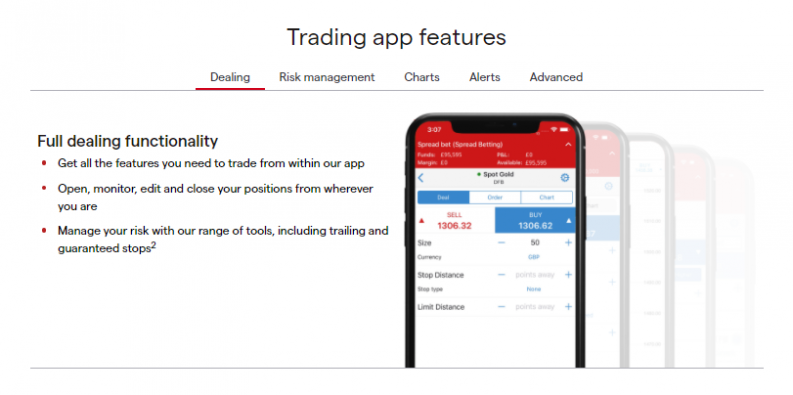

IG is one of the most well-known multi-asset brokers in the market, and unsurprisingly its award-winning trading app offers clients a portal to first-class trading while on the move. The firm has always been quick at getting on board with technological advances, but it also offers the security of having been trading since the 1970s and is regulated by Tier-1 authorities.

Being an international multi-asset broker means that the app offers clients the chance to trade a wide range of assets and markets. It’s a one-stop shop, and if IG doesn’t offer a market in a particular instrument, it’s likely that nobody does. This extends to the India stock market, where the IG app offers a relatively strong offering in India stock names using global depositary receipt (GDR) and American depositary receipt (ADR) instruments.

The multilingual customer service team is contactable around the clock, and the charting tools and trade indicator software are high grade. The most impressive feature of the IG app is how the broker manages to get so many of its powerful features into a format that suits a smaller screen.

IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). (Source: IG)

Registered address: Cannon Bridge House, 25 Dowgate Hill, London, EC4R 2YA, UK. Both IG Markets Ltd (register number 195355) and IG Index Ltd (register number 114059) are authorised and regulated by the Financial Conduct Authority. (Source: IG)

#2Pepperstone

What We Liked:

What We Liked:

- Great demo account that is free to use

- Low-cost trading and no hidden charges

- Very strong in the forex markets

- Strong trading architecture ensures low-cost and super-fast reliable trade execution

- Online learning tools such as webinars are ideal for beginners

- Choose from a range of market-leading trading platforms – MT4, MT5, TradingView and cTrader

- Award-winning, knowledgeable and friendly customer service

82.51% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone is an Australia-based but globally orientated broker. It has built a strong reputation in the trading community for giving traders just what they need, and the apps it provides carry on this tradition. Pepperstone account holders can trade using up to three platforms on their app – these are provided by highly regarded third parties MetaTrader and cTrader. Pepperstone doesn’t try to be all things to all people, but the app demonstrates how it understands what traders want and need, and for many, this is the ideal approach.

The Pepperstone desktop platform is streamlined and razor-sharp, and this means that the functionality of it carries over well to apps and mobile trading. The customer service team consistently wins industry awards, which is something that beginners might want to consider. The webinars and research notes that it releases are trade focused and designed to help its clients learn how to spot trading opportunities, so they will appeal to newbies and more experienced traders alike.

Pepperstone Limited is authorised and regulated by the FCA and is registered with number 684312.

Registered office: 70 Gracechurch Street, London, EC3V 0HR, UK.

#3Tickmill

What We Liked:

What We Liked:

- Some of the lowest-cost trading in the market

- A choice of market-leading trading platforms

- Ultra-fast trade execution speeds

- Additional third-party trading tools to help identify trade entry and exit points

- Innovative features enhance the trading experience

- Transparent reporting of T&Cs – no hidden charges

- Supports a wide range of strategies, including scalping, hedging and automated trading

There is intense competition among brokers, and Tickmill keeps on picking up new clients thanks to its aggressive approach to trading costs. It even offers bid-offer spreads of 0.0 pips in some markets, which means that traders using this app are as well positioned as possible to make a profit from their trading. Whether you are trading from a desktop or a handheld device, it’s hard to beat zero spreads.

The broker is low cost, but the app still offers some excellent additional services, the most notable being the third-party research tools such as Myfxbook and Autochartist, which can fast-track the learning process for beginners. The Tickmill app provides everything that a new trader might need to get started and does a good job of tilting the odds in favour of its clients.

Tickmill UK Ltd is authorised and regulated by the FCA and is registered with number 717270.

Registered Office: 3rd Floor, 27-32 Old Jewry, London, EC2R 8DQ, UK. (Source: Tickmill)

Tickmill Ltd address: 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles. It is regulated by the Financial Services Authority of Seychelles and its 100%-owned subsidiary Procard Global Ltd. (Source: Tickmill)

#4XTB

What We Liked:

What We Liked:

- One of the largest FX and CFD brokers in the world

- Has been operating for 15 years, but is still introducing innovative trader-supporting ideas

- Proprietary trading platform xStation Mobile is one of the best apps out there

- Dedicated customer support available 24/5

- Easy to set up and easy to use

- Over 2,100 CFD markets, including FX, indices, commodities, stocks and ETFs from around the world

- Award-winning research and educational materials

- Regulated by the world’s leading supervisory authorities

It’s worth opening a demo account with XTB just to try out the xStation Mobile trading app. XTB develops a lot of its trading software in house, which means that it can’t be found at other brokers. Putting on a few virtual trades with xStation Mobile will highlight just how good the mobile trading experience can be.

XTB is well-regulated and has a solid track record, but it stands out for being a broker that is consistently trying to push the boundaries of what is possible. The XTB app trading experience combines a broker that is solid and reliable but also willing to improve its clients’ trading experience by introducing innovative new features.

XTB Limited is authorised and regulated by the FCA and is registered with number 522157.

Company address: Level 9, One Canada Square, Canary Wharf, London., E14 5AA, UK (company number 07227848) (Source: XTB)

#5Admirals

What We Liked:

What We Liked:

- Dedication to developing the trading skills of its clients

- Hot on security, including two-factor authentication

- Fast trade execution speeds thanks to clever positioning of trading servers

- Invest and trade from the same account

- Markets covered include forex and CFDs on indices, metals, energies, agricultures, stocks, ETFs and bonds

- Has been operating for 20 years – used to be known as Admiral Markets

- Specialist tools to support day traders

Admirals, which until recently was known as Admiral Markets, offers its clients a high-quality app trading experience. The firm was founded in 2001 and has always invested heavily in offering tools and services designed to develop the trading skills of its clients. The Admirals app is also a good choice for those who want to invest and trade from the same account.

Regulated by the FCA, the firm takes client safety very seriously. It has two-stage login authentication and its site provides regular updates on scams and how to avoid them. Admirals also engages external auditors to review and upgrade operational and internal procedures as well as to ensure regulatory compliance.

Admiral Markets UK Ltd is registered in England and Wales under Companies House – registration number 08171762. Admiral Markets UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) – registration number 595450. (Source: Admirals)

Registered office: 60 St. Martins Lane, Covent Garden, London, WC2N 4JS, UK

#6FXTM

What We Liked:

What We Liked:

- A global leader in online trading and investment

- Three account types, including the Micro account, which allows beginners to trade in small size

- Over 2 million clients

- Market-leading platform and award-winning mobile apps

- Winner of the World Finance ‘Best Trading Experience’ award, 2021

- Winner of the Global Business Awards ‘Best Online Leveraged Trading Specialists’ award, 2021

- Extensive trade analysis tools, including FXTM Pivot Point Strategy and Trading Signals

- Multilingual customer services and friendly personal account managers

With the new FXTM Mobile app, it’s possible to open and close positions in seconds, access live currency rates, manage your trading accounts, and stay one step ahead of the markets – anytime, anywhere.

FXTM has been operating for 10 years and is regulated by Tier-1 authorities, which offers a degree of security. It also has a hunger to build market share and this is exemplified by its attention to client satisfaction and a trading app that offers high-grade trade execution.

There is a feeling that FXTM is on the same side as its clients. One way that it supports beginners is its Micro account, which allows traders to trade real money, but in small size. Bridging the gap between demo and full-scale live trading is a great idea and can help traders develop the skills they need to be profitable. The minimum deposit requirement to set up a Micro account and start trading using its app is only $10 (or equivalent).

ForexTime is authorised and regulated by the FCA and is registered with number 777911. UK office: 30 Churchill Place, London, E14 5EU, UK. (Source: FXTM)

Exinity Limited (www.forextime.com) is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer Licence bearing number C113012295. (Source: FXTM)