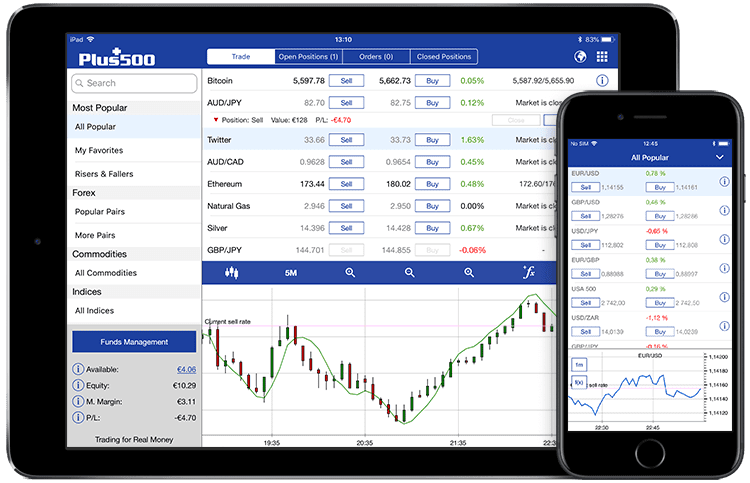

Plus500 is one of the leading online trading platforms that allows traders to trade CFDs on over 2,000 financial instruments including Forex, Shares, Cryptocurrencies (*availability subject to regulation), Indices, ETFs, Commodities and Options.

* 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

In this guide, we’ll be taking a look at some of the Plus500 fees you may (or may not) be aware of and how to avoid any unexpected charges. These include:

Plus500 Trading Fees

First of all, let’s take a look at some of the day-to-day fees involved with trading, including:

Deposit Fees

Plus500 does not charge a deposit fee and covers most payment processing fees. However, minimum deposit levels vary depending on the payment method you select. The minimum deposit for Plus500 starts at $100 (credit/debit cards and electronic wallets) and goes up to $500 (bank transfers).

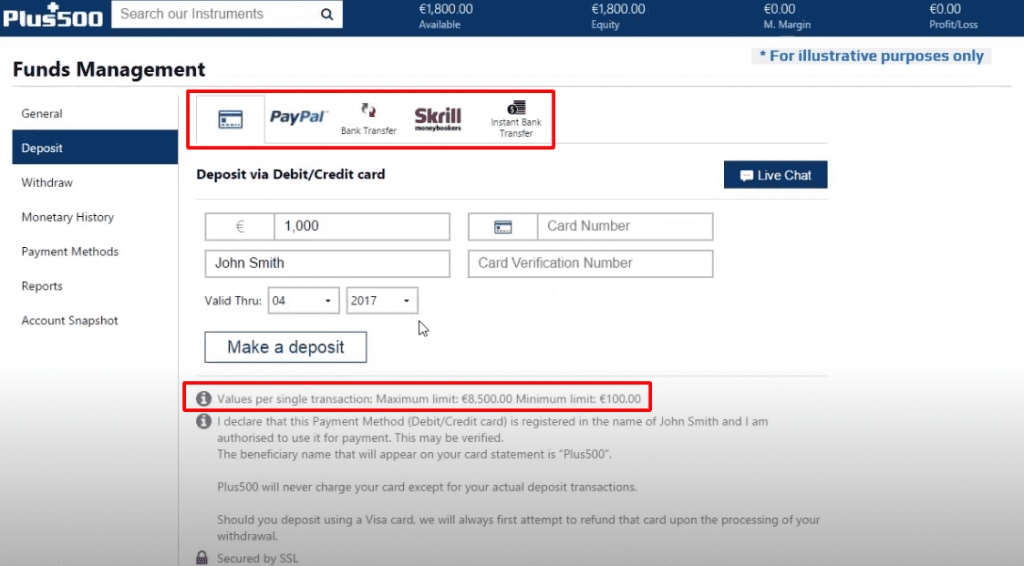

You can deposit money into your Plus500 account via:

- Credit/debit card

- PayPal

- Skrill

- Bank transfer

* 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Detailed information on minimum deposits for each payment methods can be found in the Deposit section of your account:

Commission and Transaction Fees

Unlike other brokers, Plus500 does not charge dealing commission fees on each trade. A zero dealing commission fee means they will not charge you for executing your buy or sell orders.

Instead, Plus500 primarily makes money through the market bid/ask spread, i.e., the price difference between where you buy or sell an asset.

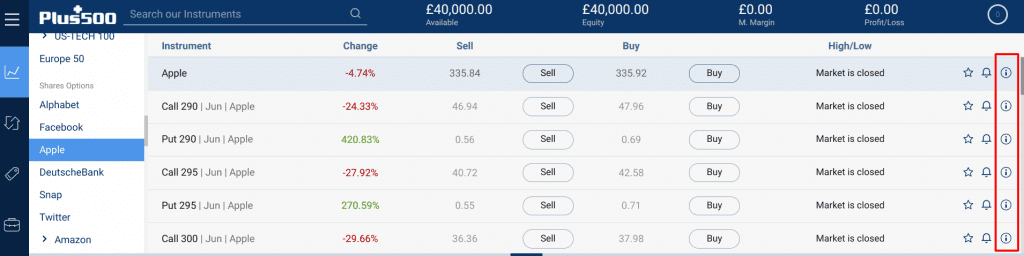

Spread Costs

You can find the current spread cost (measured in pips) of an instrument by checking the ‘Details’ page. It’s worth checking if the spread is dynamic or as this can affect your profit levels and overall strategy. Traders are reminded that such a strategy does pose a risk of a loss of capital.

Dynamic, or variable spreads, on the other hand, are volatile and will fluctuate within a range.

Guaranteed Stop Order

If you want to guarantee your position closes at a specified price, your trade with Plus500 may be subject to a broader spread cost.

Currency Conversion Fees

Plus500 will charge a currency conversion fee of up to 0.7% for all trades on instruments you hold in a currency that is different from your account's currency. For example, if your account's currency is in GBP and you want to buy shares using USD, the broker will need to convert your GBP to USD before purchasing the shares for you.

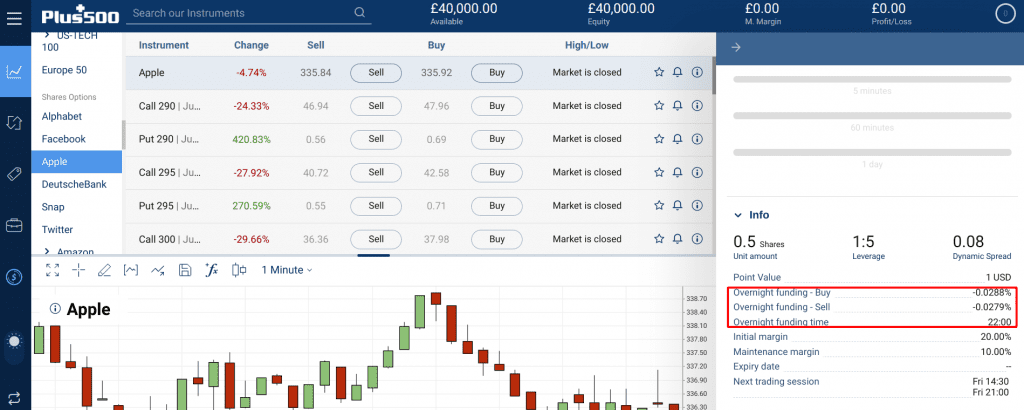

Overnight Funding

An overnight fee is charged by Plus500 to cover the cost of the leverage a trader uses overnight on open CFD positions. The fee will either be added to or subtracted from your account. You can easily check Overnight Funding details on your account:

Click on the ‘details’ button next to the instrument’s name:

A window will appear with the overnight funding time and the daily overnight funding percentage

* 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500’s Trading Fees Compared to Other Brokers

| Plus500 | eToro | XTB | |

| Deposit Fees | 0 | 0 | 0 |

| Transaction & Commission Fee | 0 | 0 | €3.5 /£2.5 /$4 per lot for PRO accounts.

US stock fee: 0.08% of trade value with $8 minimum |

| Spread Costs | Variable | 3 is the average spread cost | 0.7 is the average spread cost |

| Guaranteed Stop Order | Subject to a broader spread cost | Subject to a broader spread cost | Subject to a broader spread cost |

| Overnight Funding | Subject to type of instruments | Subject to type of instruments | Subject to type of instruments |

Low Cost Plus500 Alternatives

eToro: Market-Leading Platform

Take A LookPepperstone: FCA and ASIC Regulated

Take A LookAdmirals (Admiral Markets): Impressive Range of Assets

Take A LookIf you are looking for a reliable broker with low fees and fair conditions then this is who we recommend. All have been reviewed by our team and have been found to offer a low-cost way to trade.

Plus500 Non-Trading Fees

Below is a brief overview of the non-trading related fees you need to be aware of:

- Withdrawal fees

- Inactivity fees

Withdrawal Fees

In general, there are no fees for withdrawal. However, withdrawals via bank transfer may incur a charge of $6 to cover bank processing fees.

Withdrawal requests of less than the minimum amount for each payment method will incur a fee of $10, so it’s important to ensure that you are always withdrawing at least this amount each time.

The minimum withdrawal amount depends on the payment method you have chosen:

- Paypal/Skill – $50

- Bank transfers/credit card – $100

- Inactivity Fee

The inactivity fee is applicable for users who don't log in to their accounts for at least three months. Plus500 will be charging a fee of up to $10 per the inactive month. While this isn't great news if you're a ‘buy and hold' trader, all you need to do is log in to your account from time to time to prevent the charge from being applied.

* 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500’s Non-Trading Fees Compared to Other Brokers

| Plus500 | eToro | XTB | |

| Withdrawal Fee | 0 | $5 | 0 |

| Inactivity Fee | $10 per quarter after 3 months of inactivity | $10 per month after one year inactivity | 0 |

| Account Fee | 0 | 0 | 0 |

Conclusion

Plus500 fees do include deposit, withdrawal, or commission charge. The main chargeable fees that traders need to be aware of are currency conversion, guaranteed stop order, and overnight funding fees. Additionally, Plus500 charges an inactivity fee for dormant accounts that are inactive for three months.

New traders can also practice trading with the Plus500 demo account before embarking on a real-life trading journey. You can also head over to our expert Plus500 review for a comprehensive look at this broker.

People who read this also viewed:

- How to buy/ sell Bitcoin with Plus500

- How good is Plus500's Webtrader

- Stock trading for beginners