BlackBull (formerly BlackBull Markets) is a brokerage firm based in New Zealand with several offices across the globe. They are experts in the forex markets and provide excellent investment opportunities for traders.

The company offers the opportunity to trade over 70 currency pairs, more than 26,000 stocks, commodities, and cryptocurrencies.

The company was founded in 2014, in Auckland, New Zealand, by a group of individuals with extensive industry experience. Their sole aim was to build a company providing top-notch institutional-level resources for retail clients.

Over the years, the BlackBull team has achieved its goals by developing multiple fintech solutions, most notably, its proprietary in-house trade-order aggregation software.

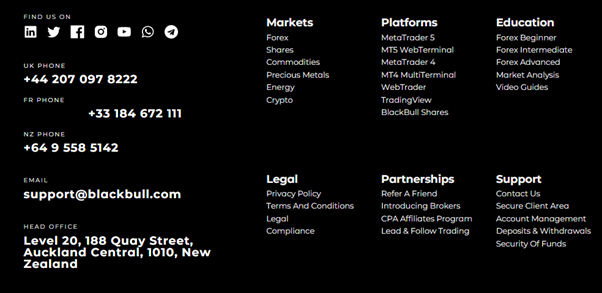

Like many other retail trading firms, the company brand has expanded recently. The business now operates in several jurisdictions worldwide, with offices in New Zealand (headquarters), the United Kingdom, Malaysia, and New York.

To learn more about BlackBull Markets read our broker review below.

What can you trade?

Forex

| App Support | Max Leverage | Trading Fees |

| Good | 1:30 | Low |

Regarding currency pairs: the company allows you to trade more than 64 pairs and to set up bespoke pairs, which aren’t available as a default option. They consist of major, minor and exotic pairs, such as GBPAUD, USDZAR, and EURNOK, to name a few. As you may already know, the market is very liquid due to the enormous volume of trading that takes place daily.

The company does not offer an in-house developed trading platform but allows users to trade via MetaTrader 4 or MetaTrader 5, popular platforms amongst retail traders. MetaTrader 4 (MT4) is the platform primarily used in the forex market, so many traders should feel comfortable getting to grips with it.

CFDs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £150 | Mid | 1:30 | Mid |

BlackBull Markets trades index CFDs like the AUS200, GER30, US30, UK100, and SPX 500. Indices provide a market-wide value on a specific basket of stocks. Typically, these companies are selected based on specific criteria, such as the grouping of companies in similar industries or the top-valued companies in that country or region.

Stocks

| App Support | Trading Fees |

| Good | High |

What did our traders think after reviewing the key criteria?

Fees

The company allows its clients to choose between its various accounts, with the minimum spread on trades being 0.00 pips.

If you have a Prime account, the minimum round-trip cost can be as low as 0.1 pips.

Against the usual practice of other brokers, BlackBull does not charge inactivity fees.

The general charges and rates are competitive compared to the market rate but do not stand out as an advantage for choosing the company over others.

Account Types

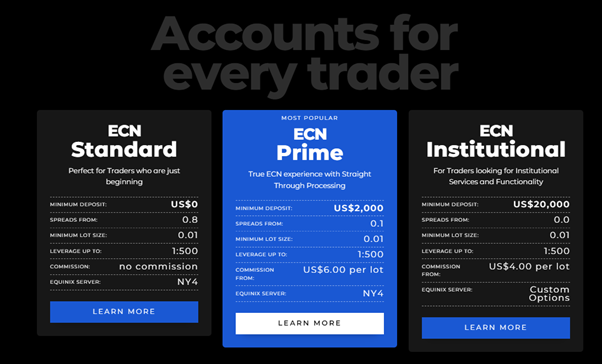

The company offers three account types, all of which use ECN protocols to ensure high-quality trade execution.

ECN Standard: This account has no minimum opening balance requirement and offers a minimum spread of 0.8 pips. BlackBull Markets does not charge a commission on this account. The Equinix server used is NY4.

ECN Prime: to operate the ECN Prime account, you must make a minimum deposit of $2,000. The account offers a minimum spread of 0.1 pips. You’ll be charged a commission of $6 at every lot per round. The commission, therefore, raises the spread from 0.1 to about 0.6. The NY4 Equinix is the server used on this type.

ECN Institutional: to trade the ECN Institutional, you must make a minimum deposit of $20,000. It offers a minimum spread of 0 pips. This type also allows the individual client to negotiate commissions. You can trade with several custom Equinix server options.

In addition to the types listed above, BBM offers a swap-free Islamic account that is Shariah-compliant as well as access to demo accounts.

Platforms

BBM does not have its own trading platform but allows users to trade effectively via the MetaTrader 4 and MetaTrader 5 platforms.

The MetaTrader4 platform is available for free via Android or IOS.

MetaTrader4 Desktop Application: The MT4 platform is available for desktops or laptops. You can download it via the BBM website.

It may be worth noting that the MT4 platform is more widely used for trading the forex markets, while the MT5 platform is more suitable for trading stocks.

Usability

The MT4 and MT5 platforms provide automated trading using Expert Advisors and access to the MetaTrader market, where tools and strategies are available.

They provide various types of charts that are easy to understand. For example, line charts, bar charts, and candlesticks are all available.

Traders who are used to using and who like these platforms should have no trouble adjusting; however, if you do not favour the platforms, there are no other platforms available with the broker.

Customer Support

BlackBull Markets has proven time and time again that they are customer-oriented by providing top-notch customer support to their clients.

We believe the company’s reputation amongst clients is due to the fact that it is fully regulated and provides global Forex/CFD brokering services.

Support is available 24/7 via email, telephone, or chat. There is also an FAQ section covering common questions that clients can refer to instead of spending time trying to contact the company directly.

Payment Methods

BlackBull Markets does not accept cash payments or payments from third parties, and the depositor must always be the person who signed up.

Various payment options are available to users. BBM does not charge deposit fees.

CARD TYPES

Two types of credit cards are allowed; a picture of both sides of the credit card showing the last four digits is required. Only Mastercard and Visa are accepted for deposits and withdrawals.

BANK WIRE TRANSFER

Bank wire transfers are accepted for both deposits and withdrawals. It takes five business days to process, and the minimum deposit is £1000.

E-WALLET

Neteller, Skrill, China Union Pay, and FasaPay are accepted types of e-wallet solutions. Transactions are usually processed within 5 minutes but sometimes can take up to an hour.

Depositing with Neteller offers multi-currency options. The currencies available through Neteller are USD, AUD, EUR, GBP, CAD, JPY and SGD.

Please be aware that during the withdrawal process, if you use Credit Card, Skrill, FasaPay, Neteller, or union pay, you can only withdraw via the same method you used to deposit the money initially. That is due to the company’s strict AML Policies.

Best Offers

BBM offers a free demo account for new traders who want to test the waters and try strategies before entering live trades. Some experienced traders may also opt for a demo to test new trading strategies.

BBM makes educational materials available to traders and provides excellent customer support services in multiple languages. Traders are given lots of insight into the CFD and forex markets to try and help them succeed.

BlackBull are currently offering free TradingView Pro subscriptions to new clients. They constantly review their promotional offerings, and it may be worth watching out for them in the future. However, we must stress that bonuses and promotions should not impact your decision on whether to trade.

Regulations, Deposits, and Protections

The company enjoys a moderate level of regulation. Black Bull Trade Limited is a New Zealand limited liability company incorporated and registered under the laws of New Zealand, with NZBN 9429049891041 and registered address Floor 20, 188 Quay Street, Auckland Central, Auckland 1010, New Zealand. Black Bull Trade is registered FSP1002113.

BBG Limited (trading name: BlackBull Markets) is a limited liability company incorporated and registered under the laws of Seychelles, with company number 857010-1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahé, Seychelles. The company is authorised and regulated by the Financial Services Authority in Seychelles (“FSA”) under license number SD045 for the provision of investment services.

Following regulations, the company holds client funds at a tier-1 (currently ANZ) bank in segregated accounts and offers same-day withdrawal and deposit methods.

To register with the company, you’ll be required to provide a valid means of identification and a utility bill to show your proof of residence. To prevent money laundering or criminal activities, the company does not accept third-party deposits or withdrawals.

The company uses the latest technology to keep a client’s personal information safe. All transmissions are secured and protected through a 128-bit SSL encryption.

Awards

As a leading figure in financial markets with a strong appetite for innovation, BlackBull Markets has consistently received awards for its outstanding services and role in the industry.

This year alone BlackBull Markets has already been titled number one in execution speed by Compare Forex Brokers and ‘Best in Class for Offering of Investments’ by ForexBrokers.com, but its strong track record dates back several years. At the Forex Expo of 2022, it was awarded the Best Global Forex Broker title. In 2018 and 2019 Deloitte placed BlackBull on its Technology Fast 500 list in recognition of its commitment to using the latest technology to improve the client experience.

Over the years, the company has become one of the most reputable forex brokers in New Zealand and is gradually spreading its reach to other countries worldwide. The company has also engaged and fully leveraged the power of the internet to achieve its goals.

So, in conclusion, we believe BBM is excellent for traders in New Zealand; however, we would be reticent about recommending the broker to traders in other parts of the world due to the lack of regulation elsewhere.

You can install the BlackBull MetaTrader by signing up for a demo or live account. If you'd like to try the 30-day demo first, complete the simple application form and click on ‘Open demo account.' Once done, you will receive an email from the broker with the BlackBull Markets MT4 demo login and password. Install the platform and start trading with $100,000 in virtual funds.

BlackBull assures it processes client withdrawal requests within 24 hours. Once approved, it could take 3-5 days for the funds to be credited to your bank account or credit card. Also, the CFD broker does not charge for withdrawals, but your bank or payment processor could levy a fee. Also, the max withdrawals via cards or payment processors should equal the amount initially deposited. Profits over and above the initial deposits would only be processed by bank transfer.

BlackBull (previously BlackBull Markets) is the trading name of BlackBull Group Limited, a New Zealand-incorporated LLC. The only regulatory agency monitoring BBG Limited is the Financial Services Authority (FSA) in Seychelles. The firm is not regulated by the FMA in New Zealand or the FCA in the UK, so clients are not protected if the broker fails. As a consolation, BlackBull is registered with the Financial Services Provider Registry (FSPR) and is a member of the FSCL dispute resolution scheme in New Zealand.