The answer to the question then is that for some, but not all, forex trading can be profitable. The challenge is finding ways to stack the odds in your favour. In this article, we will explore ways of improving your chances of success, including:

- Understanding the forex market and the other participants

- Developing a trading mentality

- Knowing the best ways to make trading profitable

- Setting realistic profit targets as a beginner trader

Understanding the nature of the forex market and its participants

If you based your trading on the toss of a coin, you would statistically speaking, expect to have a 50–50 split between winning and losing trades. The reality is that retail traders have a win-loss ratio worse than that.

All reputable and regulated brokers are required to publish the information on the percentage of retail investor accounts which lose money when trading spread bets and CFDs with them.

A quick search of the respective brokers shows that even the high-profile brokers report somewhere between 75% and 80% of retail investor accounts lose money.

That’s despite the brokers offering Demo accounts to practise with, research and learning services and even ‘trade of the week’ style support.

If the laws of probability suggest that losses can be expected 50% of the time, why is the actual total closer to 75%?

Part of the answer is that there are some seriously well-equipped traders operating in the forex markets. Institutional traders, such as hedge funds are well resourced and very experienced.

The aim is to be in the 25% that tilt the scales enough in their favour to make money.

What are efficient ways to make my trading profitable?

One way to make trading more profitable is to ensure you make full use of practice trading. New ideas should always be researched, developed and tested using a Demo account.

Only after extensive testing should any strategy make the switch to live trading. This transition should also be accompanied by trading in small amounts.

One off-shoot of following this process is that you’ll improve your chances of success by developing a better understanding of managing the life of a trade.

Let’s go back to the coin-toss example. If 50% of price moves go your way and 50% go against you, the cash return will be skewed if you ‘panic’ and cash in winners too early while letting your losers run to completion.

That is a common trait amongst beginner traders and comes down to basic human psychology.

Human nature assumes that things will ultimately get better — so some traders let losers run for too long. That nature loathes giving back something it has already ‘won’, which leads to traders cashing in too early on winners.

The win-loss ratio can be 50–50, but poor trade management results in you becoming one of the retail investor accounts that lose money.

Also, remember that as a small-scale operation, you might not be able to compete with the big investment houses in all the markets. Concentrating on one currency pair, such as EURUSD or GBPAUD, can tilt things in your favour.

Having established that specific currency pairs or strategies may be a better fit for you, there is also the question of where to trade them. There are a lot of high-quality regulated brokers to choose from and finding a good fit can make a real difference to your trading bottom line.

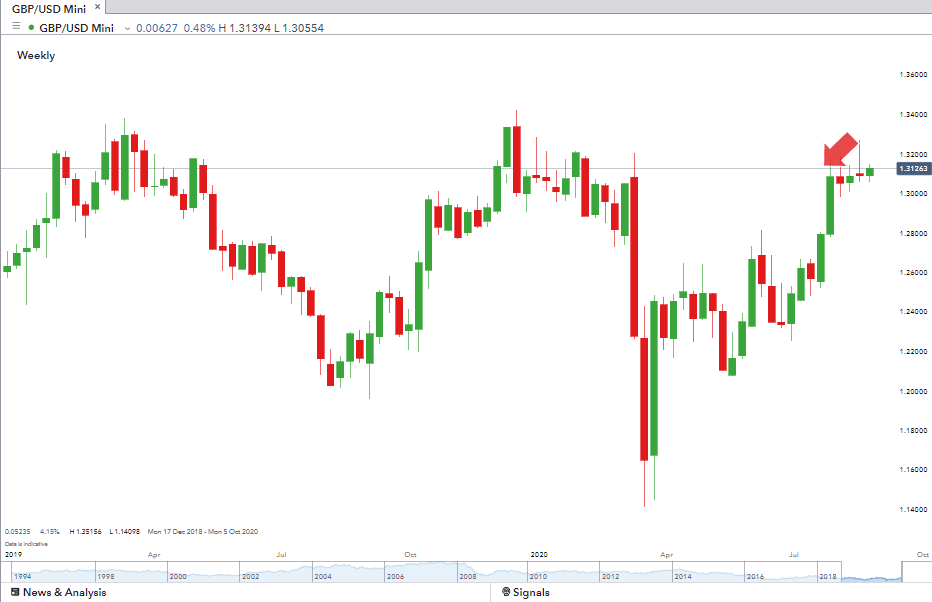

Source: IG

Ensure a tier-one regulatory body regulates the broker you intend to use. The next step is to open a Demo account to try it out. Also, consider the mobile trading experience as this differs from broker to broker.

Checking any of the ‘Top 5 forex broker’ lists will ensure you get off to a good start, but while all are good, you may find one that works particularly well for you. Some traders, of course, have multiple accounts and take what they want from each broker.

Developing a trading mentality

The learning journey associated with trading can be fascinating and rewarding. It is essential, however, to be aware of what you find to be exciting and what you find is profitable. The two may not always coincide.

Focussing on one particular currency pair can help your learning to be focussed and informative. In the same way, you may find a specific strategy works for you and choose to apply it to the currency pair most likely to generate a profit.

By concentrating on one currency pair or one strategy, such as Elliot Waves you can work on resisting the temptation to spread yourself too thinly. The aim is not to be a market expert but to be a profitable trader.

Successful trading requires discipline and composure. Strategies should include trade entry and trade exit points. Taking on the free signals from third parties is a great place to start.

Do though be wholly cynical and resist the temptation to allow anyone else’s signals to run real money until you’ve thoroughly tested them using virtual funds.

A Demo account also has the benefit of accustoming you to failed trades. If you put on 100 trades and they are all winners you have either developed the ultimate strategy or are doing something wrong.

You won’t win every time. Developing an ability to accept losses while reducing their occurrence is one of the ways of improving your chances of being profitable when trading forex.

Realistic targets for a beginner trader

The follow-on question from ‘Is Forex Trading Profitable?’ is one relating to how much money can be made trading forex? In some ways, this is the crux to the whole issue of being profitable or not.

Any trader starting with $200 who wants to make $1,000 per month is going to have to run strategies with a risk-return profile that ensure they are almost certainly going to wipe themselves out. You can’t buck the market.

A more realistic target would be based on percentage returns and not total cash terms.

With interest rates, at the time of writing, at record lows, and in some instances negative levels, the first hurdle to clear is set very low.

Returning a percentage profit higher than the base interest rate could probably be achieved if your first trade is a winner and you then close your book for the rest of the year.

In a low-interest-rate environment, big institutional investors such as hedge funds are also struggling to make significant percentage returns. As Reuters explained:

“Years of low or sub-zero interest rates, trillions of dollars in stimulus and perhaps most crucially, the almost total lack of policy divergence between the world’s big central banks, has all but eliminated opportunities.” (Source: Reuters)

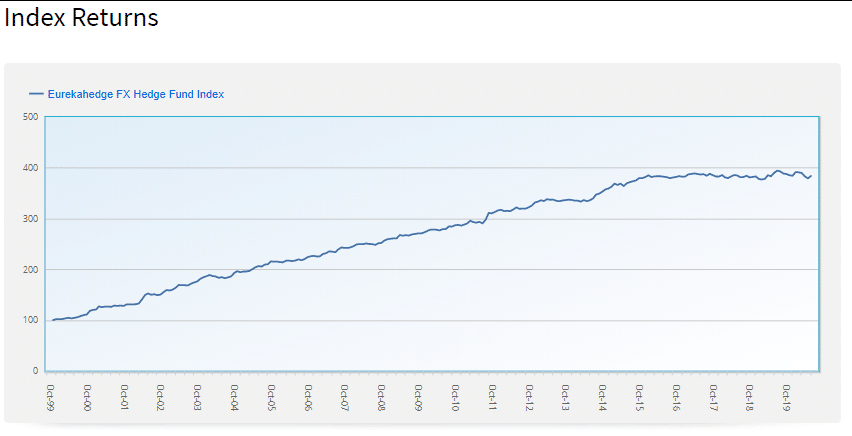

The Eureka Hedge index of performance by FX hedge funds shows the forex markets have been in a tough place over the last few years, even for the more prominent players. The percentage returns have flatlined since 2014.

Source: Eureka Hedge

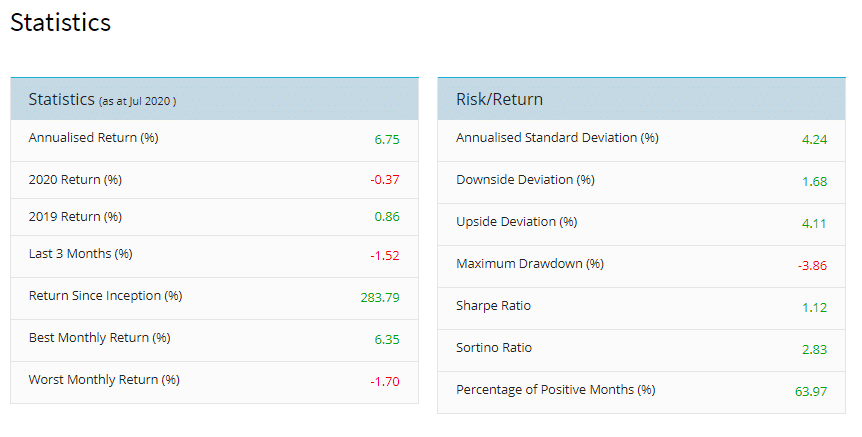

The index of FX hedge funds posted a return of only 0.86% last year. If the ‘smartest people in the room’ are posting such returns, then beating yourself up over returns of 5%, 10% and 25% might be a case of being too hard on yourself.

Source: Eureka Hedge

Can You Get Rich by Trading Forex

Some people do make considerable amounts of money trading forex. If you have a large cash amount to put into play, then you can build on that and join the rich people club even using a relatively low risk/return strategy. If you have a smaller amount of capital and want to get rich, then the risk/return would need to be turned up. Traders that do the latter tend to make up a large part of that 80% of traders who lose money. Given that they are your ‘opposition’, adopting a more professional approach, again, could move you into the top 20%.

Some retail investors will quite happily tell you how they’ve given up their day jobs. Big banks and investment funds constantly trade the markets and make returns for their investors and shareholders.

However, even the top forex traders have to factor in some down days.

As news agency Reuters reports:

“Goldman Sachs Group Inc lost more than $1 billion on currency trades during the third quarter, regulatory filings show, offering some insight into why the firm, considered one of Wall Street’s most savvy traders, reported its worst quarter in a key trading unit since the financial crisis.”

Source: Reuters

Final thoughts

These hands-on ways of weighing the odds in your favour could make you one of the 25% of traders who are profitable.

A positive first step is to lose the unrealistic ambition of making x10 your initial investment in a short time. Then consider that any profitable returns put you in a rather exclusive club. Being part of the 25% of successful retail investors is a significant achievement.

Converting that success into a bigger pile of cash involves scaling up in position size rather than moving away from a winning strategy.