IG is an eminent global online provider of trading and investment opportunities. The company also helps clients to trade financial markets on leverage, through CFDs and spread betting.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

These products allow investors to explore both rising and falling markets, so they are not confined to one asset class and can choose to trade on commodities, forex, shares cryptocurrencies and much more. IG’s investments service can be used to buy and sell shares and ETFs in a more conventional way, or clients can choose a portfolio managed by IG on their behalf. Access to investment opportunities is via platforms and apps. Read on to learn more about Spread Betting with IG, including:

Table of contents

Fees and Charges for Spread Betting With IG

New traders at IG enjoy reduced, minimum deal sizes for six weeks for UK share CFDs and two weeks for spread betting and all other CFDs. IG spread betting charges involve paying a spread on every spread bet or non-share CFD.

Commission is charged on share CFDs, but not on spread bets, and trades involving share dealing. As with any broker, IG is keen to make fees, commissions and charges as transparent as possible. Traders should always check costs when making a spread betting broker comparison, as some brokers are likely to have higher charges than others. IG sets out its different rates for different types of product and market, for example:

- Indices

- Forex

- Commodities

- Cryptocurrencies

- Shares

There are minimum bets of £1 required for FTSE 100 and forex. Commodities vary according to the market: for example, £5 minimum for gold and silver, and £1 minimum for crude oil. IG spread betting fees for share spread bets are permanently low spreads, given as a percentage of the underlying market value. The broker subtracts the spread from the market value to arrive at a Sell price, and adds it to the market value to get a Buy price. As with most brokers, total costs of spread betting will increase in proportion to a trader's volume of trading and the sizes of their trades.

A Quick Guide to Spread Betting With IG

Spread betting enables traders to speculate on the future movement of market prices, regardless of whether a particular asset falls or rises in value. On its website, IG provides some helpful tips on how to get started with spread betting.

The principles of spread betting are the same, no matter which broker is handling a spread betting account. A trader will buy a market to ‘go long’ or sell it to ‘go short’, and the ‘spread’ is the difference between the buy and sell prices. With IG, there are four simple steps traders need to follow to make their first spread bet. These steps are to:

- Open and fund their account

- Identify an opportunity

- Open a position

- Monitor and close their position

It’s quick and easy to create an IG spread betting account. Once a trader has verified their identity and opened their account, they need to deposit some funds before beginning to deal. A credit or debit card, or a bank transfer can be used. A demo account allows new traders to get to know apps and platforms without risking real funds, as IG offers £10,000 of virtual funds for practice sessions.

With the help of charts, analyses and data, traders can then find an opportunity they wish to pursue. Through this IG spread betting review you’ll get all the information you could want to decide.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Opening a Spread Betting Position With IG

Once a trader has identified a market they think is going to move down or up, they’re ready to open a position and place a deal. For instance, if an investor thinks a particular telecoms share price is about to rise, they can buy; if they think it will fall, they can sell.

It’s best to bear in mind that buy and sell prices will be different from the market value, and that traders use the spread to pay their betting provider to open the position for them.

Each of the IG markets has a unique minimum bet size per point. The minimum for a telecoms company, for instance, might be £1 per point. A bet like this will mean the trader will either gain or lose £1 for each point of movement in the telecoms share price. In this case, one point is equal to one penny of movement, meaning if the price of the telecoms company increases by £1, the trader stands to make £100, and vice versa.

Investors can select a daily funded bet (DFB) that will remain open more or less indefinitely, and a lengthier term bet that will end on a specific date – for example, at the end of a quarter.

IG clients can use a stop to close a position when the market reaches a particular level, in order to restrict any potential losses.

Monitoring and Closing Spread Bet Positions

IG provides a number of alerts that help their clients to keep in touch with what's happening in the markets, while the market data pages they provide offer a huge range of insights. These include details of the day's most traded markets, and information about the biggest market movers.

The economic calendar provides clients with a full schedule of macroeconomic events as well as company announcements. Traders can compare actual against estimated data. Signals highlight the availability of potential deals by alerting traders to significant trading patterns or trends.

Whichever dealing platform an investor is using, there will be an ‘open positions’ section they can use to view all their bets. A profit/loss column displays how much the trader is winning or losing on each bet.

As well as the option to use a stop, an investor can decide to take their profit or cut their losses, as long as the market is open. They simply have to click on the market name and then place a bet in the opposite direction. So, for example, if a trader bought telecoms company shares, and wished to close their position, they would now sell them.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

User-Friendly Technology

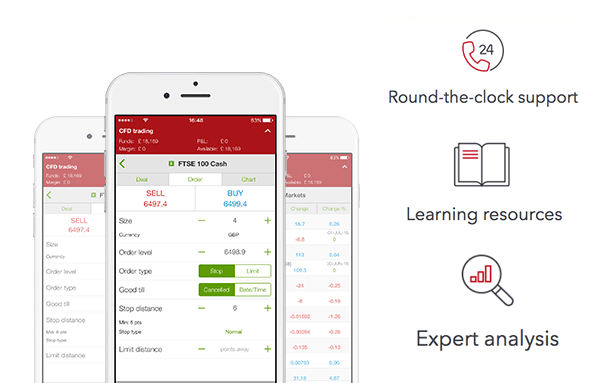

IG offers a number of ways in which clients can trade, and has won awards for the development of its own browser-based website, which has been optimised for use on smartphones and tablets. Products supported on the core platform on all devices include share dealing, spread bets and CFDs. The MetaTrader 4 platform is also an option for CFDs and spread betting, and is enhanced with 18 free add-ons and indicators, plus the Autochartist monitoring tool. The advanced technology at IG means the company fares very well in any broker comparison, due to the wide range of choices that traders have. Clients can customise their dealing as they wish to suit their preferences, and also trade on the move with the company’s in-house mobile and tablet apps.

IG has two further advanced platforms: ProRealTime, suitable for spread bets and CFDs, and L2 Dealer, suitable for shares and CFDs.

Technology is a very important factor in broker choice, and at IG, spread betting is made much easier, thanks to the platforms and tools available. The flexible MT4 platform can be used in a variety of ways, so clients can test trading strategies, close deals and analyse quotes with the help of a wide range of practical tools. MT4 has preset templates to make it easier to read charts and can be further simplified by traders if they wish. This is a very popular platform with traders all over the world, and is accessible in many languages.

CFD Trading and Spread Betting With IG – Which Is Best?

New traders are sometimes confused about the options provided by CFDs and spread bets. IG has some very useful tips on its website and has undertaken a straight comparison between the two to help clients decide which one might suit them best. The IG CFD review and the IG review are featured side by side so the advantages and implications of each one can be monitored, making it easier for clients to decide which one is best for them.

Advantages of CFDs include leveraged access to the markets, plus:

- Clients can offset losses against profits for tax purposes

- Shares can be traded at market prices

- No stamp duty is payable

- There is direct market access (DMA) on shares and forex

- Clients can deal on rising and falling markets

- Clients can use prices based on the underlying market

For spread betting, clients also have leveraged access to the markets, use prices based on the underlying market, and trade free of stamp duty. In addition, the advantages are:

- There is no capital gains tax

- Clients do not pay commission; just the IG spread

- It’s simple to bet in the currency of choice

- Clients have greater control over currency exposure

- Clients can deal on rising and falling markets

IG spread betting fees are likely to be lower than the capital gains tax that may be incurred by CFD trading. However, with CFDs, clients can offset losses against profits.

To find the best spread betting broker, it makes sense to consider spread betting with IG alongside spread betting with other top brokers. Financial websites like our own carry out comparisons all the time, so it’s not difficult to find good independent reports.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Our IG Spread Betting Review – The Bottom Line

There is no doubt that IG is an immensely popular spread betting broker, for several reasons. In fact, IG holds approximately 41% of all active spread betting accounts, and clients enjoy a range of benefits. Fees and charges for spread betting are very competitive and IG does not charge commission on spread betting, although it does do so for CFD trading. The company provides clear information on the spread betting process and promotes user-friendly technology, including multiple platforms and tools. This IG spread betting review is exactly what you need to decide whether to benefit from IG’s features.

Comparisons with other brokers offering spread betting are very favourable and IG makes it easier for clients to understand the differences between CFD trading and spread betting, with useful online guides. This is a global brand that is well established (founded in 1974) and was the first of its kind. IG has clients all over the world across five continents. In 2017, IG won the Best Spread Betting Provider award from Online Personal Wealth Awards.