Some of the old practices, such as personalised stock brokers remain available, but so do the problems associated with them. High fees and lack of control were the main drivers for innovative firms setting up to help the public find new routes into the equity markets. These more direct routes are outlined below.

- Online trading platforms

- Direct Stock Purchase Plan (DSPP)

- Dividend Reinvestment Plan (DRIP)

Online trading platforms

Online trading platforms are places where you can trade yourself. It is worth establishing that modern online trading platforms are about as far from traditional stockbrokers as you can get.

Trading platforms offer a direct route into the markets with features including:

- Only you have access to your account. Login details and passwords are set up and managed by you.

- You have complete control of funds moving into and out of your account.

- If you use a regulated platform (always advised), it will likely be compliant with anti-money laundering rules, which means funds can only be returned to the account from which they came. This reduces the risk of you being defrauded.

- You’ll also have complete control over your trading decisions. Though you can get help from the research and learning tools on offer, or take on trading ‘signals’ from third parties

- A lot of investors prefer to have more control over their account and the neat kicker is that, as you do a lot of the work, the fees at online platforms are much lower than at traditional brokers.

The process of trading shares with an online platform is very straightforward, and they will offer demo accounts these days too in order to practice what you are doing before you get started for real.

Step 1: Register for an account

Demo accounts take moments to open. The eToro version requires little more than an email to set one up. Live trading requires a bit more input, including verification of your address and sharing details of your trading experience. If you don’t get asked questions about your trading aims, then take a step back as the platform you are on might not be regulated.

Step 2. Get familiar with the platform

You may have an idea of what company you want to invest in. If not, you can access the research and learning materials most brokers offer.

Step 3. Develop a clear strategy

Knowing your entry and exit points is key to successful trading. As is having a clear idea on your stop-loss positions. If you’re new to trading and need help developing those skills, then once you’ve registered a wide range of materials becomes available to you.

- The online platform offered by Tickmill provides its clients with third-party research services.

- FCA regulated IG has in-house analysts who provide in-detail reports on firms you might want to buy in to. Their platform supports trading in over 10,000 different shares.

- The input of others is the unique selling point of eToro. Its site includes a forum where traders can share ideas on particular stocks or the market in general.

Step 4. Practice and double-check

Unless your target stock is running away on the back of time-sensitive information, then practising trading is a good next step. Demo accounts allow you to trade virtual funds and risk-free trading will allow you to get a better understanding of the markets and how the platform operates.

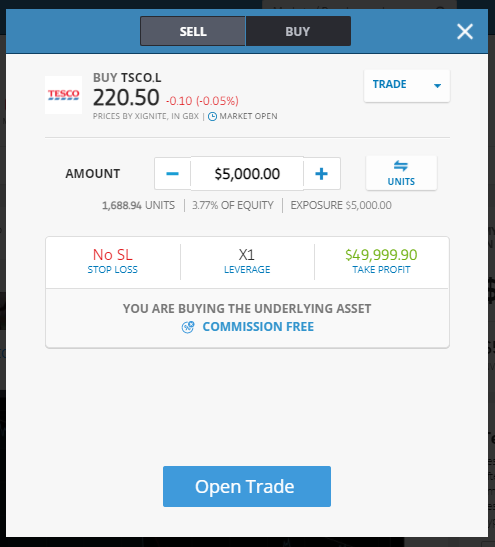

Source: eToro

Buying shares in demo or live accounts simply involves inputting the size of your trade and whether you want to buy or sell. Good habits help your bottom line and get used to checking and double-checking what you think you bought is what you actually bought. This can be done by accessing the ‘Portfolio’ or ‘Open Trades’ section of the site.

Step 5. Sell up and if you want, cash out

As you have complete control over your account, it’s possible to close positions in any shares you have bought which will crystallise any profits or losses on the trade. You can then enter the markets again and buy or sell more shares.

Alternatively, you can wire the funds back from your trading account to the account you used to make the initial funding.

A step-by-step guide on how to buy shares in US car-maker Tesla Inc using an online trading platform can be found here.

Direct Stock Purchase Plan (DSPP)

There are other ways to buy stocks directly. One is a Direct Stock Purchase Plan (DSPP), which involves buying the equities directly from the firm.

There is still a middle-man involved in this process. The firm you want to invest in outsources that role to a Transfer Agent — a firm that keeps a register of shareholders. It’s even possible to set up a direct debit so that your position in the firm grows over time.

There are possible downsides associated with DSPP:

- Fees– Using a Transfer Agent doesn’t mean you avoid fees altogether. As this approach to investing is not widely used, TAs aren’t able to accrue the economies of scale that online brokers do, and so the charge to the customer can be higher than at an online broker.

- Price & Control– Your instruction to buy shares will be processed in accordance with the TA’s ‘execution policy’. There will be little additional input into when to buy and so you can’t guarantee you might not buy at the top of the day. Even relatively stable firms such as Royal Dutch Shell can have significant intra-day price moves, which you might be able to take advantage of if you’re putting the trade on yourself.

- Accessibility – Not all firms offer DSPP programs.

The below chart shows how the intra-day price of oil giant Royal Dutch Shell in one day’s trading session printed prices ranging from 1306p to 1363p. Making a profit from investing is about optimising all opportunities and getting into a position, even a long-term one at the best price of the day can have a considerable impact on Return on Investment (ROI).

Source: IG

Dividend Reinvestment Plan (DRIP)

There is a third way to buy shares without using a broker. This could apply to you if you’re holding a position in a firm that pays dividends and operates a Dividend Reinvestment Plan (DRIP).

In this process, shareholders can elect to receive any dividends in the form of further equity rather than cash. It’s a way of reinvesting dividends back into the company.

One fun fact relating to this is that charts showing phenomenal returns for investors who buy shares often have a footnote stating that ‘dividends were reinvested’. By this, they mean that DRIP was applied where possible and it brings about an effect called ‘compounding’. A chart of the same timeline, but with dividends being paid out as cash, tends to look a lot less impressive.

DRIP schemes are more widely available. Firms like the idea of investors buying more of their stock and not seeing cash drain off their balance sheet. Individual investors can also benefit as there can be tax breaks for shareholders who take dividends in DRIP form rather than cash.

Final thoughts

There are now a range of ways of getting exposure to stocks and shares and trying to benefit from returns on your investment. The revolution that swept through the broker sector has resulted in user-friendly and safe trading platforms being set up, so that money sitting in a bank earning zero interest can be put to use.

Direct investing isn’t for everyone, but the popularity of the approach has resulted in millions of people around the world finding convenient and cost-effective ways to get involved in the markets.

People who read this also read: