The market can only move in two directions, up or down. Given the binary choice, then statistically speaking, tossing a coin and deciding whether to buy or sell should result in a 50–50 win-ratio. It's important to note that the actual win-loss ratio is actually 70–30 against retail traders. European Regulations require regulated brokers to disclose this statistic. While it varies from broker to broker, the question is, how does a 50–50 situation become skewed to 70–30.

One of the main reasons is because traders choose a currency trading strategy into which they cannot devote enough time and resources to make it effective. Then there are the traders who devote too much time to a strategy in the form of over-trading. Finding buy and sell signals where there aren't any will eat away at your cash balance. As the adage in the City goes, ‘some of the best trades you do are the ones you don't do’.

Establishing clear goals, ensuring your forex trading strategy is capable of achieving those goals and applying it with a degree of discipline are the first steps towards shifting the odds in your favour. Whether you are a complete beginner, or an experienced trader looking to find the best forex strategy, do remember that the lessons can be as easily learnt trading virtual funds on a Demo account. Scaling up the risk will help you realise the importance of developing a trading psychology. The best forex traders are adept at managing the emotions of trading and using a Demo account before trading for real can break the learning process down into a two-stage process.

Outlined below are some popular and effective forex trading strategies. They have been graded in terms of how much time they take to operate with the most demanding coming first. There are three useful criteria to keep in mind when comparing and choosing strategies. The time and resources needed to manage it, the trading frequency and the typical holding period.

Scalping

Before going into the details of what ‘scalping entails' it's worth making a quick note on the nature of the Forex markets. The volume of currency transactions put through each day is massive. Some of the currency trades are based on fundamental economic activity such as selling USD to buy EUR for an American customer to buy a Mercedes-Benz car from Germany. Speculators also play their part and even a small GBPAUD trade adds to the volume of trades in the market. This creates market liquidity with millions of buyers and sellers engaging in the same market and trading the same price moves.

Liquidity is an essential consideration because scalping involves trading short-term price moves and works better in more liquid markets.

Scalping is one of the forex trading strategies that works and it involves trading short-term price moves. While there is no particular reason for it being the case, the strategy is typically associated with trades being of a small size. In layman's terms, it's a ‘little bit here and a little bit there’, but lots of it.

Many beginners are drawn to scalping-style forex strategies. They are quite intense and involve a high volume of trades being placed regularly. This results in time being devoted to watching market moves and trading monitors, and as a result, lessons (both good and bad) are quickly learnt.

The aim is to take small profits frequently. That is achieved by opening and closing multiple positions throughout the day. They can be directional, all buys or all sells, but are more likely to be a mix of both. Scalping can be done manually or via an automated trading program where algorithms determine trading instructions. Beginners may, for educational reasons, be drawn to the manual approach but cross-referencing to some of the algo models is also beneficial.

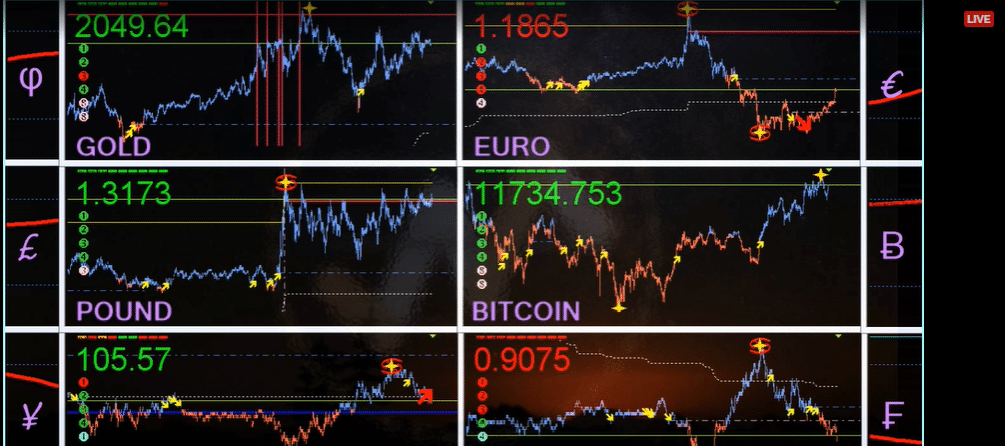

Source: ForexGold

Trading spreads are important. As a result, scalpers congregate in the most liquid markets where the difference between bid and offer prices is generally tighter.

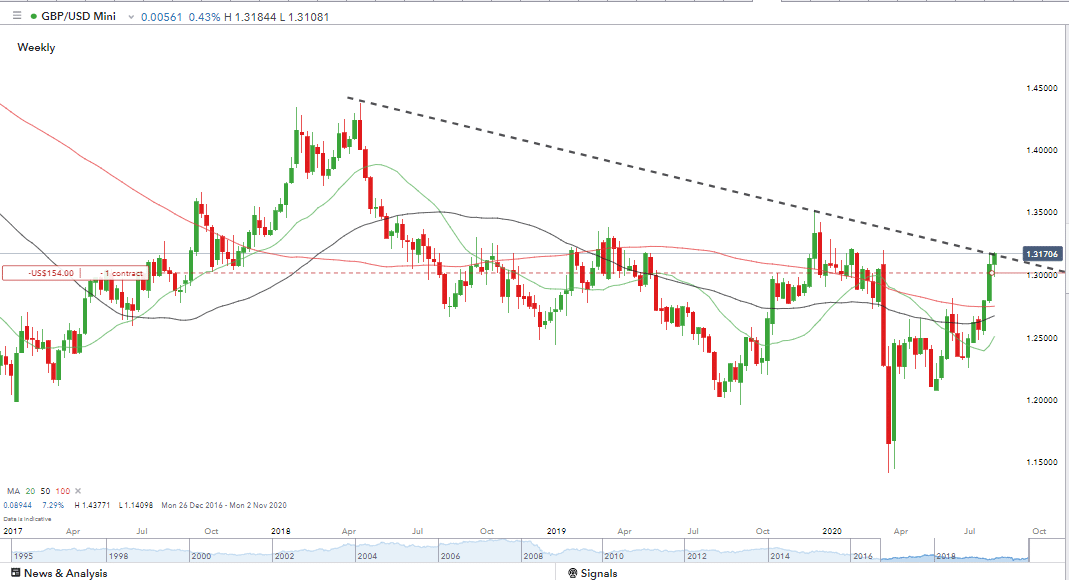

In the below example, GBPUSD has increased in value and met a long-term resistance line.

GBPUSD – weekly candles – scalping strategy

Source: IG

The downward trend line dates from 2018 so is a significant technical indicator. The weekly price chart shows GBPUSD posting a series of green / bullish candles during the last three weeks and price action looks bullish.

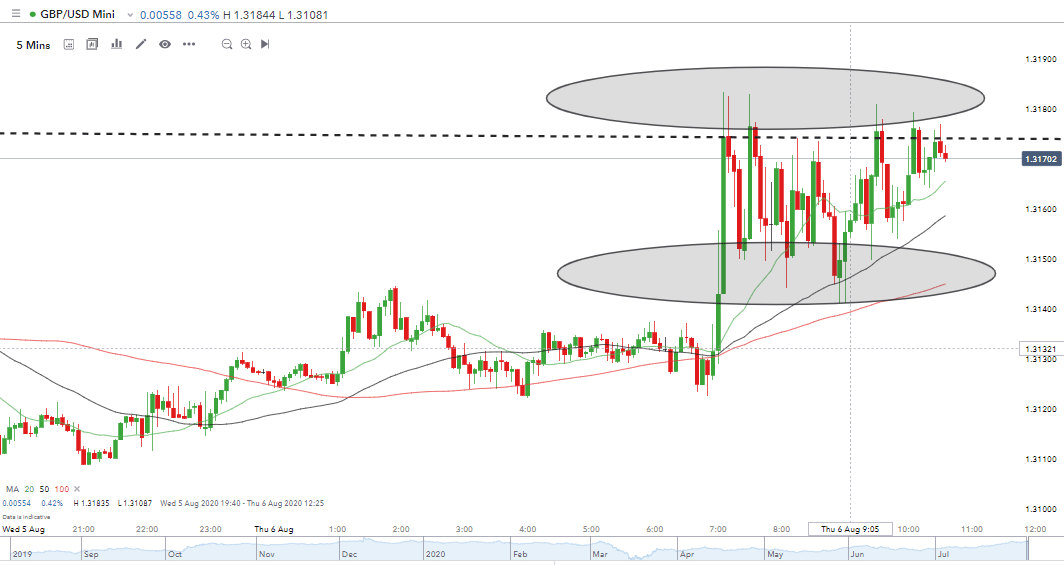

GBPUSD – five minute candles – scalping strategy

Source: IG

Zooming in to the five-minute chart shows price bumping against the downward trend line and falling back. This could be price consolidation before breaking through the resistance level. It could be the moment the upward trend runs out of steam. For scalpers, the longer-term price move is of less interest than the short-term trading opportunities offered by buying in the lower zone and selling in the higher one. Closing out those trades and putting them back on in reverse would have generated profits for more than three hours.

Stop losses would be placed relatively close to trade entry levels meaning that when the break out eventually occurs that losing trade does not erode all the profits made in the earlier period.

Crowd Trading

With so many of the strategies being well known within the market, there are trading opportunities to be had by trading the crowd. Scalping forex strategies, for example, can become crowded and with a lot of traders placing stop-losses near the same level these can be triggered, causing a momentary spike in prices.

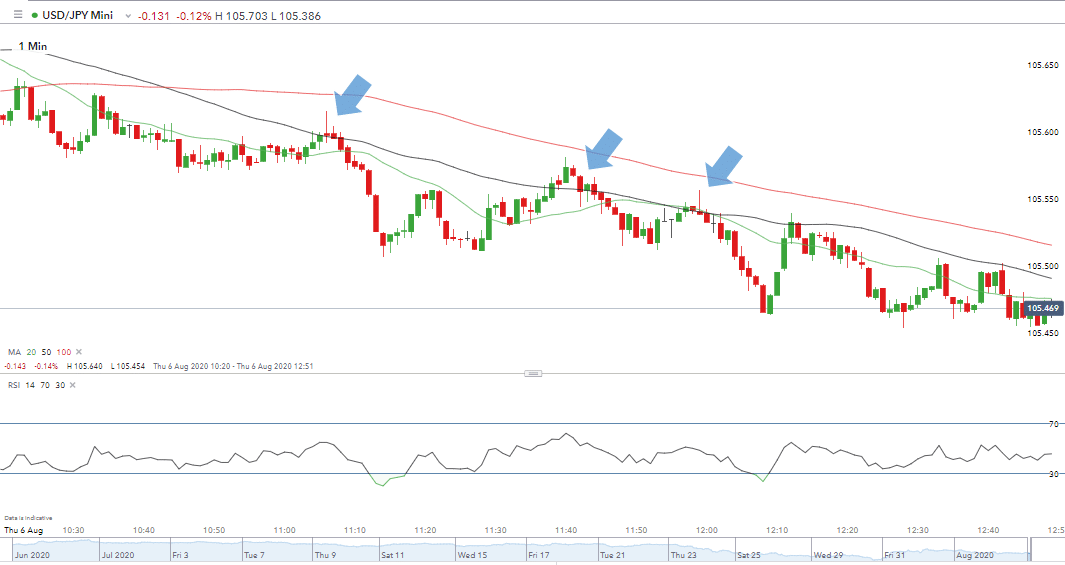

The one-minute candle chart for USDJPY shows scalping opportunities for sell trades where price touches and falls away from the 50 SMA. In three instances, the suggestion that price is going to break out to the upside sees short position stop losses hit and those positions closed out. These trades, of course, represent buying pressure. Maybe not the powerful buying pressure associated with a genuine breakout.

USDJPY – one-minute candles – crowd trading

Source: IG

The domino effect converts to long upper wicks on the candles and an opportunity to sell at the higher prices brought about by stop-losses being triggered. In other words, a chance to scalp the scalpers. It can be traded as a strategy in its own right or incorporated into scalping strategies by running those positions with wider stop losses.

Day Trading

The strictest definition of Day Trading is that all positions are closed out at the end of the trading day — there is no over-night risk. This feature of the strategy developed out of day trading activity in the stock markets. Stocks and shares on exchanges such as the Nasdaq are typically on something near a 9–5 basis. Price moves between the previous day's close and next day's opening price can be significant and are out of an investor's control.

Forex markets operate on a 24/5 basis but the principle of day trading has carried over to the currency markets. The ‘cleaner' approach means that risks can be mitigated.

The strategy, therefore, requires some of your time and resources but there is a degree of flexibility. Day trading strategies can involve putting on one trade at the start of a session and closing it at the end.

Range Trading

Prices don't move in a straight line and Range trading involves trading price movements with the range. This strategy works in markets which are experiencing a period of low volatility. If medium and long-term price direction is yet to be confirmed, price may well ‘trade sideways'.

Technical analysis is the primary tool used with this strategy. In the Scalping strategy detailed above, there was an opportunity for trading the range, which was caused by price meeting a significant trend line resistance level.

Other indicators can also cause price to trade within a range. It could even be the case that markets are quiet, for example, during the summer months when a lot of institutional investors are on holiday. National holidays, particularly in the US, have traditionally been a sign that markets might range while the rest of the world waits for the big hitters in the US to return to work and give the market a sense of direction.

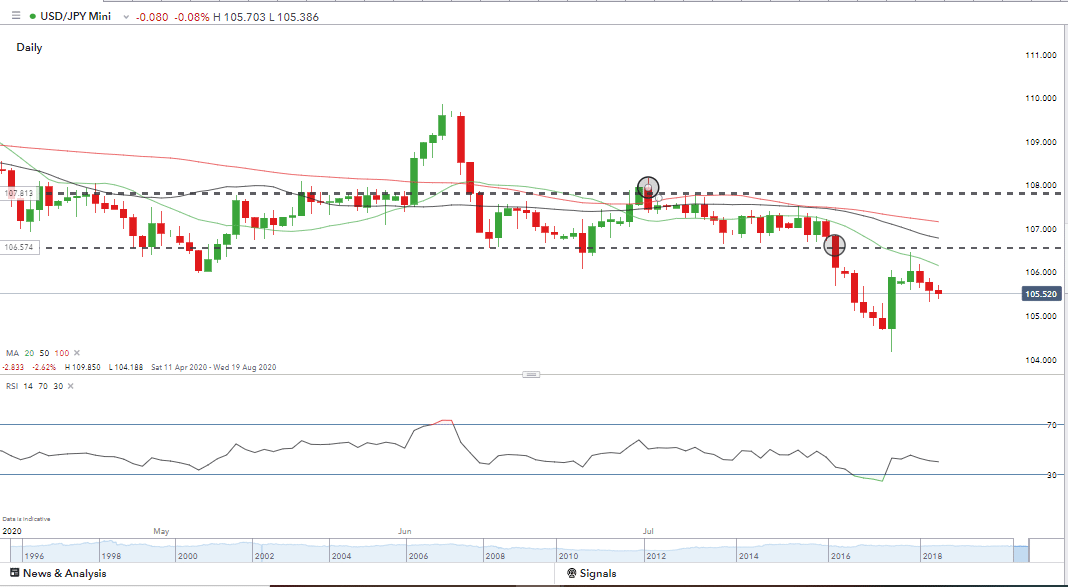

USDJPY – daily candles – range trading off SMA

Source: IG

Range trading can be done using variable time frames. The above chart shows range opportunities that occurred in the Daily candle chart of USDJPY over 24 days.

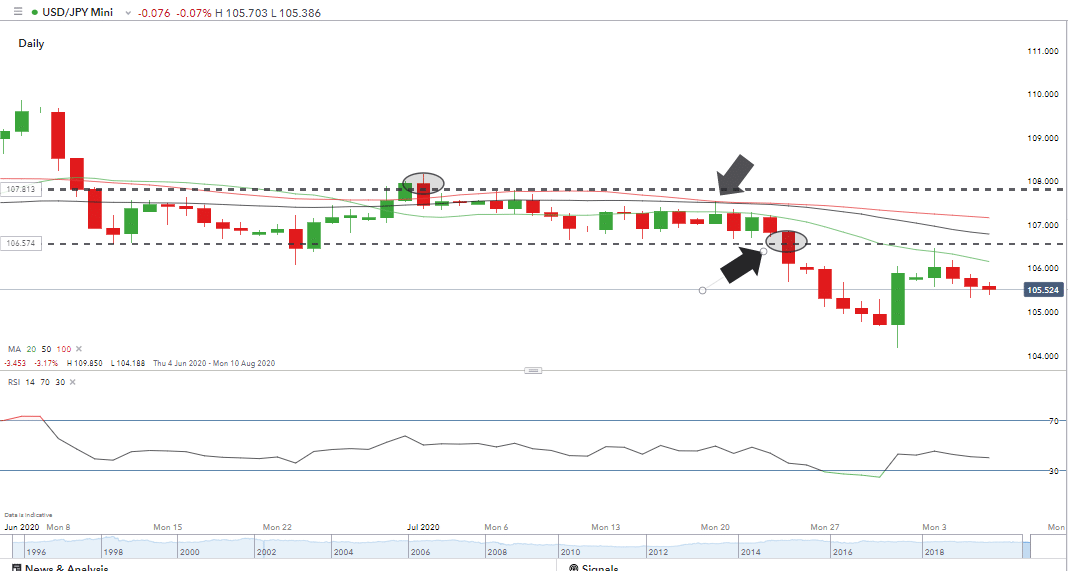

USDJPY – daily candles – range trading off SMA

Source: IG

Zooming in, it is possible to see the upper price level was primarily based on the 100-day SMA. It acted as resistance to upward price movement and a selling opportunity for range traders. The buy signals are less clear-cut and suggest price was simply reverting back to touch the 100 SMA. The lack of direction occurred when price broke out to the downside.

The aim for those following the Range Trading strategy would be to accrue enough profits in the days of range-bound trading and setting stop losses tight enough to protect those when the inevitable break out finally happened.

Trend

One of the most straightforward forex trading strategies involves identifying and following a price trend move. Traders of all levels of experience use it. In fact, the strategies such as Blue Trend operated by hedge fund BlueCrest Capital made billions of dollars of profits for investors during the great financial crisis of 2008. The firm's computer algorithms were identifying the medium and long-term trends and riding them down and then back up again.

It is possible to trade short-term trends, using a minute-candle chart would be as effective as using a daily one. However, the strategy is associated with a more extended holding period.

One of the basic forex tips relating to trend-spotting is ‘higher-highs and higher lows' indicate a bull market and vice versa for a bearish one.

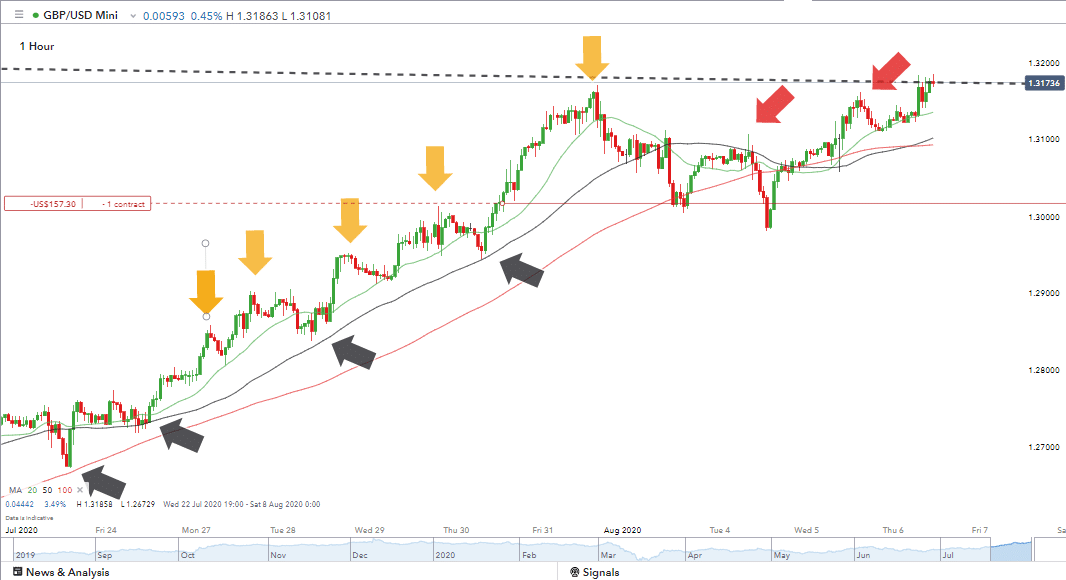

The hourly candle-chart for GBPUSD shows a series of higher highs and higher lows (yellow and black arrows) right up to whichever of the two red candles you want to take as a lower high.

GBPUSD – hourly candles – trend – higher highs and higher lows

Source: IG

Stop-losses tend to be wider, to ensure you aren't kicked out of a position before it gets going. Trailing stop losses are also a feature of the market, so profits aren't given up. After all, as the saying goes, the trend is your friend until the bend in the end.

Beginners often make the error of trading retracements, the short-term reversals in a longer-term trend pattern. Reversal trading can be profitable but it is worth developing the skills needed to go with the trend rather than against it.

Fundamentals

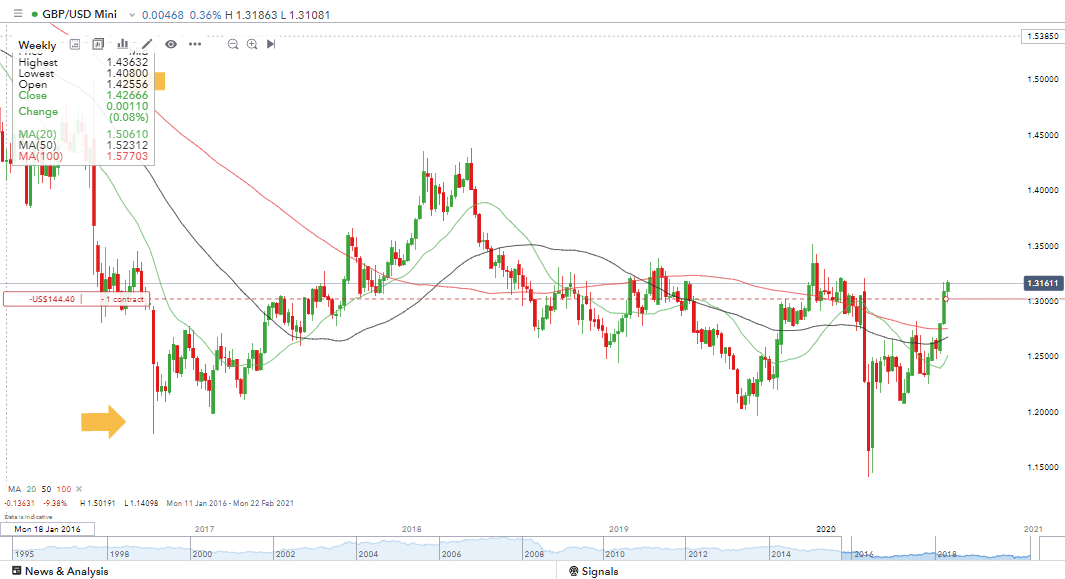

Recent geopolitical events such as Brexit illustrate how societal shocks can move forex prices. The GBPUSD forex rate famously tanked after the surprise result of the 2016 Brexit referendum result. Fundamentals, and news based trading remains hugely relevant.

GBPUSD – weekly candles – Brexit

Source: IG

Technical analysis can be useful for exiting such trades, once markets have calmed down, but less so for entering into them.

Carry Trading

Carry Trading involves anticipating forex moves based on the interest rate policies of individual central banks. If the Bank of Japan is believed to be about to lower interest rates, then speculative funds will move out of the Yen and into other currencies which offer a better rate of interest.

The Bank of Japan currently operates a negative interest rate of -0.1% while the Reserve Bank of Australia is running an interest rate of 0.25%. The Japanese economy is suffering from long-term deflationary pressures while sectors of the Australian economy, notably the property market, is seen as posing an inflationary risk.

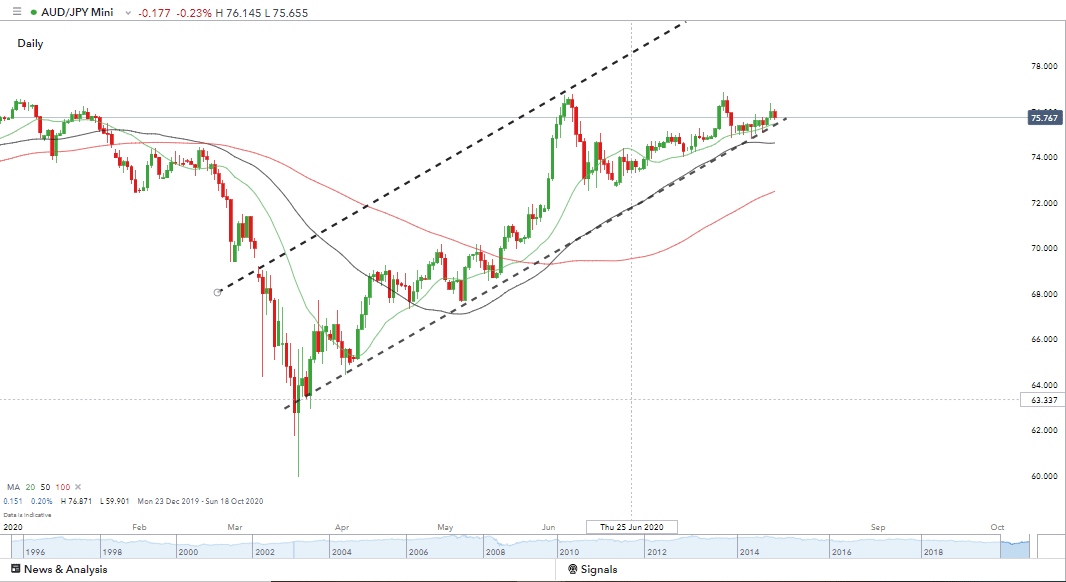

AUDJPY – daily candles – carry trade

Source: IG

The intermittent nature of central bank announcements means this is a strategy with a longer holding period. Some positions are held for weeks, months and even years. That allows the flow of funds from one country to move to another and to be reflected in a forex rate move. If the account you hold your long position in pays interest on credit balances, there is, of course, an opportunity to earn a second passive income from that part of the strategy as well.

Copy Trading

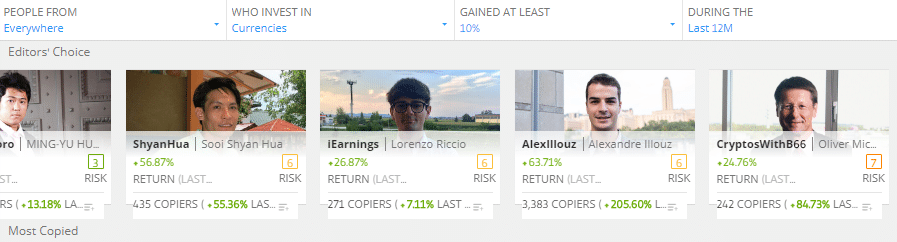

The last strategy is a reminder of the need for them to be compatible with your circumstances. Copy Trading involves taking the trade instructions of other traders and applying them to your account. An increasingly popular form of trading, it can be the most ‘hands-off' approach.

Source: eToro

A lot of the strategies use technical analysis and this may not be as effective if euphoria takes over a market. If FOMO and ‘buy it because it's going up' take over, then moving averages, trend lines and oscillators become weaker indicators.

Whichever methodology you choose, be consistent and be sure your method is adaptive. Your approach should keep up with the changing dynamics of a market. While you may have a preferred strategy if market conditions aren't appropriate for it, then your bottom line will probably be helped by you not trading at all or by using a different strategy.