Finding a trading strategy that provides you with a market edge can be an extremely difficult task to conquer, with various factors to consider. However, for those who prefer fast-paced action and the potential for swift returns, then the 1-minute scalping strategy might be the one for you.

In this article, we'll explore some of the top 1-minute scalping trading strategies to help you make quick, informed decisions in the fast-paced world of trading. Stay tuned to discover which approach best suits your trading style and goals.

Check out our 1-minute scalping guide video for a brief overview of the strategies explained below

YOUR CAPITAL IS AT RISK

Table of contents

What Is Scalping and How Does It Work?

Scalping is a trading style where a trader capitalises and profits from small price movements. The goal of scalping is to take as many small profits as possible. The trades are usually held for a short period, and the trader executing a scalping strategy will not hold positions overnight.

Scalping requires a very strict exit strategy, as one large loss could eliminate the many small gains you may have made.

The main premises of scalping are:

Lessened exposure limits risk: A brief exposure to the market diminishes the probability of running into an adverse event.

Smaller moves are easier to obtain: A bigger imbalance of supply and demand is needed to warrant bigger price changes. For example, it is easier for a stock to make a $0.01 move than it is to make a $1 move.

Smaller moves are more frequent than larger ones: Even during relatively quiet markets, there are many small movements a scalper can exploit.

To understand scalping further, let us take a look at two scalping strategies:

Scalping Strategy 1

This 1-minute scalping strategy is really easy to learn and can be extremely profitable if used correctly.

Here's what you need to get started:

Asset: The asset you are trading should be trending.

Time frame: Of course, your chart should be set to a one-minute time frame

Indicators: You'll need to use the Stochastic 5, 3, 3, and the 50 EMA/100 EMA

Sessions: Trade in the highly volatile New York and London trading sessions

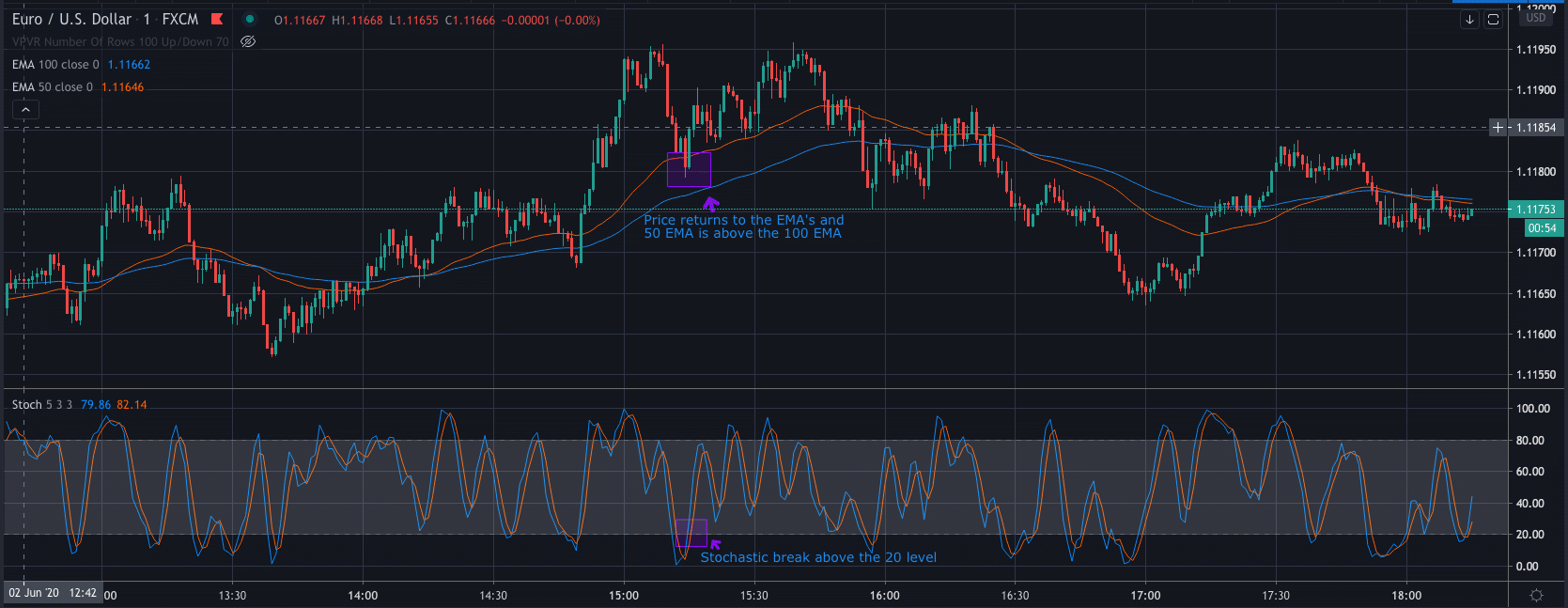

How To Enter A Long Position

Let's focus on how to enter a long position on the strategy. A buy position in the scalping strategy will need to meet the following criteria:

- To enter a buy position, we first need to wait until the 50 EMA (Exponential Moving Average) is above the 100 EMA.

- Secondly, we need to wait for the price action to return to the EMA's.

- Finally, the Stochastic Oscillator must break above the 20 level.

If all three of these have occurred, there is now an opportunity to open a buy order (long position).

How To Enter A Short Position

To enter a short position and sell, you will need the following to happen:

- The 50 EMA needs to be under the 100 EMA.

- Similar to the buy entry, you should wait for the price to reach the EMAs.

- The Stochastic Oscillator must then break below the 80 level before you open your sell order.

Stop-Loss & Take-Profit Levels

The SL and TP levels for this strategy are set out below:

Take-profit: The ideal take-profit level for this strategy is 8-12 pips from your entry.

Stop-loss: The best place for a stop-loss is around two to three pips under or above the most recent swing level.

YOUR CAPITAL IS AT RISK

Scalping Strategy 2

The next strategy is easier to understand and follow, so let's get straight into what you will need to make it work:

Asset: Assets with a lot of volatility ( e.g.currency pair such as the EUR/USD)

Time frame: For this scalping strategy, you will need to use both the thirty-minute and one-minute charts.

Indicators: For this strategy, you will only need the Bollinger band set up.

Sessions: Again, the ideal sessions for this strategy are the New York and London sessions.

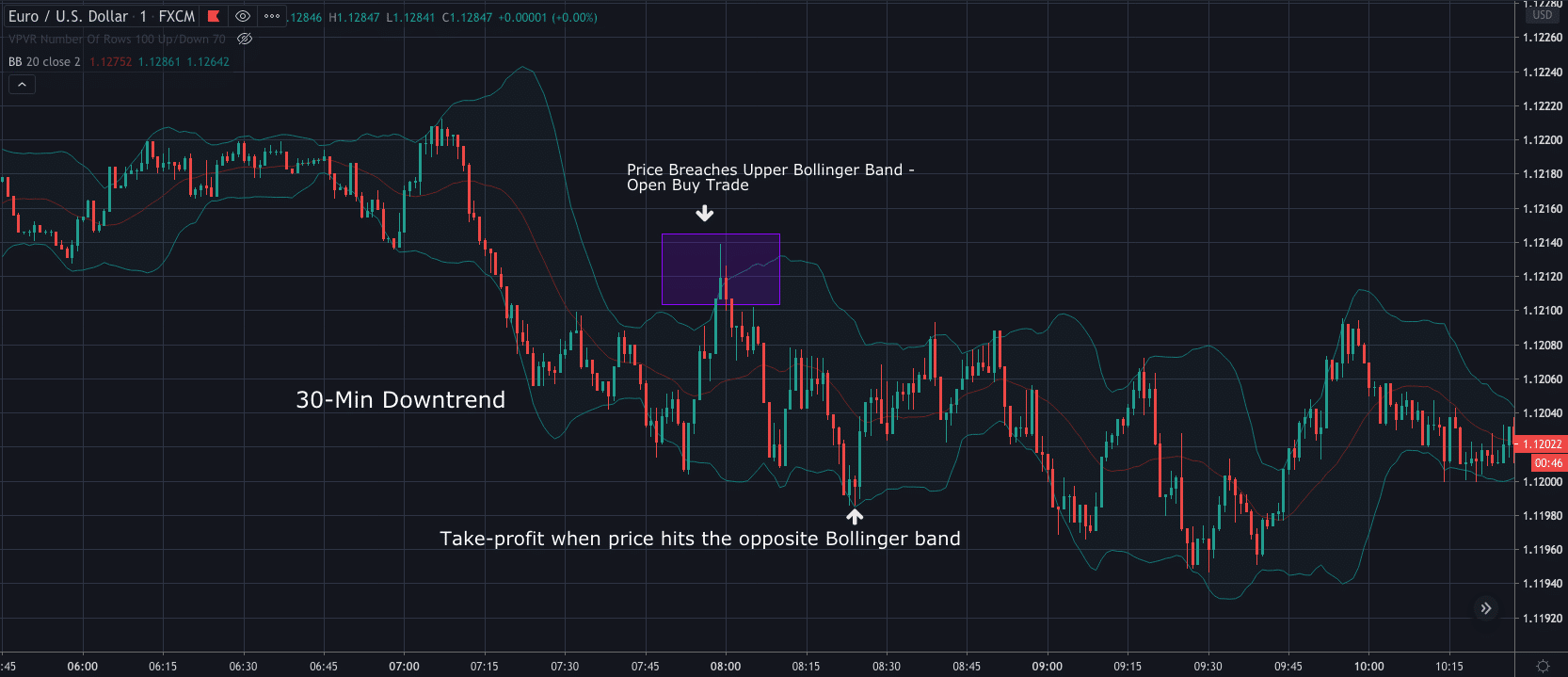

How To Enter A Long Or Short Position

To enter a position using this strategy, there are only two things you need to be aware of, so I have grouped them into one.

- Firstly, you need to determine the trend and market conditions using the 30-minute timeframe

- If the price is in an uptrend, then you enter a buy position once the price has breached the lower Bollinger band.

- If the price is in a downtrend, then you enter a sell position once the price has breached the upper Bollinger band.

Take-Profit & Stop-Loss Levels

Take-Profit: When using Bollinger bands as a trading strategy, it's important to note that profit targets should be based on where the price touches the opposite band, as seen in the picture.

Stop Loss: The stop-loss level should be set 2-3 pips above or below the candle that broke the band.

YOUR CAPITAL IS AT RISK

Advantages & Disadvantages of 1-Minute Scalping Strategies

| Advantages of Scalping | Disadvantages of Scalping |

|---|---|

| Minimised risk as the trade is only open for a short period | Novice scalpers might be at risk of losing if they haven't carried out thorough backtesting |

| The trading plans allow for more frequent trades as they are smaller in size | Keeping a positive risk-to-reward ratio can be challenging |

| Finally, the strategies provide many potential entries throughout the day | There is a high risk of many consecutive losses |

| These strategies require you to dedicate a significant amount of time in front of the charts |

Attributes of a Successful Scalper

On the surface, scalping strategies appear simple and more lucrative than swing trading due to the fact that traders have the ability to collect a full day’s profit in just a few minutes.

In reality, the successful implementation of 1-minute scalping strategies can create unexpected challenges when it comes to both the technical and mental aspects of trading. Here are some key characteristics successful scalping traders have:

- A high level of discipline, following a strict trading plan

- Be willing to follow the parameters of a trading system at all times

- Scalpers are often required to make important decisions without hesitating

- At the same time, scalpers are flexible and recognise the differences between a trade that’s working and one that isn’t.

In the end, a successful scalper is a person that’s able to play to the strengths of the market and exit trades at highly favourable moments.