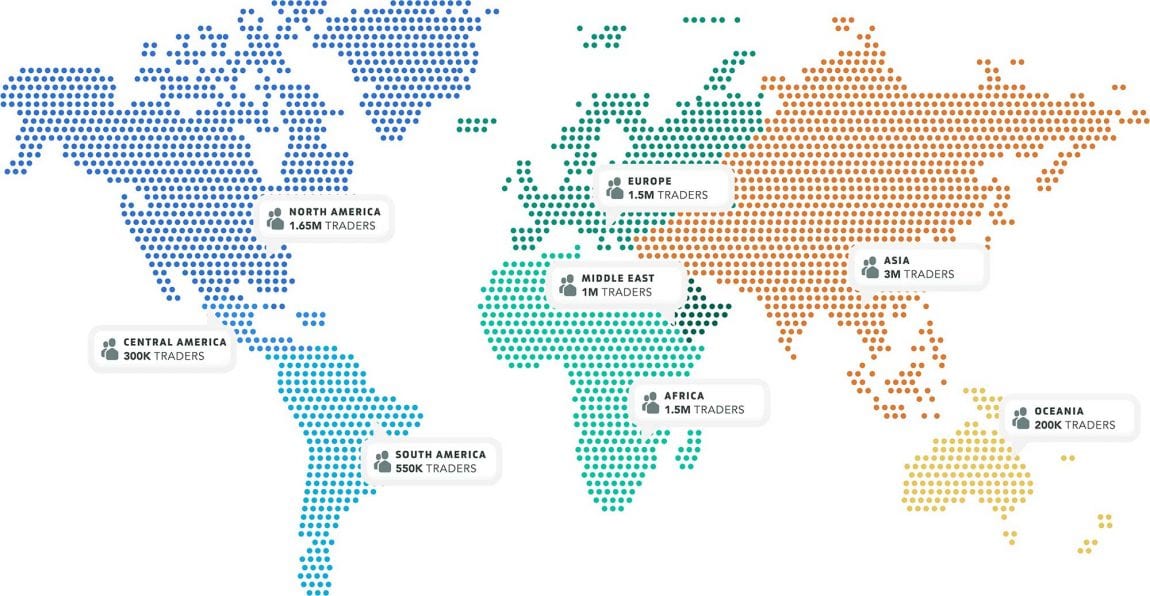

When most people think about the concept of “financial trading,” asset classes like stocks and bonds tend to receive most of the discussion. However, the foreign exchange market (or forex) has risen steadily in popularity over the last five decades and is now composed of close to 10 million professional forex traders positioned all around the globe:

Today, the foreign exchange market is the largest financial market in the world, with an average trading volume of more than $5 trillion each day. Banks and other large financial institutions are responsible for a substantial portion of this incredible figure, significant advancements in trading software have opened these markets to retail traders everywhere. Rising competition amongst forex brokers has led to the development of individualized trading platforms that are easy to use, which is why so many people around the world are becoming involved with online trading.

Related Articles

Before we start, take a look at out other forex trading articles

- Compare Forex Brokers

- Read our Admiral Markets review

- Get the latest trading news from our experts

Recent statistics have shown that approximately 9.6 million people are actively trading online, which is about one in every 780 people. Where are the world’s online traders? Similar to the cryptocurrency industry, the foreign exchange market is truly global in nature and many large forex brokers have permission to operate in several different countries. Large concentrations of trading activity can be found in the United Kingdom and the United States. However, emerging concentrations of trading activity have also been seen in the Middle East and Asia, which suggests that the modern trading environment’s centers have expanded in reach.

Recent market figures show that roughly one-third of the online trading community is now based in the Middle East or Asia. Online trading platforms managed to shift focus from traditional financial hubs in New York and London and made it easier for anyone looking to access the financial markets. All combined, Asia and the Middle East have added over a million more than Northern America and Europe.

Rising Digital Trading Capabilities on the Web

Market figures are more surprising when we consider the ratio of new traders in countries where internet usage is less prevalent. Today, an estimated 3.8 billion people use the internet, which means that about one out of every 400 people has some experience trading online. In the United States, about one out of every 210 people has experience trading online. In Europe, research studies show that 1.5 million people have traded online (out of about 650 million internet users), which means that one in every 435 people in the region has some prior experience with online trading.

In the United Kingdom, there are approximately 46 million people that use the internet and over 280,000 financial traders with experience using online market platforms. This indicates that the region has at least one online traders out of every 165 internet users. Overall, these trends show that Great Britain has the highest ratio of online traders when compared to any other country in Europe.

In Asia, we find the largest total number of traders, as 3.2 million people have experience trading in the financial markets using an online brokerage platform. The region’s collective number of internet users has risen above 1.9 billion, so it’s not much of a surprise that online trading has become very popular in the region. On a per-user basis, this means one in every 600 internet users has past experience trading online and broader trends suggest that this figure could grow significantly over the next few years.

In Africa, there are 1.5 million online traders amongst the nearly 400 million people that are active internet users. This indicates a high ratio of online traders out of total internet users (roughly one in every 300 users). An even higher proportion of online traders amongst total internet users can be found in the highest in the Middle East, where one out of every 150 people that use the internet in the region has experience with financial trading platforms. In both of these regions, the long-term consensus projections amongst analysts suggest that these figures could grow substantially over the next decade.

Why Has Forex Trading Become So Popular?

Recent changes in market regulations throughout Europe have allowed easier access to leveraged products (i.e. CFDs and forex instruments), and this may have contributed to rising sentiment with respect to digital trading mechanisms. For example, in Holland, Belgium, and France trading with leverage is no longer permitted. In Cyprus, market regulator CySEC has actually introduced additional controls that make higher leverage levels more difficult to encounter the risks commonly associated with excessive levels of trading leverage. In this case, traders can only trade using leverage after it is specifically requested and traders are able to demonstrate a level of experience that is suitable and appropriate for margin positions.

In the United Kingdom, the Financial Conduct Authority (or FCA) has held discussions and consulted with experts on the use of financial leverage when trading in active markets. However, the FCA hasn’t yet enforced rule changes in this regard. Market traders in the United Kingdom are still able to take advantage of the benefits of trading on margin. Essentially, traders are able to use leverage to magnify position exposure. When traders open a trading account using a small deposit size, currency movements can have a limited impact on the ability to generate profits. However, the use of margin and leverage can remove many of these obstacles and enable traders to command large position sizes even with a relatively small capital outlay.

In Europe, other protective measures have been implemented by the German regulator BaFin, which initiated negative balance protection. These type of restrictions place added responsibilities on the shoulders of market trading brokers, which must install mechanisms to prevent market losses that are larger than the money that has been deposited into a trading account. Given the region’s highly transparent markets, ease of access, and favourable regulatory environment, it’s not entirely surprising that the United Kingdom has emerged as one of the world’s main hubs for forex traders. What is also clear is that financial market trading has grown strongly in terms of its popularity amongst global internet users and that there are many positive trends that support the outlook for continued growth and popularity in the future.

Continued Improvements in Trading Technology

These days, traders only need a stable internet connection and a reliable market platform in order to begin building wealth through investments in foreign exchange. Since many brokers offer platforms that are available as mobile apps, traders can even take their trades on the go while using a smartphone. From a trading management perspective, this is an excellent approach for traders that tend to have active investment styles (i.e. day trading or swing trading). Of course, not al trading styles will fall into these categories but it remains clear that better access to mobile technology has made it easier for forex brokers to connect with a growing number of traders around the world.

While the number of people trading in the online marketplace has made an impressive rise, most of the projections amongst market analysts suggest that the upward trend is likely to continue at an even faster pace. What many new traders have come to realize is the fact that financial trading really isn’t that much different than any of the other buying and selling transactions that consumers conduct on a daily basis. The only real difference is the massive potential for profit, which can be enhanced even further when investors are trading on margin. In this way, global traders are realizing that wealth building and plans for future retirement can often depend heavily on the success of these types of strategies.

Looking at each of these numbers, we can see that the world of modern trading is still in its earliest stages. While impressive developments continue to characterize the trading technology platforms at are made available by the market’s biggest financial brokers, it looks likely that more and more people will develop an interest in the ability to trade online and generate wealth over time. At this stage, the trends are clear and investors are no longer restricted to establishing their positions on the trading floor of a stock exchange in a major city. As long as these trends continue, we should see greater availabilities open up to market traders based anywhere in the world.

Of course, the proper level of research remains a vital part of the process for anyone that is looking to begin a career trading in the financial markets. For more information on the best ways to learn about finance, economics, and the exciting world of online market trading, visit AskTraders.com and read the up-to-date market commentaries available every asset class that’s currently available. Financial market educational tutorials can take each trader through the processes of conducting the proper market analysis and placing live-money trades. Given the rising popularity of each of these in-depth investment strategies, it’s likely that traders will find the information to be valuable as expert economic analysis successfully guides new traders and generates favourable returns over time.