Admiral Markets was founded in 2001 and is viewed as a prominent Forex and CFD broker, operating in over 40 countries. It is viewed as a safe broker, being regulated in four countries, notably including by the FCA in the UK. The broker offers their own native platform as well as Meta Trader, and stands out amongst these brokers with its strong offerings of education, research and add-on tools (Trading Central, Dow Jones News and Acuity Trading).

In this review, we will look at regulation, account types, fees and more.

Account options

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:30 | Low |

Admiral Markets offers clients access to a wide mix of currency pairs, competing with other notable brokers, offering majors, minors, and emerging markets. In full, there are 50 currency pairs to trade, with leverage rates of up to 1:30 for Retail Clients (and 1:500 for Professional Clients).

The minimum deposit to use MT4 is 250 EUR/USD/GBP/CHF and the minimum deposit to use MT5 is 100 EUR/USD/GBP/CHF.

Trading spreads start from as low as 0 pips (yes zero), with some notable trading features such negative balance protection (which helps traders minimise their market risk by preventing their accounts from sliding into a negative amount).

CFD

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:30 | Low |

If you are focused on equity markets, then you can trade CFDs on a total of 44 stock market averages (19 cash indices and 25 index futures). Plus, there are CFDs on over 3400 individual stocks from an assortment of global markets. All of the major stock exchanges are available, include the New York Stock Exchange (NYSE), London Stock Exchange (LSE) and Tokyo Stock Exchange (TSE). Leverage of up to 1:5 is available for retail clients.

With Admiral Markets, you can also trade CFDs on the popular commodities with leverage up to 1:20 for Retail Clients. In total, there are 28 commodities to choose from, including: Agriculture (7), Commodity Futures (11), Energies (4) and Metals (6).

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:5 | Low |

Admiral Markets offers trading in individual stock CFDs, plus on the actual stocks themselves and ETFs via the MT5 Invest account. There are over 3400 stock CFDs available to trade across global markets, including the New York Stock Exchange (NYSE), London Stock Exchange (LSE) and Tokyo Stock Exchange (TSE). Retail clients have access of up to 1:5 leverage on the individual stock CFDs.

ETF

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £250 | 500 | 1:5 | Low |

CDFs on Crypto

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Many | 1:2 | Low |

If you want to trade cryptocurrencies with Admiral Markets, you will have access to 32 cryptocurrencies CFDs. This is made up of 22 cryptocurrency pairs versus fiat currencies and 10 cryptocurrency cross pairs (cryptocurrency versus cryptocurrency). For Retail Clients the leverage for cryptocurrencies is 1:2 with the option to go long or short on any cryptocurrency CFD. In addition to popular cryptocurrencies such as Bitcoin, Ethereum and Ripple, Admiral Markets also supports altcoins such as Dash, Ether and Stellar.

Direct investing in and actual ownership of cryptocurrencies is not offered.

What did our traders think after reviewing the key criteria?

Trust and Regulation

Admiral Markets is authorised and regulated by two of the world’s leading financial regulatory bodies, ensuring a safe trading experience for its clients. They are authorised in the UK by the Financial Conduct Authority (FCA). They are also regulated in Cyprus and Estonia.

| Trust and regulation | Admiral Markets |

| Regulated in how many countries | 4 |

| Year established | 2001 |

| Publicly traded | N |

These regulators require Admiral Markets to fully segregate traders’ accounts from company funds, adhere to strict anti-money laundering and capital requirements, comply with ‘know your client’ procedures, as well as a host of other stringent measures designed to protect traders. Admiral Markets is not a publicly listed company.

Offering of Tradeable Products

As mentioned above, the product offering from Admiral Markets includes 50 currency pairs, 44 stock market averages, over 3400 individual stock CFDs, 28 commodities and 32 cryptocurrencies CFDs. This is a strong offering when compared to many of their peers.

Via the MT5 Invest account it is also possible to invest directly into 4000 stocks and also between 200-500 ETFs (dependent on whether you are a retail or professional client).

Admiral Markets do not, however, offer trading in or actual ownership of cryptocurrencies.

| Product offering | Admiral Markets |

| How many Forex Pairs offered | 50 |

| How many Stock Indices offered | 44 |

| How many Individual stocks offered | 3400 |

| How many Bonds offered | 2 |

| How many Commodities offered | 28 |

| How many Crypto pairs offered | 32 |

Fees/Commissions

There is no account opening fee, but Admiral Markets does charge an inactivity fee of €10 per month if you have not made any transactions in the previous 24 months. Transfers to bank accounts of the same base currency are not charged, but you will pay a 1% exchange fee to transfer funds to a bank account with a different base currency. Most accounts can make one free withdrawal requests each month, although as mentioned some wire transfer withdrawals will involve modest charges.

| Fees/ Commissions | Admiral Markets |

| EUR/USD average spread | 0.6 pips |

| EUR/USD minimum spread | 0.0 pips |

| Minimum account opening deposit | 250 EUR, 250 USD, 250 GBP, 250 CHF |

| Withdrawal Fee | Yes |

| Inactivity Fee | Yes |

The MT4 and MT5 accounts have no commission, but as with most CFD brokers, clients will pay a dealing spread when they enter or exit a trade. Spreads are very competitive due to Admiral Markets having a STP (Straight Through Processing model), which gives its clients direct market access. Admiral Markets provides agency execution meaning it doesn’t have a dealing desk or take internal risk.

The Admiral Markets MT5 Trade account (or MT5 Invest for exchange-traded stocks) provides the broadest number of markets to trade, whereas those focused on just on Forex may gravitate to the Admiral Zero MT4 or MT 5 accounts. The lowest all-in cost (spreads plus any commission) are found in the Admiral Zero accounts, but which have a far smaller range of tradeable markets.

Unless you have an Islamic account, you may be charged rollovers (or swaps) fees. This should be taken into consideration by traders who hold trades overnight. These fees are levied when holding a long position on the lower interest rate currency in a pair overnight and also on open overnight positions on various non-Forex CFDs.

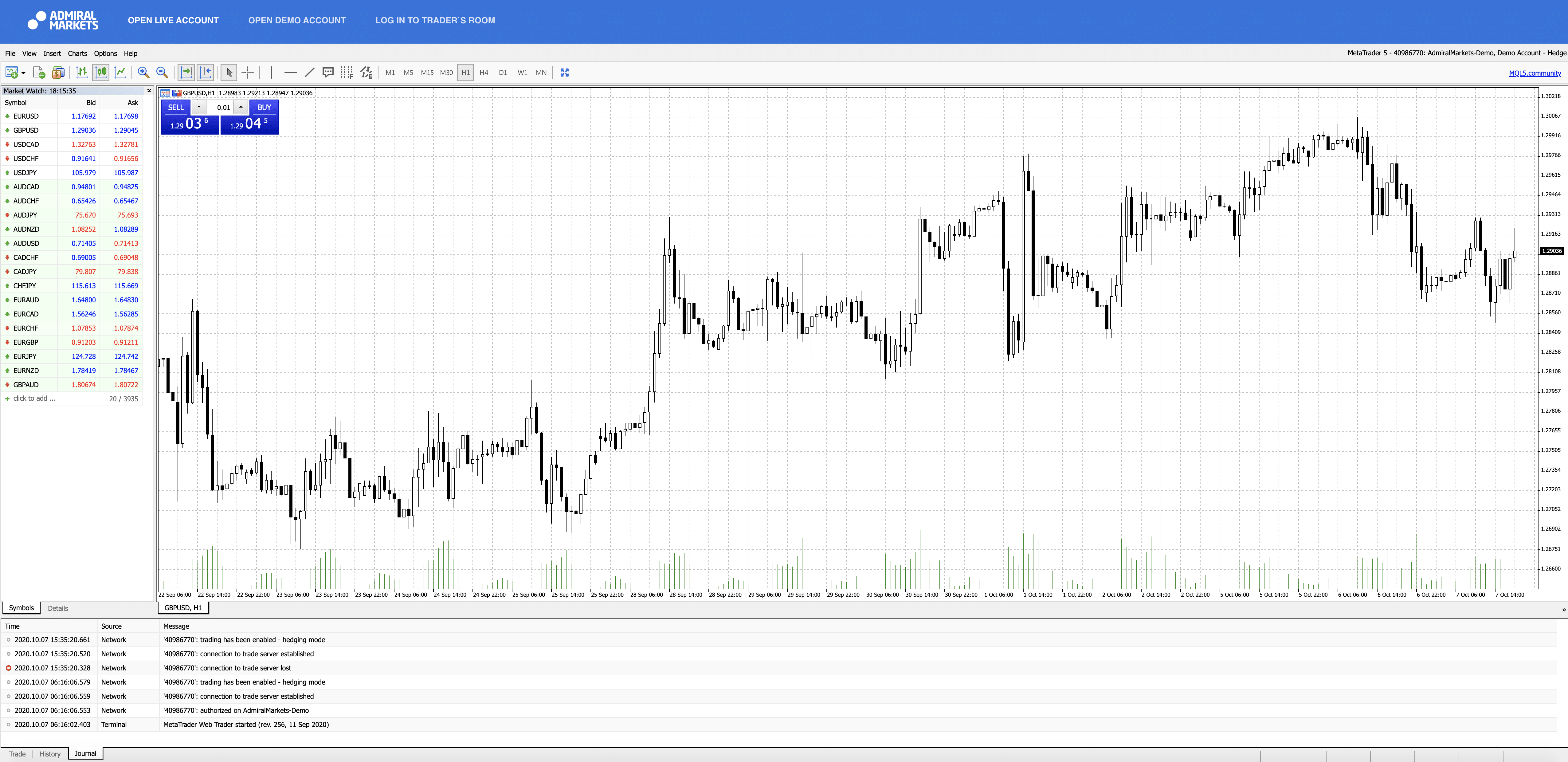

Trading Platform

Admiral Markets is a MetaTrader broker and offers the full suite of MetaTrader platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Both trading platforms are available for download on Windows and OS X and are also available as a web-based client (MT WebTrader) that you can use in your browser.

Admiral Markets now also offers their own native web trading platform along with a mobile app.

In addition, both the MT4 and MT5 platforms have a free MetaTrader Supreme Edition plugin that extends the platform’s capabilities and works on both live and demo accounts. The MetaTrader Supreme Edition plugin includes news events on the chart, and various other trading and analysis widget.

Admiral Markets also offer volatility protection settings, which include:

- Limit maximum price slippage on market and stop orders.

- Limit or fully avoid losses on pending orders falling into price gaps.

- Get filled on larger orders by enabling the partial fills and allowing to fill your orders part by part.

- Execute limit orders and take-profits even on instant price spikes by transmitting them as market orders.

- Avoid order activation due to spread widening, when there`s no actual movement in market.

| Platform feature | Admiral Markets |

| Own platform | Yes |

| Demo account offered | Yes |

| MT4 | Yes |

| MT5 | Yes |

| cTrader | No |

| Chart Indicators | 53 |

| Chart drawing tools | 33 |

Mobile Offering

Admiral Markets do offer their own mobile app for both iOS and Android. The app is fairly basic, offering a summary/ watchlist page, plus the ability to trade and also trading, positions and orders pages. There are also contact options from within the app, via live chat, email and phone.

Both the MT4 and MT5 apps are also available for both Android and iOS for use with Admiral Markets. Although the normal functionality for these apps is available Admiral Markets when using with Admiral Markets, which is useful for doing analysis on the go, the extras from the MetaTrader Supreme Edition plugin that are available with the desktop platform, are not on offer for the mobile version.

| Mobile feature | Admiral Markets |

| Own Apple app | Yes |

| Own Android app | Yes |

| Third party app (MT4/MT5/other) | Yes |

Education

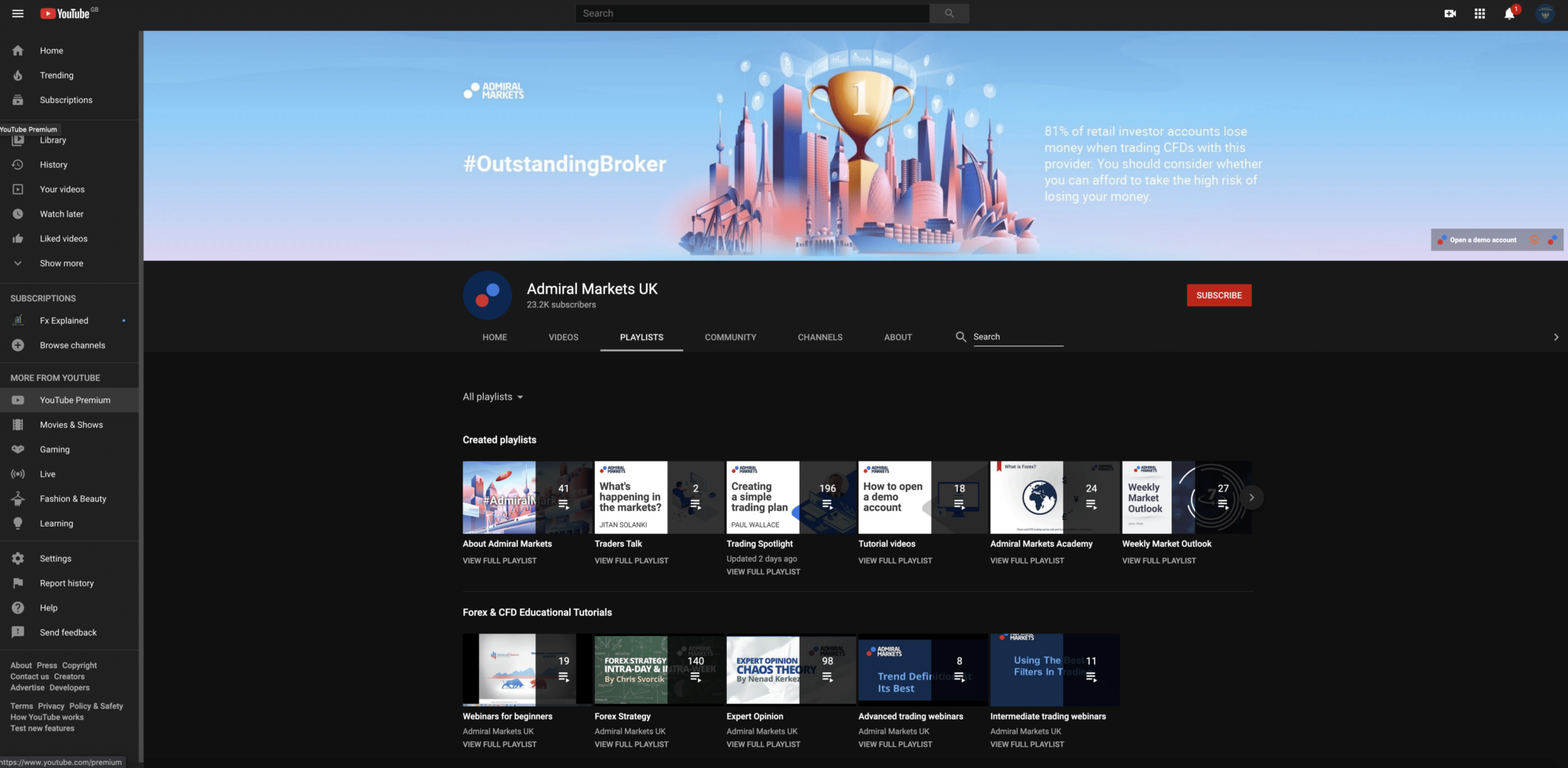

When it comes to education and learning content, Admiral Markets offer substantial educational help for newbie traders. In addition, the content also helps intermediate level traders, and even offers some more advanced material for traders who have experience.

Moreover, the Admiral Markets educational suite delivers this educational content via webinars and seminars, articles, how-to video tutorials, e-books and a guide to risk management.

Aimed specifically at the beginner trader, they have the 21-day “Zero to Hero” trading course and a forex 101 online course. Their YouTube channel has a wealth of educational videos

on CFD and Forex trading.

| Education feature | Admiral Markets |

| Webinars | Yes |

| Videos | Yes |

| Community Forums | Yes |

| Education Organized by Experience Level | Yes |

| Education Organized by Topic | Yes |

| Education Organized by Type | Yes |

| Has Education – Forex | Yes |

| Has Education – Stock Indices | Yes |

| Has Education – Individual Stocks | No |

| Has Education – Bonds | No |

| Has Education – Commodities | Yes |

| Has Education – Crypto | Yes |

| Investor Dictionary/ Glossary | Yes |

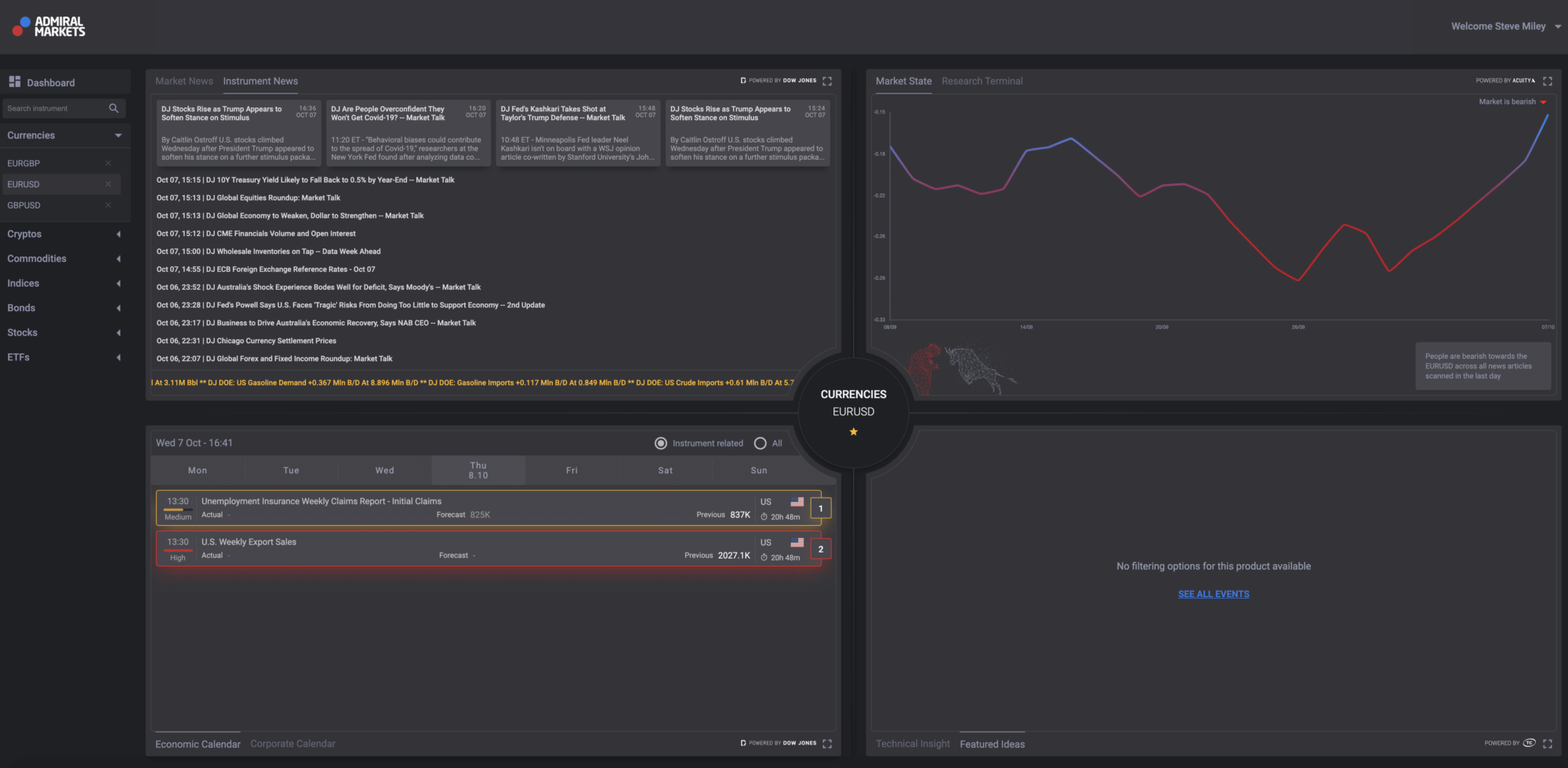

Research

Admiral Markets offers a diverse and solid variety of research analysis and tools on both the website and via the MT4 and MT5 trading platforms. The research offering and content that are available on their website is easily navigated and traders are able to find the research they need.

Moreover, their Premium Analytics offering, which is free to all customers allows access to the macroeconomic and geopolitical news flow via the Dow Jones News calendar, sentiment indicators by Acuity, plus technical analysis from Trading Central. In addition, there are various technical analysis reports, fundamental macroeconomic content, plus trading tools such as heat maps.

| Research feature | Admiral Markets |

| Research Organized by Experience Level | Yes |

| Research Organized by Topic | Yes |

| Research Organized by Type | Yes |

| Has Research – Forex | Yes |

| Has Research – Stock Indices | Yes |

| Has Research – Individual Stocks | No |

| Has Research – Bonds | No |

| Has Research – Commodities | Yes |

| Has Research – Crypto | Yes |

Customer Support

Admiral Markets offers its trading clients the typical range of contact options on its website that you can use to contact the customer service team; telephone, live chat and an email contact form. Telephone support is 12 hours a day, Monday through Sunday, UK time 06:00-18.00.

The web chat feature is particularly impressive as you can contact Admiral Markets via their own Live Chat, but also have options to chat via What’s App, Facebook Messenger and Telegram (available 24/5).

| Customer support | Admiral Markets |

| Customer call support Mon-Fri over 8 hours | Yes |

| Customer call support Mon-Fri 24 hours | No |

| Customer call support Saturday all day | No |

| Customer call support Saturday part day | Yes |

| Customer call support Sunday all day | No |

| Customer call support Sunday part day | Yes |

| Web Chat | Yes |

Overview

Admiral Markets are a well-respected and trusted broker and they certainly provide an extremely robust offering, with a wide variety of markets available to trade. Highlights include extremely impressive research and a very well stocked library of educational content for the beginner, the intermediate and even the advanced trader.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here are our latest trending stories

- Trade stocks with top-rated eToro

- Learn everything about Plus500 Withdrawal