Can I invest in US shares if I live in the UK?

Yes you can, not only is it possible to buy US shares if you live in the UK, but some brokers are even offering commission-free trading. The popularity of US stocks is such that these special offers are a great way for brokers to attract new customers. It’s good for their clients too.

How is trading US stocks different from trading UK ones?

In terms of the process of buying shares, for a UK citizen, there is little difference between buying US shares and UK listed ones. The steps are as follows.

- Complete the US tax forms – The US authorities do require non-US traders to complete an online tax disclaimer. This is to establish that you aren’t a US citizen because US and non-US citizens are treated differently in terms of taxation on trading profits.

- Trading hours are different – As the US working day starts some hours after the European one, the US exchanges also have trading hours, which are different due to time zones. The New York Stock Exchange has opening hours that are usually five hours behind London’s. That means in London time, they start trading at 2:30 pm and finish at 9:30 pm. There can be slight adjustments to this during the period of daylight savings adjustments.

- Research & Learn – There is enough high-quality research to be found freely available online that any stock idea of yours can be thoroughly tested before being implemented. You will also want to learn how to evaluate stocks properly, as US listed companies often have multiples on income that significantly outweigh their UK counterparts. This is one of the reasons that many firms have added US listings in recent years, some whilst holding onto UK markets, others leaving entirely. The capital inflows from other international markets are just that much greater.

- Develop a strategy – You might have a buy-and-hold approach, be a dividend investor searching for income, or be happy swing trading US stocks for a defined entry and exit. Either is possible, but long-term success comes from establishing what you want your approach to be, and sticking to your guns.

- Find the right broker – You will need a broker or a trading platform that offers access to US stocks, but fortunately due to the size of the markets there, most brokers will be able to support you. Make sure they are regulated by a tier-1 authority. Even if you are buying US shares, you will still come under the regulatory protection of the regulator which oversees your particular broker. So, a UK domiciled investor, using a broker regulated by the Financial Conduct Authority (FCA) in the UK will be protected in accordance with FCA terms and conditions.

- Practice – The US stock market, particularly the tech stocks, may feel like a train that is about to leave the station. But trading on a demo account will allow you to familiarise yourself with the ins-and-outs of US shares in a risk-free environment.

- Sign up and fund your account – The onboarding process is quite straightforward. The broker is required to comply with some Know Your Client (KYC) protocols. After spending a few minutes ‘onboarding’, it’s time to wire funds to your account. If you choose to use a bank or credit card, this will take moments to go through.

- Book a trade – The broker sites are set up to accommodate complete beginners. Finding US shares is a case of looking up a particular stock name. Then enter the amount you want to trade, the direction (buy or sell) and if you want, include risk management instructions such as stop-losses and take-profit instructions.

Best Brokers to Buy US Shares:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookFinding the right broker for you is one important part of the process, but not the most important. Your strategy will outweigh most variables within brokers, but you will need one that actually allows you to buy US stocks, and safely.

While you can buy US shares with most brokers on the market today, not all brokers are created equal. If you're ready to start trading, you'll need to use a broker that is FCA regulated, has low trading commissions and a reliable trading platform. Finding one can be an arduous and daunting task, which is why we've hand-picked favourites that tick all of these boxes to help you get started.

Should I use CFDs, shares or ETF dealing services?

Trading US stocks is so similar to trading UK ones that there is also the question of whether to hold your position in CFD, Exchange Traded Funds (ETFs), or share format. All get the job done, just in slightly different ways.

Trading US shares in CFD format

CFDs have some additional functionality. Leverage and short-selling are two features that make them popular. They tend to be favoured by traders operating short-term strategies as marginal fees mean frictional costs add up in the long-run.

Trading US shares in ETF format

ETFs offer a convenient way to get exposure to a whole range of stock positions. By simply buying one ETF, for example, you can gain exposure to the shares of over 500 US firms. The ETF fund manager will do the hard work of buying and managing each position. You and other clients will share the fees involved and get the full exposure associated with a Fund style product.

US share ETFs

- At Plus 500, the SPY ETF tracks the daily price movement of the flagship S&P 500 index.

- The extensive range of ETFs at eToro includes the Ishares Nasdaq Biotechnology ETF. This fund gives investors exposure to the biotechnology and pharmaceutical industries.

- IG offers markets in more than 6,000 ETFs, which is a number that is hard to beat. The PowerShares EQQQ Nasdaq-100 UCITS ETF tracks the Nasdaq 100 index.

ETFs are different from traditional funds in that they take real-time prices. You can trade them whenever the Exchange is open. There’s no need to wait until the end of a trading session to open or close a trade at the market closing price.

Buying US shares in share dealing format

Buying shares outright is typically associated with up-front commissions and lower on-going running costs. This makes them more cost-effective for buy-and-hold investors. It should also be noted that brokers periodically run promotions where trading commissions are not charged.

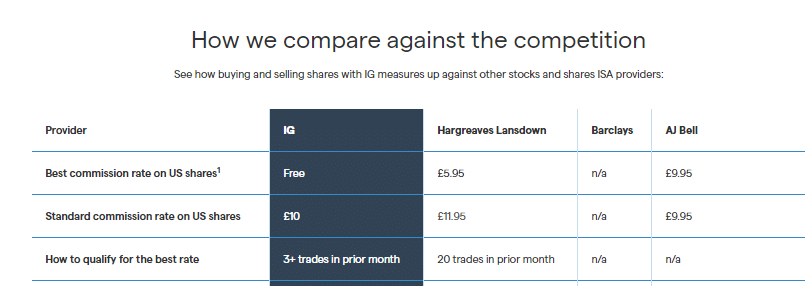

It’s always important to check the small print, but below are some ideas of the kind of offers available.

Source: IG

How have US shares performed historically?

As you can see from the main indexes above, the 52 week range in US markets is typically considerably wider than that of the UK's FTSE indices. The growth in US markets over some time has outpaced that of the UK, and the underlying stock components inside these markets have done the same. That is not to say that all US companies will outperform their UK counterparts by any chalk, but over a broad portfolio basis, that has historically been the case.

Does that mean that UK stocks are undervalued, or that US markets are just that more attractive for global capital inflows is a question for another time, but the fact of the matter remains that big tech, and other growth names have typically performed better when listed in the US than at home.

Some US tech-stocks have posted stratospheric returns for investors. The truth is that the UK stock market doesn’t contain any large-cap names in the same league as Tesla, Microsoft or Apple.

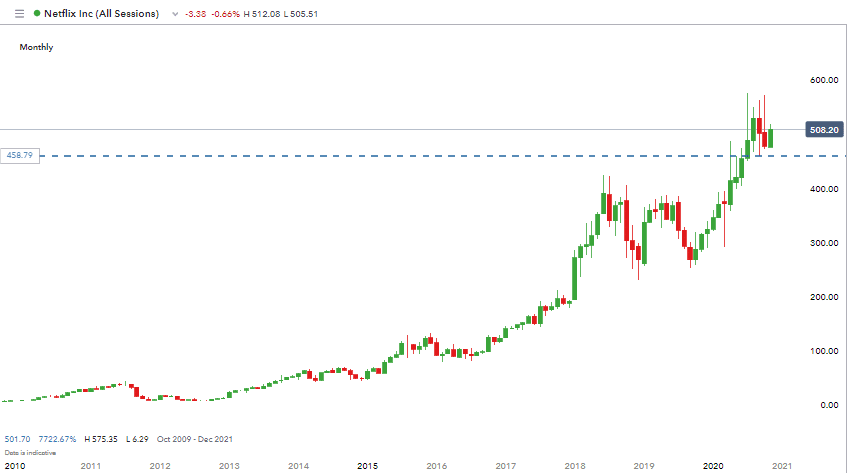

The trailblazer for US shares has been Netflix. This report gives an in-depth appraisal of the streaming giant’s progress.

Netflix share price 2010–2020

Source: IG

On a year-to-date basis, Netflix has at times posted a 79% return on investment. The shares, which listed on the Nasdaq in 2002 at $15, have often times during the last three months reached prices as high as $570.

An added attraction for UK-based investors is that these firms aren’t high-risk start-ups. They are major players with bright futures. In July 2020, the share price of Netflix was high enough to allow it to claim the title of the world’s largest entertainment/media company.

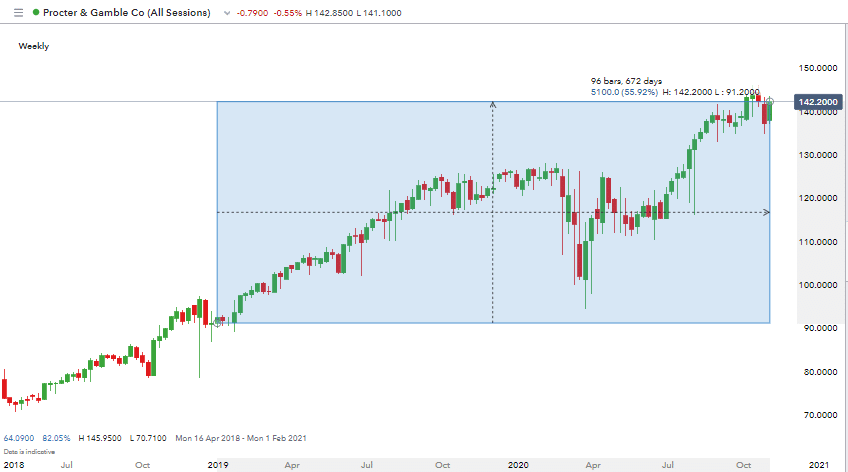

Proctor & Gamble share price 2018–2020

Source: IG

Proctor & Gamble, the consumer goods multinational firm may be associated with household items, but its share performance has been anything but boring. In 2019, its share price increased in value by 34%. It’s even managed to navigate the ups and downs of 2020 with the share price increase in value between Jan 2019 and November 2020 being greater than 55%.

Final thoughts

Past performance is no guarantee of future returns, but US stocks have over several years outperformed UK listed names. Not only do the returns look more tempting, but there is also a wide variety of firms and sectors to choose from.

Online brokers have cottoned on to the trend and now offer their clients access to US shares. Some go as far as offering commission-free execution. Most also offer a one-stop-shop service, where with one single account, clients can get exposure to US shares using a combination of CFDs, share dealing and ETFs.