The Webull platform has functionality that makes it particularly easy to use and the mechanics of trading the option market are very straightforward. This article will offer a step-by-step guide on how to trade options on Webull and the benefits of joining a platform that already has 11 million registered users.

Can You Trade Options on Webull?

The good news is that Webull offers markets in options – not all brokers do. This is partly down to the nature of options markets, which have some distinct features that are worth recapping.

If you buy options on Webull, you are buying the right to carry out a particular transaction at a future date. You pay a fee to buy the options and have the privilege, but not the obligation, to exercise your right to carry out a future-dated deal. It might, for example, be to buy (or sell) shares in Amazon stock at a price of $3,400.

At any point, your options will be ‘at-the-money’ or ‘in-the-money’. The former describes options that you wouldn’t convert into the underlying instrument, as you could buy or sell Amazon in the open market for a better price. If your options are ‘in-the-money’ then you are sitting on an unrealised profit. When you come to convert your options for the underlying Amazon stocks, you’ll be doing so at a better price than can be found in the open market.

There is also a time constraint. Options trading is associated with the ‘right’ to buy or sell the underlying instrument until a certain date. If price doesn’t move to a level to make your options profitable, then they will ‘expire worthless’. Longer-dated options tend to be more expensive – you have to pay more to hold them because there is more time for price to move.

How to Buy Options on Webull

Those who are new to options benefit from appreciating that buying options can give the holder the right to buy or sell an instrument. A ‘Call’ option is the right to buy the underlying at a certain price, and a ‘Put’ option is the right to sell it. So, although you are buying an option, it can be because you think the value of the underlying is going to fall.

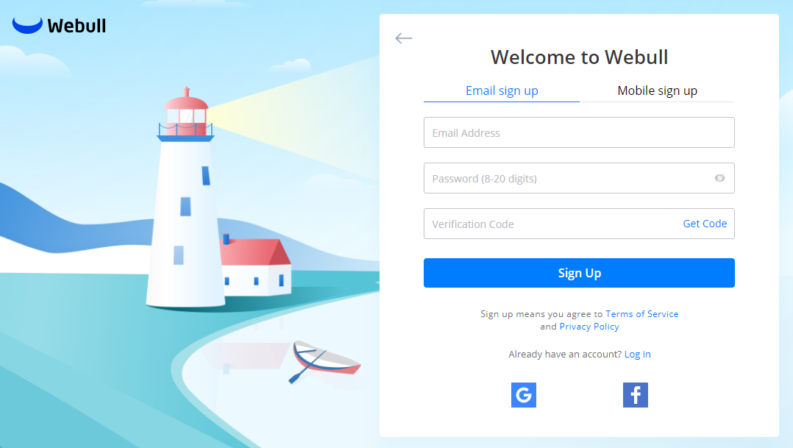

Step 1 – Open and Fund an Account

This can be done using a handheld or desktop device. The process is fully online and takes minutes to complete. One particularly attractive feature of Webull is that there is no minimum balance requirement. Starting off trading in small sizes can help newbie traders as it’s possible to develop the skill required to be successful without burning through your entire cash pile.

Complete novices may want to take advantage of the Paper Trading account, which uses virtual funds. This is a risk-free way to get to grips with the basics of trading and errors can be seen as valuable lessons learned rather than painful hits to real cash balances.

Option trading is currently not available in the Webull Paper Trading service. This is an amber warning to beginners, as option trading is usually regarded as being more appropriate for more experienced investors and isn’t promoted to those who are taking their first steps in trading. As the Webull site itself states:

“Option trading entails significant risk and is not appropriate for all investors. Option investors can rapidly lose the entire value of their investment in a short period of time and incur permanent loss by expiration date. You need to complete an options trading application and get approval on eligible accounts.“

Step 2 – Locate the Option Market You Want to Trade

First off, you have to identify and locate the option you want to trade. Option names and tickers often include reference to the underlying instrument. That is ultimately the instrument you are going to trade if you end up exercising the option.

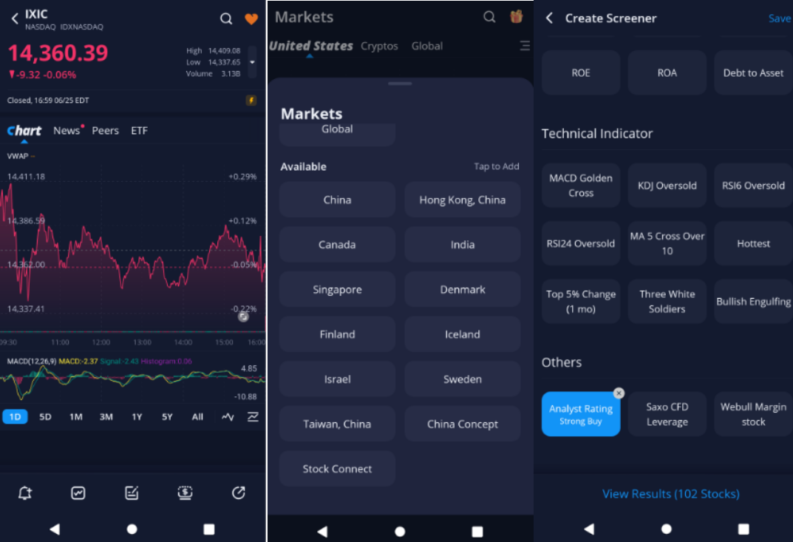

If you’re using the Webull mobile app displayed below, first navigate to the home page of the underlying instrument asset group. If you’re looking to buy options in Amazon stock, then head to the stocks home page. It is possible to filter by country or other indicators such as ‘Analyst Rating’, then click on the ‘Options’ button at the bottom of the page. You can now select the options market you’d like to trade.

Step 3 – Enter the Quantity You Want to Trade

When you’re working out how to buy options on Webull, it’s important to remember that ‘Puts’ and ‘Calls’ work in the opposite direction but might have the same strike price. You could, for example, find ‘Puts’ and ‘Calls’ on the Nasdaq index, both with a Strike price of 14,350. After entering the number of options you want to trade, then it’s simply a case of clicking ‘Buy’.

Are There Any Fees for Trading Options?

There are two pieces of good news relating to option trading fees on Webull. The first is that they are low. There are, for example, no extra commissions for option trading. The second positive point is that Webull is completely transparent about the other unavoidable charges, which do need to be factored in. As is often the case, brokers that are comfortable that their pricing offers them a competitive advantage over their rivals tend to be most willing to talk about what charges do apply.

- Option trading contract fees – $0

- Option trading commissions – $0

- Option trading assignment or exercise fees – $0

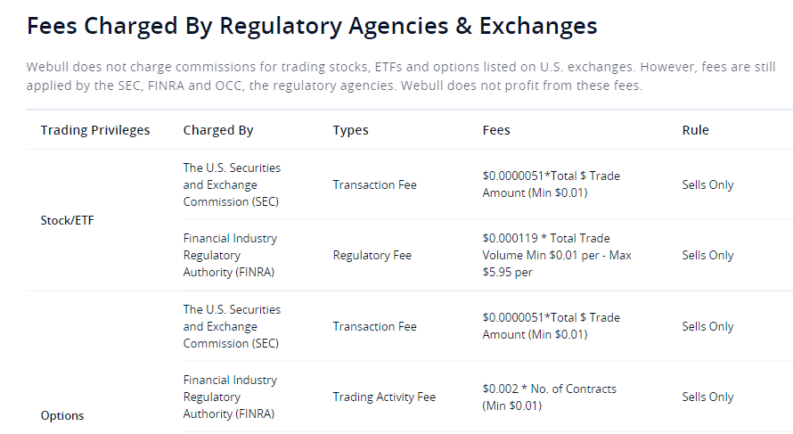

Regulator and exchange fees can’t be avoided, regardless of the broker you choose to use. These fees help finance the organisations, which supervise market activity and tend to be small enough to avoid them becoming deal-breakers.

The transaction fee is charged by the US Securities and Exchange Commission (SEC), an independent agency of the United States federal government.

The Financial Industry Regulatory Authority (FINRA) requires each member to pay trading activity fees for the sale of covered securities.

The options regulatory fee is a fee assessed by exchanges on their members. It is collected by The Options Clearing Corporation (OCC) on behalf of US options exchanges.

The clearing fee is charged by the OCC, which provides central counterparty (CCP) clearing and settlement services to 16 exchanges.

Webull provides clients with free online reporting, but if you want hard-copy statements, there is a fee to pay.

- Paper confirm fee – Apex (clearing firm): $2/Confirm

- Paper statements fee – Apex (clearing firm): $5/Statement

- Paper prospectus fee – Apex (clearing firm): $2.5/Mail

There are also some banking fees relating to cash deposits and withdrawals. However, it should be repeated that Webull is in a good position compared to its peer group on these.

- ACH deposit – US bank account: $0.00

- ACH withdrawal – US bank account: $0.00

- Deposit via wire transfer – US bank account: $8 per deposit – Apex (clearing firm)

- Withdraw via wire transfer – US bank account: $25 per withdrawal – Apex (clearing firm)

- Deposit via wire transfer (international) – Non-U.S. Bank Account: $12.5 per deposit – Apex (clearing firm)

- Withdraw via wire transfer (international) – Non-US bank account: $45 per withdrawal – Apex (clearing firm)

What Are the Risks of Trading Options?

Options and other derivative products have something of a bad reputation in some circles. They’re seen as being high risk-return, which is ironic because they largely came about due to investors looking for a way to manage risk.

Using Options to Manage Risk

Take, for example, a long-only equity investor. Historical data suggests that over the long run, its portfolio of diversified equity positions should increase in value. There is, however, the risk of the value of the portfolio being hit by a short-term market correction.

As COVID demonstrated, price drops of 10% and 20% aren’t unheard of. One approach to managing that risk has been to buy out-of-the-money ‘Put’ options, which allow the holder to make a profit selling at levels much lower than current market prices. Being out-of-the-money also makes them relatively cheap to buy. In the event that the market does crash, the long equity position losses are hedged by the increased value of the put options that have become profitable.

Using Options to Leverage Trading

At Webull, each stock option converts into 100 shares. This means option traders gain more exposure to the market with less money. It also frees up cash for other strategies and positions.

Option Price Moves

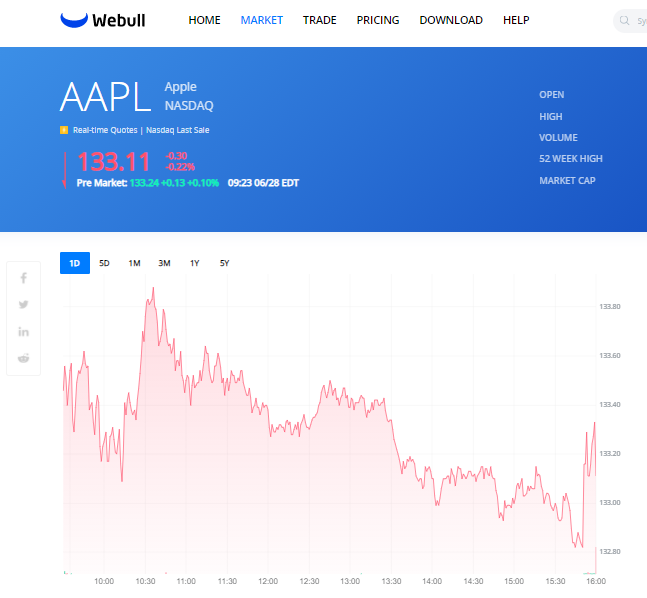

One notable feature of option trading is the way in which price moves. If you have options that give you the right to buy Apple stock at $150, but the current price of the stock is $135, then even a $1 upwards move in the price of the underlying won’t influence the price of the options too much. There are still $14 of price gains needed before your options would be exercisable.

If the $1 price move was at a level closer to the exercise price, for example, $148, then it would lead to a far greater rise in the value of the options. If you hold $150 calls and the price of Apple is $155, then your options will be in-the-money and effectively trade as if they were the stock itself. Your one option converts into 100 underlying Apple shares, so a $1 price move would be matched by a $100 move in the price of the option.

Can I Sell Options?

One of the riskiest forms of option trading is selling options. This is different from buying a ‘Put’ option and strictly something for institutional investors. The advantage of selling options is the seller receives the premium income. The obligation on the seller is that they must deliver the underlying asset if the options are exercised. Big banks that engage in the selling of options hedge positions to manage risk.

Retail traders who are buying options ultimately only risk the premium they use to make the initial purchase. As long as they don’t exercise at-the-money options, the worst that can happen is that options expire worthless.