Understanding the costs associated with a Stocks & Shares ISA is essential for making informed investment decisions. While these investment accounts offer tax-free growth potential, various fees can impact your overall returns. This comprehensive guide breaks down the different types of charges you may encounter and provides strategies to minimise costs.

Investment platforms typically charge multiple types of fees, each serving different purposes. These include platform management fees, fund charges, trading costs, and foreign exchange fees. By understanding these charges upfront, you can better compare providers and select the most cost-effective option for your investment strategy.

Platform Fees

Platform fees represent the core charges for maintaining your Stocks & Shares ISA account. These annual charges vary depending on whether you hold funds or shares in your portfolio. Most providers structure their platform fees as a percentage of your total account value, typically ranging from 0.25% to 0.45% annually.

The calculation method for platform fees differs between investment types. For example, if you hold £10,000 in funds and £3,000 in shares, your annual account charge might be £58.50 per year, averaging £4.88 per month. This calculation demonstrates how platform fees scale with your investment value.

Key aspects of platform fees include:

- No opening charges: Most reputable providers do not charge for opening an account

- Free cash holding: You can hold cash in your account without additional charges while deciding on investments

- No inactivity fees: Accounts remain active without penalty charges during periods of non-trading

- Automatic collection: Monthly charges are automatically deducted from available cash in your account

If insufficient cash exists to cover platform fees, providers typically sell a portion of your investments to meet the charges. This automatic process ensures your account remains active without additional administrative fees.

Fund Fees

Fund fees, also known as Ongoing Charges Figures (OCF), represent annual management charges paid to fund managers. These charges are separate from platform fees and are automatically deducted from the fund’s assets throughout the year.

Each fund carries its own specific OCF, which covers portfolio management, administration, and operational costs. The OCF is calculated as a percentage of your holding in that particular fund and varies significantly between different fund types and management styles.

Important considerations for fund fees include:

- Direct deduction: Fund fees are taken directly from fund assets, not from your cash balance

- Continuous charging: These fees apply for the entire period you hold the investment

- Variable rates: Different funds carry different OCF percentages

- Transparency requirements: All fund charges must be disclosed in the Key Investor Information Document

Additional fund-related costs may include bid-offer spreads, which represent the difference between buying and selling prices. These spreads can vary depending on market conditions and fund liquidity.

Trading Fees

Trading fees apply when buying or selling individual shares, exchange-traded funds (ETFs), investment trusts, gilts, and bonds. These charges are typically structured as fixed amounts per transaction rather than percentage-based fees.

Standard online trading fees for UK shares usually range from £1.50 to £11.95 per transaction, depending on your provider and trading frequency. Some platforms offer reduced rates for frequent traders, with charges potentially dropping to £3.50 per deal for customers making ten or more transactions monthly.

Trading fee structures include:

- Online dealing: Standard rates for internet-based transactions

- Telephone dealing: Higher charges, typically £25 per transaction, for phone-based orders

- Regular investment plans: Reduced fees, often £1.50 per transaction, for systematic monthly investments

- Dividend reinvestment: Special rates for automatically reinvesting dividend payments

Additional trading-related charges may apply for non-standard investments requiring paper applications, such as structured products or initial public offerings (IPOs). These specialised transactions typically incur higher fees, potentially reaching £100 per application.

Government taxes and levies also apply to certain transactions, including UK stamp duty at 0.5% on share purchases and various international transaction taxes for overseas investments.

FX Fees

Foreign exchange fees apply when investing in overseas shares or foreign currency-denominated funds. These charges cover the cost of converting your pounds sterling into the required foreign currency for international investments.

FX fees typically range from 0.5% to 1.5% of the transaction value, depending on the currency and deal size. Some providers offer preferential rates for larger transactions, while others maintain fixed percentage charges regardless of investment amount.

Key aspects of FX fees include:

- Currency conversion: Charges apply when buying or selling foreign investments

- Automatic application: FX fees are added to standard dealing charges for international transactions

- Variable rates: Different currencies may carry different exchange rate margins

- Dividend payments: Foreign exchange charges may apply to dividend payments from overseas investments

When investing internationally, consider the cumulative impact of both trading fees and FX charges. For example, a £1,000 investment in US shares might incur a £9.95 dealing charge plus a 1% FX fee, totalling £19.95 in transaction costs.

Regular investment plans for international funds typically maintain the same FX charging structure, meaning systematic investing does not necessarily reduce foreign exchange costs.

Reducing Costs

Several strategies can help minimise the total cost of your Stocks & Shares ISA while maintaining investment flexibility and growth potential. Cost reduction requires balancing fee minimisation with investment quality and diversification needs.

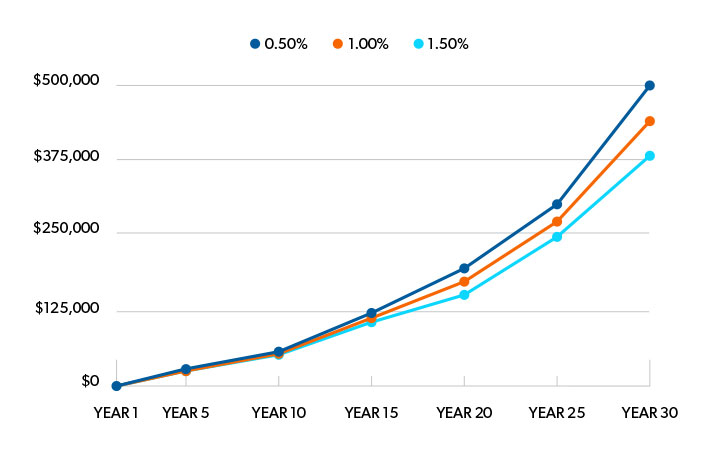

Choose low-cost providers: Compare annual platform fees across different providers, as small percentage differences compound significantly over time. A 0.2% annual fee difference on a £20,000 portfolio saves £40 yearly.

Consider fund selection carefully: Actively managed funds typically charge higher OCFs than passive index funds. While active management may provide superior returns, ensure the potential outperformance justifies the additional costs.

Optimise trading frequency: Frequent trading increases cumulative dealing charges. Consider whether your trading strategy genuinely adds value or merely increases costs without improving returns.

Utilise regular investment plans: Systematic monthly investing often qualifies for reduced dealing charges, making pound-cost averaging more cost-effective than lump-sum investments.

Minimise international exposure costs: If investing globally, consider using international index funds rather than individual overseas shares to reduce FX fees and trading charges.

Maintain adequate cash reserves: Ensure sufficient cash remains in your account to cover platform fees, preventing forced investment sales that may occur at unfavourable market timing.

Take advantage of free services: Many providers offer free account transfers, withdrawal facilities, and cash holding. Utilise these services to reduce overall investment costs.

Monitor fee changes: Platform charges and fund fees can change over time. Regularly review your provider’s fee structure and consider switching if more competitive alternatives become available.

By implementing these cost-reduction strategies while maintaining a well-diversified investment approach, you can maximise the tax-free growth potential of your Stocks & Shares ISA. Remember that the lowest-cost option may not always provide the best overall value if it compromises investment choice or service quality.