Identifying the right time to buy, sell or hold a position is what determines whether traders make a positive return on their trading. That’s where eToro’s user-friendly trading signals come in. They’re not only backed up by powerful software but are easy to use and can simplify the process of gathering the necessary information for effective trades and investments.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

The beauty of technical indicators is they can be applied to very different market conditions and strategies. If you’re looking to take advantage of increased market volatility to spot a trade entry point or using trend analysis to determine if a winning streak will continue, the below indicators can help you optimise your returns.

We’ve considered the trading signals and market sentiment resources made available to eToro clients and selected our favourite three. Whether you’re trading short-term strategies or looking to make long-term investment returns, they all have a strong claim to be part of your approach.

Table of contents

Volatility Indicator – Keltner Channel

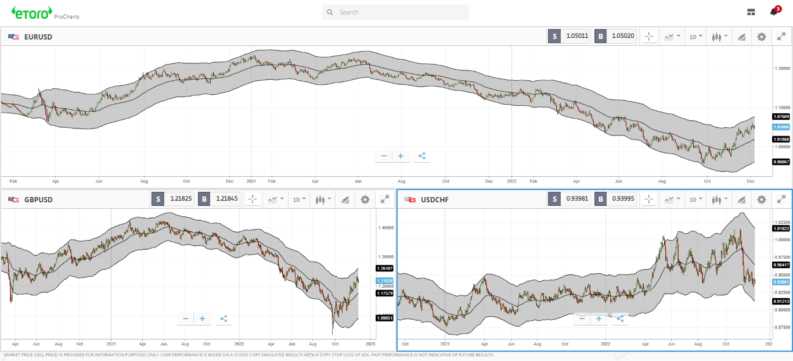

eToro clients can use the Keltner Channel indicator to monitor price movements in relation to a market’s Exponential Moving Average (EMA). That way, traders can consider how far price has deviated from a long-term price range. The greater the deviation, the greater the current levels of price volatility.

At the point where price reaches the edge of the Keltner Channel, market participants are left making a call on whether it will revert and move back towards the EMA line, or breakout of the channel and start a new trend. The Keltner Channel does not, on its own, offer conclusive guidance on which way the market will head, but it does help traders identify the point where most of the traders in the market will be considering the question.

eToro users looking to firm up whether price will go up or down can incorporate other indicators and signals into their strategy, but for many, it’s just as useful to know that the market has reached a crossroads. Extra care and a reassessment of risk management policies may be required, or a trading opportunity may be about to appear.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Trend Indicator – Bollinger Bands

The Bollinger Band indicator available at eToro helps traders identify if momentum levels in a market are building or waning – and that helps them spot whether a trend is about to start or end.

eToro’s default metrics used on Bollinger Band charts are set at two standard deviations and a time period of 20. That’s in line with standard market practice, but traders can adjust the parameters with ease to ensure the signal given is the ideal one for their strategy.

Bollinger Bands measure the extent to which price moves away from the long-term average price for the market, as determined by the EMA. As with the Keltner Channel, eToro users can use Bollinger Bands as a sign of momentum and volatility increasing rather than an indicator of which direction price will go.

Volume Indicator – Chaikin Oscillator

The Chaikin volume oscillator measures the flow of money into and out of a market. That helps eToro traders to identify if a price move is well supported or one made during a period of relatively low liquidity. That’s important as the greater the amount of trading activity taking place, the stronger the signal generated.

The Chaikin volume indicator uses the Moving Average Convergence Divergence (MACD). However, rather than to market price, this follows the accumulation/distribution line. That means that the Chaikin oscillator identifies when a greater number of participants are stepping into a market, and that can signify the start of a new trend forming.

The GBPUSD price chart below illustrates how two separate spikes in the value of the Chaikin oscillator were subsequently followed by a bull run in the currency pair. Optimising returns from winning trades is also an important way to counterbalance those trades which are losers. For eToro clients, using a signal as effective as the Chaikin oscillator is a great first step towards trading success.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

The Benefits of Using eToro Trading Signals

eToro’s client base is millions of people strong and it has a global appeal. That success is based on giving traders what they want, when they want it and how they want it. The indicators and trading signals that the broker offers follow that tried and tested approach. They’re easy to use, intuitive, effective, and ideal for all types of traders.

One nice to have feature is that they can be used across multiple asset groups. That’s ideal for eToro clients who are drawn to the site by the fact that the broker offers markets in assets ranging from stocks to cryptocurrencies.

It is also possible to personalise your settings and use non-default parameters on indicators. The signals can be adapted to any time frame or strategy you are looking to implement, and the Pro Charts feature allows multiple screens to be monitored at once, which helps traders run comparisons of markets.

Simplicity is part of eToro’s DNA, but don’t let the easy functionality of the platform deceive you. We’ve chosen three of our favourite eToro signals, but many others are available and all offer a way of measuring and predicting market sentiment. From ADX/DMS, to Williams%R, there are more than 60 indicators and signals to choose from at eToro.

Final Thoughts

eToro’s continued investment in its platform’s bespoke trading tools is a sign of success and demonstrates a clear commitment to pushing the boundaries of what indicators can be made available to retail traders. Few other firms invest in new products to the extent that eToro does, which makes it an ideal choice of broker.

Whether you’re looking to upgrade an existing strategy or to develop a new one from scratch, eToro has all the tools you’ll need. The platform has been developed in-house, so has a range of attractive and unique features, such as the ability to toggle between live and virtual accounts with the click of a button or a tap of a screen.

The rest of the platform’s credentials also stack up. It’s regulated by Tier-1 financial authorities and uses its dominant market position to offer its clients excellent T&Cs. All in all, it’s an ideal platform to use to develop your trading skills and put yourself in the best position possible to trade the markets.