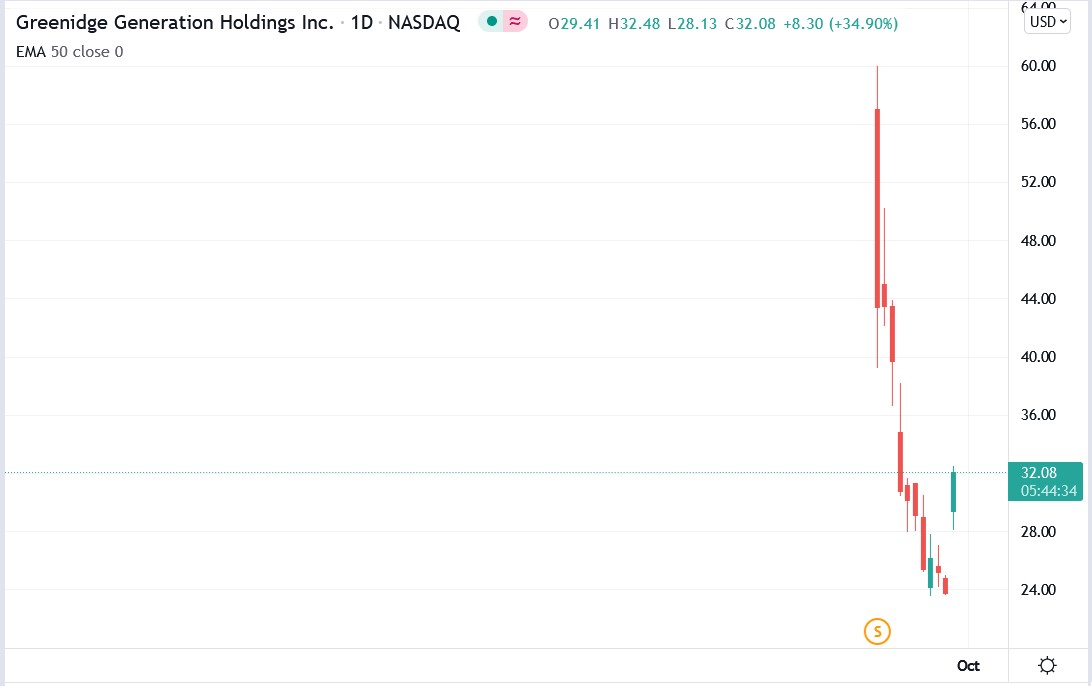

Greenidge Generation Holdings Inc (NASDAQ: GREE) stock surged up to 36.24% today, finally reversing the losing streak that has been in place since conducting a 23/200 reverse stock split on 15 September 2021 after its merger with Support.com.

Greenidge shares have been falling after the short-squeeze that preceded its merge with Support.com faded as investors took profits on their positions after the merger sending the stock into a massive crash from a high of $60.

Investors may have decided to finally jump back in and drive Greenidge stock higher as the company looks forward to opening its second Bitcoin mining facility in South Carolina, USA.

Greenidge has differentiated itself by being the first and only carbon-neutral Bitcoin miner in the US, given that it operates a mining facility powered by electricity generated from natural gas only.

The company also has meagre mining fees after saying that it can mine one Bitcoin at an all-in cost of just $3,000, giving it massive profit margins given Bitcoin’s current trading price of $42,000.

The company may not integrate Support.com operations into its existing operations, given that the two firms operate in different industries. Therefore, Support.com might continue working as a standalone subsidiary in the foreseeable future.

Investors will be watching the company to see if today’s rally will be sustained in the coming days or if the meme stock will be doomed to trading at its current lows for much longer.

From a fundamental perspective, Support.com’s business was not doing well at the time of the merger, except for the meme stock inspired rally, but the company may get a boost from Greenidge after the merger.

*This is not investment advice.

Gree stock price.

Gree stock rose 36.24% to trade at $32.48, rising from Tuesday’s closing price of $23.84.

Should you invest in Greenidge Generation shares?

Tech stocks offer some of the best growth potential, but time and time again, traders and investors ask us “what are the best tech stocks to buy?” You've probably seen shares of companies such as Amazon and Netflix achieve monumental rises in the past few years, but there are still several tech stocks with room for significant gains. Here is our analysts view on the best tech stocks to buy right now