An overview of share certificates

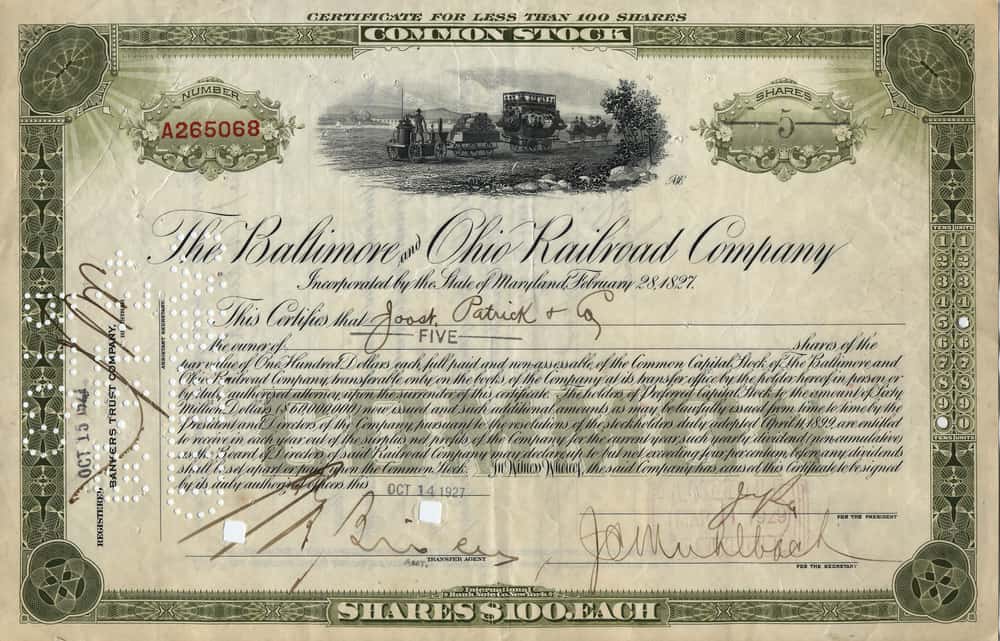

Investors who purchase newly issued shares of stock are issued a certificate of ownership in the company. The share certificate effectively serves as a receipt for the acquisition and ownership of a corporation's shares.

This document establishes the registered ownership of the shares by the holder as of the indicated date.

Historically, dividend claims were supported by presenting a stock certificate. On each presentation, the dividend payment receipt was imprinted on the reverse of the certificate. Using this method, all dividend payment documentation may be consolidated in a single spot.

Currently, firms are required to deliver a certificate representing such shares within two months of their issuance or transfer. Unless a shareholder requests an alternative certificate, a corporation may issue a single certificate for all shares issued or transferred at a given moment.

A stockholder may occasionally nominate another individual to vote on his or her behalf by executing a proxy.

Even if they lack genuine certificates, shareholders can nevertheless appoint proxies to vote on their behalf at shareholder meetings. The voting rules are stipulated in the company's charter and corporate law.

If your old share certificate has been lost, stolen, or irreversibly destroyed, you can request a replacement for the same amount of shares. In this instance, the shareholder must return the damaged original to the corporation before a replacement can be issued.

Currently, the shareholder may request a single or several certificates, based on their requirements.

Share certificates in Nigeria

The connection between a corporation and its shareholders is based on shares, which represent the shareholders' ownership stake in the company.

The issuance of a share certificate with the company's common seal to shareholders is sufficient to demonstrate the members' ownership of the shares, given that this interest is the means by which its holders join a corporation.

This paper-based approach is rapidly becoming obsolete in Nigeria as a result of technological developments and a general preference for electronic solutions for identifying share ownership.

The most usual procedure for an intending shareholder to enter into a contract with a corporation is to apply to the business for an allocation of a specified number of shares. The company will then make the allocation and notify the shareholder, effectively activating section 125 of the Act.

If the firm accepts the application in whole or in part, the applicant will receive an allocation, and he will be notified of the allocation and the number of shares awarded to him within 42 days (s.125(c)).

Upon registration of the recipient's name in the company's register, the recipient becomes a member of the organization. In accordance with section 146(1) of the Act, every business must also issue a certificate of shares assigned or transferred to the allotted or transferee, as applicable.

Share certificates confer ownership rights to the holder and can be sold or transferred by the shareholder in the same manner as other personal property.

A share certificate, like a membership registration, is only prima facie evidence and not a title document because, in the event of a dispute, the register of members is a more reliable source of prima facie evidence than the share certificate for establishing the company's ownership and membership.

Why paper-based share certificates might become redundant in Nigeria

The Central Securities Clearing System (CSCS), launched by the Securities and Exchange Commission (SEC) in partnership with the Nigerian Stock Exchange, has rendered the issuance of physical paper certificates unnecessary in Nigeria.

This is especially true for companies whose shares are traded on the Stock Exchange, as the CSCS includes a Central Securities Depository for share certificates of listed securities as well as a sub-registry for all listed securities.

When a shareholder registers a CSCS account, their information and the number of securities that are electronically credited to the CSCS depository are put into an electronic register.

Previously issued physical paper share certificates have been replaced by an electronic statement that details the shareholder's shareholding and its current value. The dematerialization procedure, also known as paperless trade, facilitates the execution of computerized transactions.

Nonetheless, the Act requires that the certificate be issued under the company's common seal, even if the Articles of the Company dictate the form of the certificate (s.146) (3). Essentially, the Act only acknowledges paper certifications.

Even yet, the majority of corporations, especially publicly traded ones, do not actually issue share certificates; rather, they advise recipients to open CSCS accounts so that their ownership holdings can be documented there.

Despite the fact that the shareholder or investor may request physical share certificates (s.146) (5) gives the shareholder the right to seek redress in court if the firm fails to issue physical share certificates), these companies breach the Act's requirements by their actions.

Benefits of share certificates

Share certificates provide both benefits and drawbacks. If you have a substantial amount of money, are interested in investing, and wish to generate substantial dividends, some recommend stock certificates (the amount your firm provides to shareholders from its monthly earnings).

In terms of investment, a certificate of deposit account and a stock certificate account are comparable (CD). However, it is issued by a credit union and not a bank.

Stock ownership certificates are a terrific way to invest and build wealth through dividend accumulation. Unlike other options, you won't be able to withdraw your funds without paying a fee, but you should earn higher interest. Here are more advantages:

- Certificates are more valuable to banks since certificate holders have less access to their funds than ordinary savings account customers. Thus, the certificate's interest rate is more significant than that of a conventional savings account. This could boost your investment's return.

- The annual rate of return on a stock certificate represents the prospective dividend or profit. This interest rate includes the period over which compound interest will be computed or the duration during which earnings will be credited to your account. Financial cooperatives may establish rates annually, quarterly, monthly, or even daily.

- Adjustable terms: Consistent investment returns are assured. Knowing the rate at which your account balance increases simplifies financial planning.

- Stock certificates, among the different savings products, give substantial returns while being a dependable investment option over time. Select the method for which the increased time commitment is outweighed by the increased revenue.

Drawbacks of share certificates

There are a number of disadvantages associated with issuing share certificates.

The company's largest financial and time commitment is highlighted. Producing physical stock certificates is expensive and time-consuming. In reality, the majority of companies desire an entire department devoted to handling stock certificates.

Maintenance of a stock certificate system involves a substantial amount of time-consuming documentation. Any transaction, such as a merger or spinoff, must be signed and sent to the company in order to be finalized. Managing compliance becomes significantly more complicated.

Additionally, it is particularly difficult to keep track of ownership because shareholders may transfer certificates to third parties without informing the corporation. Identity verification and obtaining signatures are required administrative stages for the ownership transfer.

In other words, the corporation must regularly monitor the ownership of the shares. Typically, a computer is used for this purpose.

Lastly, if a shareholder's paper certificate is lost or stolen, the business will be required to perform a great deal extra labour. The company must first identify the old paper certificates, confirm their ownership, “stop” the old certificates, and then issue the new certificates.

During this procedure, the shareholder will probably experience some inconvenience.

In conclusion, it is extremely difficult to manage and document transactions involving paper stocks and to verify their validity.

Final Thoughts

Signed on behalf of a corporation, a share certificate attests to the ownership of a specified number of shares in that company. Certificates of ownership are sometimes known as stock certificates.

Both the company's bylaws and business law stipulate voting rights. If the original stock certificate is lost, stolen, or destroyed, the same number of shares will be represented by a new stock certificate.

If this occurs, shareholders must return the damaged copy to the corporation before receiving a replacement. In addition, stockholders have until the end of the day to exercise their option to issue a single or separate certificate.

Voting power is greater for shareholders who physically possess share certificates. Similarly, investors without a certificate would be entitled to vote for other shareholders' shares.