Broker selection — which represent favourable regulation and a good fit?

It can’t be stressed too much that you should only trade live funds if you are completely comfortable with your chosen broker. Luckily the high-quality regulated brokers such as eToro, Plus500, IG and Pepperstone offer demo trading accounts where you can practice using virtual funds.

Yes, trading is exciting and, of course, time spent using a demo account might mean you miss an opportunity to make a ‘certain profit’ on a price move you think is about to take place. Checking your enthusiasm is one of the most important lessons in risk management. Emotional trading is bad trading.

Spending some time using a demo account will allow you to become familiar with the trading interface. The good brokers operate demo accounts and live accounts, which have identical functionality. That means if you have got to grips with trading on a demo account, you just need to fund your account and flick a switch to go live.

You’ll also be able to check that if a particular platform fits in with your other day to day activity. If you’re likely to be trading on hand-held devices, then selecting a broker with a good app is going to be important.

Most of the best brokers keep novice traders in mind. New clients are, of course, always welcome. If you are new to trading, you might find functionality and research at one firm suits you particularly well.

The most important risk management item is to ensure the broker you use is regulated by a Tier-1 regulatory authority. These include:

- Financial Conduct Authority (FCA) in the UK

- The Australian Securities and Investments Commission (ASIC) in Australia

- Dubai Financial Services Authority (DFSA) in the UAE

- The Cyprus Securities and Exchange Commission, (CySEC)

Choose a broker that operates under license from one of these bodies. Other compliance safeguards include:

- FSCS— protection of cash balances up to £85,000

- Segregation of funds

- Negative balance protection (NBP)

- Quality of cyber-security provision

Stop-loss orders — automated instructions to cap losses

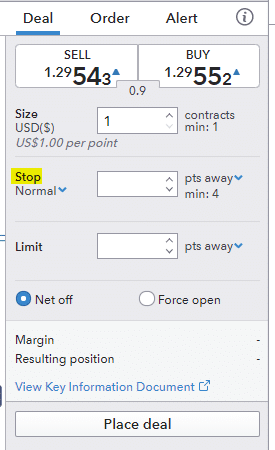

Once set up on a trading platform, you’ll want to put some trades on. If on a demo account, this is a good time to experiment and push the boundaries. If you’re trading live funds, hopefully you’ve learnt how ‘experimentation’ leads to losses and the importance of trading discipline.

Source: IG

One part of that discipline are stop-loss orders. These are automated instructions to close out a position if price goes against you. You set the cut-off price and can add or adjust stop-losses at any time.

If a position starts making a profit, but you don’t want to trade out of it too early, you can move the stop loss to a level that would secure some kind of profit. This is a trailing stop loss.

The T&Cs relating to stop losses do vary according to broker. Guaranteed stop loss orders are something you might want to consider. These incur a charge, but remove the risk of price ‘gapping’ and making your stop loss redundant.

Take profit orders — automated instructions to crystalise trading gains

Take profits are similar to stop-losses, but these close out a profit-making position, not a loss making one. There is something to be said for the old market saying ‘run your winners’, but there are times when locking in profits is a good idea.

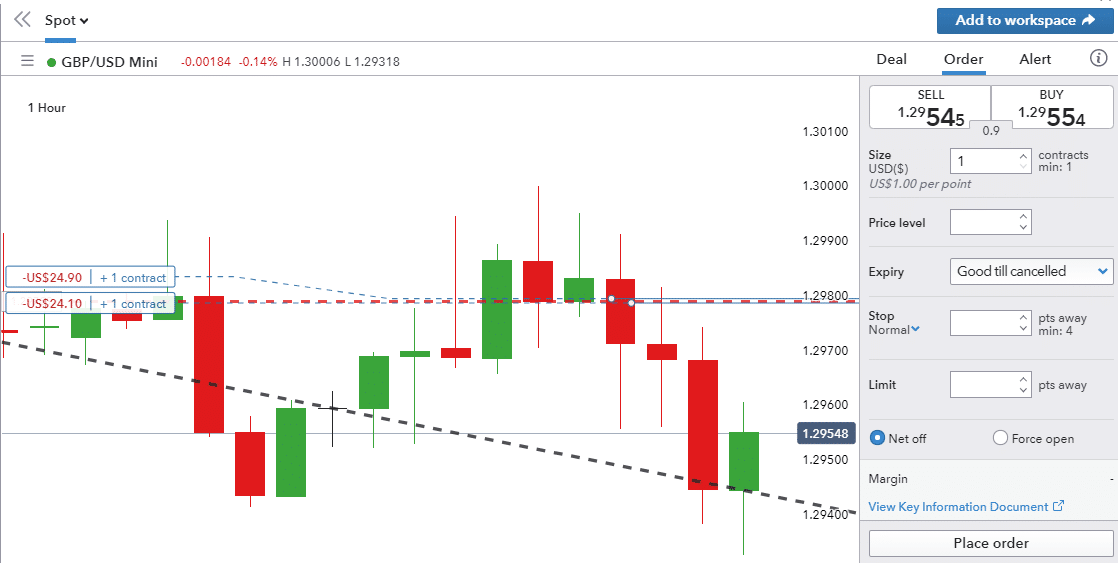

Source: IG

If your strategy has a clear entry and exit point, then applying a take-profit order would make sense, particularly if you’re not able to follow live prices closely.

Some traders set ‘out of the money’ take-profit instructions in case their position spikes. With forex and commodity markets trading 24/5, an ambitious take-profit triggered overnight can be a welcome boost to a trading account the next morning.

The one per cent rule — entering into trades in a way that limits potential down-side

If you’re new to trading, then it’s worth taking note of one risk-management tool that is used by millions of experienced traders.

As its name suggests, the ‘one per cent rule’ states that you should never put more than 1% of your capital into a single trading position. For example, a trading account of $5,000 would cap trade size at $50.

This means that even if the worst-case scenario pans out, your loss will be capped at 1%. That doesn’t take into account that you’ll probably have stop-losses in place, which means a total wipe out is unlikely.

Diversification — position management to spread your risk

Concentrating your positions in one sector, such as energy commodities or one instrument means any market moves will have a more intense impact on your P&L.

Ask someone who holds Tesla shares (Nasdaq:TSLA). Controversial comments from the firm’s maverick owner, Elon Musk, might be throwaway quips to him. But for holders of the stock, it can shave 10% off the value of their holding.

Hedging — market neutral strategies designed to squeeze profits out of the market

Hedging again involves ‘squeezing’ profits out of the market. Two assets may have negatively-correlated price histories. So, if the price of one goes up, the other goes down.

An example of two such instruments is GBPUSD and the UK100 FTSE index. As a large percentage of the FTSE100 is made up of multinational firms that generate income abroad. This means a fall in the price of sterling is good for UK PLC, which sees an FX gain on its earnings that are reported in GBP.

By going long one and short the other, if the price of one goes up 10% and the price of the other goes down 8%, your net P&L gain is +/- 2% depending on whether you picked them the right way round.

Other assets traditionally associated with negative price correlation are:

- Gold vs USD — gold is seen as a safe haven and USD is needed when the world is open for business

- Airline stocks vs crude oil prices — revenues are exposed to fuel price moves

- Equities vs bonds — one is ‘risk-on’ the other ‘risk-off’

- High street retail vs online retail — as highlighted by behavioural shifts during the COVID pandemic

Strategy planning — trade with expectation, not hope

If you’re doubtful of the benefits of having a clear strategy in place, then testing random trades and a ‘gut-feeling’ approach on a demo account might help you come round to the need for greater discipline.

Developing a strategy also involves learning where and when to set stop-losses.

One commonly used approach is to set stop-losses just ‘the other side’ of a recognised support or resistance level. If you have bought a position your stop-loss would be below a support level and if you’re selling it would be above a resistance level.

Support and resistance are terms used to reflect the regions of a price chart where price might struggle to move through. They can be moving averages or trend lines and can even be psychologically significant numbers.

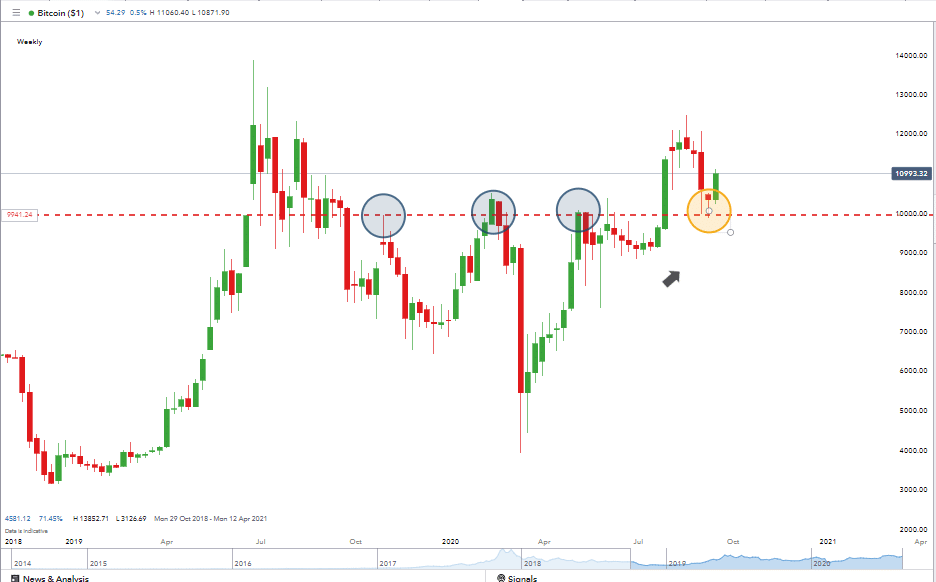

Take, for example, the bitcoin market. The $10,000 price level is a big round number when a lot of participants step into the market. This is triggered by the view that ‘this is just too high’, or ‘too low’, depending on your opinion and analysis.

Source: IG

The price chart shows three blue circles with each representing a point of resistance. Price hit the $10k marker and sellers stepped in. Each time price fell back and any traders who set their stop-losses in the region of $10,500 (the blue line) would have stayed in the position and profited from the correction.

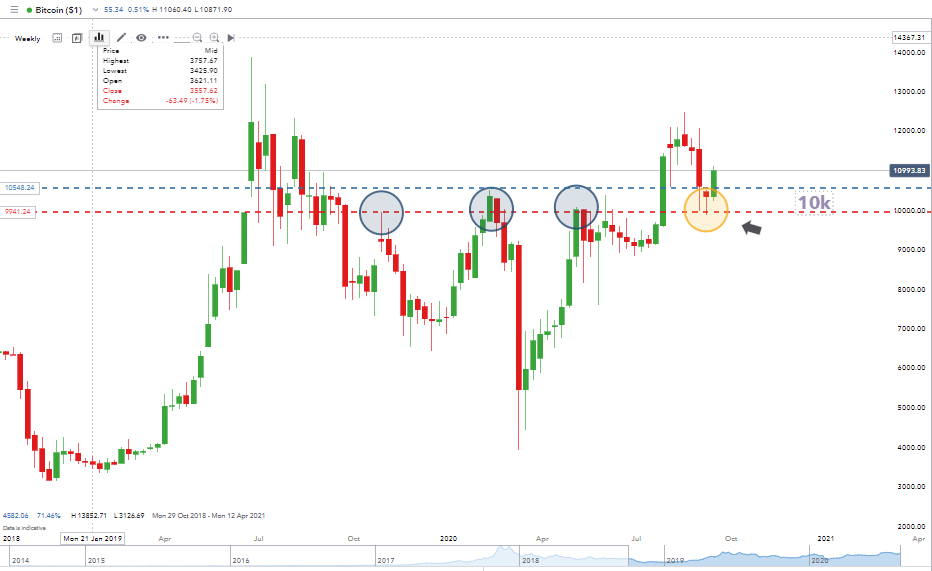

Source: IG

As seen in the graph above, with bitcoin doubters running out of fire power, the gold circle saw price fall back to $10k and then bounce. This time the bulls had control of the market and stop losses set lower than $9,850 would not have been triggered.

Options — advanced risk management techniques

If your broker offers options markets, then these can act as an insurance policy. This strategy is used by a lot of professional traders, but that should be taken as a sign that they work, rather than one that they are difficult to understand.

An option allows the holder to sell an asset at a particular price.

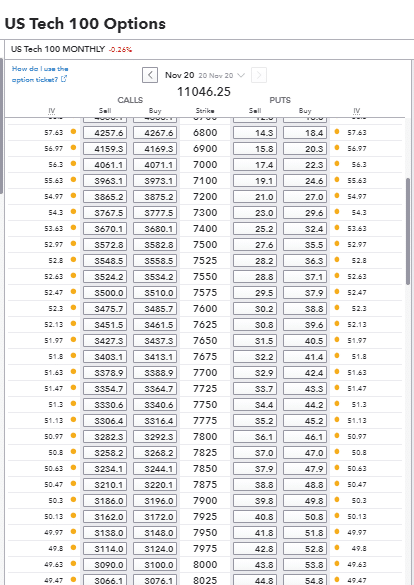

IG offers options markets, and while the US Tech 100 index trades above 11,000, you can buy the option to sell it at levels lower than that. The ‘strike’ is the price you can sell at and the options are future dated.

This means that if you pay a small premium to hold the option, if the market then goes into meltdown, you can profit from exercising your right to sell at any price level below the strike price.

The further ‘out of the money’ the strike price is, the less you have to pay for the option, as statistically speaking the chances of reaching that level are lower.

Source: IG

The bottom line

Risk management, to a large extent, involves building a network of overlapping controls, which go together to form one disciplined approach. For example, ‘hedging’ incorporates some elements of the ‘one per cent rule’ and ‘diversification’.

‘Stop-losses’ and ‘take-profits’ are also closely related.

Risk management can be learnt quickly but can take some time to master. It is a crucial part of being a profitable trader. so devoting some time to the task will be a good investment.

People who read this also viewed: