Plus500 was founded in 2008 and since 2018 has been listed on the London Stock Exchange (operating as Plus 500 Limited, symbol: PLUS and at the time of publication is a constituent of the FTSE 250 index. Plus500 are headquartered in Israel, and as we will look at below Plus500CY Ltd is regulated by the CySEC #250/14.

So, is Plus500 the right broker for you? Here we will review all you need to know, including; regulation, fees, the trading platforms, education and research, plus more.

Account options

Forex CFDs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Mid | 1:30 | Mid |

Plus500 offers their client a wide variety of forex pairs to trade, including the majors, minors, and emerging markets. There are 71 currency pairs to choose from, which is at the upper end of offerings among brokers. This high number of currency pairs makes Plus500 a good choice for FX traders.

CFDs

| Min Deposit | App Support | Trading Fees |

| £100 | Mid | Mid |

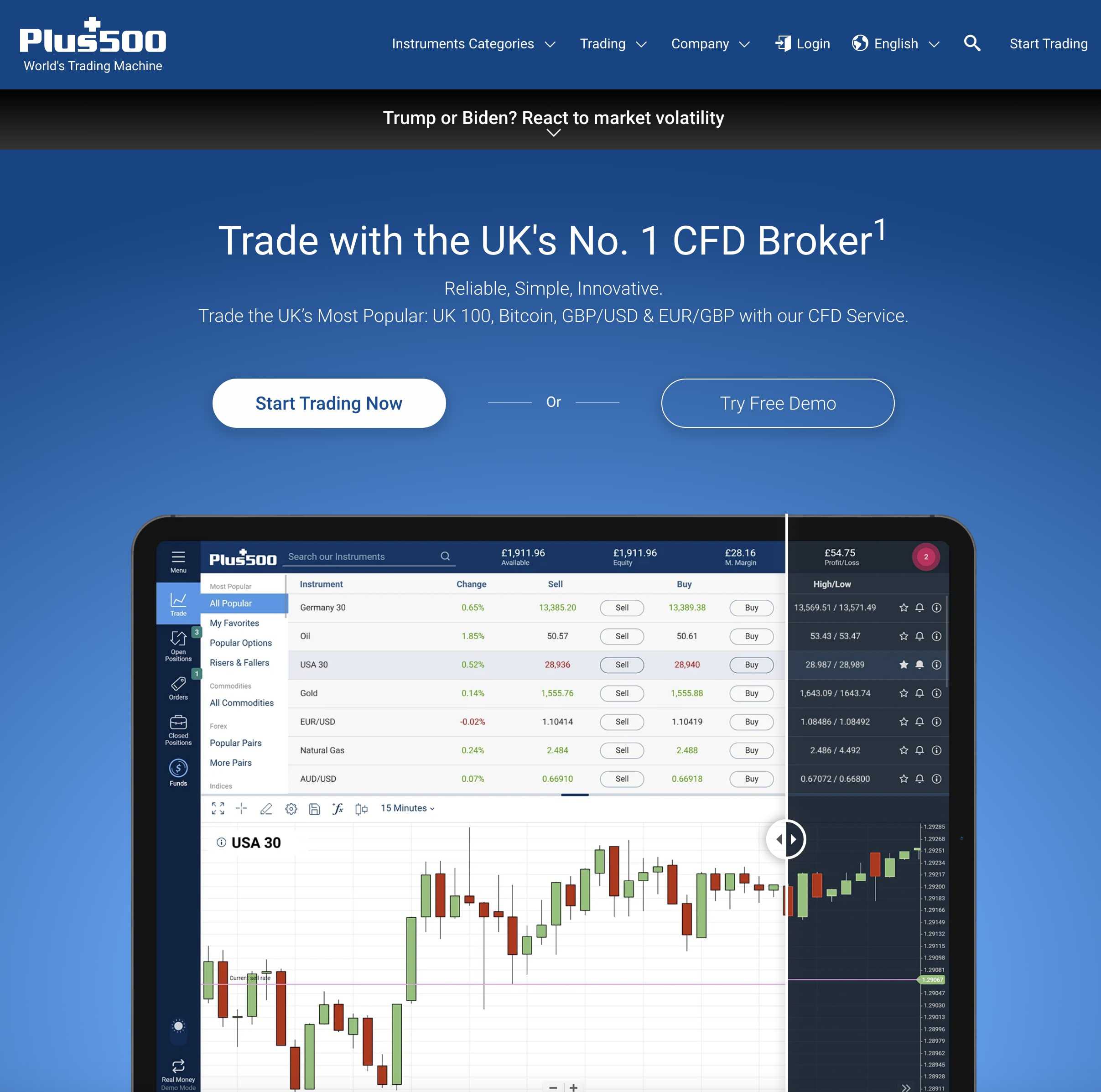

Plus500 is a top provider of Contracts for Difference (CFDs) including CFDs on currencies (forex), stock indices and individual shares, Exchange Traded Funds (ETFs), cryptocurrencies (*Availability subject to regulation) plus commodities. They also offer options on some of these CFDs.

The breadth of different asset classes offered (particularly the ETFs, individual stocks and options markets) alongside a deep offering within most asset classes, makes Plus500 a strong candidate if you want to trade CFDs across the spectrum of financial markets.

We look at this in more details in the section below, “Offering of Tradeable Products”.

CFDs as Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:5 | Low |

Plus500 offer trading in shares from the most common global markets including the USA, UK, Japan and Germany. There are many hundreds, into the thousands of different shares available to trade across the full range of industries. Leverage of up to 5:1 is available for retail clients trading individual stocks.

CFDs as Crypto (*Availability subject to regulation)

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Few | 1:2 | Mid |

Plus500 offers 13 of the popular cryptocurrencies and altcoins as CFDs as well as a Crypto 10 Index (*Availability subject to regulation). This is far from the highest number available in the market. More experienced cryptocurrency traders, looking for niche cryptocurrencies will perhaps look elsewhere for a broker offering a deeper number of cryptocurrency options. With Plus500 the leverage for retail clients trading cryptocurrencies is 2:1.

Plus500 do not offer direct buying of the underlying cryptocurrency assets on an outright basis.

What do our traders think about Plus500?

Trust and Regulation

We would view Plus500 as a very trustworthy broker. For a start it is publicly listed on the UK stock market and is a FTSE 250 company. Plus500 operates through different subsidiaries and each of them is regulated in its country. Plus500CY Ltd is authorized & regulated by CySEC (#250/14).

| Trust and regulation | Plus500 |

| Year established | 2008 |

| Publicly traded | Yes |

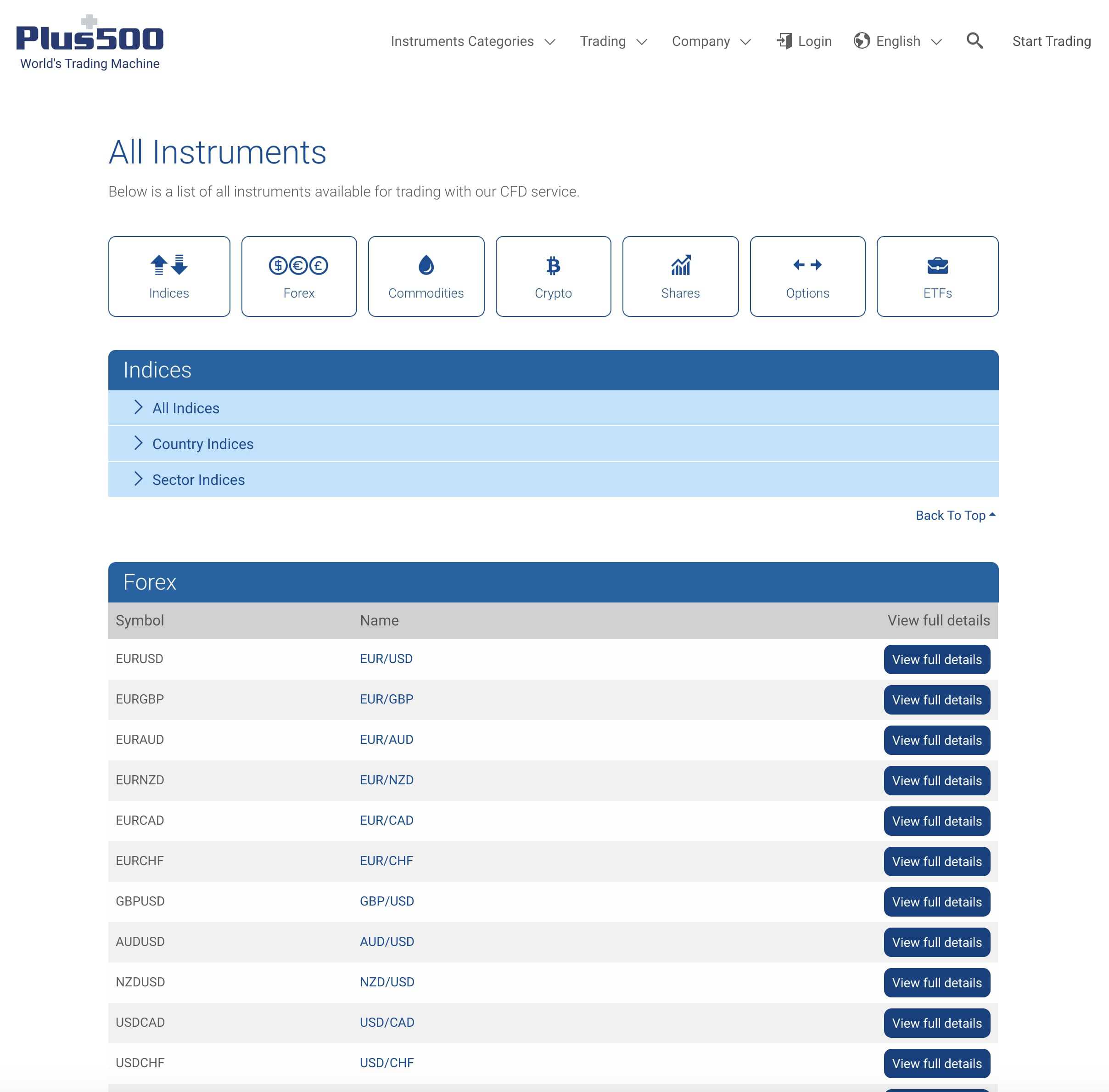

Offering of Tradeable Products

As we have touched on above, the extent of different asset classes offered (including ETFs, individual stocks and options markets) alongside a wide offering within each asset class. makes Plus500 a strong candidate if you want to trade CFDs across many different financial markets.

We have already noted the high number of forex pairs on offer at 71, plus thousands of individual stocks that can be traded via CFDs. On the stock index side there are 28 different indices available to trade, which include both country and regional averages, as well as some sector indices (including a Cannabis Stock Index, Lithium & Battery Index and Real Estate Giants Index)

Related

On the Exchange Traded Fund (ETF) side, traders and investors looking for maybe longer-term portfolio diversification benefits of ETFs will appreciate the 95 different ETF CFDs available. These are offered with up to 5:1 leverage.

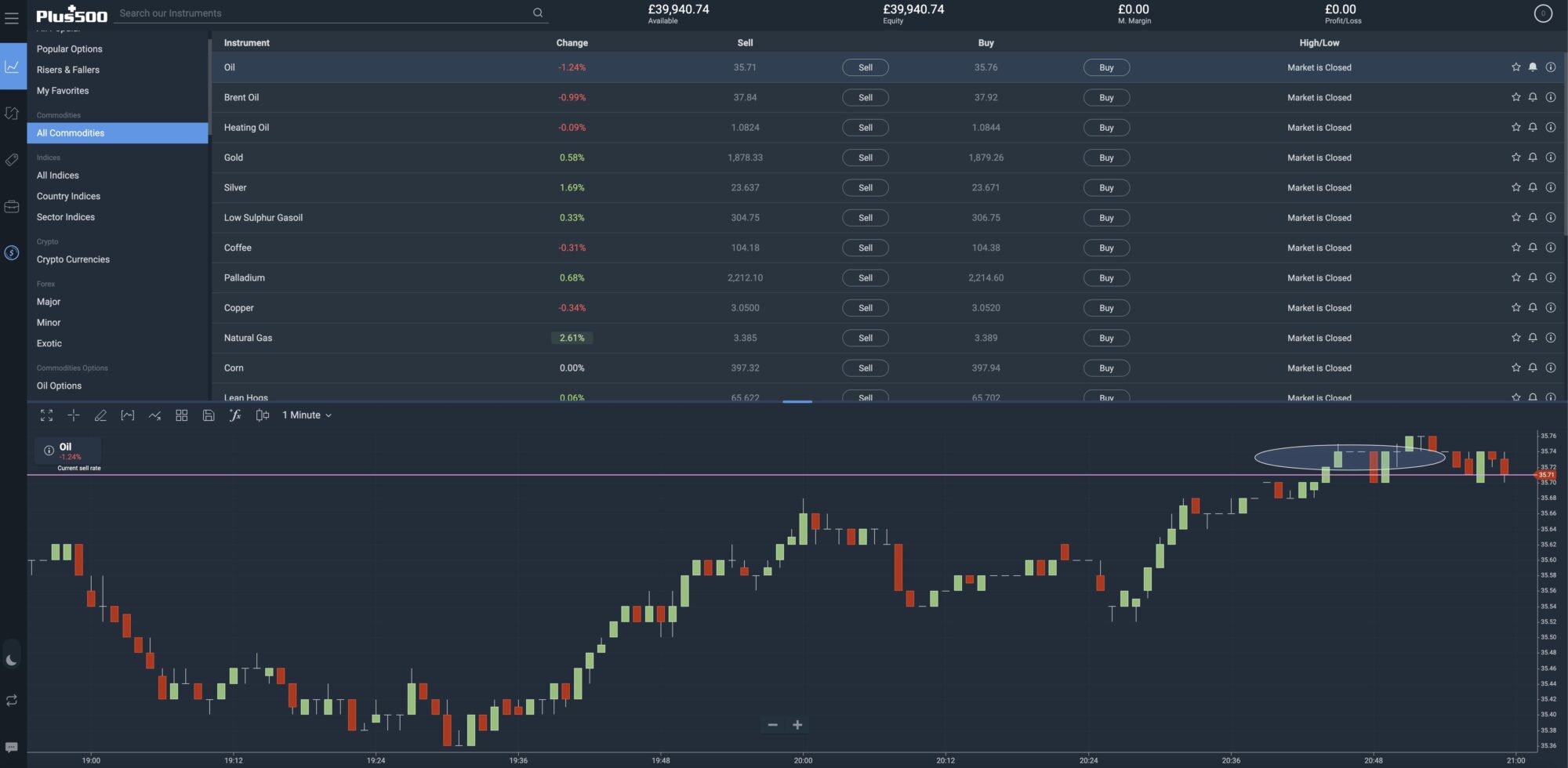

The crypto offering is relatively light (*availability subject to regulation), with 13 cryptocurrencies and one crypto index, whilst on the commodity side the offering is again fairly strong, with 22 to select from (with leverage of up to 20:1). There are no bond markets available to trade.

| Product offering | Plus500 |

| How many Forex Pairs offered | 71 |

| How many Stock Indices offered | 28 |

| How many Individual stocks offered | Thousands |

| How many Bonds offered | 0 |

| How many Commodities offered | 22 |

| How many Crypto pairs offered (*Availability subject to regulation) | 14 |

Finally, Plus500 also offer options trading. Options are a derivative product that will likely appeal to the more experienced trader, and Plus500 offer a range of options across stock indices, individual shares and commodities.

Generally, we are very impressed by the overall width and depth of the offering and the large number of tradeable products from Plus500.

Fees/Commissions

As with most brokers, Plus500 does not charge any deposit or commission fees. The bid/ask spread (the difference between the buy and sell price of an asset) is the “fee” paid by the user.

The spreads offered by Plus500 are aligned with the average for the industry but given the fact that we would place Plus500 as a higher tier broker, spreads are wider than the best spreads offered by some of the other upper tier brokers. For EUR/USD, the spread is variable. In addition, Plus500 does not offer discounted spreads to more active traders or Professional traders (*Traders with professional accounts lose their ICF rights).

In addition, there are some other trading and non-trading fees that you should be aware of including: Other fees and charges may apply. More information at: https://www.plus500.com/en-CY/Help/FeesCharges?productType=CFD\

Inactivity Fee

A fee of up to $10 USD (or equivalent) per month will be charged if you don’t log in to your trading account for a period of at least three months. From then onwards, this fee will then be charged monthly if no login is made into your account.

Guaranteed Stop Order Fee

Certain instruments allow for a ‘Guaranteed Stop’, which guarantees that a position will be closed out at exactly the price specified with zero risk of slippage. However, there is a price for this peace-of-mind which is charged via a wider spread than normal.

| Fees/ Commissions | Plus500 |

| EUR/USD average spread | Variable |

| EUR/USD minimum spread | Variable |

| Minimum account opening deposit | £100 |

| Withdrawal Fee | 0 (Plus500 may charge the trader fees after the 5th withdrawal of the month.) |

| Inactivity Fee | £10 |

There are three account types with Plus500; the Demo Account, Retail Account (Standard Account) and Professional Account (*Traders with professional accounts lose their ICF rights).

We like the fact that the Demo Account doesn’t have any time restrictions, for example, a 30-day time limit, which we’ve seen with other brokers.

Related

Trading Platform

Plus500 does not support the popular MetaTrader trading platforms, which are offered by most, but not all of its competitors. Some traders might see this as a significant disadvantage, but the in-house platform, Plus500 WebTrader is a very solid offering.

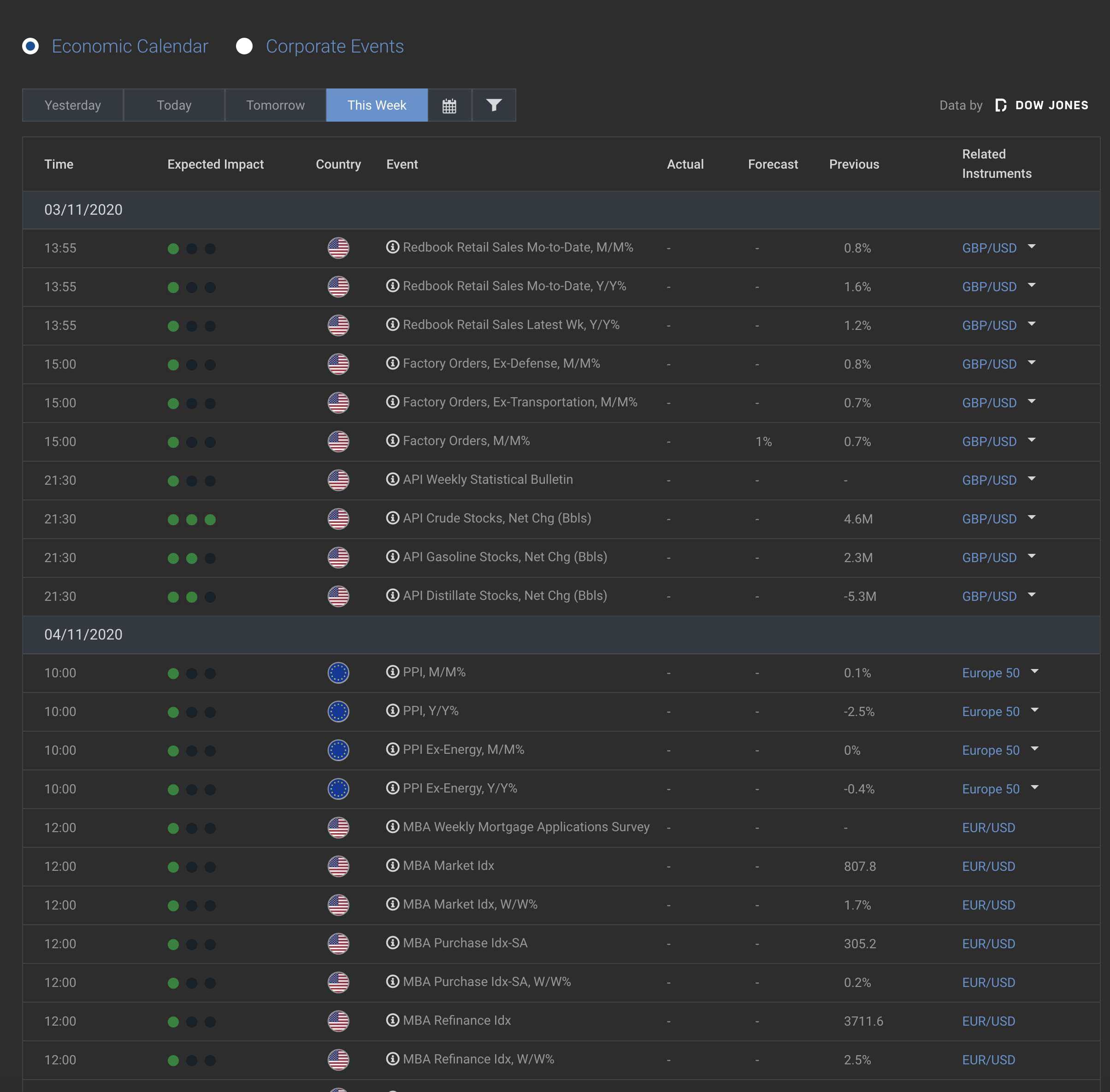

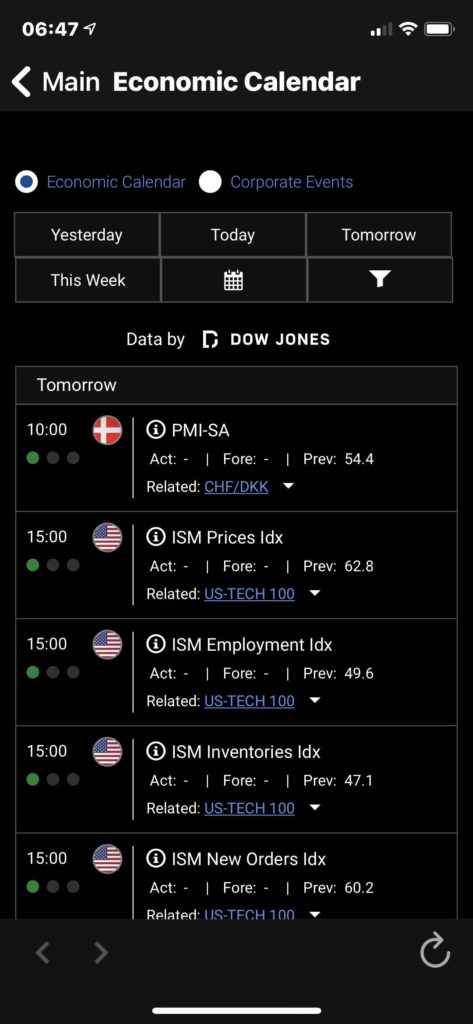

The trading platform is functional and particularly user-friendly. There are the usual technical analysis indicators and drawing tools, an economic calendar, plus real-time sentiment analysis. There are 110 technical analysis indicators alongside 22 chart/ drawing tools available, plus the important functionality to be able to save chart layouts.

There are also the usual trading tools available for traders to help minimise losses and lock in profits such as Stop Loss, Stop Limit and Trailing Stop, but also a Guaranteed Stop Loss. The Guaranteed Stop limits your risk by putting an absolute limit on your potential loss and protects you against losses even if the price of the instrument suddenly moves against you (known as slippage). This tool is only available on some markets and comes at a cost of a wider initial trading spread.

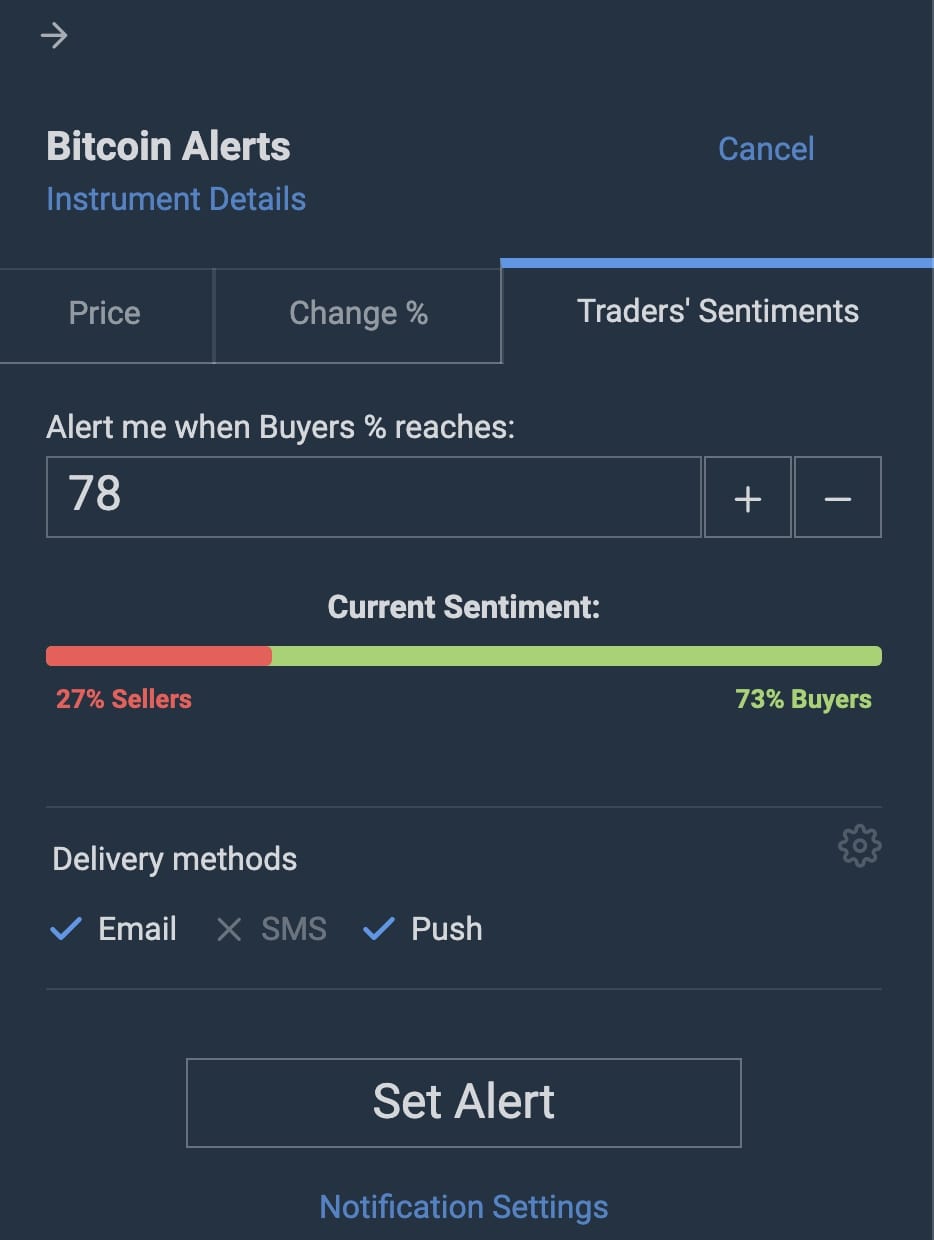

There is also a very impressive alerts feature. This allows you not only to set an alert for any individual market when it moves above or below a certain price level, but also to set an alert on a percentage change in the price for the day or for the hour. Furthermore, it is possible to set an alert when the trader sentiment tool moves above or below a certain level. Alerts can be received on the platform, via email and SMS text.

| Platform feature | Plus500 |

| Own platform | Yes |

| Demo account offered | Yes |

| MT4 | No |

| MT5 | No |

| cTrader | No |

| Chart Indicators | 110 |

| Chart drawing tools | 22 |

Related

Mobile Offering

Plus500 offers a mobile app for both Apple and Android phones and the experience efficiently replicates the experience from the WebTrader platform. As with the WebTrader platform, the app has the same user-friendly functionality and mirrors the 22 chart/ drawing tools and 110 technical analysis indicators, alongside the alerts access we discuss above. The only drawback is that any settings on the charts saved on the mobile and/ or WebTrader platform are not mirrored.

The economic calendar can be accessed via the app, but the limited education and research offerings are not accessible in the app.

| Mobile feature | Plus500 |

| Own Apple app | Yes |

| Own Android app | Yes |

| Third party app (MT4/MT5/other) | No |

Related

Education

The educational offering from Plus 500 is very light, given the calibre of the broker in other areas. There are a handful (7) of very brief videos in the Trader’s Guide series, which is far from a well-bounded, in-depth educational offering from a broker of the standing of Plus500. There just isn’t enough content to engage and educate their clients, Plus500 could do better.

| Education feature | Plus500 |

| Webinars | No |

| Videos | Yes |

| Community Forums | No |

| Education Organized by Experience Level | No |

| Education Organized by Topic | No |

| Education Organized by Type | No |

| Has Education – Forex | Yes |

| Has Education – Stock Indices | No |

| Has Education – Individual Stocks | No |

| Has Education – Bonds | No |

| Has Education – Commodities | Yes |

| Has Education – Crypto (*Availability subject to regulation) | Yes |

| Investor Dictionary/ Glossary | No |

Research

The offering of research from Plus500 is similar to the educational content, in that it is sparse and could certainly do with being improved, given Plus500 is placed in the higher tier amongst brokers.

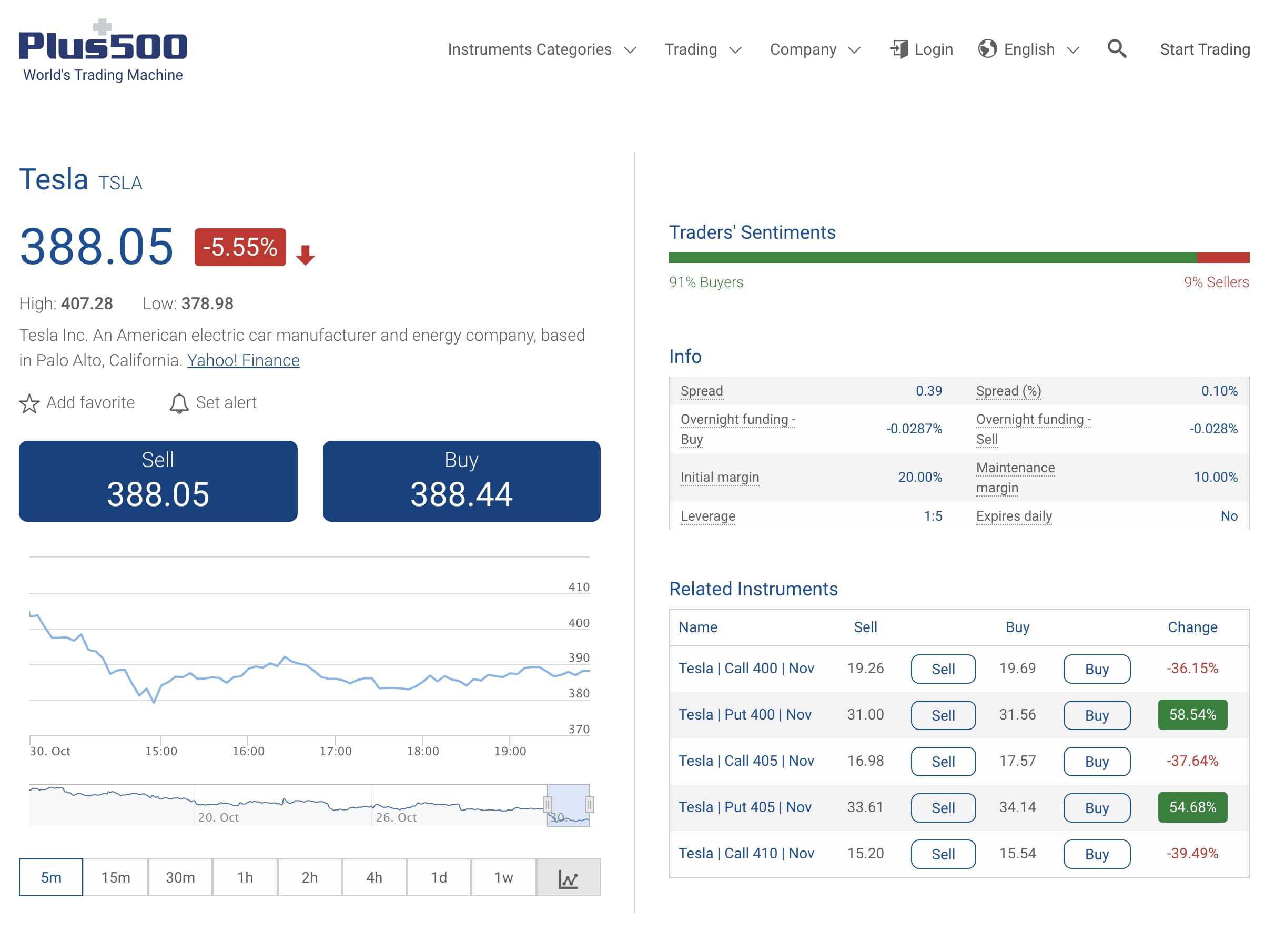

There is a quick look “snapshot’ of each market, where traders can easily see information at a glance such as traders’ sentiment, current spread, overnight funding costs, leverage, a basic chart and related instruments.

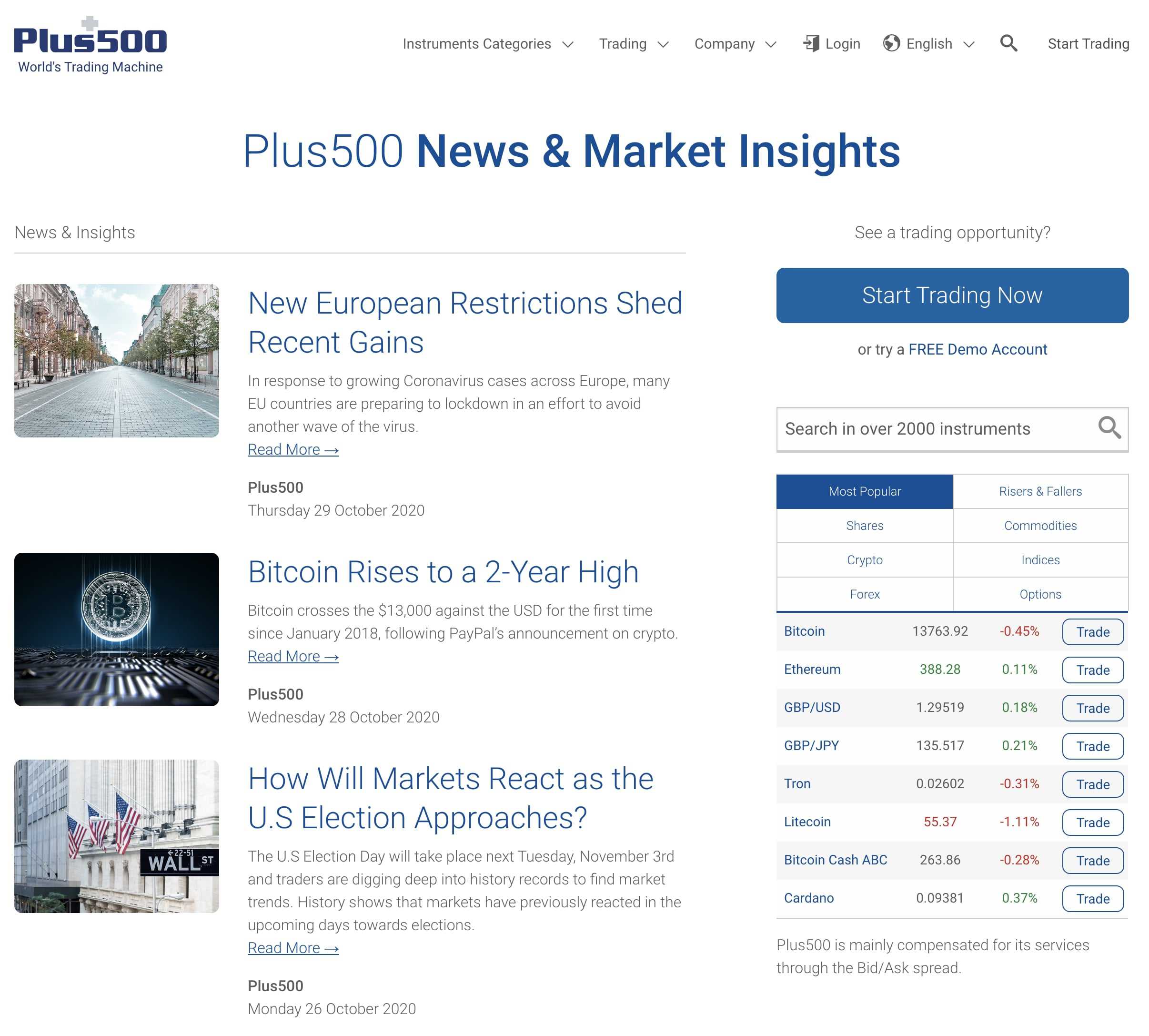

There is also a News and Markets Insights section on the website that has research articles posted sporadically. However, these are fairly infrequent (2-3 a week) and have little depth.

There is also an economic calendar available and the sentiment alert indicators we highlighted in the platform section above, which is a useful research add on.

| Research feature | Plus500 |

| Research Organized by Experience Level | No |

| Research Organized by Topic | No |

| Research Organized by Type | No |

| Has Research – Forex | Yes |

| Has Research – Stock Indices | Yes |

| Has Research – Individual Stocks | Yes |

| Has Research – Bonds | No |

| Has Research – Commodities | Yes |

| Has Research – Crypto (*Availability subject to regulation) | Yes |

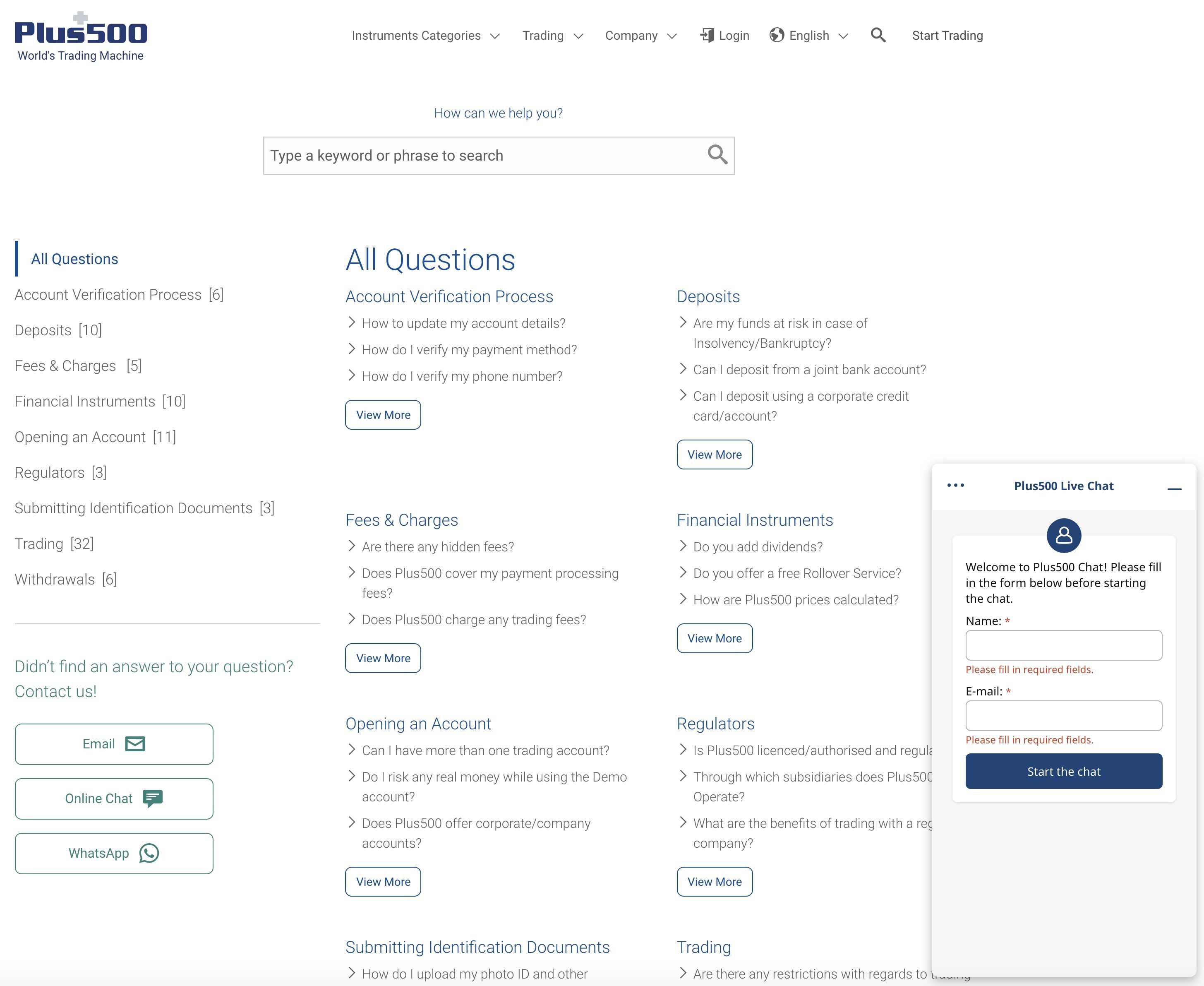

Customer Support

Plus500 stands out from many of its competitors as it offers customer service that is contactable 24/7 to answer any questions or queries you may have. This is a significant plus in the market, as most brokers only offer support 24/5, Monday to Friday. These additional operating hours will undoubtedly add value for Plus500 clients who trade on the weekend.

The customer service team can be contacted 24/7 via live chat, WhatsApp and email, but they do not offer phone support at all. The inability to contact the support team by telephone may deter some clients, who prefer to speak with agents on the phone.

Plus500 operate in 50 countries, with the website is available in 32 languages, with support available in many of these languages.

| Customer support | Plus500 |

| Customer call support Mon-Fri over 8 hours | No |

| Customer call support Mon-Fri 24 hours | No |

| Customer call support Saturday all day | No |

| Customer call support Saturday part day | No |

| Customer call support Sunday all day | No |

| Customer call support Sunday part day | No |

| Web Chat | Yes |

Overview

Overall it is a mixed offering from Plus500. The breadth and depth of different tradable markets is very impressive, as is the 24/7 customer support, via email, live chat and WhatsApp. Although the web based and mobile platform options are relatively basic, they are extremely user-friendly, with a large number of technical analysis tools, plus customisable alerts.

However, the educational content is far from adequate given the standing of Plus500 and would be disappointing for a novice trader. Also, more advanced technical traders would probably want more from the trading platform, whilst the research area is lacking any depth.

As an whole package, we believe that the User-friendliness, 24/7 customer support and high level of regulation (and trust) makes Plus500 a strong contender for traders.