How are stocks valued?

Stock valuation is a method of calculating the current value of the company that listed these shares. In general, there are two basic concepts of analyzing the performance of an asset: Fundamental and technical analysis. The debate about these two concepts is probably as old as the stock market itself.

Fundamental analysis seeks to determine the natural or inherent value of the asset. To do so, analysts look at financial statements, and the industry and environment it operates in. For example, investors will focus on the company's earnings, net income, free cash flows, listed assets, revenue, sales, growth potential, liabilities, etc.

Conversely, technical analysis believes that all external factors (e.g. profits, sales, balance sheets, revenue, industry outlook, etc.) have already been taken into account. Hence, investors should seek to better understand the historical price action of stock and realize the market value.

Both fundamental and technical analysis use different techniques to value a stock. This guide is focused on the financial valuation of stocks, therefore we will be describing below different techniques used today for stock valuation.

Why should I value stocks before buying?

The stocks are valued for a number of important reasons. First, investors would like to learn more about the intrinsic value of a stock, before investing in it. This is a key investment concept – looking for undervalued assets.

Knowing how to evaluate stocks allows investors to see through current market perceptions to get to the intrinsic value of a stock. If this is done successfully, a stock investor will purchase the stock before it rises and ultimately exploit the capital gain to yield a profit.

Moreover, investors are looking to project how the stock is likely to perform in the future and what returns they will be able to generate. To this end, they are looking to learn more and better understand the product that they are buying.

Ultimately, there will be a list of stocks that are too expensive as their current price will be higher than the calculated value. Conversely, stocks that are cheaper compared to their market price will yield investment opportunities.

More: How To Trade Stocks Online

Value Stock vs Growth Stock

Different investors have different stock preferences. Some are looking to invest and yield returns in the long-run, while some other investors have less patience.

Value Stocks

Value stocks refer to stocks that trade below their inherent value. This type of stock requires a lot of time and resources invested in analysis in order to identify them. Value stocks are typically considered to offer a lower degree of risk.

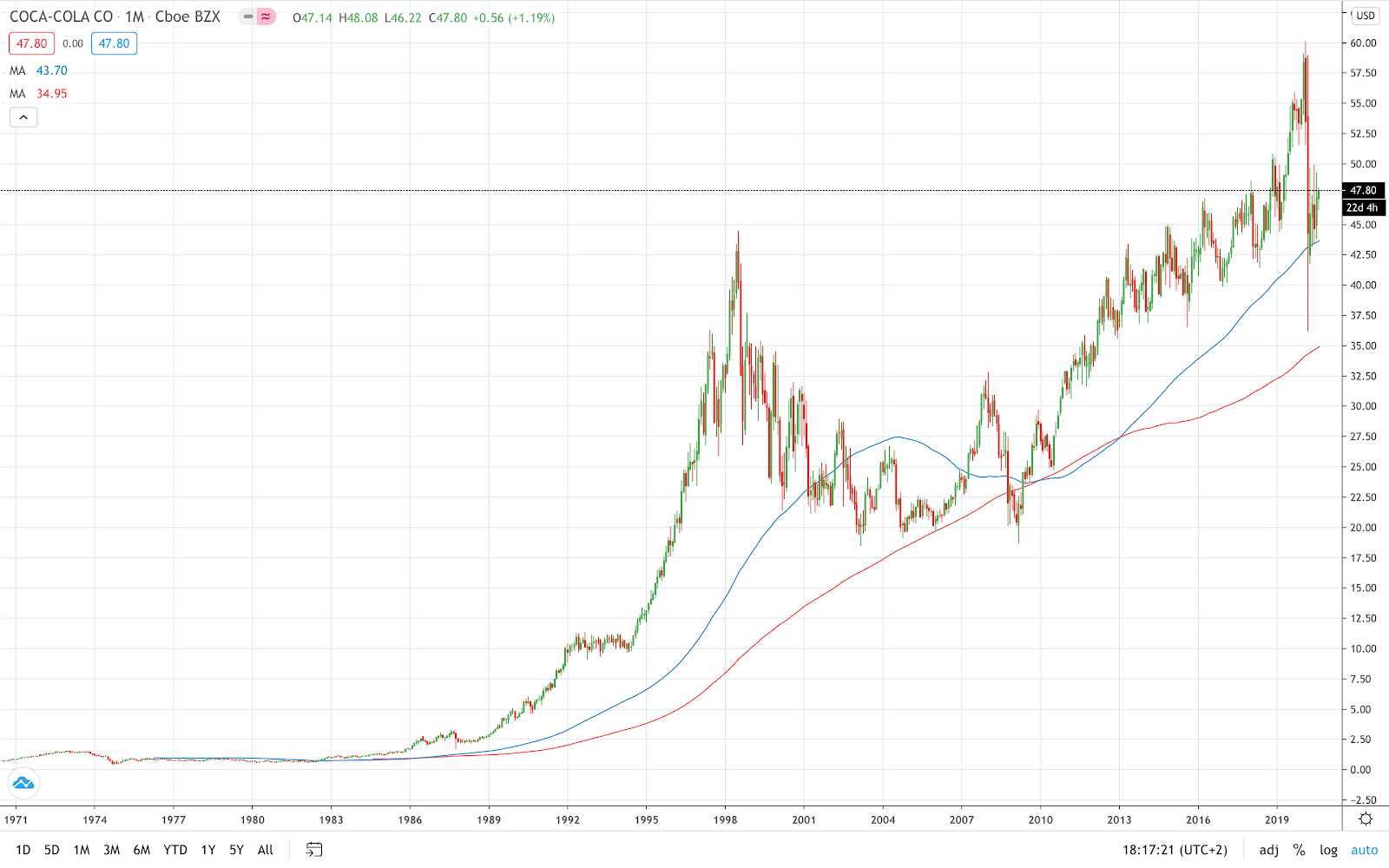

Example Value Stock

When you think of value stocks, the first thing that gets on our mind is Coca Cola. Value stocks are usually associated with long-established companies, sustainable profitability, and gradual revenue growth year after year. Their brand is well-recognized around the world, which is likely to keep the value of a stock in the long-term.

Growth Stocks

On the other hand, growth stocks are more risky assets. They are seen as a more aggressive method of raising the value of your portfolio. Growth stocks are growing at a faster rate than the overall stock market and yielding higher rates of return. The focus of this type of company is more on growth and expansion than income or dividend.

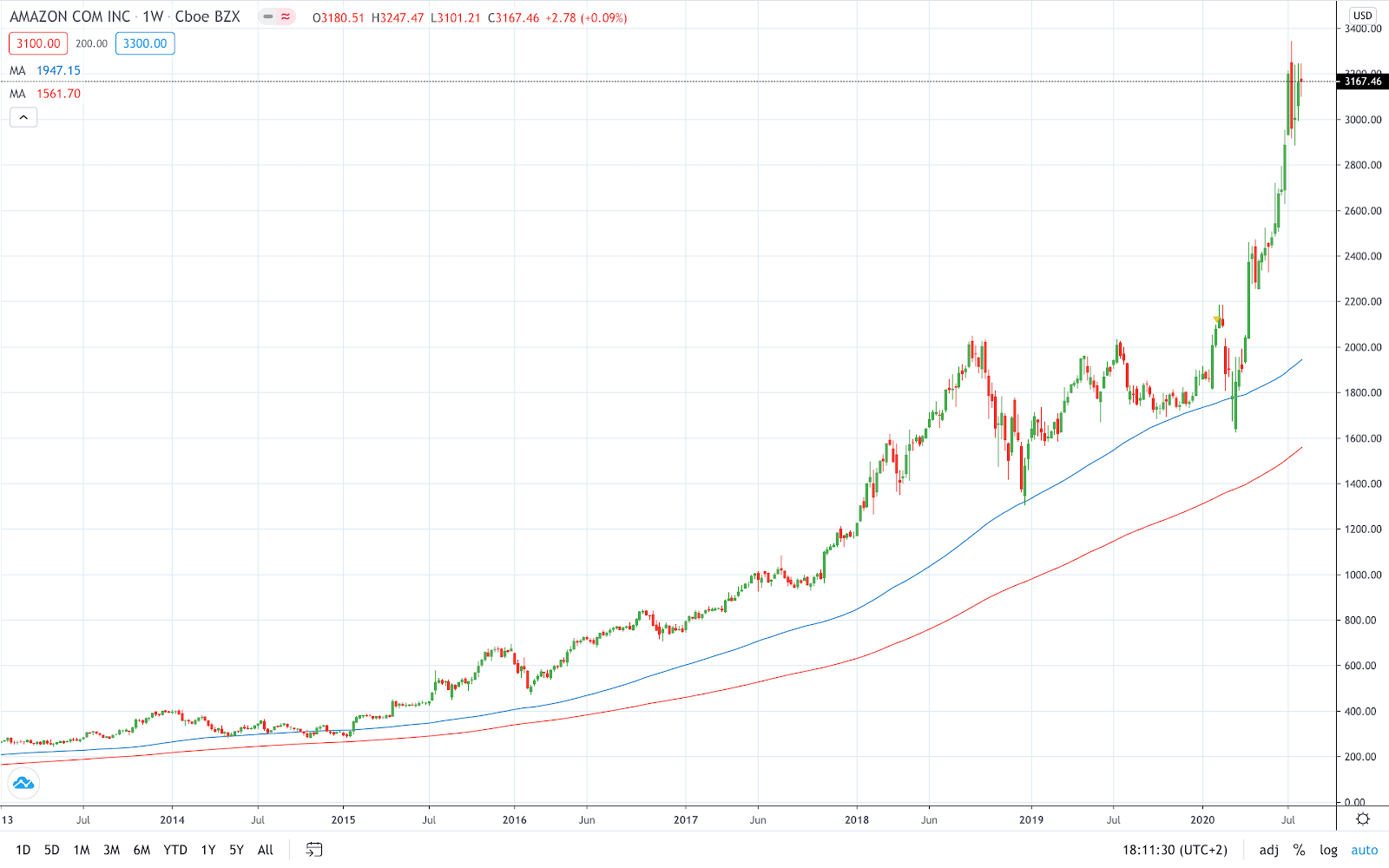

Example Growth Stock

Amazon is a classic example of the growth stock. It has grown spectacularly in the past 5 years as the world moves to online shopping and e-commerce. For this reason, certain investors tend to play it more aggressively and try to capitalize on new booming trends and focus less on dividends. Hence, growth stocks are usually tied to growth companies.

Best Brokers for Trading Stocks:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to start investing in stocks and building your portfolio you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

Stock Valuation Techniques

As noted above, there are numerous stock valuation techniques. Here, we present some of the most popular valuation methods used by successful investors and Wall Street analysts.

1. Earnings per Share (EPS)

Out of all valuation methods, earnings per share is probably the most used tool to value a stock. Its success lies in its simplicity as it is calculated by dividing the company's profit by the number of outstanding shares of its common stock.

EPS seeks to gauge the company’s profitability in relation to the market price. Therefore, the higher the EPS the more profitable the company has been. EPS is a relative valuation method as it is used to compare the profitability of companies working in the same industry.

2. P/E Ratio

The P/E (price to earnings) ratio represents one of the most popular valuation methods. It is widely used by all kinds of investors due to its simplicity and wide adoption. The P/E ratio places company earnings on the forefront of a stock’s value. It determines whether the company will be able to sustain earnings growth over an extended period of time.

Investors use P/E to determine whether the stock X is overvalued or undervalued. A lower P/E ratio signals that the current share price is lower than the reported earnings. In a nutshell, it calculates how long it will take for the stock to pay back its value should company earnings not continue to rise.

For example, If an investor purchases a company’s stock for £50 per share on the market with earnings valued at £5 per share, the share yields a P/E ratio of 10, (£50/£5).

If nothing changes in the company earnings, it may take an investor 10 years, to earn back their initial investment. For a more accurate evaluation, P/E ratios should only be compared with companies operating in the same sector industry or index.

3. PEG Ratio

Price-earnings to growth (PEG) ratio is based on the future projection of the company’s growth. The PEG ratio is calculated by dividing the stock's P/E ratio by the growth rate of its earnings per share for a certain period of time. The time frame used in this context is usually a one-year period, three years, and five years.

The PEG ratio is considered to be a more advanced version of the P/E ratio as it takes into account the future projections. Its key limitation is that its formula is dependent on the accuracy of forecasts.

4. Dividend Discount Model (DDM)

Unlike the PEG ratio that is based on the earnings growth rate, the dividend discount model (DDM) is designed on future dividends. Investors seek to understand the value of the company’s stock based on the sum of all future dividends. Hence, the DDM calculates the present value (what they would be worth today) of those dividends.

This method is usually applied to better understand the value and dividend stocks of well-established companies that have a history of paying a dividend.

5. Price-to-book ratio (P/B)

The P/B ration is made for more sceptical investors. This is because it calculates the value of the stock if everything were to go awry and the stock needs to be sold immediately.

It looks at the company’s current performance according to their books. It accounts for company liabilities and assets, as well as the current profits on hold for the year up to the day the calculation is done. It works in three stages:

- It regards the worst possible situation where the company liquidates

- Pays off its debts and

- Pays out the remainder of its value to the shareholder

The P/B is calculated when the company’s total liabilities and intangible assets (assets without physical substance e.g. patents) are deducted from the company’s total assets.

When this is done, investors get a “book value” of the business, which is then compared to the market price of the company. Companies with low P/B ratios are viewed as good investments on the basis that holding the stock promises a potential good payout.

6. Dividend Yield

Dividends are earnings that companies pass on to their shareholders. The dividend yield, then, is a method used to value stocks on the basis of their dividend payout potential. This is especially common with regards to stocks which pay out yearly or sometimes bi-annual dividends to shareholders.

The dividend yield can signal a number of things to investors. Firstly, a company that is able to pay out a dividend year in, year out is signalling that they are performing well enough to afford a dividend payout. The higher the dividend yield, the better the perceived earning potential of the company. A dividend payment is seen as a sign of a company's strength. This can make a stock more attractive, pushing the stock’s price even higher.

A company choosing not to pay-out dividends on a dividend-yielding stock can signal that the company is struggling. Investors will shy away, fearing they are backing a sinking ship. However, the decision not to pay out dividends can sometimes be a good sign, especially if the company has announced plans to expand or grow. Growth is a good thing, and steady growth oftentimes equates to steady profits.

Stock Valuation Tips

Diversify your portfolio

Having a balanced portfolio is extremely important. If you invest in one industry, whenever it’s is suffering or underperforming your portfolio will plummet in value. Diversification helps eliminate certain risks and maintain your portfolio’s value when a market enters choppy waters. It also allows for steady growth, as stronger stocks within the portfolio can balance out the losses experienced by others.

Avoid stagnant stocks

You don’t want to find yourself invested in a stock that never moves or changes. If a stock cannot react with the market and its own sector, then it may prove to be an unfruitful investment. A stock needs to be able to react to market conditions, whether positively or negatively.