Choosing between a cash ISA and a stocks & shares ISA is one of the most important decisions you can make when planning your savings. Both offer tax-free growth on your money, but they work in completely different ways. Understanding these differences will help you pick the right option for your financial goals.

An ISA, which stands for Individual Savings Account, is a special type of account that protects your money from UK tax. Whether you earn interest or make investment gains, you won’t pay any tax on the growth. For the 2025/26 tax year, you can put up to £20,000 into ISAs.

The key question is: should you keep your money in cash, or invest it for potentially higher returns? Let’s explore both options to help you decide.

What Is a Cash ISA?

A cash ISA works just like a regular savings account, but with one major benefit – you don’t pay tax on the interest you earn. When you put money into a cash ISA, your bank or building society keeps it safe and pays you interest over time.

Think of a cash ISA as a protective wrapper around your savings. The money inside grows slowly but steadily through interest payments. You can access your money whenever you need it (depending on the type of cash ISA you choose), and you’ll never lose the original amount you put in.

There are two main types of cash ISAs:

- Variable rate cash ISAs – The interest rate can go up or down over time. These usually offer instant access to your money, making them perfect for emergency funds

- Fixed rate cash ISAs – The interest rate stays the same for a set period, often one to five years. You typically can’t access your money during this time, but you might earn slightly higher interest

Cash ISAs are ideal for people who want to keep their money completely safe. You’ll always have at least the amount you put in, plus any interest earned. This makes them perfect for short-term savings goals or building an emergency fund.

However, cash ISAs have one major weakness: inflation. Even though your money grows through interest, the cost of living usually rises faster. This means your money might buy less in the future than it does today. For example, if you earn 2% interest but inflation is 3%, your money actually loses 1% of its buying power each year.

What Is an S&S ISA?

A stocks & shares ISA (also called an investment ISA) works completely differently from a cash ISA. Instead of earning interest, your money is invested in things like company shares, bonds, and investment funds. The goal is to achieve higher growth over time than you’d get from cash savings.

When you put money into a stocks & shares ISA, you’re buying small pieces of companies or investment funds. As these companies grow and become more valuable, your investment should grow too. You can also earn money from dividends – payments that some companies make to their shareholders.

The key advantage of a stocks & shares ISA is the potential for much higher returns than cash. Over long periods, investments have historically grown much faster than cash savings. This growth can help your money keep up with or even beat inflation.

However, there’s an important trade-off: risk. Unlike cash ISAs, the value of your investments can go down as well as up. This means you might get back less than you originally put in, especially if you need to access your money during a bad period for the stock market.

Most financial experts recommend keeping money in a stocks & shares ISA for at least five years. This gives your investments time to ride out any short-term ups and downs and benefit from long-term growth.

Key Differences

Understanding the main differences between cash ISAs and stocks & shares ISAs will help you choose the right option for your situation.

Risk

The biggest difference between these two ISA types is risk – the chance that you might lose money.

Cash ISAs are low-risk. Your original money is completely safe, and you’ll earn interest on top. The only risk is that inflation might reduce what your money can buy over time. UK banks and building societies are also protected by the Financial Services Compensation Scheme, which covers up to £85,000 per institution if the provider goes bust.

Stocks & shares ISAs are higher-risk. The value of your investments will go up and down regularly. During bad periods for the stock market, you might see your account value drop significantly. However, history shows that over long periods, investments tend to recover and grow.

Think of it this way: with a cash ISA, you’re guaranteed not to lose your original money. With a stocks & shares ISA, you’re accepting some risk of loss in exchange for the possibility of much higher gains.

Return

The potential returns from each ISA type are very different.

Cash ISA returns come from interest rates set by your provider. In recent years, these have typically ranged from 1% to 5% per year, depending on the type of account and economic conditions. The returns are predictable and guaranteed.

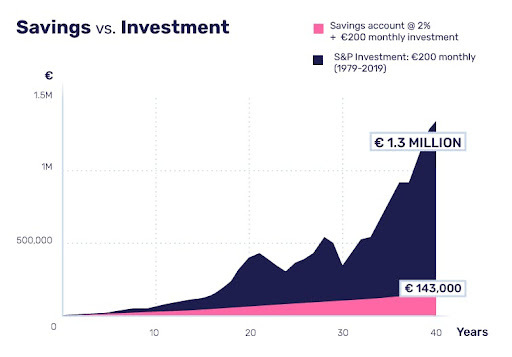

Stocks & shares ISA returns depend on how well your investments perform. While there are no guarantees, historical data shows that stock market investments have averaged around 7-10% annual growth over long periods. However, this includes some years with significant losses and others with large gains.

The key difference is predictability. Cash ISAs give you steady, guaranteed growth. Stocks & shares ISAs offer the potential for much higher returns, but without the guarantees. There are generations’ worth of data that show major indexes outpace savings rates over time, but you need to give the markets time in order for averages to play out.

Time Horizon

Your time horizon – how long you plan to keep the money invested – is crucial for choosing between ISA types.

Cash ISAs work for any time horizon. Whether you need the money next month or in ten years, cash ISAs provide steady growth and easy access. They’re perfect for:

- Emergency funds you might need quickly

- Short-term savings goals (holidays, car purchases)

- Money you’ll need within the next five years

Stocks & shares ISAs work best for long-term goals. The stock market can be volatile in the short term, but tends to smooth out over longer periods. They’re ideal for:

- Retirement planning

- Long-term wealth building

- Goals that are at least five years away

- Money you won’t need to access soon

The longer you can leave money invested, the more time it has to grow and recover from any temporary setbacks.

Which Works for Different Goals?

Choosing between a cash ISA and stocks & shares ISA depends on your specific financial goals and circumstances. Here’s how to match each ISA type to different situations:

Choose a cash ISA when you:

- Need an emergency fund you can access quickly

- Are saving for a specific goal within the next 1-3 years

- Want guaranteed safety for your money

- Are uncomfortable with any risk of losing money

- Need predictable, steady growth

- Are approaching retirement and want to protect your savings

Choose a stocks & shares ISA when you:

- Are saving for long-term goals (5+ years away)

- Want the potential for higher returns than cash

- Can handle seeing your account value go up and down

- Don’t need to access the money soon

- Want to build wealth over time

- Are young and have time to recover from any losses

Consider using both when you:

- Have multiple financial goals with different time horizons

- Want to balance safety and growth potential

- Have enough money to split between both types

- Want to diversify your savings approach

Remember, you can contribute to both a cash ISA and stocks & shares ISA in the same tax year, as long as your total contributions don’t exceed £20,000. Many people use this strategy to create a balanced approach to saving and investing.

For example, you might keep 3-6 months of expenses in a cash ISA as an emergency fund, while investing additional money in a stocks & shares ISA for long-term growth. This gives you both security and growth potential.

The most important thing is to choose an approach that matches your comfort level with risk and your financial timeline. If you’re unsure, consider speaking with a financial adviser who can provide personalized guidance based on your specific situation.

Both cash ISAs and stocks & shares ISAs offer valuable tax benefits and can play important roles in your financial plan. The key is understanding how each works and choosing the right tool for each of your financial goals.