Individual Savings Accounts (ISAs) offer UK savers and investors a valuable opportunity to grow their wealth tax-free. With a generous annual allowance of £20,000, ISAs represent one of the most effective ways to protect your money from taxation while building long-term financial security. However, even experienced investors can make costly errors that significantly impact their returns over time.

Understanding and avoiding common ISA mistakes is crucial for maximising your investment potential. Small missteps can compound over time, potentially costing thousands in lost returns. From choosing inappropriate account types to making emotional investment decisions, these errors are surprisingly common among both novice and experienced investors.

The key to successful ISA investing lies in understanding the various account options available, implementing a disciplined investment approach, and avoiding the psychological traps that lead to poor decision-making. By recognising these common pitfalls early, you can develop a more effective investment strategy that aligns with your financial goals and risk tolerance.

This comprehensive guide examines the most frequent ISA mistakes that can derail your investment success. Whether you are new to ISA investing or looking to refine your existing approach, understanding these common errors will help you make more informed decisions and potentially save significant amounts over the long term.

Overpaying Fees

One of the most damaging mistakes ISA investors make is failing to monitor and control the fees they pay. Fund management charges, platform fees, and transaction costs can significantly erode your returns over time, yet many investors overlook these expenses when selecting their investments.

Laura Suter, director of personal finance at AJ Bell, emphasises that “paying some fees is part and parcel of investing, but one ISA mistake to avoid is paying out too much in charges, as ultimately this will eat into your returns.”

The cumulative effect of high fees can be substantial, potentially reducing your portfolio value by thousands of pounds over a typical investment timeframe.

Understanding Fee Structures

Different types of fees affect ISA investments in various ways. Annual management charges typically range from 0.1% to 2.5% depending on the fund type and investment strategy. Platform fees, which cover the cost of holding your investments, can add another 0.25% to 0.45% annually. Transaction fees for buying and selling investments vary significantly between providers, with some charging fixed amounts per transaction while others use percentage-based pricing.

The impact of fees becomes more pronounced over longer investment periods due to compounding effects. For example, an additional 1% in annual fees on a £10,000 investment could cost over £2,600 over 20 years, assuming 6% annual growth. This demonstrates why fee management should be a priority for all ISA investors.

Strategies to Minimise Costs

Several practical approaches can help reduce the isa fees you pay on ISA investments:

- Avoid excessive trading activity, as frequent buying and selling generates transaction costs that quickly accumulate

- Consider consolidating your investments with fewer providers to reduce platform fees

- Choose low-cost index funds or exchange-traded funds (ETFs) where appropriate

- Review your investment costs annually to ensure you are not paying unnecessarily high fees

Many investors set up their ISAs and forget about ongoing charges, missing opportunities to switch to lower-cost alternatives. Online comparison tools can help identify more cost-effective options for your investment strategy.

Poor Diversification

Diversification represents one of the fundamental principles of successful investing, yet many ISA investors fail to implement adequate portfolio diversification. This mistake can expose your investments to unnecessary risk and potentially limit your long-term returns.

Recent market trends have highlighted the dangers of poor diversification. Many investors have concentrated their holdings in technology stocks, particularly US-based companies, creating significant portfolio concentration risk. While these investments have performed well recently, the volatility experienced by companies like Nvidia demonstrates the potential downside of inadequate diversification.

Geographic and Sector Concentration Risks

Investing too heavily in specific geographic regions or industry sectors creates vulnerability to localised economic or political events. Many UK investors maintain excessive exposure to domestic markets, missing opportunities in international markets and increasing their dependence on UK economic performance.

Similarly, sector concentration has become increasingly common, with many portfolios heavily weighted towards technology companies. While technology has delivered strong returns in recent years, this concentration leaves investors vulnerable to sector-specific downturns or regulatory changes that could significantly impact performance.

Building Effective Diversification

Effective diversification involves spreading investments across different asset classes, geographic regions, and industry sectors. A well-diversified ISA portfolio might include UK equities, international developed market funds, emerging market exposure, and potentially some fixed-income investments depending on your risk tolerance and investment timeline.

Jason Hollands, managing director of Bestinvest, suggests that reasonable diversification can be achieved “with half a dozen funds providing they are all doing slightly different things.” However, he warns against over-diversification, noting that some investors hold up to 75 different funds, which can dilute returns without providing meaningful additional diversification benefits.

Consider geographic diversification beyond traditional markets. European and UK markets may offer better value compared to expensive US markets, particularly given current geopolitical uncertainties. Regular portfolio rebalancing helps maintain your desired diversification levels as market movements can cause your allocation to drift from your target weightings.

Emotional Trading

Emotional decision-making represents one of the most destructive forces in investment management. Fear and greed drive many investors to make poor timing decisions that significantly undermine their long-term returns. Understanding and controlling these emotional responses is crucial for ISA investment success.

Market volatility can trigger strong emotional responses that lead to poor investment decisions. During market downturns, fear often drives investors to sell their holdings at the worst possible time, crystallising losses and missing subsequent recovery periods. Conversely, during market peaks, greed can lead to excessive risk-taking or chasing performance in overvalued investments.

The Cost of Market Timing

James Norton, head of retirement and investments at Vanguard Europe, emphasises that “successful investors are those who manage to ride out the market falls, remain focused on their goals and stay invested for when markets recover.”

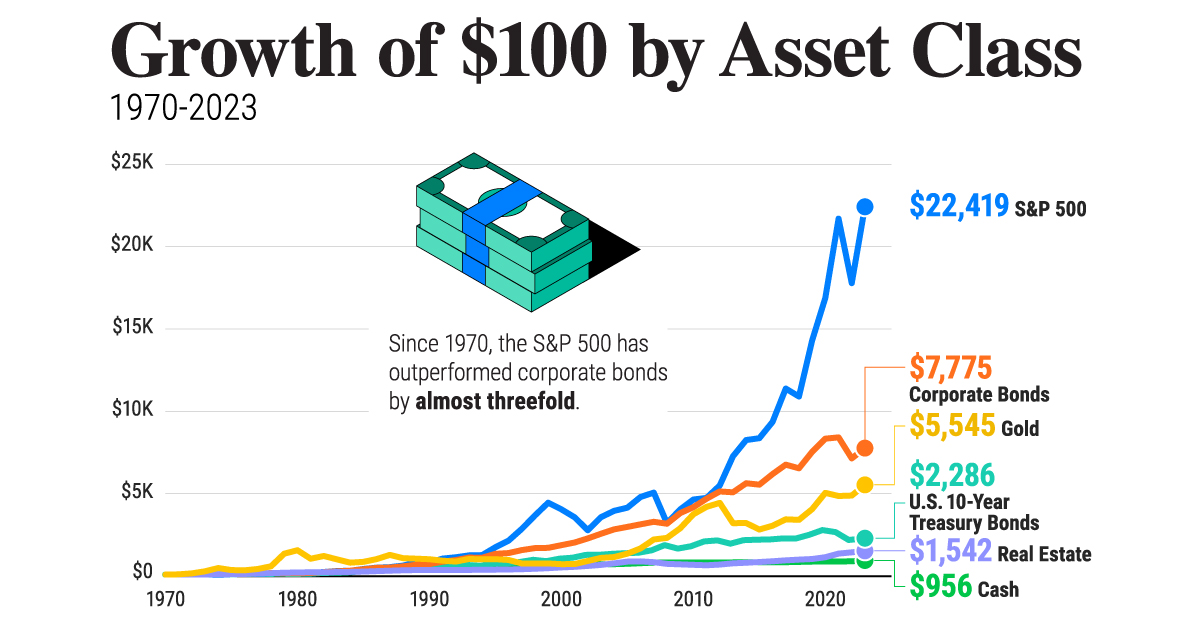

Historical data consistently shows that markets recover from major shocks and reach new highs over time. Attempting to time market movements typically results in buying high and selling low, the opposite of successful investment strategy. Studies demonstrate that investors who remain invested during market downturns generally achieve better long-term returns than those who attempt to avoid volatility through market timing.

Developing Emotional Discipline

Several strategies can help manage emotional responses to market movements:

- Establish clear investment goals and time horizons before investing

- Implement a regular investment schedule through direct debits rather than making large lump-sum investments

- Limit exposure to financial media during volatile periods if it increases anxiety

- Focus on factors you can control, such as costs, diversification, and contribution levels

Nick Winter, financial planner at Quilter, advises that “your ISA should be built around your long-term goals, and making small changes every time the market moves often does more harm than good.”

Successful investing requires patience and discipline rather than constant portfolio adjustments.

Not Using Allowance

Failing to utilise your full ISA allowances represents a significant missed opportunity that can cost thousands in potential tax savings over time. With personal tax thresholds frozen and dividend allowances reduced, maximising tax-efficient savings has become increasingly important for UK investors.

The current ISA allowance of £20,000 per year provides substantial tax shelter for most investors. However, many people either fail to use their full allowance or delay their contributions until late in the tax year, missing valuable growth opportunities.

The Impact of Delayed Contributions

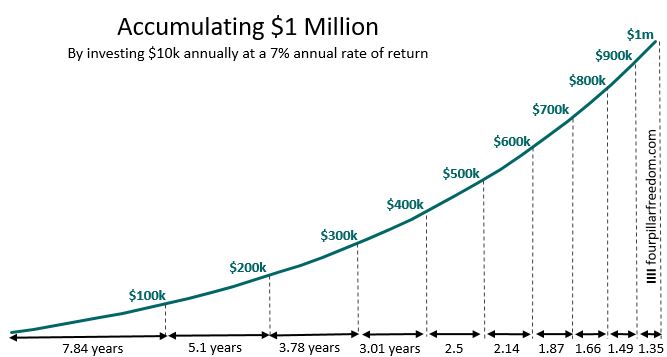

Research consistently shows that investors who contribute early in the tax year achieve better returns than those who delay their contributions. This occurs because early contributions have more time to benefit from compound growth and dividend payments throughout the tax year.

Stock markets have historically risen in 10 out of the previous 14 years, making early investment statistically advantageous. By investing early in the tax year, you increase the probability of benefiting from market growth and maximise the time your money can work for you tax-free.

Strategies for Maximising Allowance Usage

If you cannot afford to contribute the full £20,000 allowance immediately, consider setting up a regular monthly contribution plan. This approach makes the contribution more manageable from a cash flow perspective while ensuring you use your full allowance each year.

Jason Hollands from Bestinvest suggests that regular monthly contributions provide “a very good discipline, which is both easier on your cash flow situation and for investors can help iron out the effect of market ups and downs.”

Remember that unused ISA allowances cannot be carried forward to future years. Each tax year provides a fresh £20,000 allowance, but any unused portion is lost permanently. This makes annual planning essential for Maximising ISA allowance and your long-term tax efficiency.

Long-Term Benefits of Full Allowance Usage

Consistently using your full ISA allowance can result in substantial tax savings over time. A portfolio built through regular maximum contributions could grow to several hundred thousand pounds over a typical working career, all sheltered from income tax and capital gains tax.

The tax benefits become more valuable as your wealth grows and you potentially move into higher tax brackets. ISA investments provide protection against future tax rate increases and changes to tax allowances that could affect non-ISA investments.

Regular ISA contributions also provide valuable investment discipline, encouraging consistent saving and investment behaviour that benefits long-term wealth building. This systematic approach helps overcome the tendency to delay or avoid investment decisions that could benefit your financial future.