Managing your Individual Savings Account (ISA) requires finding the right balance between staying informed and avoiding the pitfalls of excessive monitoring. Understanding how often to check your ISA portfolio is crucial for maintaining a disciplined investment approach while working towards your long-term financial goals.

For beginners entering the world of ISA investing, the frequency of portfolio checks can significantly impact both investment performance and emotional wellbeing. Research from leading investment platforms suggests that checking investments once every three months provides an optimal balance between staying informed and maintaining investment discipline.

Understanding ISA Portfolio Monitoring

When you check your ISA portfolio, you’re reviewing the performance of your investments to ensure they align with your financial objectives. This process involves examining individual fund performance, overall portfolio value, and progress towards your savings goals.

The key to effective ISA monitoring lies in understanding what to look for during these reviews. Rather than focusing on daily price movements, successful investors concentrate on longer-term trends and whether their investments continue to support their financial strategy.

Your ISA portfolio review should include:

- Assessment of overall portfolio performance against your goals

- Evaluation of individual fund or stock performance

- Review of asset allocation and diversification

- Consideration of any necessary rebalancing

- Analysis of contribution levels and remaining allowances

Risks of Overchecking

Frequent portfolio monitoring can lead to several detrimental behaviors that may harm your long-term investment success. Understanding these risks helps explain why restraint in checking your ISA is often beneficial.

Emotional Decision Making

Daily market fluctuations can trigger emotional responses that lead to poor investment decisions. When you check your ISA portfolio too frequently, you expose yourself to the natural volatility of financial markets, which can cause anxiety and prompt hasty decisions.

According to investment platform data, even well-regarded funds experience significant short-term volatility. For example, during the global pandemic from February to March 2020, popular equity funds saw losses of 25-30%, yet those who maintained their positions recovered these losses over time.

Knee-Jerk Reactions

Overchecking often results in reactive investment behavior rather than strategic decision-making. Investors who monitor their portfolios daily are more likely to buy high during market euphoria and sell low during market downturns, directly contradicting successful investment principles.

Loss of Long-Term Perspective

Frequent monitoring can shift your focus from long-term wealth building to short-term performance tracking. This perspective change often leads to abandoning well-constructed investment strategies during temporary market downturns.

Increased Trading Costs

Excessive monitoring frequently leads to unnecessary trading, which can erode returns through transaction costs and potential tax implications within your ISA wrapper.

Time Opportunity Cost

Spending excessive time monitoring your ISA portfolio diverts attention from other important financial planning activities or personal pursuits that could provide greater value.

Suggested Schedule

Establishing a structured approach to checking your ISA portfolio helps maintain discipline while ensuring adequate oversight of your investments. The following schedule provides a framework for effective portfolio monitoring.

Quarterly Reviews (Every Three Months)

Investment professionals recommend conducting comprehensive ISA portfolio reviews every three months. This frequency aligns with natural market cycles and provides sufficient time for meaningful performance assessment without exposing you to excessive short-term volatility.

During quarterly reviews, allocate approximately 10 minutes to:

- Review overall portfolio performance

- Check progress towards annual ISA allowances

- Assess whether rebalancing is necessary

- Evaluate individual fund performance

- Consider any changes to your financial circumstances

Annual Comprehensive Assessment

Once per year, conduct a thorough review of your ISA strategy, including:

- Complete portfolio rebalancing if required

- Review and adjust investment objectives

- Assess risk tolerance changes

- Plan for the new tax year’s ISA allowance

- Consider switching between ISA providers if beneficial

Event-Driven Reviews

Certain circumstances may warrant additional portfolio checks outside your regular schedule:

- Significant life changes affecting financial goals

- Major market events requiring strategic assessment

- Approaching retirement or other financial milestones

- Changes in personal risk tolerance

- Regulatory changes affecting ISA rules

Setting Up Automated Monitoring

To maintain discipline in your checking schedule, consider:

- Setting calendar reminders for quarterly reviews

- Using portfolio alerts for significant changes only

- Establishing automatic contributions to maintain consistent investing

- Creating written investment policies to guide decision-making

Long-Term Mindset

Developing and maintaining a long-term investment mindset is fundamental to ISA success. This perspective helps you navigate market volatility while staying focused on your ultimate financial objectives.

Historical Market Performance

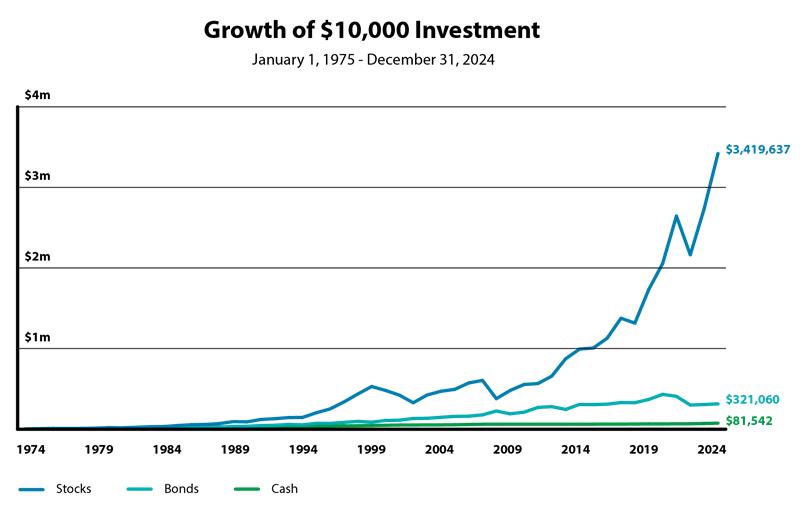

Understanding historical market behavior reinforces the importance of long-term thinking. While markets experience regular fluctuations, they have historically trended upward over extended periods, rewarding patient investors who maintain their positions through various market cycles.

The Power of Time in Investing

Time serves as a powerful ally in ISA investing through several mechanisms:

- Compound growth amplifies returns over extended periods

- Market volatility tends to smooth out over longer timeframes

- Regular contributions benefit from pound-cost averaging

- Tax-free growth within ISAs maximizes long-term wealth accumulation

Staying Focused on Goals

Maintaining focus on your long-term financial objectives helps resist the temptation to make emotional investment decisions based on short-term market movements. Whether saving for retirement, a house deposit, or other major expenses, keeping these goals in mind provides perspective during market turbulence.

Building Investment Discipline

Successful ISA investing requires developing discipline around:

- Sticking to your predetermined checking schedule

- Avoiding reactionary changes to your investment strategy

- Maintaining regular contributions regardless of market conditions

- Focusing on factors within your control rather than market movements

Managing Investment Expectations

Realistic expectations about investment returns and volatility help maintain a long-term perspective. Understanding that markets will experience both gains and losses helps you prepare mentally for the inevitable fluctuations in your ISA portfolio value.

The Role of Diversification

Proper diversification within your ISA portfolio reduces the impact of individual investment volatility and supports long-term wealth building. Whether through diversified funds or a mix of different asset classes, spreading risk helps smooth your investment journey.

By implementing a structured approach to checking your ISA portfolio and maintaining a long-term investment mindset, you position yourself for investment success while avoiding the common ISA mistakes that derail many investors. Remember that successful ISA investing is about time in the market, not timing the market, and your checking frequency should support this fundamental principle.

The key to ISA success lies in finding the right balance between staying informed about your investments and maintaining the discipline necessary for long-term wealth building. By checking your portfolio quarterly, avoiding the risks of overchecking, and maintaining a long-term perspective, you create the optimal conditions for achieving your financial goals through Stocks & Shares ISAs investing.