A Stocks and Shares ISA is a tax-efficient investment account that allows UK residents to grow their money through various investment opportunities. Understanding how these accounts generate returns is crucial for beginners looking to build long-term wealth while protecting their gains from UK Income and Capital Gains Tax.

Unlike Cash ISAs that rely solely on interest rates, Stocks and Shares ISAs generate money through several distinct mechanisms. With an annual allowance of £20,000 that refreshes each 6th April, these accounts provide substantial opportunities for tax-free growth when invested wisely over the long term.

Capital Growth

Capital growth represents the increase in value of your investments over time. When you purchase shares, funds, or other securities within your ISA, their market value can rise above your initial purchase price, creating unrealised gains.

This appreciation occurs when companies perform well, expand their operations, or become more valuable to investors. For example, if you invest £1,000 in a company's shares and they increase to £1,200, you have achieved £200 in capital growth.

The key advantages of capital growth within an ISA include:

- Tax-free gains: Any increase in investment value remains completely free from Capital Gains Tax

- Compound potential: Gains can be reinvested to purchase additional investments

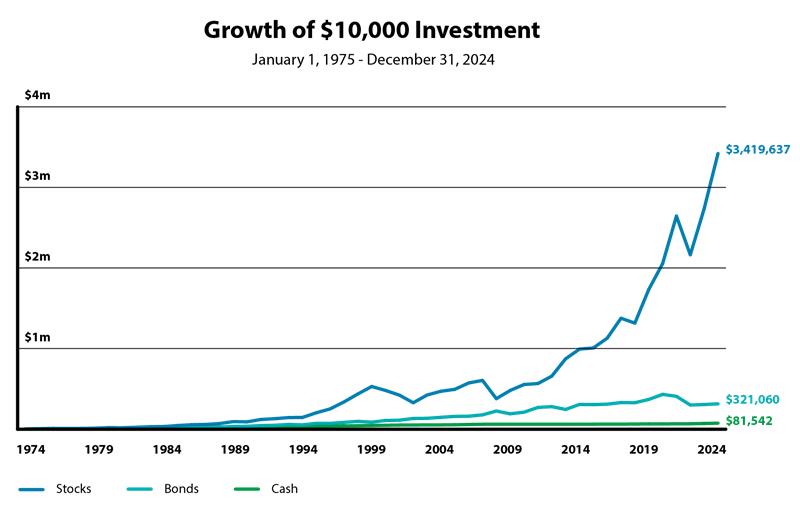

- Long-term wealth building: Historically, equity markets have delivered positive returns over extended periods

Capital growth becomes particularly powerful when investments are held for five years or longer, allowing sufficient time for market fluctuations to smooth out and underlying company value to be recognised by the market.

Dividends

Dividends are regular payments made by companies to their shareholders, typically distributed quarterly or annually from company profits. These payments provide a steady income stream within your ISA, separate from any capital appreciation.

When companies generate profits, they often return a portion to shareholders through dividend payments. The amount varies based on company performance, industry sector, and management decisions regarding profit distribution versus reinvestment.

Dividend benefits within ISAs include:

- Tax-free income: No Income Tax applies to dividend payments received

- Reinvestment opportunities: Dividends can be automatically reinvested to purchase additional shares

- Inflation protection: Many companies increase dividend payments annually, helping maintain purchasing power

- Portfolio diversification: Dividend-paying investments often provide stability during market volatility

Dividend yields typically range from 2% to 6% annually for established companies, though this varies significantly across different sectors and market conditions. Technology companies may pay lower dividends while focusing on growth, whereas utility companies often provide higher, more stable dividend payments.

Compounding

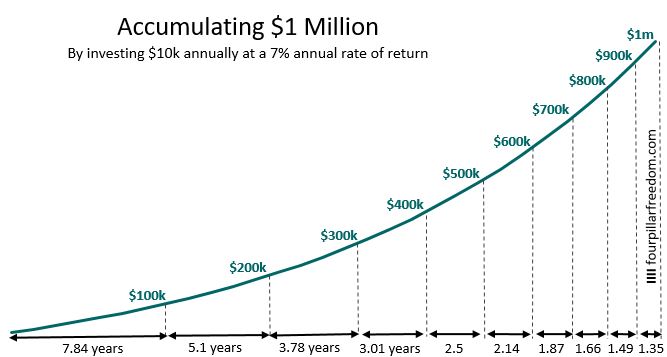

Compounding occurs when your investment returns generate their own returns over time, creating an accelerating growth effect. This powerful mechanism transforms modest regular contributions into substantial wealth over extended periods.

Within a Stocks and Shares ISA, compounding works through multiple channels. Dividend payments can be reinvested to purchase additional shares, which then generate their own dividends. Similarly, capital gains increase your total investment value, providing a larger base for future growth.

The mathematical impact of compounding becomes dramatic over time:

- Year 1: £1,000 investment grows by 7% to £1,070

- Year 10: Same investment compounds to approximately £1,967

- Year 20: Compounding effect produces roughly £3,870

- Year 30: Original £1,000 becomes approximately £7,612

Regular monthly contributions amplify compounding effects significantly. Investing £200 monthly with 7% annual returns could generate over £500,000 after 30 years, despite total contributions of only £72,000.

The ISA wrapper protects this entire compounding process from taxation, ensuring that every pound of growth remains available for further reinvestment rather than being reduced by tax obligations.

FX Effects

Foreign exchange effects impact ISAs containing international investments, as currency movements can enhance or reduce returns when converted back to pounds sterling. These effects become increasingly relevant as investors diversify globally.

When you invest in overseas companies or international funds, your returns depend on both the underlying investment performance and currency exchange rates. A successful US company investment could still lose money in pound terms if the dollar weakens significantly against sterling.

Currency impacts work in both directions:

- Positive FX effects: Strengthening foreign currencies increase the pound value of overseas investments

- Negative FX effects: Weakening foreign currencies reduce returns when converted to sterling

- Natural hedging: Some companies have international operations, providing built-in currency diversification

Many investment funds offer currency-hedged versions that aim to eliminate FX effects, allowing investors to focus purely on underlying investment performance. However, unhedged international exposure can provide additional diversification benefits and protection against sterling weakness.

Professional fund managers often use sophisticated currency management techniques to optimise FX effects, making international funds an accessible way for beginners to gain global exposure without directly managing currency risks.

Long-Term Strategy

Successful ISA investing requires a long-term perspective, as short-term market volatility can obscure the underlying wealth-building potential of equity investments. The recommended minimum investment period of five years allows sufficient time for market cycles to complete.

Long-term strategies benefit from several key principles:

- Time diversification: Longer periods reduce the impact of short-term market volatility

- Market cycle averaging: Regular investing captures both market peaks and troughs

- Compound acceleration: Extended timeframes maximise the mathematical power of compounding

- Tax efficiency: ISA benefits compound over decades without tax erosion

Historical data demonstrates that equity markets have delivered positive real returns over virtually all 20-year periods, despite experiencing significant short-term fluctuations. This pattern supports the long-term approach recommended for ISA investing.

Regular review and rebalancing ensure your ISA remains aligned with your objectives as circumstances change. However, frequent trading can reduce returns through dealing costs and market timing errors, making a patient, disciplined approach generally more effective.

The combination of tax efficiency, compounding returns, and long-term market growth makes Stocks and Shares ISAs particularly powerful for retirement planning, house deposits, or other major financial goals requiring substantial capital accumulation over time.

By understanding these five key mechanisms – capital growth, dividends, compounding, FX effects, and long-term strategy – beginners can make informed decisions about ISA investing and harness the full wealth-building potential of these tax-efficient accounts.