Individual Savings Accounts (ISAs) represent one of the most valuable tax-efficient savings tools available to UK residents. Understanding your ISA allowance and how to use it effectively can significantly impact your financial future. This comprehensive guide explains everything you need to know about ISA allowances, from basic limits to advanced strategies for maximising your tax-free savings potential.

The ISA system allows UK residents to save and invest money without paying tax on interest, dividends, or capital gains. However, there are strict rules governing how much you can contribute and how you can use these accounts. Whether you are new to ISAs or looking to optimise your existing strategy, understanding these allowances is crucial for effective financial planning.

What Is the ISA Allowance?

The ISA allowance refers to the maximum amount of money you can contribute to ISAs during a single tax year without losing the tax benefits. This allowance represents your annual limit for tax-free savings and investments across all ISA types.

The allowance operates on a use-it-or-lose-it basis, meaning any unused portion cannot be carried forward to the following tax year. The UK tax year runs from 6 April to 5 April the following year, and your allowance resets at the beginning of each new tax year.

Your ISA allowance covers contributions to all types of ISAs, including:

- Cash ISAs for savings accounts

- Stocks and Shares ISAs for investments

- Innovative Finance ISAs for peer-to-peer lending

- Lifetime ISAs for first-time buyers and retirement savings

The allowance applies to new money you add to ISAs, not the growth or returns your investments generate. Once money is in an ISA, any interest, dividends, or capital gains do not count towards your annual allowance and remain tax-free indefinitely.

Understanding the difference between contributions and account values is essential. Your ISA can grow beyond the annual allowance limit through investment returns, and this growth does not affect your ability to make new contributions up to the current year's limit.

The allowance system ensures fairness by providing the same opportunity to all eligible UK residents, regardless of their income level or tax bracket. This makes ISAs particularly valuable for higher-rate taxpayers who would otherwise pay significant tax on savings interest and investment returns.

Annual Limits

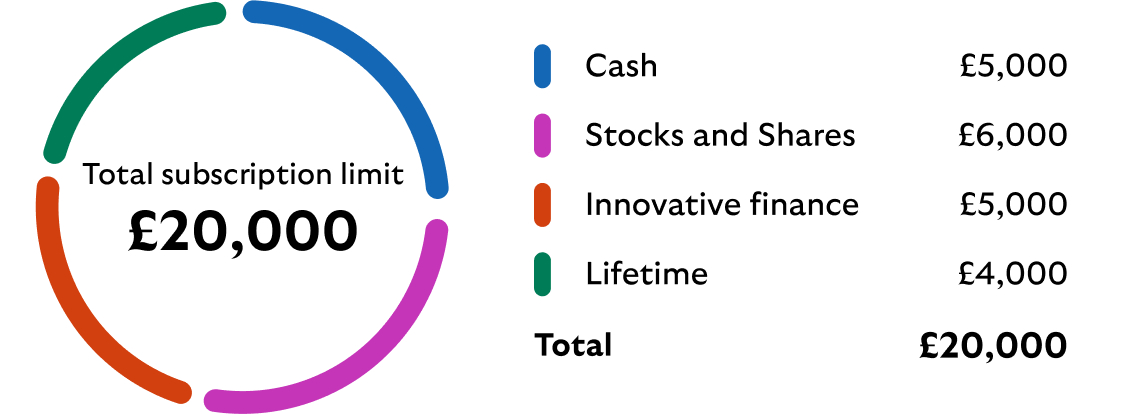

The ISA allowance for the 2024-25, and the 2025-26 tax year is £20,000 for adults aged 18 and over. This limit has remained unchanged since the 2017-18 tax year, providing stability for long-term financial planning.

During the recent budget, there was a change in how much of the allowance can be allocated in Cash ISAs (now £12,000 for those under 65). This did not impact S&S ISA allowances.

The £20,000 allowance can be allocated across different ISA types according to your preferences and financial goals. You have complete flexibility in how you distribute this allowance, allowing you to adapt your strategy based on market conditions and personal circumstances.

For the Junior ISA, which is available for children under 18, the annual allowance is £9,000 for the 2024-25 tax year. Parents, guardians, or the child themselves can contribute to this allowance, but the total contributions from all sources cannot exceed the annual limit.

Lifetime ISA holders face a sub-limit within the main allowance. You can contribute up to £4,000 per year to a Lifetime ISA, and this amount counts towards your overall £20,000 ISA allowance. This means if you maximise your Lifetime ISA contribution, you have £16,000 remaining for other ISA types.

The government reviews ISA allowances periodically, typically announcing any changes during the annual Budget. While the allowance has remained stable in recent years, it has increased significantly from the original £7,000 limit when ISAs were first introduced in 1999.

Historical allowance increases demonstrate the government's commitment to encouraging tax-efficient saving:

- 1999-2008: £7,000 annual limit

- 2008-2014: Various increases reaching £15,000

- 2014-2017: £15,000 to £20,000

- 2017-present: £20,000 annual limit

These increases reflect inflation adjustments and policy changes designed to maintain the real value of tax-free savings opportunities for UK residents.

Contribution Rules

ISA contribution rules are designed to prevent abuse while maximising flexibility for savers. Understanding these rules helps you avoid penalties and make the most of your allowance.

The fundamental rule states that you can only contribute to one Cash ISA and one Stocks and Shares ISA per tax year with different providers. However, you can contribute to multiple ISAs of the same type with the same provider, subject to their terms and conditions.

Timing of contributions affects your strategy significantly. You can make contributions at any point during the tax year, but you cannot backdate contributions to previous tax years. This means you must use your allowance within the current tax year or lose it permanently.

The minimum age requirements vary by ISA type:

- Cash ISAs and Stocks and Shares ISAs: 18 years old

- Junior ISAs: Under 18 years old

- Lifetime ISAs: 18-39 years old for opening, contributions allowed until age 50

Transfers between ISA providers follow specific rules that protect your allowance. You can transfer ISA funds between providers without affecting your current year's allowance, but you must follow the proper transfer process. Direct transfers preserve the tax-free status, while withdrawing and redepositing money may count towards your current allowance.

Withdrawal rules vary significantly between ISA types:

- Cash ISAs and Stocks and Shares ISAs: Generally allow withdrawals without penalties

- Lifetime ISAs: 25% government penalty for non-qualifying withdrawals

- Innovative Finance ISAs: Withdrawal terms depend on underlying investments

Some providers offer flexible ISAs that allow you to withdraw and replace money within the same tax year without affecting your allowance. This feature provides additional liquidity while maintaining tax efficiency, but not all providers offer this option.

Contribution methods include regular monthly payments, lump sum deposits, and standing orders. Many savers find regular contributions help them budget effectively and take advantage of pound-cost averaging for investment ISAs.

Using Multiple ISAs

Managing multiple ISAs requires careful planning to maximise benefits while staying within allowance limits. The rules allow strategic allocation across different ISA types to match your financial goals and risk tolerance.

You can hold multiple ISAs simultaneously, including accounts from previous tax years that remain open. However, your annual contributions are limited by the current year's allowance, regardless of how many accounts you maintain.

Strategic allocation involves matching ISA types to specific financial objectives:

- Cash ISAs for emergency funds and short-term savings goals

- Stocks and Shares ISAs for long-term growth and retirement planning

- Lifetime ISAs for first-time home purchases or additional retirement savings

- Innovative Finance ISAs for alternative investment opportunities

Provider diversification offers several advantages, including access to different investment options, competitive rates, and reduced concentration risk. However, managing multiple accounts requires more administrative effort and careful tracking of contributions.

The one-provider-per-type rule for new contributions means you must choose carefully when selecting where to place each year's allowance. You can contribute to a Cash ISA with Provider A and a Stocks and Shares ISA with Provider B in the same tax year, but you cannot split your Cash ISA contributions between multiple providers.

Rebalancing strategies help maintain your desired asset allocation across multiple ISAs. You can achieve this through:

- Directing new contributions to underweighted areas

- Using transfer rights to move funds between providers

- Adjusting investment selections within existing accounts

Tax year planning becomes more complex with multiple ISAs, but offers greater flexibility. You can adjust your allocation each year based on changing circumstances, market conditions, and financial goals.

Record keeping becomes crucial when managing multiple ISAs. Track contributions to each account, transfer dates, and provider details to ensure compliance with annual limits and optimise your strategy.

How to Maximise the Allowance

Maximising your ISA allowance requires strategic planning, timing, and understanding of the various optimisation techniques available. The goal is to make the most of your tax-free savings opportunity while aligning with your financial objectives.

Early contribution strategies help you benefit from compound growth over the entire tax year. Contributing at the beginning of the tax year, rather than the end, provides additional months for your money to grow tax-free. This approach is particularly beneficial for investment ISAs where time in the market can significantly impact returns.

Monthly contribution plans help spread the cost and can improve investment outcomes through pound-cost averaging. This approach reduces the impact of market volatility and makes ISA contributions more manageable within your budget. Setting up automatic payments ensures you do not miss contribution opportunities.

End-of-tax-year planning becomes critical as the 5 April deadline approaches. Many savers leave contributions until the last minute, but this can limit your options and create unnecessary pressure. Planning ahead allows you to:

- Research the best rates and investment options

- Complete application processes without rushing

- Take advantage of promotional rates or bonuses

- Ensure transfers complete before the deadline

Allowance splitting strategies help optimise tax efficiency across different time horizons. Consider allocating portions of your allowance based on when you might need access to funds:

- Immediate access needs: Cash ISAs with competitive rates

- Medium-term goals: Balanced investment ISAs

- Long-term growth: Growth-focused Stocks and Shares ISAs

- Specific purposes: Lifetime ISAs for qualifying uses

Transfer timing can help you maximise returns without sacrificing allowance space. Transferring underperforming ISAs to better providers frees up your current year's allowance for new opportunities while maintaining your existing tax-free savings.

Rate monitoring ensures you achieve the best returns on Cash ISA portions of your portfolio. Interest rates change frequently, and moving to higher-paying accounts can significantly impact long-term returns. However, consider any transfer restrictions or penalties before making changes.

Investment diversification within Stocks and Shares ISAs helps balance risk and return potential. Use your allowance to build a diversified portfolio across different asset classes, geographic regions, and investment styles to optimise long-term growth potential.

Family planning strategies can multiply the benefits across household members. Spouses can each use their full allowance, effectively doubling the household's tax-free savings capacity. Consider coordinating strategies to optimise the combined benefit.

Professional advice becomes valuable when managing larger ISA portfolios or complex financial situations. Financial advisers can help optimise allocation strategies, suggest suitable investment options, and ensure compliance with all relevant rules and regulations.

The key to maximising your ISA allowance lies in consistent annual contributions, strategic allocation across different ISA types, and regular review of your approach to ensure it continues meeting your evolving financial needs and objectives.