Learning how to make money out of the markets involves getting a lot of different factors right. For starters, you want to make sure your broker is trustworthy, so opt for a regulated one. Then there’s the matter of developing the skills to get trade entry and exit points right. The truth is that even experienced traders get the second part wrong — though you’ll rarely find one using an unregulated broker.

Successful trading involves accepting that there are losses as well as gains. A good way to develop this winning mindset and get to hands-on experience of trading is to use a Tickmill demo account. It is free, there are no strings and signing up here takes moments.

- What is a Tickmill demo account?

- Tickmill demo account login

- Creating a live account

- Understanding currency markets

- Trading other markets

Tickmill Demo Account

A Tickmill demo account is an online trading account that allows you to practise buying and selling in the financial markets.

Tickmill gives you virtual funds to buy or sell assets, ranging from forex to crypto. If you lose, you can put it down to part of the learning process. If you make a profit, you, unfortunately, can’t withdraw the funds, but will also learn some valuable lessons.

The prices feeding into the trading dashboard will be real-time live prices — the same as if you were trading real cash. The tools and indicators to help you spot a trading opportunity will also be the same as with a live account.

This means that once, or if, you want to take the decision to step up to live trading, you will already be familiar with the mechanics of the process. This means you’ll hopefully be less likely to make an operational error — what professional traders call ‘fat finger risk’.

There is one small way in which trading conditions differ from those of a live account. As your instruction to execute a trade doesn’t actually go into the markets, any slight differences between what you see on the screen at the time of trade and the price you buy at aren’t recorded. This is termed ‘slippage’ and is a part of live trading, but not demo account trading.

Tickmill Demo Account Login

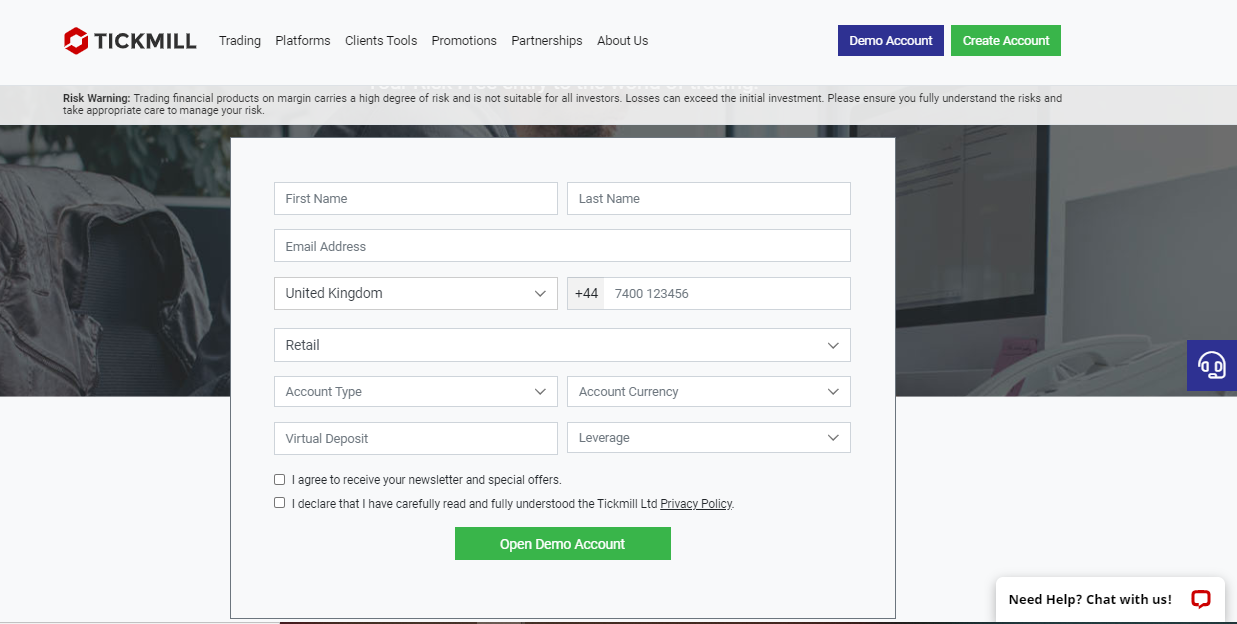

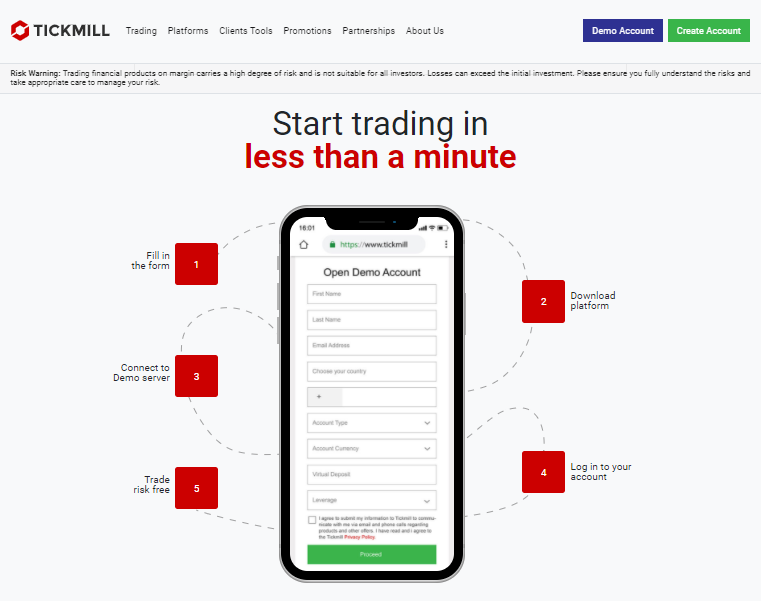

The registration process is very straight forward and takes moments to complete. You really can be up and running and trading the virtual markets in a matter of minutes.

A bare minimum of information is required, just enough to be able to identify your login.

Data fields determining your account type, base currency, leverage and amount of funds to practise with are down to your preference.

The next step is verifying the email sent to you and noting the registration details.

Then you’re ready to log in and start trading.

It’s a well-trodden path, so there shouldn’t be any problems. If there are any issues, the Tickmill customer support team is on hand to help via live chat or phone.

The process is similar for setting up the mobile app demo account.

Creating a live account

Setting up demo accounts requires a minimal amount of information. This is great for those who want to get started and try trading for the first time.

When it comes to trading real cash, there is an obvious need for more information so that the funds can be identified as yours. You’ll be asked to provide details on aspects such as your home address, date of birth and the source of your wealth.

There are also questions relating to your experience of trading and your investment goals. These questions are asked because a regulated broker has a duty of care to their clients. There aren’t right or wrong answers, but the broker will use the information to develop a profile for you.

Filling in the online forms can take minutes to do if you have the information to hand. While it can feel slightly invasive, it should be embraced. As you’re at times effectively being asked ‘what kind of trading do you want to do?’, it’s an opportunity to embrace that and use it as part of your planning.

Just going into the market and putting on trades can be a sure-fire way to lose money. You need a plan.

One neat feature of using a regulated broker is that they have to comply with anti-money laundering regulations. That means they can’t be used to launder funds. Any cash going into a Tickmill account has to be returned to the account it initially came from. This protocol is a good thing for the end-user as it mitigates the risk of funds being wired to someone else.

The functionality of the trading dashboard on the Tickmill demo and live accounts is identical. You just switch from trading virtual funds to trading real cash. This is done by selecting which account you want to use.

One important way that demo and live trading differ relates to trading psychology. Once you start trading real cash, you’ll experience a whole different range of emotions to when you trade virtual. Ironically, this can often make trading real cash less profitable.

Emotions can be the enemy of traders. It’s something to be aware of and is another reason you need to have a clear plan in place. Even experienced traders take breaks from real cash trading and go back into demo trading to ‘reboot’ their thinking. Protecting capital is fundamentally important.

Understanding Currency Markets

Tickmill has a strong reputation in the trading community in terms of supporting traders who specialise in forex. Forex trading involves buying one currency against another.

One of the most popular currency pairs to trade is EURUSD or euro-dollar. Traders who think USD will appreciate in value against EUR will put on a position short-Euro and Long-Dollar. This is reported in your Tickmill portfolio as only one position as you buy and sell them simultaneously.

Catalysts for currency price moves can be many and varied. Two main approaches are fundamental and technical analysis. In reality, most traders consider both.

Fundamental analysis is used to trade currencies and works on the underlying strength of the US and eurozone economies. Those with a view that the US would outperform results in higher interest rates would buy USD (sell EURUSD). If the rate hike does materialise, then a wave of hot money will flood to the US to get a better return on their cash. This will increase the demand for dollars and therefore, the price of the greenback.

Other traders might use technical analysis. This is particularly popular in the forex markets because they are so large in size. A lot of the trading decisions are based on price moving away from long-term averages and the expectation they’ll revert in the near future.

The forex markets are huge. Daily trading volumes are typically in excess of $6tn. This means markets are liquid and hard to manipulate.

High trading volumes also translate into lower costs. The bid-offer spreads on Tickmill forex markets are particularly tight as the broker takes advantage of having access to ‘pools’ of liquidity that exist in the market.

As forex markets have been popular for a long-time, there is an established community willing to share research ideas and views on current events. There are also a host of technical tools that have been developed over the years to support traders.

The primary platform available at Tickmill is MetaTrader’s MT4. This is the most popular retail forex trading platform in the world. It’s tried-and-tested and has its own community of traders who even share programs to allow others to use computer algorithms to trade the currency markets.

Trading Other Markets

Although forex is the largest global market, a lot of traders trade other asset groups. This can be based on personal preference, finding a market that suits them. Or it can be driven by news events and one market coming to their attention.

When practising trading in a demo account, it’s a good idea to try out the different asset classes as the results might surprise you.

Investing in Stocks

Stock trading has always been popular, and in recent years, there has been something of a change in the nature of the market.

An influx of new investors trading exciting new start-up companies has seen some stock prices sky-rocket. Getting the timing of a trade right is still hard to do and any market that offers big profits can also inflict big losses.

There is an uptick in price volatility of some stocks, which can catch the eye. There is still a hard-core pool of more stable stocks to invest in. Selecting a market will largely come down to personal preference and risk appetite.

Tickmill offers over 14 different stock indices, including the UK100, US30, USTEC and US500. When buying or selling, these you are trading a basket of stocks.

Diversifying your position in this way can mitigate risk, particularly single stock risk. Tickmill, for example, takes the leg work out of having to buy each constituent member of the FTSE100 and instead offers one product that gives you exposure to that market.

Commodities

Tickmill also provides markets in commodities. It’s possible to take a position in instruments such as oil, gold or silver.

Gold and silver have traditionally been seen as safe-haven assets and their price can increase if geopolitical risk picks up. Silver is used in industrial production to a greater extent than gold, so a booming economy can be good for the price of that precious metal.

The price of oil is typically linked to the health of the global economy. The more business that is being done, the more oil is needed to make and transport the goods.

Tickmill Demo Review: What We Think

Demo accounts are incredibly useful. They allow you to develop your trading skills and get to know how a broker works. Our testing of the Tickmill demo account found it ticked both of those boxes.

Learning should be continuous and there’s two other important points to keep in mind.

The first is that the demo account can also be accessed via mobile apps. Testing out how trading fits in with your existing commitments is part of the due diligence process.

The second is that even experienced traders use demo accounts. This might be because they’re testing a new strategy or just taking time out after having a bad run.

Demo accounts are useful tools at the start of the trading process but are also valuable once you’re trading real cash. The good news is that Tickmill supports clients in this and it’s possible to simultaneously run live and demo accounts.

People Who Read This Also Viewed